Forsee Power Société anonyme And 2 Other Promising Penny Stocks

Reviewed by Simply Wall St

As global markets experience a boost from easing core U.S. inflation and robust bank earnings, investors are increasingly looking for opportunities that balance affordability with growth potential. Penny stocks, while sometimes considered an outdated term, continue to capture attention due to their unique position within the market landscape. These smaller or newer companies can offer significant value when backed by strong financial health, presenting intriguing possibilities for those willing to explore this investment area further.

Top 10 Penny Stocks

| Name | Share Price | Market Cap | Financial Health Rating |

| DXN Holdings Bhd (KLSE:DXN) | MYR0.505 | MYR2.51B | ★★★★★★ |

| Datasonic Group Berhad (KLSE:DSONIC) | MYR0.41 | MYR1.14B | ★★★★★★ |

| Bosideng International Holdings (SEHK:3998) | HK$3.63 | HK$41.79B | ★★★★★★ |

| Lever Style (SEHK:1346) | HK$0.99 | HK$628.44M | ★★★★★★ |

| Begbies Traynor Group (AIM:BEG) | £0.944 | £150.76M | ★★★★★★ |

| Hil Industries Berhad (KLSE:HIL) | MYR0.90 | MYR298.75M | ★★★★★★ |

| MGB Berhad (KLSE:MGB) | MYR0.72 | MYR425.99M | ★★★★★★ |

| ME Group International (LSE:MEGP) | £2.10 | £776.24M | ★★★★★★ |

| Stelrad Group (LSE:SRAD) | £1.425 | £178.93M | ★★★★★☆ |

| Embark Early Education (ASX:EVO) | A$0.77 | A$141.28M | ★★★★☆☆ |

Click here to see the full list of 5,715 stocks from our Penny Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

Forsee Power Société anonyme (ENXTPA:FORSE)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Forsee Power Société anonyme, along with its subsidiaries, designs, manufactures, and integrates battery systems for electromobility across France, the rest of Europe, Asia, the United States and internationally; it has a market cap of €42.45 million.

Operations: The company generates revenue primarily from its Heavy Vehicles segment, which accounts for €156.42 million, and its Light Vehicles segment, contributing €20.46 million.

Market Cap: €42.45M

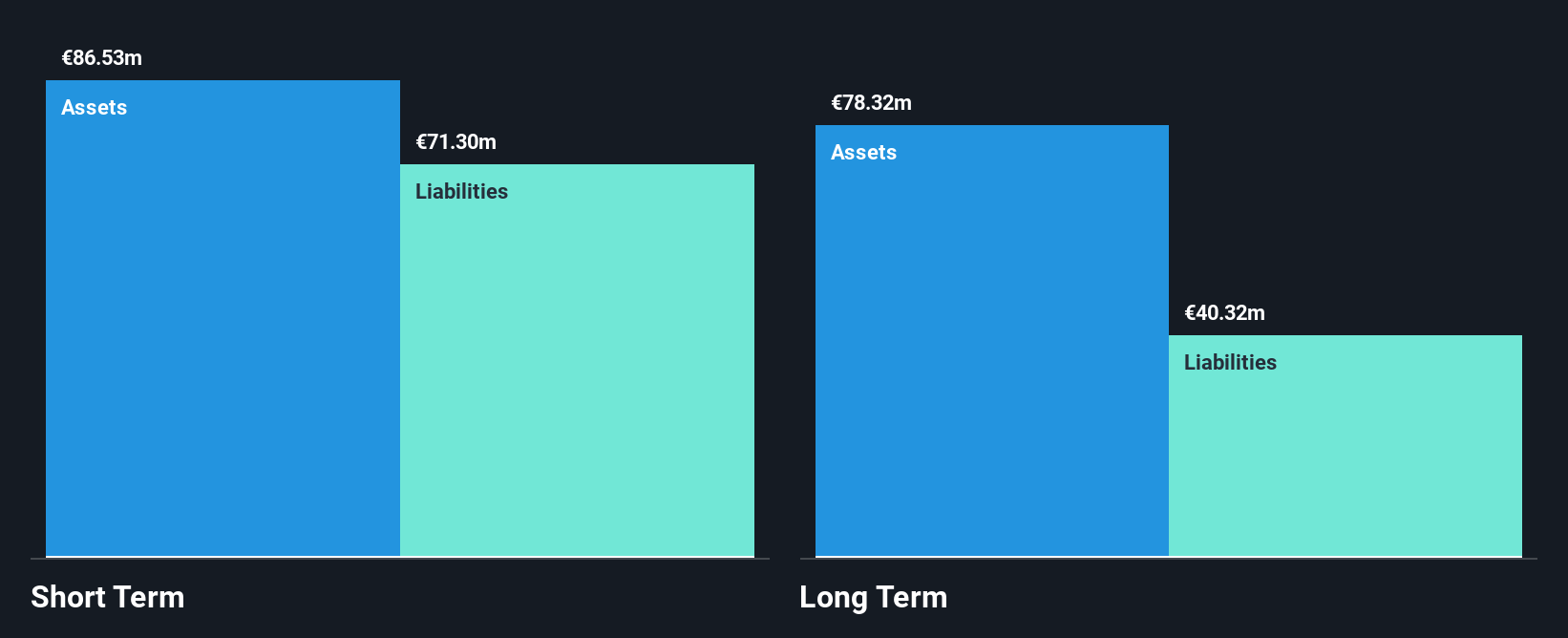

Forsee Power Société anonyme, with a market cap of €42.45 million, is navigating the penny stock landscape with both opportunities and challenges. The company’s short-term assets (€103 million) comfortably cover its liabilities, but it remains unprofitable with a negative return on equity (-26.58%). Recent collaborations, such as the one with Infinitev in Australia for battery system repairs, highlight strategic moves to enhance its electromobility footprint. Despite volatile share prices and high net debt to equity ratio (40.7%), Forsee Power maintains a stable cash runway exceeding three years if current cash flow trends persist.

