- France

- /

- Aerospace & Defense

- /

- ENXTPA:AIR

How Will the Possible Satellite Deal Shape Airbus Shares After a 47% Surge?

Reviewed by Simply Wall St

Trying to figure out what to do with Airbus stock? You are definitely not alone. After all, it is not every day you see a company with shares up 21.3% year-to-date and a staggering 47.2% over the past year. Whether you have already boarded the Airbus train or are still deciding whether to buy your ticket, understanding what has been driving these moves is essential.

Lately, Airbus has seen a steady climb, with a 7.5% gain in the last month and long-term returns that look even more impressive: 232.2% over five years. A big part of the recent momentum comes from news that Airbus could soon partner up with Thales and Leonardo to unify their satellite businesses. This kind of collaboration could open up major new growth avenues. At the same time, the company faces real challenges. Reports have surfaced about more frequent incidents of fumes leaking on Airbus A320 jets, raising potential reputational and regulatory risks. Plus, like other big aircraft makers, Airbus is racing to deliver more planes despite supply chain headaches and delays.

So, is the stock still undervalued after this run? According to our valuation screening, Airbus meets 5 out of 6 key checks, for a solid value score of 5. This is a promising signal, but here is where it gets interesting. Next, we will break down the classic valuation methods that make up this score, and later, I will show you an even sharper way to size up how fairly priced Airbus really is.

Airbus delivered 47.2% returns over the last year. See how this stacks up to the rest of the Aerospace & Defense industry.Approach 1: Airbus Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company's true value by projecting its future cash flows and then discounting those amounts back to today. This method helps paint a clearer picture of what a business is really worth, beyond just what the market says.

Currently, Airbus reports €2.72 billion in Free Cash Flow, serving as the starting point for this valuation. Analyst consensus and further projections suggest robust growth, with Free Cash Flow expected to reach €11.61 billion by 2029. Projections beyond five years, out to 2035, are extrapolated and show continued expansion in Airbus's cash generation. All figures are presented in euros to align with the company's reporting currency.

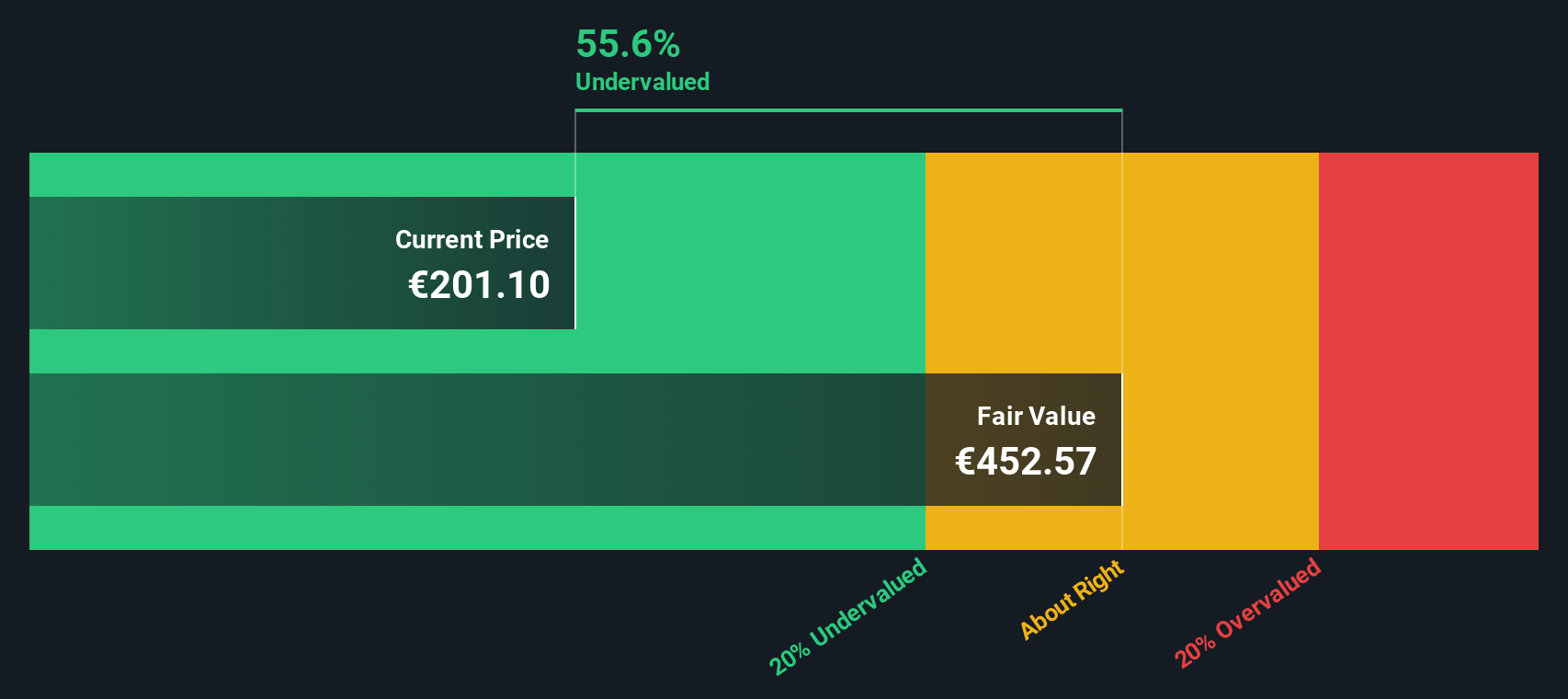

Based on these projections using the Two-Stage Free Cash Flow to Equity model, Airbus’s estimated intrinsic value comes to €452.18 per share. This represents a 57.0% discount compared to the current stock price, making Airbus look considerably undervalued on a fundamental basis.

Result: UNDERVALUED

Head to the Valuation section of our Company Report for more details on how we arrive at this Fair Value for Airbus.

Approach 2: Airbus Price vs Earnings

The Price-to-Earnings (PE) ratio is a widely used valuation tool for profitable companies like Airbus. It directly links the current share price to the company’s earnings, providing investors with a simple measure of how much they are paying for each euro of profit. A higher PE ratio can reflect loftier growth expectations or a lower perceived risk, while a lower ratio may suggest limited growth prospects or higher uncertainty.

Currently, Airbus trades at a PE ratio of 31.2x. For context, the average PE ratio among its peers sits at 34.8x, and the broader Aerospace & Defense industry shows an even higher average of 45.7x. At first glance, this could make Airbus look attractively priced compared to both peers and the sector as a whole.

Simply Wall St’s proprietary “Fair Ratio” offers a more tailored benchmark, integrating factors beyond simple averages, such as Airbus’s earnings growth prospects, risk profile, profit margins, industry trends, and market cap. For Airbus, this Fair Ratio stands at 31.4x, almost exactly in line with its current multiple. While industry and peer group comparisons offer a useful sense check, the Fair Ratio provides a more nuanced and holistic valuation benchmark.

Because Airbus’s PE ratio and its Fair Ratio are nearly identical, the shares can be considered fairly valued at today’s levels.

Result: ABOUT RIGHT

Upgrade Your Decision Making: Choose your Airbus Narrative

Earlier, we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives. A Narrative is your personal take on a company, combining your story and perspective with your assumptions about its future revenue, earnings, margins, and ultimately, fair value. Instead of seeing only the current numbers, a Narrative connects the bigger picture, such as what Airbus is doing, the industry outlook, and how future events or catalysts might impact those numbers, to a detailed financial forecast and a transparent fair value estimate.

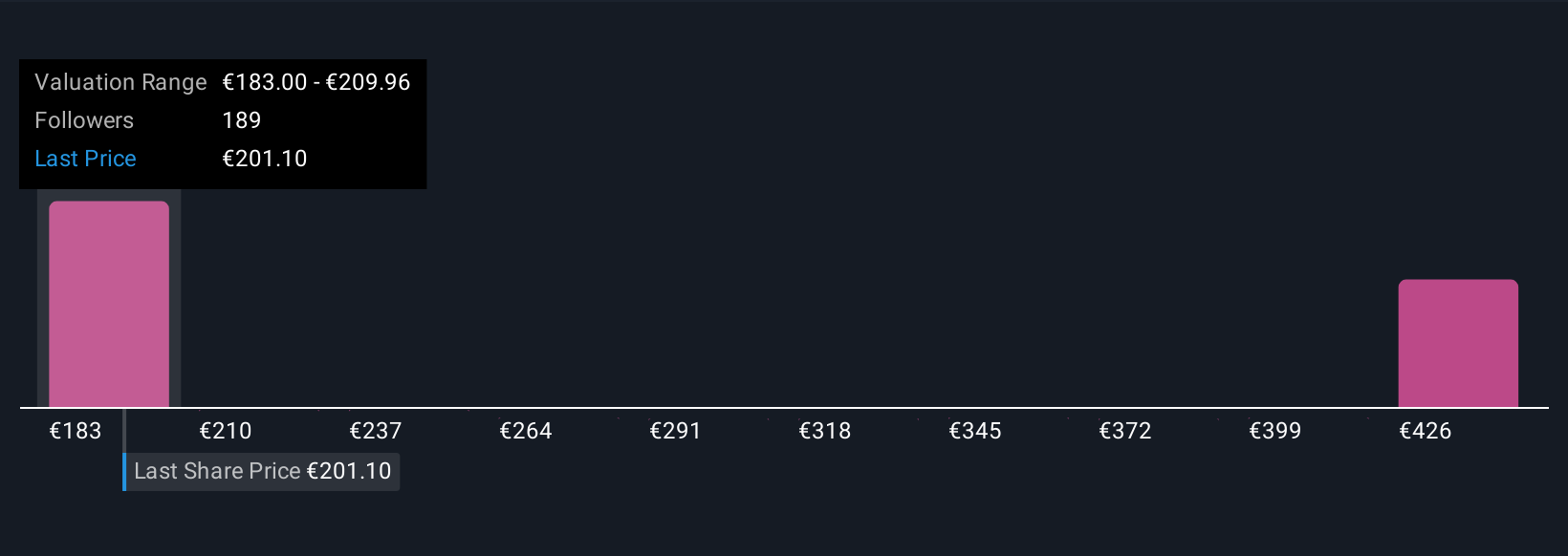

Narratives give you the power to turn your viewpoint into a clear, actionable investment thesis, helping you decide when to buy or sell by comparing your own Fair Value to the market price. These are not static predictions. Narratives on Simply Wall St’s Community page are automatically updated whenever there is new news or earnings, allowing you to quickly sense-check your assumptions when the facts change. For example, one investor might see strong emerging market demand and sustainability trends and set a bullish fair value near €244.0, while another, concerned about supply chain problems or regulatory risks, might justify a more cautious target of €140.0. Using Narratives, you can confidently invest with your own reasoning, always grounded in the latest data and a dynamic view of fair value.

Do you think there's more to the story for Airbus? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:AIR

Airbus

Engages in the design, manufacture, and delivery of aeronautics and aerospace products, services, and solutions worldwide.

Outstanding track record with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives