- France

- /

- Aerospace & Defense

- /

- ENXTPA:AIR

A320 Supplier Quality Concerns Could Be A Game Changer For Airbus (ENXTPA:AIR)

Reviewed by Sasha Jovanovic

- In recent days, a Spanish labor union alleged serious manufacturing irregularities at key supplier Sofitec Aero SL on the Airbus A320 program, prompting Airbus to launch inspections across more than 600 aircraft that may disrupt production and deliveries.

- The episode underlines how quality-control lapses at a single supplier can ripple through Airbus’s tightly stretched supply chain, amplifying existing execution risks.

- Next, we’ll examine how these A320-related quality concerns may influence Airbus’s investment narrative, particularly its ambitious production ramp-up plans.

Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

Airbus Investment Narrative Recap

To own Airbus, you need to believe its large backlog and demand for fuel efficient jets will outweigh recurring execution issues, especially on the A320 ramp up. The Sofitec allegations fit squarely into the existing supply chain risk narrative, but at this stage do not appear to change the main near term catalyst, which remains Airbus hitting its production and delivery targets, or the core risk of further disruption from key suppliers.

In that context, Airbus’s acquisition of key Spirit AeroSystems assets looks particularly relevant, as it brings critical A220, A320 and A350 work in house at a time when supplier reliability is under scrutiny. If Airbus can gradually tighten control over more of its industrial footprint while addressing issues such as Sofitec’s alleged lapses, that may matter as much to the investment case as any single quarterly delivery number.

But against this backdrop of strong demand, investors should still be alert to how recurring supply chain vulnerabilities could...

Read the full narrative on Airbus (it's free!)

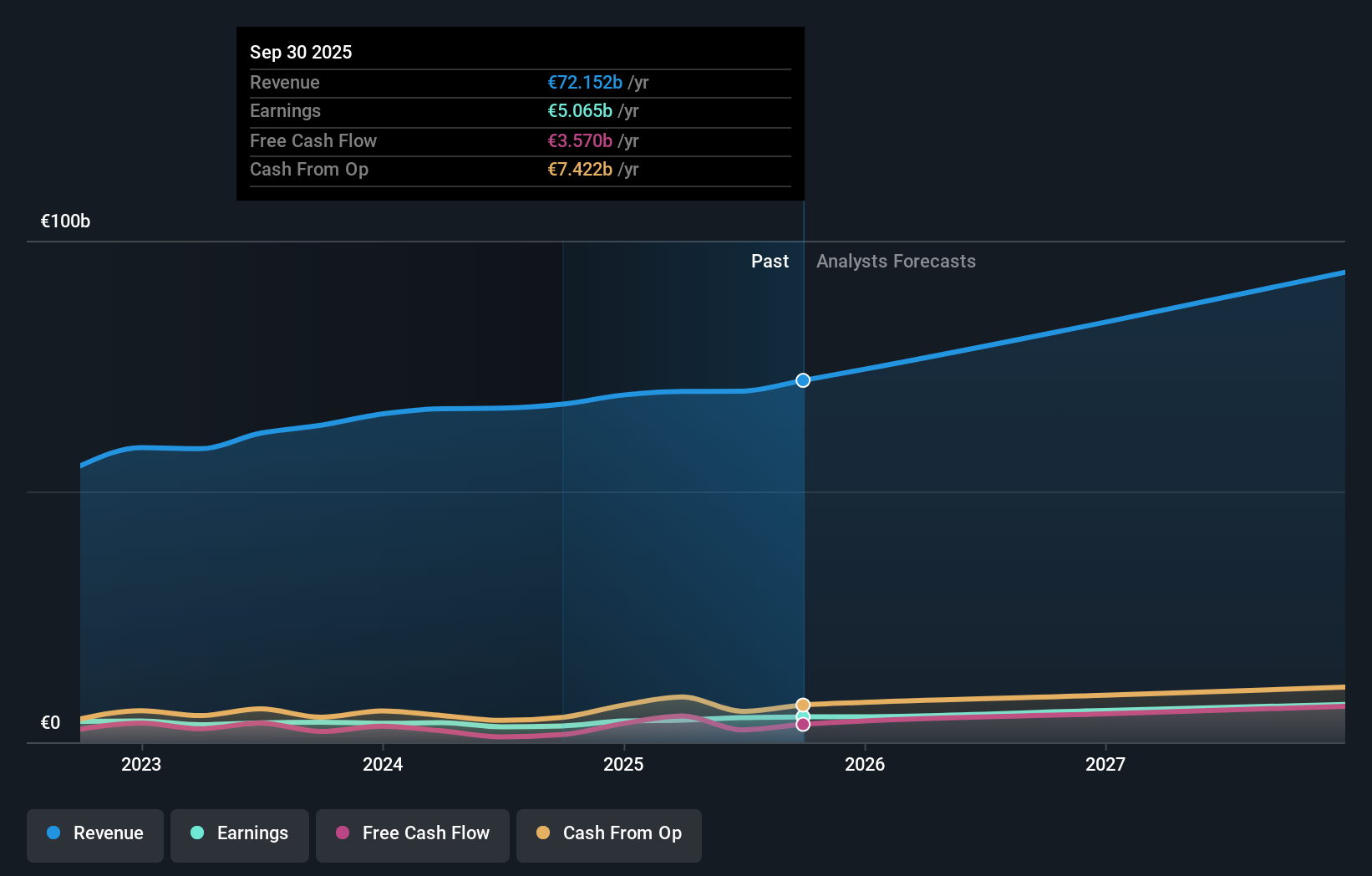

Airbus' narrative projects €98.7 billion revenue and €7.9 billion earnings by 2028. This requires 12.1% yearly revenue growth and a €3.0 billion earnings increase from €4.9 billion today.

Uncover how Airbus' forecasts yield a €224.40 fair value, a 16% upside to its current price.

Exploring Other Perspectives

Twenty two fair value estimates from the Simply Wall St Community span roughly €145 to €464 per share, with several clustered well above €300. That spread sits against a backdrop where Airbus’s ambitious A320 production ramp up remains heavily exposed to supplier reliability, a point that could meaningfully influence how you think about the company’s future execution and cash generation.

Explore 22 other fair value estimates on Airbus - why the stock might be worth 25% less than the current price!

Build Your Own Airbus Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Airbus research is our analysis highlighting 4 key rewards that could impact your investment decision.

- Our free Airbus research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Airbus' overall financial health at a glance.

Curious About Other Options?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 37 best rare earth metal stocks of the very few that mine this essential strategic resource.

- Find companies with promising cash flow potential yet trading below their fair value.

- These 10 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:AIR

Airbus

Engages in the design, manufacture, and delivery of aeronautics and aerospace products, services, and solutions worldwide.

Outstanding track record with flawless balance sheet.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Deep Value Multi Bagger Opportunity

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Unicycive Therapeutics (Nasdaq: UNCY) – Preparing for a Second Shot at Bringing a New Kidney Treatment to Market (TEST)

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026