- France

- /

- Construction

- /

- ENXTPA:FGR

Three Reliable Dividend Stocks To Enhance Your Portfolio

Reviewed by Simply Wall St

As global markets navigate a holiday-shortened week with mixed economic signals, including a decline in U.S. consumer confidence and fluctuating stock index performances, investors are increasingly seeking stability through reliable investment options. In such an environment, dividend stocks can offer consistent income and potential growth, making them an attractive choice for enhancing portfolio resilience amidst market uncertainties.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Guaranty Trust Holding (NGSE:GTCO) | 6.49% | ★★★★★★ |

| Tsubakimoto Chain (TSE:6371) | 4.09% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.84% | ★★★★★★ |

| Yamato Kogyo (TSE:5444) | 4.04% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 7.42% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.38% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 3.83% | ★★★★★★ |

| FALCO HOLDINGS (TSE:4671) | 6.38% | ★★★★★★ |

| E J Holdings (TSE:2153) | 3.82% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 5.15% | ★★★★★★ |

Click here to see the full list of 1948 stocks from our Top Dividend Stocks screener.

Let's review some notable picks from our screened stocks.

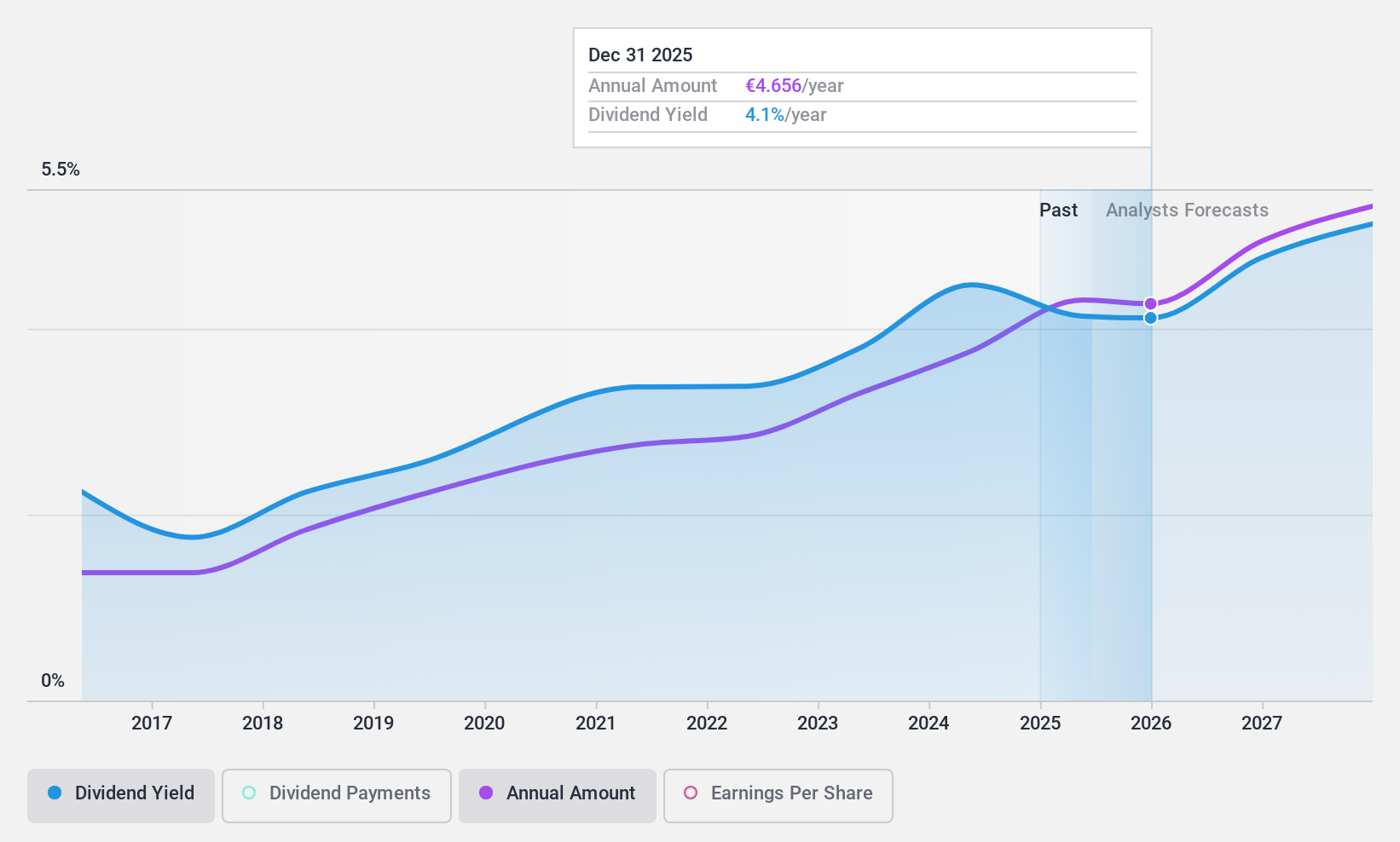

Eiffage (ENXTPA:FGR)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Eiffage SA operates in construction, property and urban development, civil engineering, metallic construction, roads, energy systems, and concessions across France and internationally with a market cap of €8.09 billion.

Operations: Eiffage SA's revenue segments include Concessions (€4.04 billion), Construction (€4.01 billion), Energy Systems (€6.49 billion), and Infrastructures (€8.78 billion).

Dividend Yield: 4.8%

Eiffage's dividend yield of 4.84% is below the French market's top quartile, and its payments have been volatile over the past decade, with significant annual drops. However, dividends are well-covered by earnings (38.6% payout ratio) and cash flows (16.4% cash payout ratio). Despite an unreliable track record, dividends have grown over ten years. The company trades at a substantial discount to fair value estimates but carries a high debt level.

- Get an in-depth perspective on Eiffage's performance by reading our dividend report here.

- Insights from our recent valuation report point to the potential undervaluation of Eiffage shares in the market.

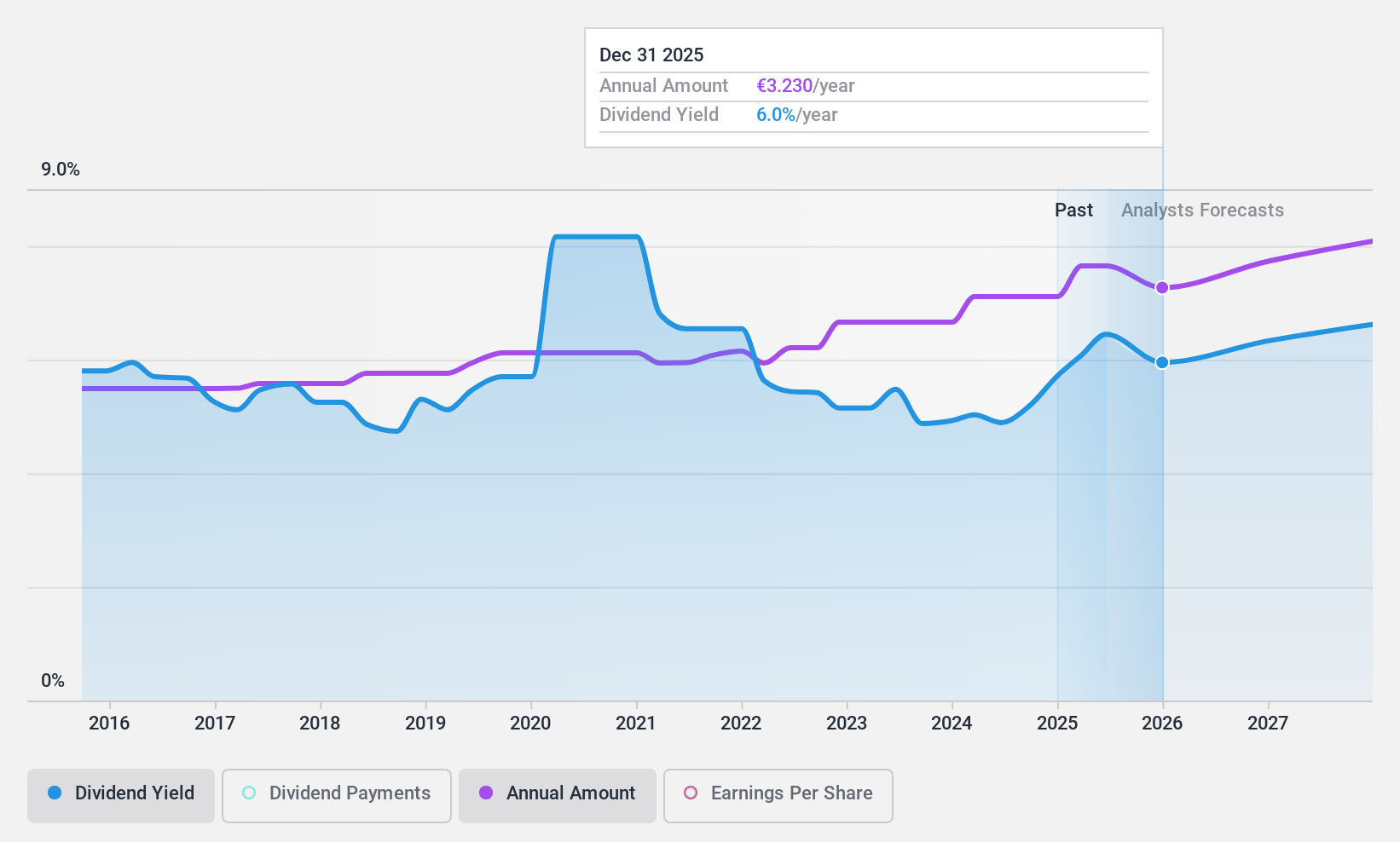

TotalEnergies (ENXTPA:TTE)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: TotalEnergies SE is a multi-energy company involved in the production and marketing of oil, biofuels, natural gas, green gases, renewables, and electricity across various regions including France, Europe, North America, Africa, and globally; it has a market cap of approximately €121.71 billion.

Operations: TotalEnergies SE generates revenue from several segments, including Integrated LNG ($21.32 billion), Integrated Power ($26.20 billion), Marketing & Services ($69.32 billion), Refining & Chemicals ($128.61 billion), and Exploration & Production ($45.58 billion).

Dividend Yield: 5.9%

TotalEnergies offers a dividend yield of 5.9%, ranking in the top 25% of French dividend payers, though its payments have been volatile over the past decade. Despite this instability, dividends are well-covered by earnings (50% payout ratio) and cash flows (41.1% cash payout ratio). Trading at 51% below estimated fair value and with strategic renewable energy expansions underway, TotalEnergies presents a complex but potentially rewarding option for dividend-focused investors.

- Dive into the specifics of TotalEnergies here with our thorough dividend report.

- Our comprehensive valuation report raises the possibility that TotalEnergies is priced lower than what may be justified by its financials.

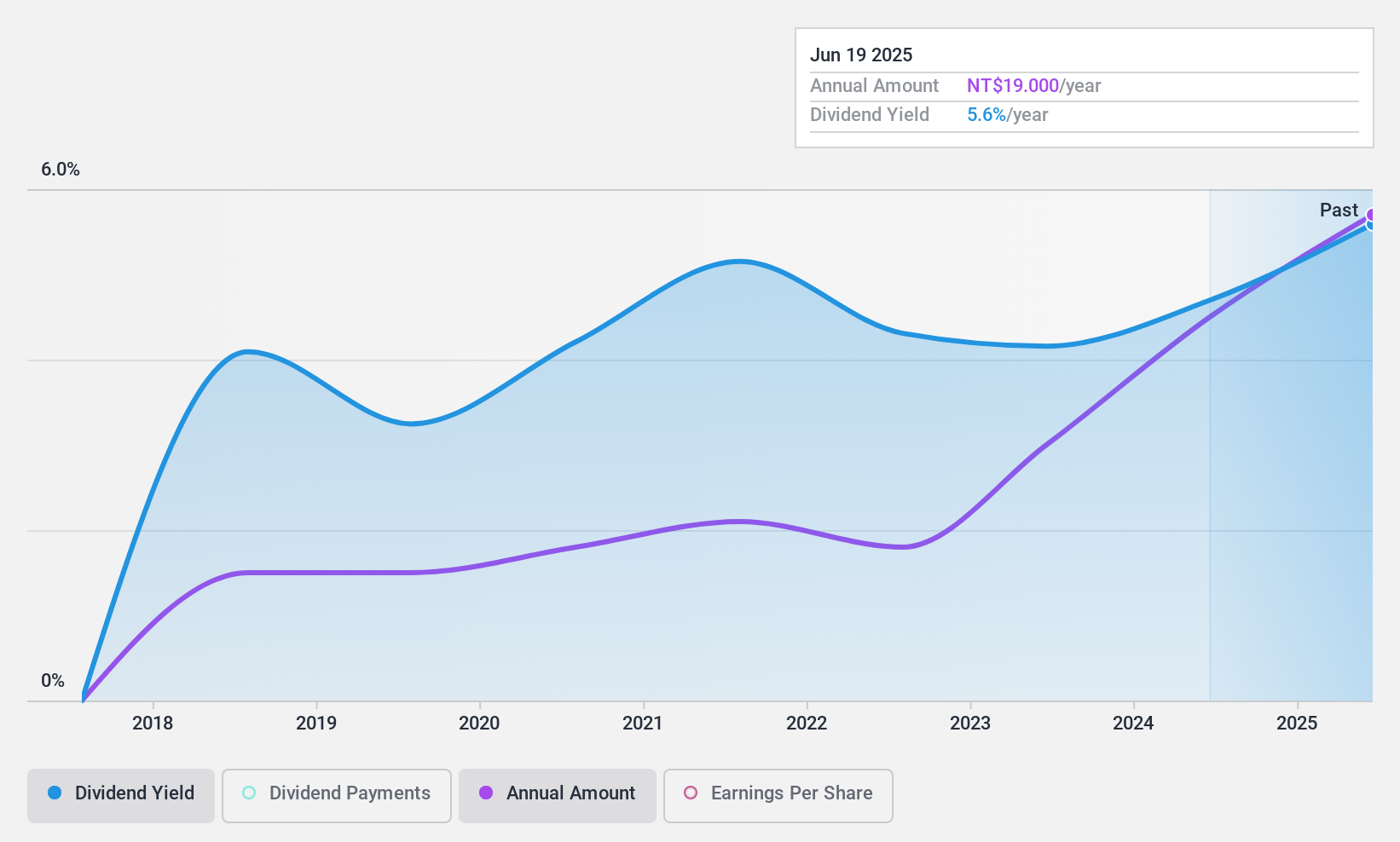

Nan Pao Resins Chemical (TWSE:4766)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Nan Pao Resins Chemical Co., Ltd. operates in the manufacturing, wholesale, and retail sale of synthetic resins and plastics, adhesives, resin coatings, dyes, and pigments across multiple continents with a market cap of NT$37.86 billion.

Operations: Nan Pao Resins Chemical Co., Ltd.'s revenue segments are comprised of NT$8.34 billion from Taiwan, NT$7.44 billion from Vietnam, NT$3.09 billion from Australia, and NT$7.68 billion from the Mainland Area, with additional contributions of NT$2.78 billion from other regions.

Dividend Yield: 4.8%

Nan Pao Resins Chemical's dividend yield of 4.78% places it in the top quartile of Taiwanese dividend payers. Despite a relatively short history of seven years, dividends have been reliable and stable, supported by earnings (68.1% payout ratio) and cash flows (85.8% cash payout ratio). The company shows robust financial health with growing profits and trades at a favorable price-to-earnings ratio of 14.3x compared to the market average.

- Delve into the full analysis dividend report here for a deeper understanding of Nan Pao Resins Chemical.

- Our valuation report unveils the possibility Nan Pao Resins Chemical's shares may be trading at a discount.

Where To Now?

- Click through to start exploring the rest of the 1945 Top Dividend Stocks now.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Eiffage might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:FGR

Eiffage

Engages in the construction, property development, urban development, civil engineering, metallic construction, roads, energy systems, and concessions businesses in France, rest of Europe, and internationally.

Undervalued with adequate balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives