As global markets react to the evolving political landscape and economic indicators, small-cap stocks have experienced varied impacts, with indices like the Russell 2000 showing a decline amid broader market volatility. Despite these fluctuations, small-cap companies often present unique opportunities for investors willing to explore beyond the more prominent names in search of potential growth. In this context, identifying promising stocks involves assessing factors such as financial health, market position, and adaptability to current economic conditions.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Marítima de Inversiones | NA | 82.67% | 21.14% | ★★★★★★ |

| Impellam Group | 31.12% | -5.43% | -6.86% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Industrias del Cobre Sociedad Anónima | NA | 19.08% | 22.33% | ★★★★★★ |

| First Northern Community Bancorp | NA | 7.65% | 11.17% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| Steamships Trading | 33.60% | 4.17% | 3.90% | ★★★★★☆ |

| Hermes Transportes Blindados | 58.80% | 4.29% | 2.04% | ★★★★☆☆ |

| Wilson | 64.79% | 30.09% | 68.29% | ★★★★☆☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

Underneath we present a selection of stocks filtered out by our screen.

Caisse Régionale de Crédit Agricole Mutuel de la Touraine et du Poitou Société Coopérative (ENXTPA:CRTO)

Simply Wall St Value Rating: ★★★★★★

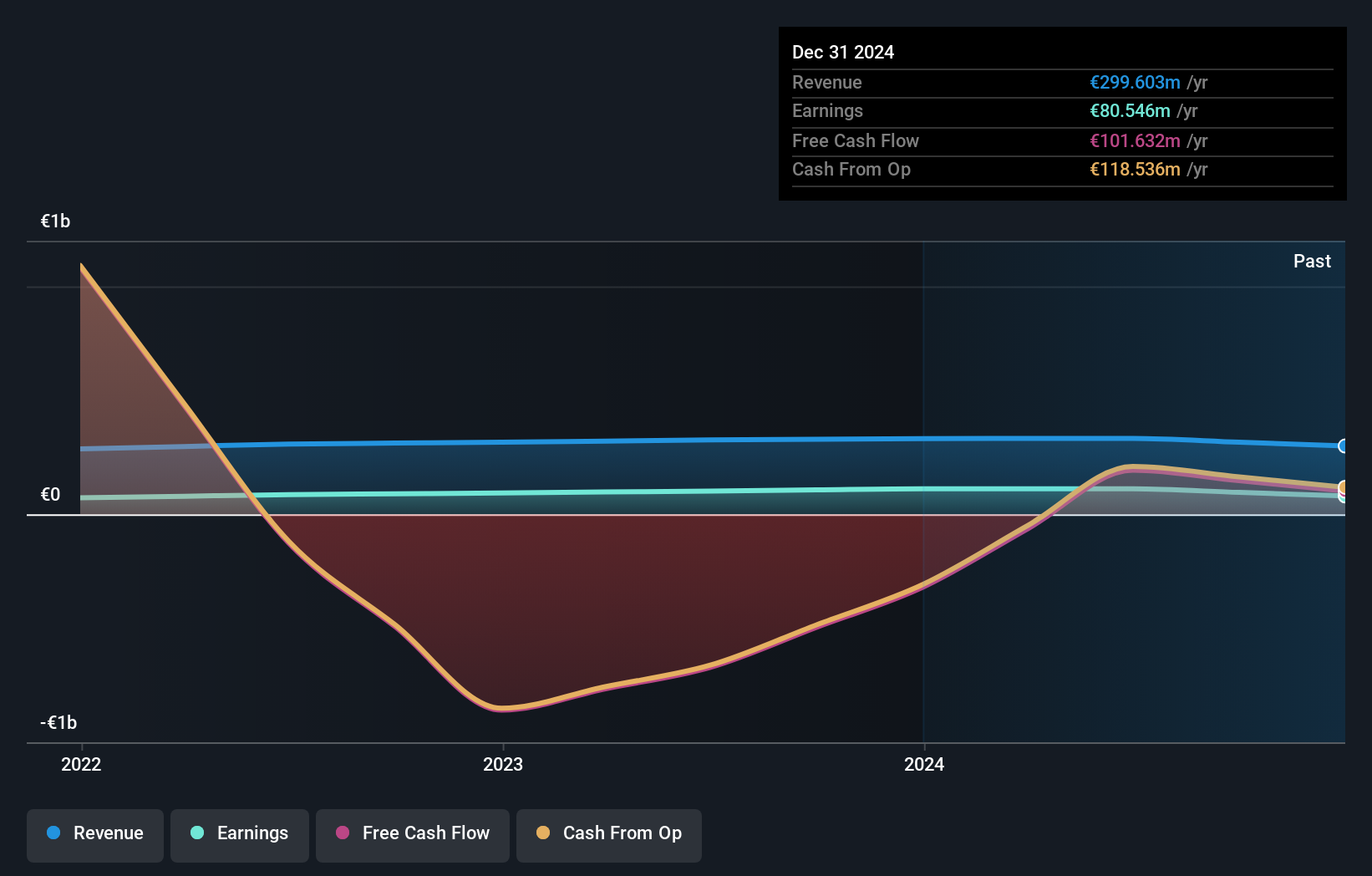

Overview: Caisse Régionale de Crédit Agricole Mutuel de La Touraine et du Poitou Société Coopérative offers a range of banking products and services in France, with a market cap of €476.25 million.

Operations: The company generates revenue primarily from its Proximity Bank segment, contributing €254.46 million, and Management for Own Account and Miscellaneous activities, adding €94.09 million.

Caisse Régionale de Crédit Agricole Mutuel de la Touraine et du Poitou, a cooperative bank with total assets of €16.9 billion and equity of €2.7 billion, offers an intriguing investment case. The company boasts high-quality earnings and trades at 57.9% below its estimated fair value, suggesting potential undervaluation. Its allowance for bad loans is robust at 132%, indicating strong risk management practices, while non-performing loans are kept low at 1.3%. With customer deposits forming the bulk of its funding sources, the bank's stability seems well-supported by low-risk liabilities amounting to 95% of its total obligations.

China Aviation Oil (Singapore) (SGX:G92)

Simply Wall St Value Rating: ★★★★★★

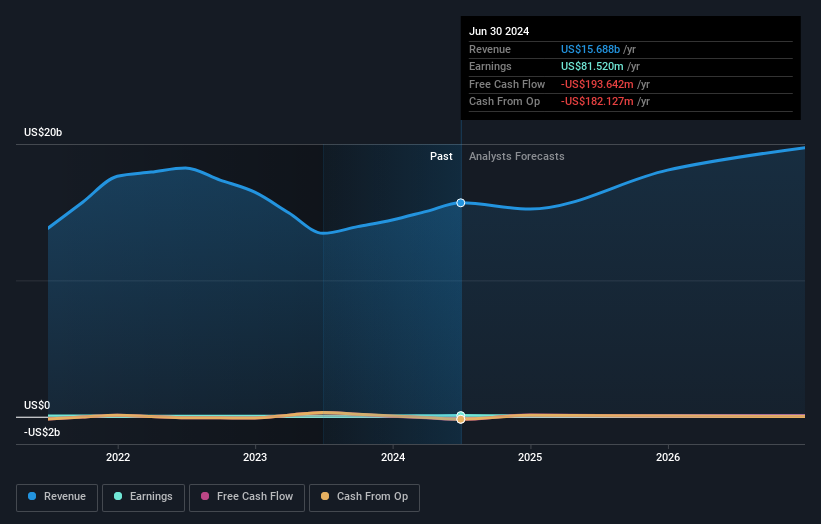

Overview: China Aviation Oil (Singapore) Corporation Ltd is involved in the trading and supply of jet fuel and other petroleum products to the global civil aviation industry, with a market capitalization of SGD769.86 million.

Operations: The company generates revenue primarily from the trading of middle distillates, contributing $10.53 billion, and other oil products at $5.16 billion. The focus on these segments highlights its significant role in the global civil aviation fuel supply chain.

China Aviation Oil (Singapore), a player in the oil and gas sector, stands out with its impressive earnings growth of 142.6% over the past year, significantly surpassing the industry's 21.4%. Despite being debt-free for five years, it trades at an attractive value, currently 61.5% below its estimated fair value. However, it's not all smooth sailing as free cash flow remains negative despite recent improvements to US$176.87 million in September 2023 from previous lows. The company also boasts high-quality non-cash earnings, indicating robust operational performance amidst industry challenges.

- Click here to discover the nuances of China Aviation Oil (Singapore) with our detailed analytical health report.

Learn about China Aviation Oil (Singapore)'s historical performance.

Yangzhou Chenhua New Material (SZSE:300610)

Simply Wall St Value Rating: ★★★★★☆

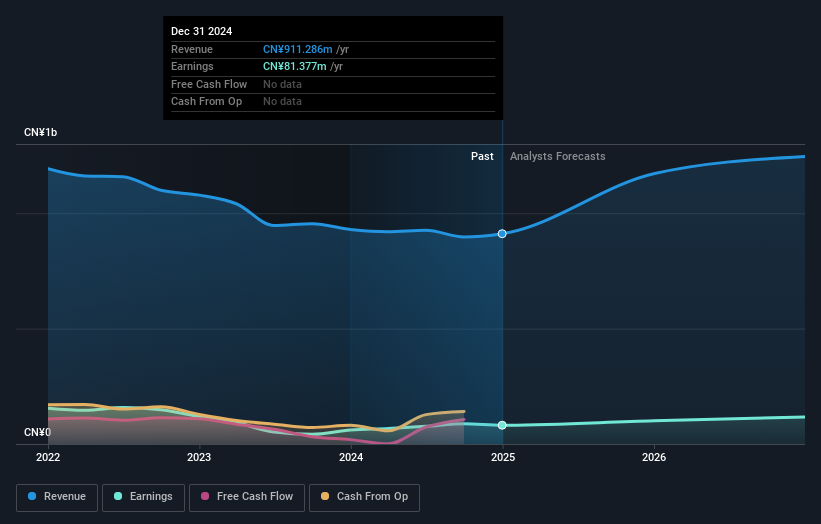

Overview: Yangzhou Chenhua New Material Co., Ltd. is involved in the research, production, and sale of various chemical products in China with a market capitalization of approximately CN¥2.31 billion.

Operations: Chenhua generates revenue primarily from its Fine Chemicals and New Materials Industry segment, amounting to CN¥893.68 million.

Yangzhou Chenhua, a promising player in the chemicals sector, has shown remarkable earnings growth of 110% over the past year, outpacing its industry peers. Despite a dip in sales to CNY 685.49 million from CNY 718.19 million last year, net income climbed to CNY 66.68 million from CNY 39.08 million, reflecting robust operational efficiency with basic earnings per share rising to CNY 0.31 from CNY 0.18. The company's debt-to-equity ratio has increased slightly to 5%, yet it remains well-covered by cash reserves, underscoring financial stability and potential for future expansion with projected annual growth of nearly 14%.

Make It Happen

- Discover the full array of 4639 Undiscovered Gems With Strong Fundamentals right here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:CRTO

Caisse Régionale de Crédit Agricole Mutuel de la Touraine et du Poitou Société Coopérative

Caisse Régionale de Crédit Agricole Mutuel de La Touraine et du Poitou Société Coopérative provides various banking products and services in France.

Flawless balance sheet, good value and pays a dividend.

Market Insights

Community Narratives