Caisse Régionale de Crédit Agricole Mutuel Nord de France Société coopérative And 2 Other Promising Small Caps with Potential

Reviewed by Simply Wall St

In a market environment where major indices like the S&P 500 are reaching new heights and investor sentiment is buoyed by optimism surrounding trade policies and AI investments, small-cap stocks often face unique challenges and opportunities. While large-cap stocks have recently outperformed, the potential for growth in smaller companies remains significant, particularly when they are well-positioned to capitalize on emerging trends or shifts in economic conditions. Identifying promising small caps involves looking for those with strong fundamentals, innovative business models, or strategic positioning that can thrive despite broader market dynamics.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Sun | 14.28% | 5.73% | 64.26% | ★★★★★★ |

| Changjiu Holdings | NA | 11.84% | 2.46% | ★★★★★★ |

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Cardig Aero Services | NA | 6.60% | 69.79% | ★★★★★★ |

| Etihad Atheeb Telecommunication | NA | 30.82% | 63.88% | ★★★★★★ |

| Sure Global Tech | NA | 10.25% | 20.35% | ★★★★★★ |

| Yulie Sekuritas Indonesia | NA | 18.62% | 9.58% | ★★★★★★ |

| S.A.S. Dragon Holdings | 60.96% | 4.62% | 10.02% | ★★★★★☆ |

| Berger Paints Bangladesh | 3.72% | 10.32% | 7.30% | ★★★★★☆ |

We're going to check out a few of the best picks from our screener tool.

Caisse Régionale de Crédit Agricole Mutuel Nord de France Société coopérative (ENXTPA:CNDF)

Simply Wall St Value Rating: ★★★★★★

Overview: Caisse Régionale de Crédit Agricole Mutuel Nord de France Société coopérative offers a range of banking products and financial services in France, with a market capitalization of approximately €858.69 million.

Operations: The company generates revenue primarily from its retail banking segment, amounting to €623.64 million.

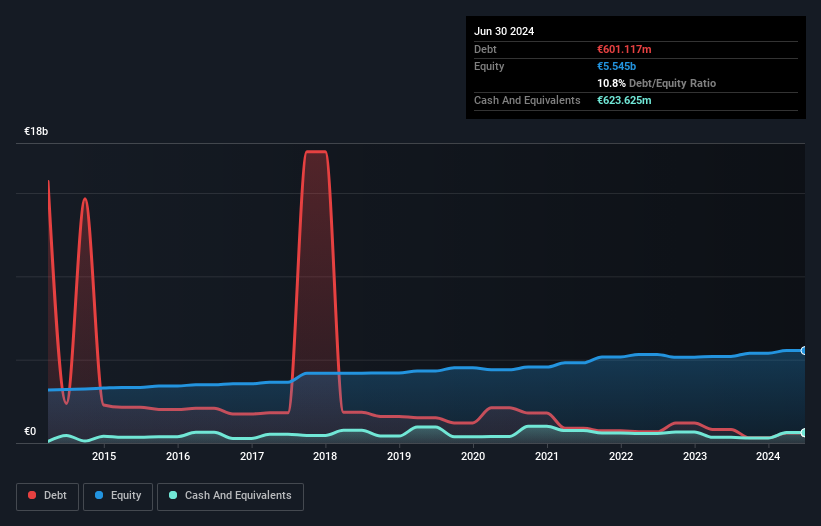

Caisse Régionale de Crédit Agricole Mutuel Nord de France, with total assets of €38.9 billion and equity of €5.5 billion, stands out for its robust financial health. The bank's earnings surged 31.6% last year, significantly outpacing the industry average of 5.3%. With 95% of liabilities funded by low-risk customer deposits and a bad loan ratio at a manageable 1.5%, it demonstrates sound risk management practices. Trading at nearly half its estimated fair value, this cooperative bank offers potential appeal to investors seeking undervalued opportunities in the financial sector.

Bera Holding (IBSE:BERA)

Simply Wall St Value Rating: ★★★★★★

Overview: Bera Holding A.S. is a diversified conglomerate engaged in sectors such as paper and cardboard, machinery, oil, construction and building materials, marble, textiles, tourism, and food on a global scale with a market capitalization of TRY10.65 billion.

Operations: Bera Holding's primary revenue streams are derived from the paper-carton-packaging sector, contributing TRY3.67 billion, and the construction and building materials sector with TRY3.24 billion. The food segment also plays a significant role, generating TRY2.19 billion in revenue. Notably, the marble and mine segment reported a negative figure of TRY1.22 million, impacting overall financial performance.

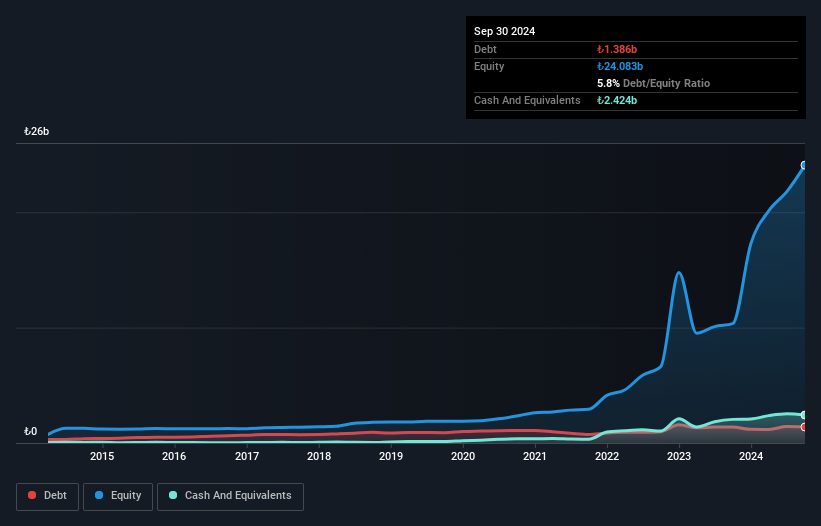

Bera Holding seems to be an intriguing prospect, having turned profitable this year with net income reaching TRY 1,146.71 million for the nine months ended September 2024. The company is trading at a significant discount, about 84.9% below its estimated fair value, which could indicate potential upside for investors. Its debt situation looks favorable as well; Bera's debt-to-equity ratio has decreased from 47.6% to just 5.8% over five years, and it holds more cash than total debt. Additionally, Bera's basic earnings per share from continuing operations improved to TRY 0.362 in the third quarter compared to a loss last year.

- Navigate through the intricacies of Bera Holding with our comprehensive health report here.

Understand Bera Holding's track record by examining our Past report.

Toho Bank (TSE:8346)

Simply Wall St Value Rating: ★★★★☆☆

Overview: The Toho Bank, Ltd. operates as a financial institution offering a range of banking products and services in Japan, with a market capitalization of approximately ¥76.66 billion.

Operations: Toho Bank generates revenue primarily from its banking operations, which contribute ¥52.69 billion, followed by leasing at ¥7.88 billion and credit guarantee services at ¥1.81 billion. The bank's net profit margin is a key financial metric to consider when evaluating its profitability trends over time.

With total assets of ¥6,590.9 billion and equity at ¥207.3 billion, Toho Bank stands as a promising player in its niche market. Total deposits reach ¥6,169.1 billion while loans are at ¥3,756.7 billion, with a net interest margin of 0.6%. The bank's bad loans are appropriately low at 1.4%, supported by primarily low-risk funding sources making up 97% of liabilities through customer deposits rather than external borrowing. Despite trading below fair value estimates by 8%, it has experienced robust earnings growth averaging 25% annually over the past five years but slightly trails industry peers recently with a growth rate of 23%.

- Click here and access our complete health analysis report to understand the dynamics of Toho Bank.

Gain insights into Toho Bank's past trends and performance with our Past report.

Next Steps

- Unlock more gems! Our Undiscovered Gems With Strong Fundamentals screener has unearthed 4684 more companies for you to explore.Click here to unveil our expertly curated list of 4687 Undiscovered Gems With Strong Fundamentals.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Toho Bank might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:8346

Adequate balance sheet with acceptable track record.

Market Insights

Community Narratives