- France

- /

- Professional Services

- /

- ENXTPA:ASY

3 Undiscovered French Gems With Strong Potential

Reviewed by Simply Wall St

As the French CAC 40 Index experiences modest gains amid broader European market optimism, investors are increasingly looking towards smaller, lesser-known companies that may offer untapped potential. In this environment, identifying stocks with solid fundamentals and growth prospects becomes crucial for those seeking opportunities beyond the well-trodden paths of major indices.

Top 10 Undiscovered Gems With Strong Fundamentals In France

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Caisse Régionale de Crédit Agricole Mutuel Brie Picardie Société coopérative | 34.89% | 3.23% | 3.61% | ★★★★★★ |

| Caisse Régionale de Crédit Agricole Mutuel Nord de France Société coopérative | 10.84% | 3.22% | 6.38% | ★★★★★★ |

| EssoF | 1.19% | 11.14% | 41.41% | ★★★★★★ |

| Gévelot | 0.25% | 10.64% | 20.33% | ★★★★★★ |

| ADLPartner | 82.84% | 9.86% | 16.18% | ★★★★★☆ |

| VIEL & Cie société anonyme | 54.02% | 5.66% | 19.86% | ★★★★★☆ |

| Caisse Regionale de Credit Agricole Mutuel Toulouse 31 | 14.94% | 0.59% | 5.95% | ★★★★★☆ |

| La Forestière Equatoriale | 0.00% | -50.76% | 49.41% | ★★★★★☆ |

| Caisse Régionale de Crédit Agricole Mutuel Alpes Provence Société coopérative | 391.01% | 4.67% | 17.31% | ★★★★☆☆ |

| Société Fermière du Casino Municipal de Cannes | 11.60% | 6.69% | 10.30% | ★★★★☆☆ |

Here we highlight a subset of our preferred stocks from the screener.

Assystem (ENXTPA:ASY)

Simply Wall St Value Rating: ★★★★★★

Overview: Assystem S.A. is a global provider of engineering and infrastructure project management services, with a market cap of €726.63 million.

Operations: Assystem S.A. generates revenue primarily from engineering and infrastructure project management services. The company's financial performance is reflected in its market cap of €726.63 million, with a focus on delivering specialized services across various sectors.

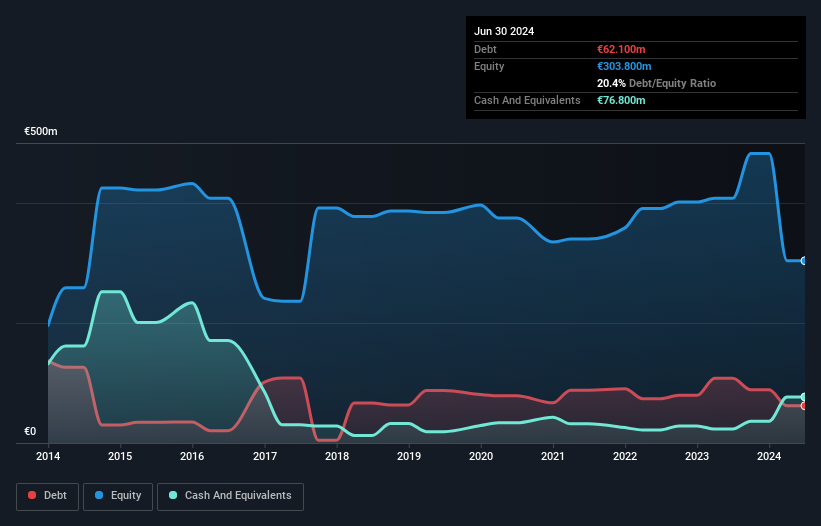

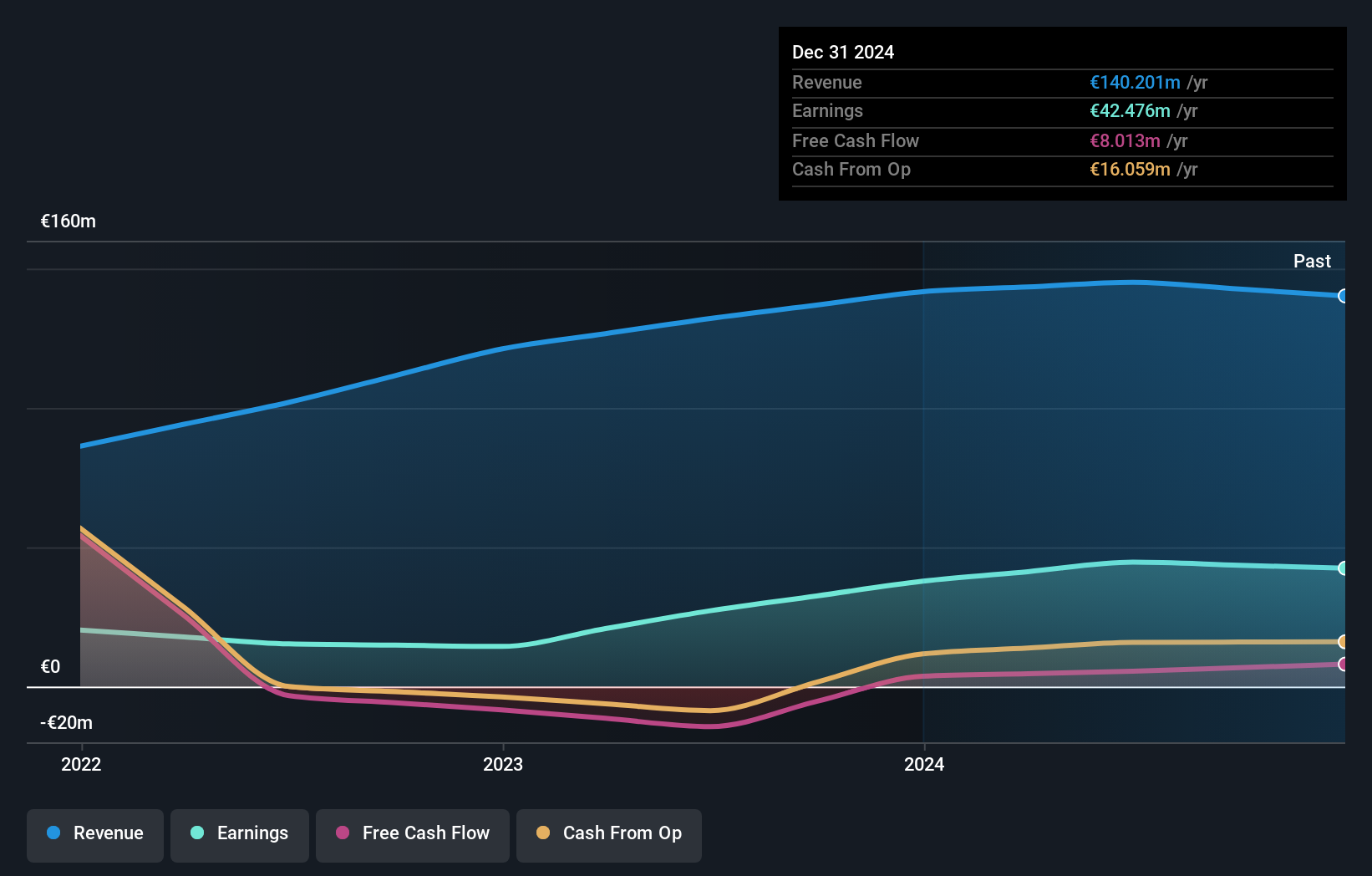

Assystem, a promising player in France's professional services sector, showcases robust financial health with cash exceeding total debt and a reduced debt-to-equity ratio from 22.8% to 20.4% over five years. Earnings soared by 137.7%, outpacing industry performance, despite being impacted by a €85M one-off gain this year. Trading at 9.4% below fair value estimates, Assystem was recently added to the S&P Global BMI Index, reflecting its growing market recognition amidst mixed earnings results for the first half of 2024.

- Dive into the specifics of Assystem here with our thorough health report.

Gain insights into Assystem's historical performance by reviewing our past performance report.

Caisse Régionale de Crédit Agricole Mutuel Brie Picardie Société coopérative (ENXTPA:CRBP2)

Simply Wall St Value Rating: ★★★★★★

Overview: Caisse Régionale de Crédit Agricole Mutuel Brie Picardie Société coopérative offers a variety of banking and financial services to diverse clients including individuals, farmers, and businesses in France, with a market cap of approximately €975 million.

Operations: Crédit Agricole Brie Picardie generates revenue primarily from its retail banking segment, amounting to approximately €626 million. The company's market cap is around €975 million.

Caisse Régionale de Crédit Agricole Mutuel Brie Picardie, a cooperative bank in France, showcases a robust financial structure with total assets of €42.2 billion and equity of €5 billion. The bank's allowance for bad loans stands at 115%, indicating solid risk management, while non-performing loans are kept low at 1.2%. With 91% of its liabilities funded through customer deposits, the institution enjoys a stable funding base. Trading significantly below fair value by 65%, the bank presents an intriguing opportunity for investors seeking undervalued financial entities.

Malteries Franco-Belges Société Anonyme (ENXTPA:MALT)

Simply Wall St Value Rating: ★★★★★★

Overview: Malteries Franco-Belges Société Anonyme focuses on producing and selling malt for brewers both in France and internationally, with a market capitalization of €342.23 million.

Operations: Malteries Franco-Belges Société Anonyme generates revenue primarily from its malt factory, amounting to €141.70 million. The company's market capitalization stands at €342.23 million.

Malteries Franco-Belges, a small player in the brewing industry, has shown impressive financial strides with earnings surging by 162% over the past year. This growth outpaces the broader food sector's 67%, highlighting its competitive edge. The company boasts a reduced debt-to-equity ratio from 2.4 to zero in five years, showcasing prudent financial management. Its price-to-earnings ratio of 9x suggests it might be undervalued compared to the French market's average of 14x.

Summing It All Up

- Embark on your investment journey to our 39 Euronext Paris Undiscovered Gems With Strong Fundamentals selection here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Assystem, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:ASY

Assystem

Provides engineering and infrastructure project management services in France, Rest of Europe, Asia, the Middle East, and Africa.

Excellent balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives