- France

- /

- Aerospace & Defense

- /

- ENXTPA:FGA

What Does Figeac Aero Société Anonyme's (EPA:FGA) CEO Pay Reveal?

Jean-Claude Maillard is the CEO of Figeac Aero Société Anonyme (EPA:FGA), and in this article, we analyze the executive's compensation package with respect to the overall performance of the company. This analysis will also look to assess whether the CEO is appropriately paid, considering recent earnings growth and investor returns for Figeac Aero Société Anonyme.

View our latest analysis for Figeac Aero Société Anonyme

How Does Total Compensation For Jean-Claude Maillard Compare With Other Companies In The Industry?

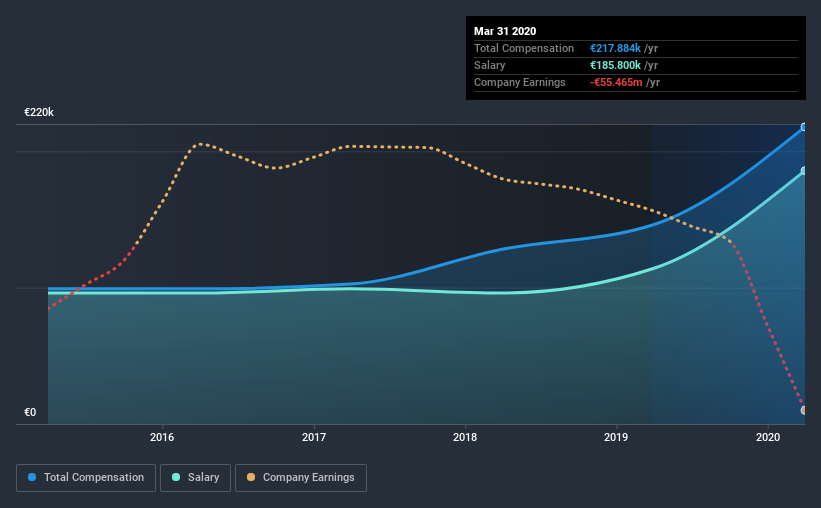

At the time of writing, our data shows that Figeac Aero Société Anonyme has a market capitalization of €140m, and reported total annual CEO compensation of €218k for the year to March 2020. That's a notable increase of 49% on last year. In particular, the salary of €185.8k, makes up a huge portion of the total compensation being paid to the CEO.

On comparing similar companies from the same industry with market caps ranging from €84m to €335m, we found that the median CEO total compensation was €332k. That is to say, Jean-Claude Maillard is paid under the industry median. Moreover, Jean-Claude Maillard also holds €106m worth of Figeac Aero Société Anonyme stock directly under their own name, which reveals to us that they have a significant personal stake in the company.

| Component | 2020 | 2019 | Proportion (2020) |

| Salary | €186k | €114k | 85% |

| Other | €32k | €32k | 15% |

| Total Compensation | €218k | €146k | 100% |

On an industry level, roughly 41% of total compensation represents salary and 59% is other remuneration. According to our research, Figeac Aero Société Anonyme has allocated a higher percentage of pay to salary in comparison to the wider industry. If salary dominates total compensation, it suggests that CEO compensation is leaning less towards the variable component, which is usually linked with performance.

A Look at Figeac Aero Société Anonyme's Growth Numbers

Over the last three years, Figeac Aero Société Anonyme has shrunk its earnings per share by 99% per year. It achieved revenue growth of 4.4% over the last year.

The decline in EPS is a bit concerning. And the modest revenue growth over 12 months isn't much comfort against the reduced EPS. It's hard to argue the company is firing on all cylinders, so shareholders might be averse to high CEO remuneration. Looking ahead, you might want to check this free visual report on analyst forecasts for the company's future earnings..

Has Figeac Aero Société Anonyme Been A Good Investment?

With a three year total loss of 72% for the shareholders, Figeac Aero Société Anonyme would certainly have some dissatisfied shareholders. So shareholders would probably want the company to be lessto generous with CEO compensation.

In Summary...

As previously discussed, Jean-Claude is compensated less than what is normal for CEOs of companies of similar size, and which belong to the same industry. While we are quite underwhelmed with EPS growth, the shareholder returns over the past three years have also failed to impress us. Although we wouldn’t say CEO compensation is high, it’s tough to foresee shareholders warming up to thoughts of a bump anytime soon.

It is always advisable to analyse CEO pay, along with performing a thorough analysis of the company's key performance areas. That's why we did our research, and identified 2 warning signs for Figeac Aero Société Anonyme (of which 1 is a bit concerning!) that you should know about in order to have a holistic understanding of the stock.

Switching gears from Figeac Aero Société Anonyme, if you're hunting for a pristine balance sheet and premium returns, this free list of high return, low debt companies is a great place to look.

If you’re looking to trade Figeac Aero Société Anonyme, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

If you're looking to trade Figeac Aero Société Anonyme, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About ENXTPA:FGA

Figeac Aero Société Anonyme

Manufactures, supplies, and sells equipment and sub-assemblers for aeronautics sector in France.

High growth potential and good value.

Market Insights

Community Narratives