- France

- /

- Aerospace & Defense

- /

- ENXTPA:AIR

Does Airbus’s Record A320 Milestone Signal More Gains Ahead for Investors in 2025?

Reviewed by Bailey Pemberton

Thinking about what to do with your Airbus stock? You are not alone. With gains of nearly 27% so far this year and a stunning 53% climb over the last 12 months, Airbus is fresh on the minds of investors seeking both resilience and potential. Add in that unbelievable 239% surge over the last five years, and it is no surprise that the company is at the center of some serious conversation right now.

There has been plenty of news adding fuel to the fire lately. The A320 now officially holds the crown as the world’s most-delivered jet, finally toppling Boeing’s long-standing record. This is a huge point of pride and a clear signal of Airbus’s competitive momentum. At the same time, Boeing is scrambling to plan its next move after stumbling through safety concerns, which has pushed even more attention toward Airbus’s strengths.

But it is not all smooth flying. Delta Air Lines recently made headlines by swapping out engine units on over 300 Airbus jets, addressing toxic fume risks that stem largely from leaks in A320 models. While certainly not a dealbreaker, events like this add a layer of nuance to the risk picture and are not lost on investors looking for the whole story.

So where does this leave us in terms of valuation? Out of six checks for undervaluation, Airbus passes five, earning a strong value score of 5. In the next section, we will break down what those valuation checks actually mean and how they play into the bigger picture for Airbus. And, if you stick around, I will share an often-overlooked perspective on valuation that could change the way you look at any stock, not just this one.

Approach 1: Airbus Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company's intrinsic value by projecting its future cash flows and discounting them back to today. This approach focuses on the real cash Airbus is expected to generate over the coming years, offering a grounded view of what the business may be worth.

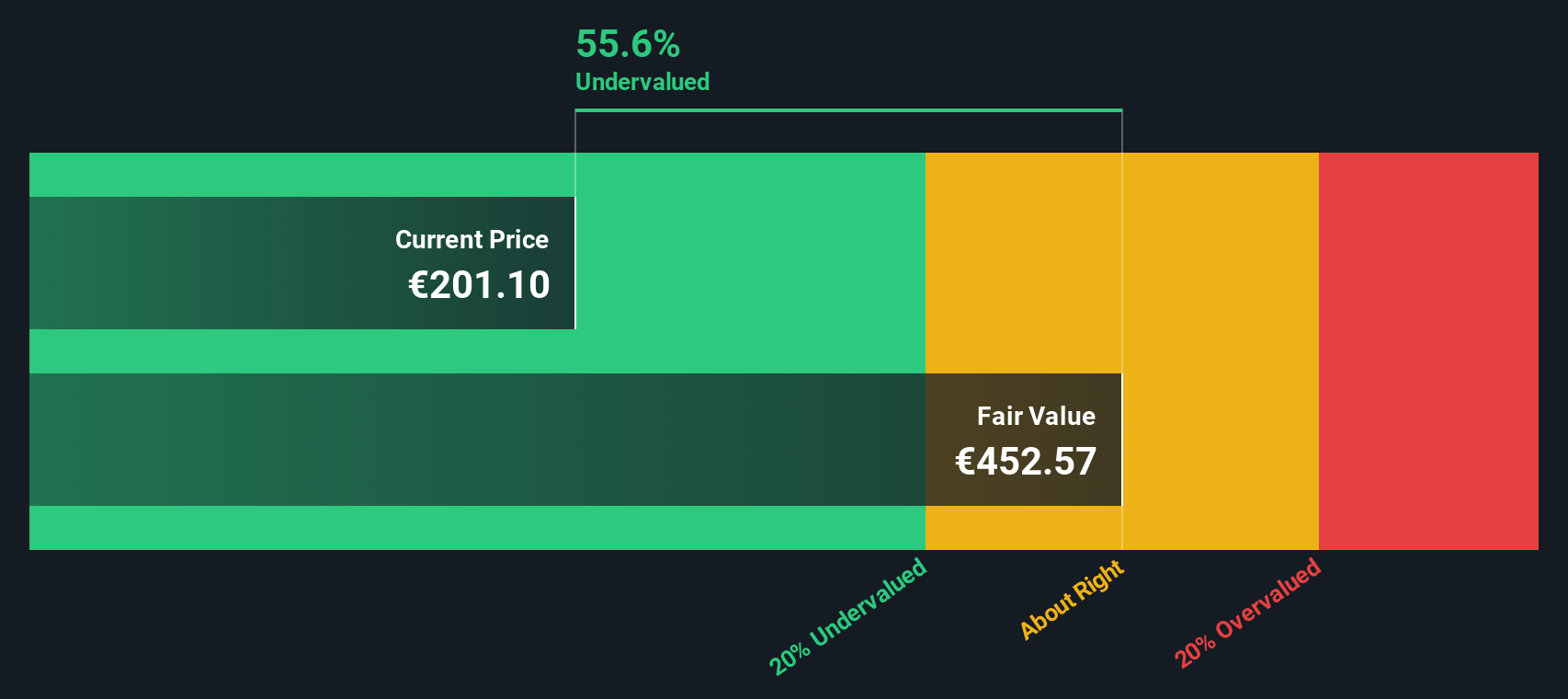

For Airbus, the current Free Cash Flow stands at €2.72 billion. Analyst estimates project that this figure will steadily rise, with forecasts reaching as high as €11.61 billion by 2029. Over the next ten years, projections from Simply Wall St show Free Cash Flow potentially hitting levels near €20.46 billion by 2035. It is worth noting that analyst coverage is typically only available for up to five years, and longer-term numbers rely on model-driven extrapolations.

Based on these estimates, the DCF model calculates Airbus’s intrinsic value at €447.79 per share. Given the current market price, this represents a significant intrinsic discount of about 54.7%. In other words, the stock appears substantially undervalued by this model’s measure.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Airbus is undervalued by 54.7%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: Airbus Price vs Earnings (PE Ratio)

The Price-to-Earnings (PE) ratio is a widely respected valuation tool, especially useful for investors assessing profitable companies like Airbus. This ratio reflects how much investors are willing to pay for each euro of earnings, making it a practical shortcut for comparing company valuations within an industry.

Growth expectations and risk play key roles in determining what constitutes a “normal” PE ratio. Higher growth or lower risk typically justifies a higher PE, while slower growth or uncertainty pushes the fair value lower. For Airbus, the current PE ratio is 32.57x. Looking at benchmarks, the average industry PE in Aerospace & Defense is a much loftier 47.23x, while Airbus's peers average 34.59x. This places Airbus below both the industry average and its direct competitors.

To offer a more tailored view, Simply Wall St estimates a Fair Ratio for Airbus at 34.69x, which accounts for the company's growth outlook, profit margins, industry factors, market cap, and potential risks. Unlike a simple peer or industry comparison, the Fair Ratio provides a more complete picture because it weighs specific elements unique to Airbus’s situation. With Airbus trading at 32.57x and its Fair Ratio at 34.69x, valuation is almost perfectly in line with what fundamentals warrant.

Result: ABOUT RIGHT

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Airbus Narrative

Earlier, we mentioned there is an even better way to understand valuation, so let us introduce you to Narratives. A Narrative is a simple yet powerful approach that lets you craft the story behind your investment view by connecting what is happening at a company like Airbus to your own expectations for future revenue, profits, and fair value.

With Narratives, you describe why a company might thrive or stumble, link that story to numbers such as your forecasted earnings and margins, and see how this translates to a personal estimate of fair value. Narratives are accessible to all investors on the Simply Wall St platform, available right within the Community page, and are used by millions to frame their decisions.

They make it easy to decide when to buy or sell by showing how your fair value compares to the actual share price, and they stay up-to-date, automatically changing as new information comes in from breaking news to fresh earnings reports.

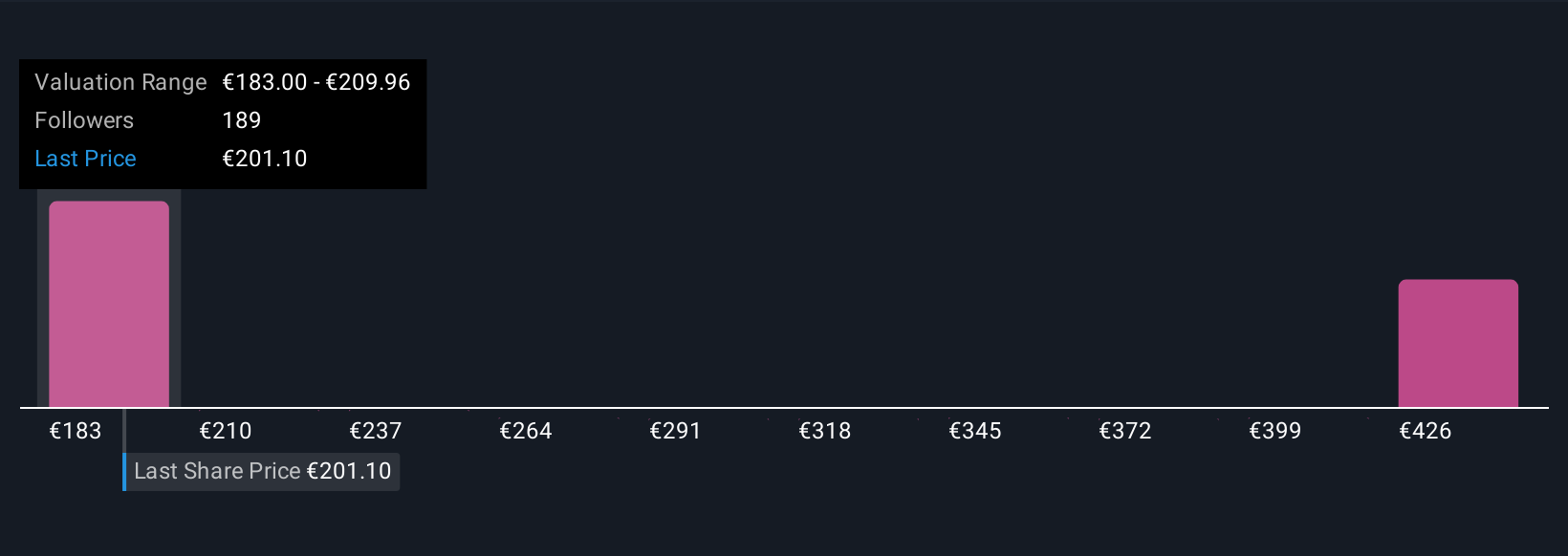

For example, when it comes to Airbus, some Narratives see a high fair value over €244 per share thanks to bullish views on emerging markets and decarbonization, while others take a more cautious stance closer to €140, focusing on supply chain and execution risks. With Narratives, you can confidently define your own path between those perspectives.

Do you think there's more to the story for Airbus? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:AIR

Airbus

Engages in the design, manufacture, and delivery of aeronautics and aerospace products, services, and solutions worldwide.

Outstanding track record with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives