Introducing Société Générale Société anonyme (EPA:GLE), The Stock That Slid 70% In The Last Three Years

The truth is that if you invest for long enough, you're going to end up with some losing stocks. But the last three years have been particularly tough on longer term Société Générale Société anonyme (EPA:GLE) shareholders. Regrettably, they have had to cope with a 70% drop in the share price over that period. And the ride hasn't got any smoother in recent times over the last year, with the price 52% lower in that time. The falls have accelerated recently, with the share price down 54% in the last three months. But this could be related to the weak market, which is down 24% in the same period.

Check out our latest analysis for Société Générale Société anonyme

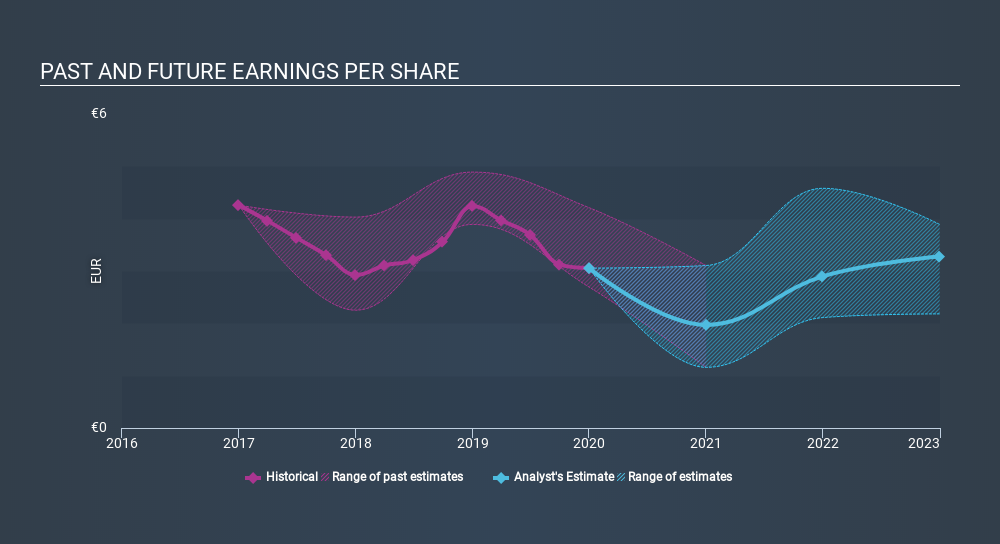

While markets are a powerful pricing mechanism, share prices reflect investor sentiment, not just underlying business performance. One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

Société Générale Société anonyme saw its EPS decline at a compound rate of 10% per year, over the last three years. The share price decline of 33% is actually steeper than the EPS slippage. So it's likely that the EPS decline has disappointed the market, leaving investors hesitant to buy. The less favorable sentiment is reflected in its current P/E ratio of 4.56.

The graphic below depicts how EPS has changed over time (unveil the exact values by clicking on the image).

Dive deeper into Société Générale Société anonyme's key metrics by checking this interactive graph of Société Générale Société anonyme's earnings, revenue and cash flow.

What about the Total Shareholder Return (TSR)?

We'd be remiss not to mention the difference between Société Générale Société anonyme's total shareholder return (TSR) and its share price return. Arguably the TSR is a more complete return calculation because it accounts for the value of dividends (as if they were reinvested), along with the hypothetical value of any discounted capital that have been offered to shareholders. Société Générale Société anonyme's TSR of was a loss of 63% for the 3 years. That wasn't as bad as its share price return, because it has paid dividends.

A Different Perspective

While the broader market lost about 15% in the twelve months, Société Générale Société anonyme shareholders did even worse, losing 47%. Having said that, it's inevitable that some stocks will be oversold in a falling market. The key is to keep your eyes on the fundamental developments. Regrettably, last year's performance caps off a bad run, with the shareholders facing a total loss of 17% per year over five years. We realise that Baron Rothschild has said investors should "buy when there is blood on the streets", but we caution that investors should first be sure they are buying a high quality business. It's always interesting to track share price performance over the longer term. But to understand Société Générale Société anonyme better, we need to consider many other factors. Case in point: We've spotted 2 warning signs for Société Générale Société anonyme you should be aware of.

But note: Société Générale Société anonyme may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on FR exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About ENXTPA:GLE

Société Générale Société anonyme

Provides banking and financial services to individuals, corporates, and institutional clients in Europe and internationally.

Solid track record, good value and pays a dividend.

Similar Companies

Market Insights

Community Narratives