- France

- /

- Aerospace & Defense

- /

- ENXTPA:FGA

A Piece Of The Puzzle Missing From Figeac Aero Société Anonyme's (EPA:FGA) 26% Share Price Climb

The Figeac Aero Société Anonyme (EPA:FGA) share price has done very well over the last month, posting an excellent gain of 26%. The last month tops off a massive increase of 114% in the last year.

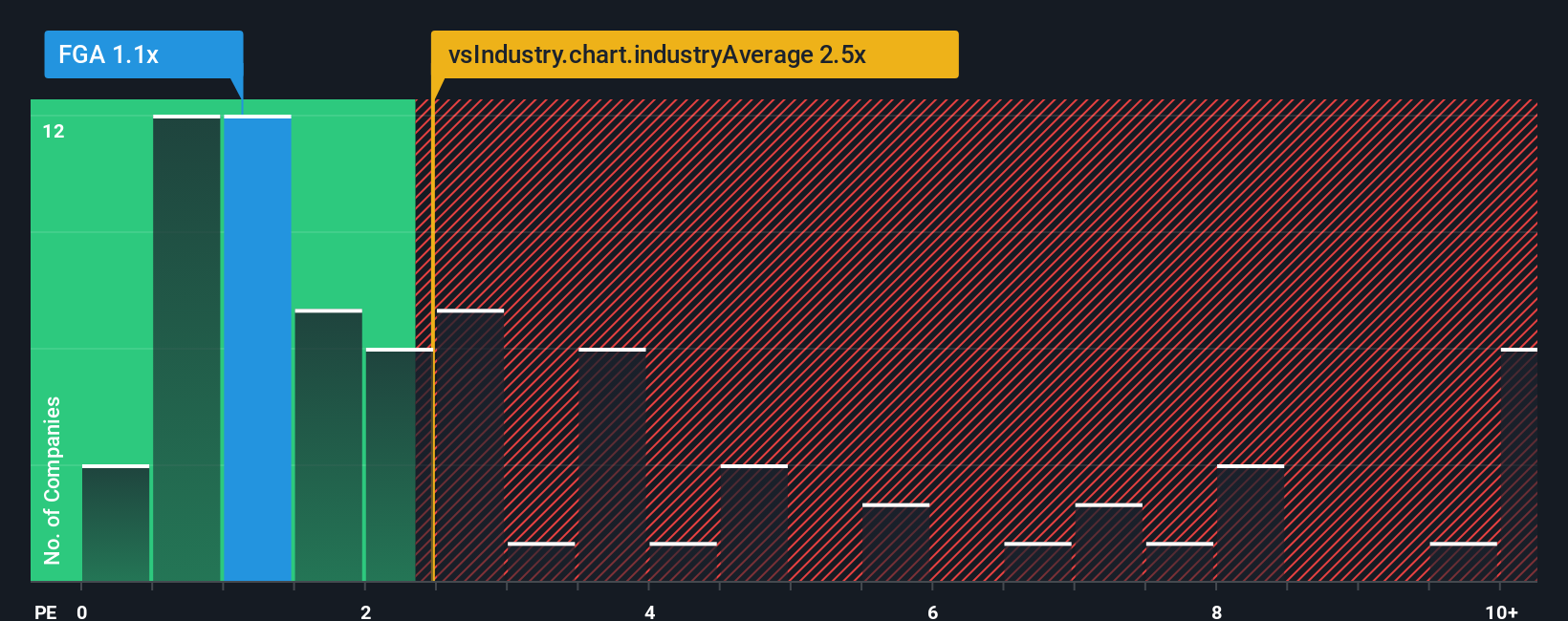

In spite of the firm bounce in price, when close to half the companies operating in France's Aerospace & Defense industry have price-to-sales ratios (or "P/S") above 2.5x, you may still consider Figeac Aero Société Anonyme as an enticing stock to check out with its 1.1x P/S ratio. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's limited.

Check out our latest analysis for Figeac Aero Société Anonyme

What Does Figeac Aero Société Anonyme's P/S Mean For Shareholders?

Recent times haven't been great for Figeac Aero Société Anonyme as its revenue has been rising slower than most other companies. Perhaps the market is expecting the current trend of poor revenue growth to continue, which has kept the P/S suppressed. If you still like the company, you'd be hoping revenue doesn't get any worse and that you could pick up some stock while it's out of favour.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Figeac Aero Société Anonyme.How Is Figeac Aero Société Anonyme's Revenue Growth Trending?

The only time you'd be truly comfortable seeing a P/S as low as Figeac Aero Société Anonyme's is when the company's growth is on track to lag the industry.

If we review the last year of revenue growth, the company posted a worthy increase of 7.5%. This was backed up an excellent period prior to see revenue up by 53% in total over the last three years. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

Turning to the outlook, the next year should generate growth of 10% as estimated by the three analysts watching the company. That's shaping up to be similar to the 9.9% growth forecast for the broader industry.

In light of this, it's peculiar that Figeac Aero Société Anonyme's P/S sits below the majority of other companies. It may be that most investors are not convinced the company can achieve future growth expectations.

The Bottom Line On Figeac Aero Société Anonyme's P/S

Despite Figeac Aero Société Anonyme's share price climbing recently, its P/S still lags most other companies. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

We've seen that Figeac Aero Société Anonyme currently trades on a lower than expected P/S since its forecast growth is in line with the wider industry. Despite average revenue growth estimates, there could be some unobserved threats keeping the P/S low. However, if you agree with the analysts' forecasts, you may be able to pick up the stock at an attractive price.

Before you take the next step, you should know about the 2 warning signs for Figeac Aero Société Anonyme (1 is potentially serious!) that we have uncovered.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ENXTPA:FGA

Figeac Aero Société Anonyme

Manufactures, supplies, and sells equipment and sub-assemblers for aeronautics sector in France.

High growth potential with acceptable track record.

Market Insights

Community Narratives