- France

- /

- Construction

- /

- ENXTPA:EN

Bouygues (ENXTPA:EN): Exploring Valuation After Mixed Share Price Movement and Strong Year-to-Date Performance

Reviewed by Simply Wall St

Most Popular Narrative: 11.8% Undervalued

According to the most widely circulated narrative, Bouygues is considered undervalued by nearly 12% relative to its calculated fair value. This view hinges on expectations for sustained earnings growth, improving margins, and robust order intake across key infrastructure and green initiatives.

“Bouygues' €33 billion construction backlog, buoyed by strong international order intake (notably outside France for Colas in EMEA, Asia-Pacific, and North America), provides solid multi-year revenue visibility. This positions the company to benefit from ongoing infrastructure demand in urbanizing markets and government green investment, supporting future revenue and EBITDA growth.”

Want to know what is driving up Bouygues’ fair value? Here’s a hint: analysts are betting on an earnings surge and profit margin boost, with forecasts suggesting a dramatic step-change from recent performance. What is behind the optimistic price target? Delve deeper to uncover the crucial numbers and surprising assumptions that underpin this valuation story.

Result: Fair Value of €41.3 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, competitive pricing in telecom and slowdowns in key projects could challenge Bouygues' growth outlook. This raises questions about the sustainability of recent optimism.

Find out about the key risks to this Bouygues narrative.Another View: What Does Our DCF Model Say?

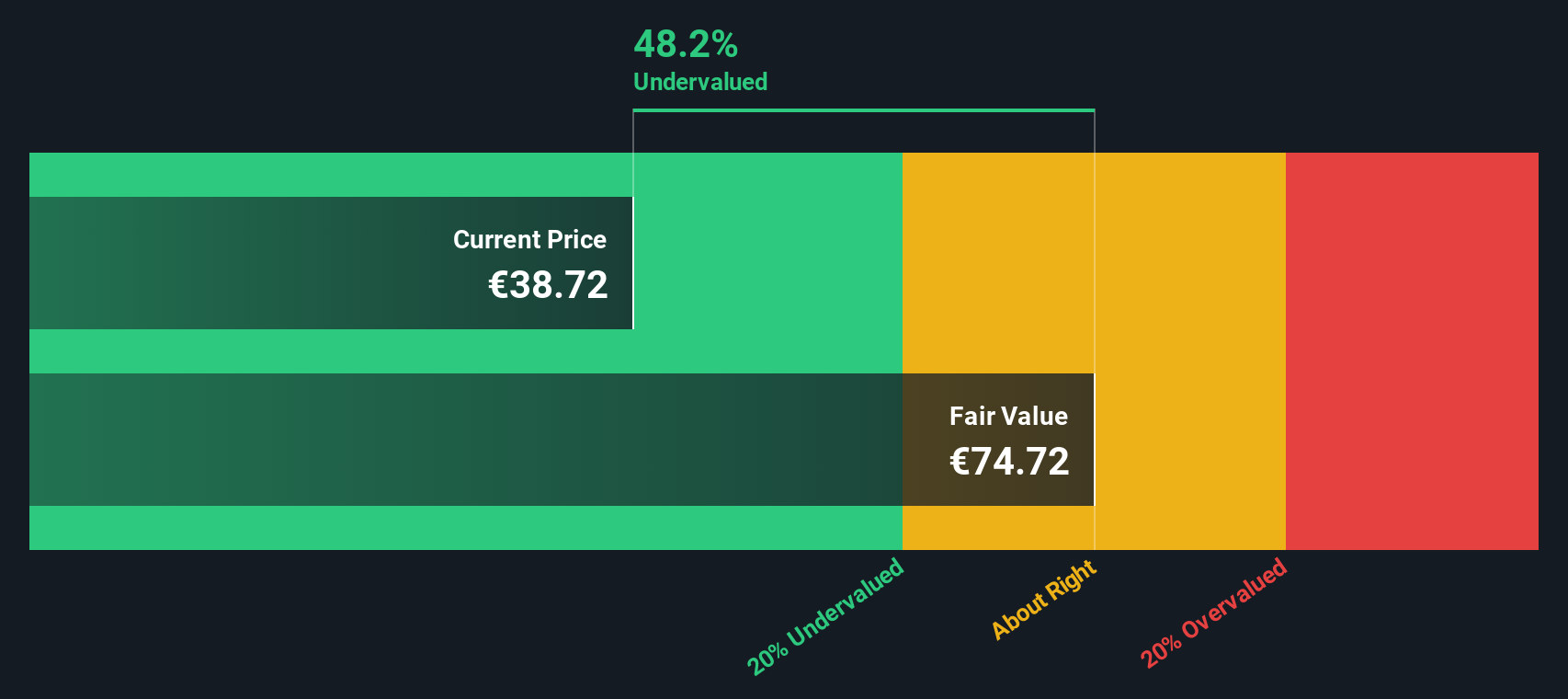

Looking from a different angle, our DCF model suggests Bouygues might be even more undervalued than the first estimate. This approach weighs future cash flows rather than recent market multiples. Could the true value be higher than most expect?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Bouygues Narrative

If you prefer to dig into the details yourself and shape your own conclusions, you can craft your own story about Bouygues in just a few minutes: Do it your way.

A great starting point for your Bouygues research is our analysis highlighting 5 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Profitable Investment Ideas?

Set your sights on new opportunities beyond Bouygues. The right screener can help you zero in on high-potential stocks that fit your unique strategy. Don't miss out on the companies making headlines for all the right reasons.

- Pinpoint rare value by targeting stocks that analysts view as truly undervalued stocks based on cash flows and position yourself ahead of the curve in undervalued markets.

- Capture the AI boom by jumping into the world of next-generation automation with AI penny stocks leading breakthroughs in machine learning and smart technologies.

- Secure higher yields by honing in on businesses delivering consistent returns above 3% using dividend stocks with yields > 3% to build your income-focused portfolio.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Bouygues might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Kshitija Bhandaru

Kshitija (or Keisha) Bhandaru is an Equity Analyst at Simply Wall St and has over 6 years of experience in the finance industry and describes herself as a lifelong learner driven by her intellectual curiosity. She previously worked with Market Realist for 5 years as an Equity Analyst.

About ENXTPA:EN

Bouygues

Operates in the construction, energy, telecom, media, and transport infrastructure sectors in France and internationally.

Undervalued established dividend payer.

Similar Companies

Market Insights

Community Narratives