- France

- /

- Professional Services

- /

- ENXTPA:ALFRE

Freelance.com SA's (EPA:ALFRE) Shares Leap 27% Yet They're Still Not Telling The Full Story

Freelance.com SA (EPA:ALFRE) shareholders are no doubt pleased to see that the share price has bounced 27% in the last month, although it is still struggling to make up recently lost ground. Not all shareholders will be feeling jubilant, since the share price is still down a very disappointing 42% in the last twelve months.

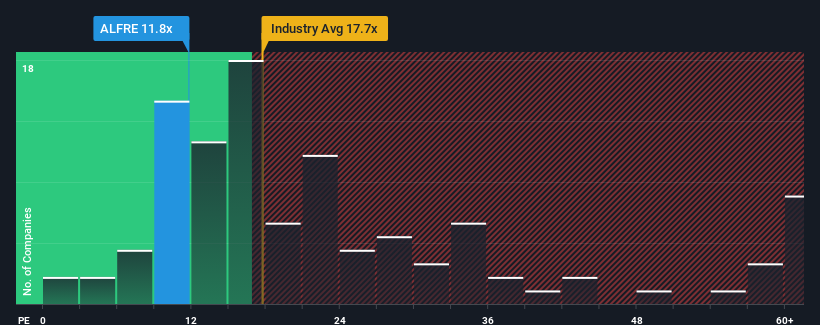

In spite of the firm bounce in price, Freelance.com's price-to-earnings (or "P/E") ratio of 11.8x might still make it look like a buy right now compared to the market in France, where around half of the companies have P/E ratios above 15x and even P/E's above 28x are quite common. However, the P/E might be low for a reason and it requires further investigation to determine if it's justified.

Recent times have been quite advantageous for Freelance.com as its earnings have been rising very briskly. It might be that many expect the strong earnings performance to degrade substantially, which has repressed the P/E. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

See our latest analysis for Freelance.com

What Are Growth Metrics Telling Us About The Low P/E?

In order to justify its P/E ratio, Freelance.com would need to produce sluggish growth that's trailing the market.

If we review the last year of earnings growth, the company posted a terrific increase of 33%. The latest three year period has also seen an excellent 143% overall rise in EPS, aided by its short-term performance. So we can start by confirming that the company has done a great job of growing earnings over that time.

This is in contrast to the rest of the market, which is expected to grow by 11% over the next year, materially lower than the company's recent medium-term annualised growth rates.

In light of this, it's peculiar that Freelance.com's P/E sits below the majority of other companies. It looks like most investors are not convinced the company can maintain its recent growth rates.

What We Can Learn From Freelance.com's P/E?

Despite Freelance.com's shares building up a head of steam, its P/E still lags most other companies. We'd say the price-to-earnings ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

Our examination of Freelance.com revealed its three-year earnings trends aren't contributing to its P/E anywhere near as much as we would have predicted, given they look better than current market expectations. When we see strong earnings with faster-than-market growth, we assume potential risks are what might be placing significant pressure on the P/E ratio. It appears many are indeed anticipating earnings instability, because the persistence of these recent medium-term conditions would normally provide a boost to the share price.

Don't forget that there may be other risks. For instance, we've identified 2 warning signs for Freelance.com that you should be aware of.

If these risks are making you reconsider your opinion on Freelance.com, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ENXTPA:ALFRE

Freelance.com

Provides intermediation between companies and intellectual service providers in France, Germany, Morocco, Luxembourg, Switzerland, and Singapore.

Undervalued with solid track record.

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

Perdana Petroleum Berhad is a Zombie Business with a 27.34% Profit Margin and inflation adjusted revenue Business

Many trends acting at the same time

Engineered for Stability. Positioned for Growth.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026