- Jump into the full analysis health report here for a deeper understanding of Forsee Power Société anonyme.

- Understand Forsee Power Société anonyme's earnings outlook by examining our growth report.

Tecnotree Oyj (HLSE:TEM1V)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Tecnotree Oyj provides telecommunication IT solutions focused on charging, billing, customer care, and messaging and content services across Europe, the Americas, the Middle East, Africa, and the Asia Pacific with a market cap of €49.32 million.

Operations: The company generates its revenue primarily from the MEA and APAC regions with €60.94 million, followed by the Americas and Europe contributing €15.25 million.

Market Cap: €49.32M

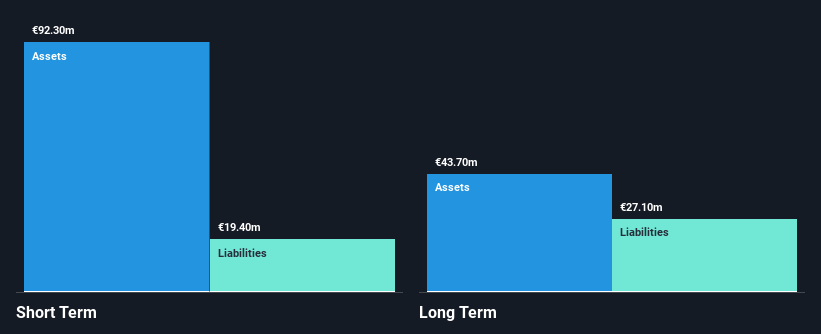

Tecnotree Oyj, with a market cap of €49.32 million, is making strides in the telecom IT solutions sector amidst the penny stock arena. The company has shown strong financial discipline with well-covered debt by operating cash flow and significant interest coverage by EBIT. Recent strategic wins include a multi-year agreement with a Tier-1 US telecom operator and collaboration with an EMEA MVNE, strengthening its global presence. Despite volatile share prices, Tecnotree's robust earnings growth of 53.4% last year surpasses industry averages, underscoring its potential for continued impact in digital transformation initiatives within telecommunications.

- Click to explore a detailed breakdown of our findings in Tecnotree Oyj's financial health report.

- Learn about Tecnotree Oyj's future growth trajectory here.

WithSecure Oyj (HLSE:WITH)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: WithSecure Oyj is engaged in the corporate security business on a global scale, with a market capitalization of €133.07 million.

Operations: The company's revenue is segmented as follows: €15.32 million from North America, €69.94 million from the Rest of Europe, €41.40 million from the Nordic Countries, and €20.54 million from the Rest of the World.

Market Cap: €133.07M

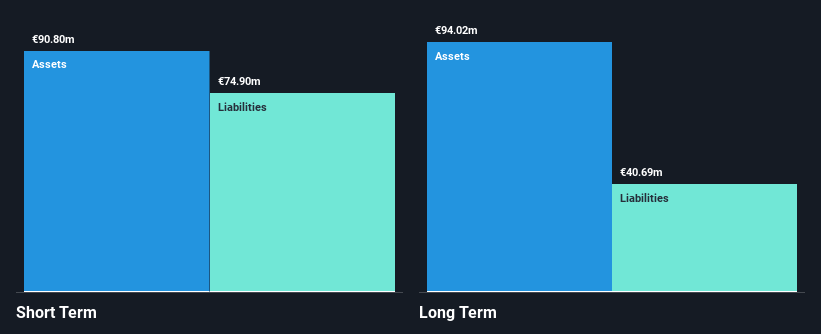

WithSecure Oyj, valued at €133.07 million, operates globally in the corporate security sector. Despite being unprofitable with a negative return on equity of -41.64%, the company is trading below its estimated fair value by 13.2% and analysts expect a potential price rise of 48.1%. Revenue is diversified across regions, with significant contributions from Europe and the Nordic countries. Although short-term liabilities slightly exceed assets, long-term liabilities are well-covered by short-term assets. Recent board changes may impact strategic direction; however, WithSecure maintains more cash than debt and has reduced its debt-to-equity ratio significantly over five years.

- Dive into the specifics of WithSecure Oyj here with our thorough balance sheet health report.

- Gain insights into WithSecure Oyj's future direction by reviewing our growth report.

Seize The Opportunity

- Get an in-depth perspective on all 5,715 Penny Stocks by using our screener here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:FORSE

Forsee Power Société anonyme

Engages in the design, manufactures, and integration of battery systems for electromobility in France, res of Europe, Asia, the United States, and internationally.

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives