- France

- /

- Construction

- /

- ENXTPA:EN

Bouygues (ENXTPA:EN): Assessing Valuation After Strong 10% Share Price Rally This Week

Reviewed by Kshitija Bhandaru

See our latest analysis for Bouygues.

After a strong push this week, Bouygues now sits at €41.58 per share, capping off a year where its share price is up a striking 44% year-to-date and total shareholder return reached 45% over the past 12 months. Recent momentum, helped by steady financial results and a wave of renewed investor optimism, suggests the upward trend is building rather than fading.

If this surge has you looking beyond Bouygues, consider broadening your horizons and discover fast growing stocks with high insider ownership.

With Bouygues’s rapid share price gains and solid fundamentals, investors are now faced with the key question: is there more upside left for buyers, or has the market already factored in the company’s future growth?

Most Popular Narrative: 3.1% Undervalued

Bouygues' widely followed narrative sets the fair value just above the last close, signaling that further upside may be limited at current prices. The stage is set for investors to judge whether recent upgrades and financial discipline justify more gains.

Equans' operating margin is outperforming targets (revised up to 4.2% for 2025 vs. original 4%, with a 5% target by 2027). This improvement is supported by the rationalization of dilutive businesses and the capacity to pursue M&A in profitable countries. These operational shifts, combined with growth in segments like data centers and energy transition projects, are expected to expand group margins and cash flow conversion in coming years.

Want to know what financial levers are driving this price target? Growth in margins, ambitious earnings trajectories, and a bold future profit multiple all shape this surprising fair value call. Why have analysts put Bouygues in a valuation league of its own? Dig deeper for the critical assumptions powering this narrative. These are numbers that could change your view on the company entirely.

Result: Fair Value of €42.91 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, risks remain, as renewed telecom price wars or a slowdown in Equans' growth could quickly dampen the upbeat outlook for Bouygues.

Find out about the key risks to this Bouygues narrative.

Another View: What Does the Market Multiple Say?

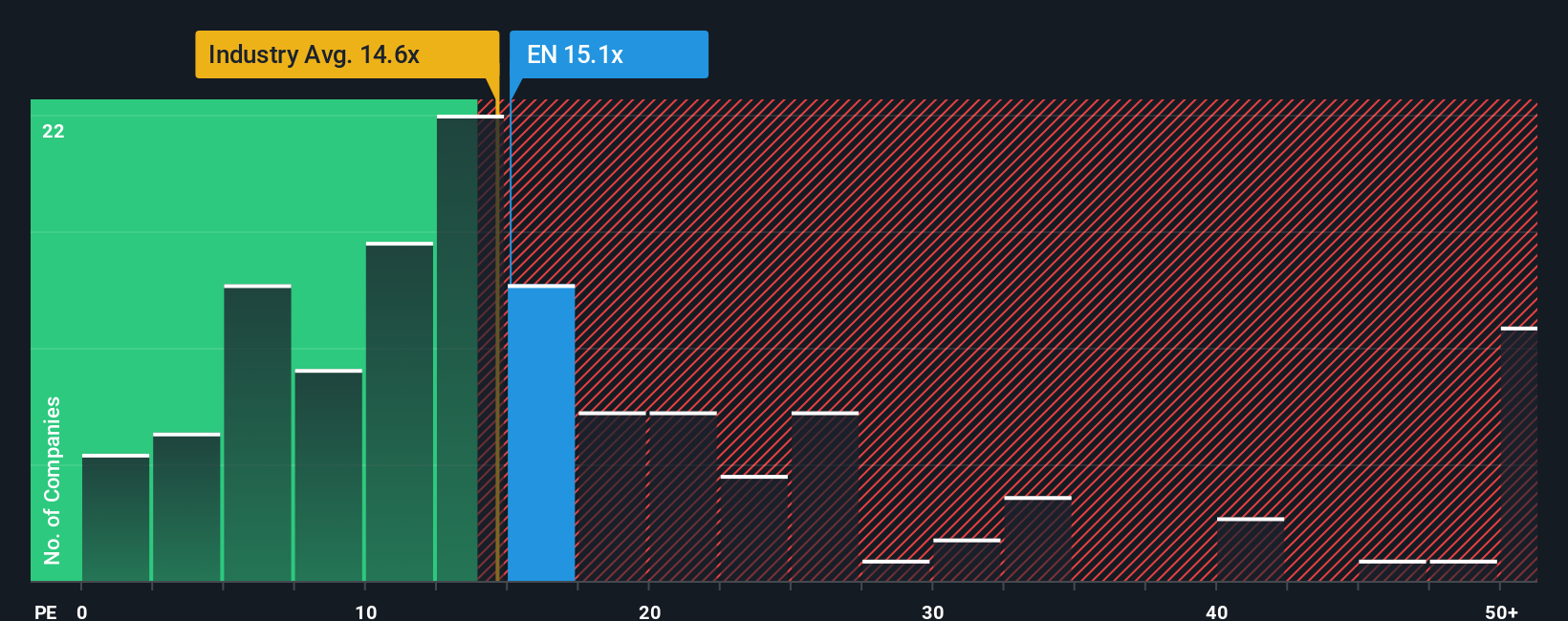

Looking at Bouygues through the market lens, its price-to-earnings ratio stands at 15.2x. This is more expensive than the European Construction industry average of 14.7x, but still much cheaper than its peer average of 32.8x. In fact, Bouygues trades below its fair ratio of 20x, which suggests that investors might be underestimating its longer-term profit potential, even after recent momentum. Is the market missing something, or is there a reason for this discount?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Bouygues Narrative

If you see the numbers differently or want to uncover your own investment angle, you can build a personalized narrative in just a few minutes using Do it your way.

A great starting point for your Bouygues research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Smart investors always stay one step ahead by uncovering new opportunities. Open up your options with top stock ideas that you do not want to miss.

- Unlock steady income streams by checking out these 18 dividend stocks with yields > 3% which offers attractive yields and reliable cash flow for your portfolio.

- Get ahead of the curve in healthcare by looking at these 33 healthcare AI stocks that is transforming patient care and diagnostics with the latest in artificial intelligence.

- Position yourself for tomorrow’s growth by scanning these 879 undervalued stocks based on cash flows which is poised for a strong rebound based on powerful cash flow analysis.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Bouygues might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:EN

Bouygues

Operates in the construction, energy, telecom, media, and transport infrastructure sectors in France and internationally.

Established dividend payer and good value.

Similar Companies

Market Insights

Community Narratives