With EPS Growth And More, Caisse Régionale de Crédit Agricole Mutuel de Paris et d'Ile-de-France (EPA:CAF) Makes An Interesting Case

Investors are often guided by the idea of discovering 'the next big thing', even if that means buying 'story stocks' without any revenue, let alone profit. Sometimes these stories can cloud the minds of investors, leading them to invest with their emotions rather than on the merit of good company fundamentals. Loss-making companies are always racing against time to reach financial sustainability, so investors in these companies may be taking on more risk than they should.

If this kind of company isn't your style, you like companies that generate revenue, and even earn profits, then you may well be interested in Caisse Régionale de Crédit Agricole Mutuel de Paris et d'Ile-de-France (EPA:CAF). While this doesn't necessarily speak to whether it's undervalued, the profitability of the business is enough to warrant some appreciation - especially if its growing.

See our latest analysis for Caisse Régionale de Crédit Agricole Mutuel de Paris et d'Ile-de-France

Caisse Régionale de Crédit Agricole Mutuel de Paris et d'Ile-de-France's Earnings Per Share Are Growing

The market is a voting machine in the short term, but a weighing machine in the long term, so you'd expect share price to follow earnings per share (EPS) outcomes eventually. So it makes sense that experienced investors pay close attention to company EPS when undertaking investment research. Over the last three years, Caisse Régionale de Crédit Agricole Mutuel de Paris et d'Ile-de-France has grown EPS by 6.1% per year. That might not be particularly high growth, but it does show that per-share earnings are moving steadily in the right direction.

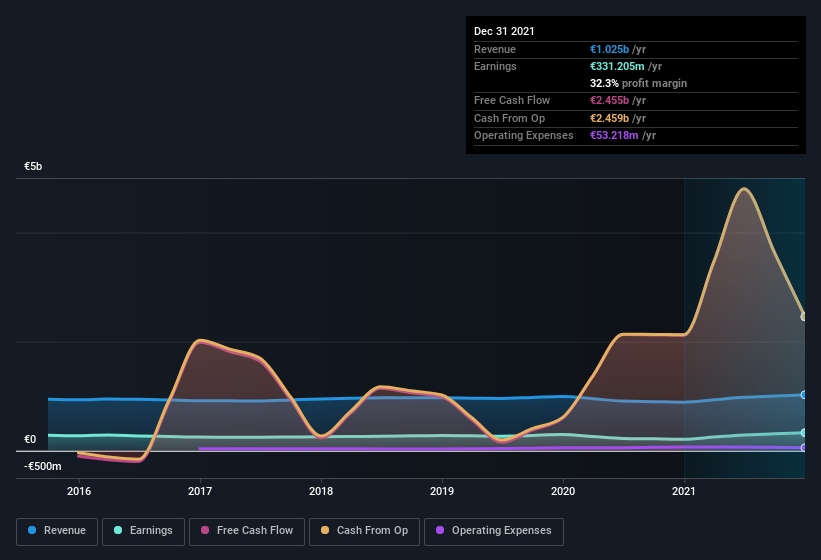

Careful consideration of revenue growth and earnings before interest and taxation (EBIT) margins can help inform a view on the sustainability of the recent profit growth. Our analysis has highlighted that Caisse Régionale de Crédit Agricole Mutuel de Paris et d'Ile-de-France's revenue from operations did not account for all of their revenue in the previous 12 months, so our analysis of its margins might not accurately reflect the underlying business. While we note Caisse Régionale de Crédit Agricole Mutuel de Paris et d'Ile-de-France achieved similar EBIT margins to last year, revenue grew by a solid 15% to €1.0b. That's a real positive.

You can take a look at the company's revenue and earnings growth trend, in the chart below. Click on the chart to see the exact numbers.

While it's always good to see growing profits, you should always remember that a weak balance sheet could come back to bite. So check Caisse Régionale de Crédit Agricole Mutuel de Paris et d'Ile-de-France's balance sheet strength, before getting too excited.

Are Caisse Régionale de Crédit Agricole Mutuel de Paris et d'Ile-de-France Insiders Aligned With All Shareholders?

As a general rule, it's worth considering how much the CEO is paid, since unreasonably high rates could be considered against the interests of shareholders. For companies with market capitalisations between €979m and €3.1b, like Caisse Régionale de Crédit Agricole Mutuel de Paris et d'Ile-de-France, the median CEO pay is around €1.1m.

The Caisse Régionale de Crédit Agricole Mutuel de Paris et d'Ile-de-France CEO received total compensation of just €431k in the year to December 2021. That's clearly well below average, so at a glance that arrangement seems generous to shareholders and points to a modest remuneration culture. CEO compensation is hardly the most important aspect of a company to consider, but when it's reasonable, that gives a little more confidence that leadership are looking out for shareholder interests. It can also be a sign of a culture of integrity, in a broader sense.

Does Caisse Régionale de Crédit Agricole Mutuel de Paris et d'Ile-de-France Deserve A Spot On Your Watchlist?

As previously touched on, Caisse Régionale de Crédit Agricole Mutuel de Paris et d'Ile-de-France is a growing business, which is encouraging. To add to this, the modest CEO compensation should tell investors that the directors have an active interest in delivering the best for shareholders. So based on its merits, the stock deserves further research, if not an addition to your watchlist. While we've looked at the quality of the earnings, we haven't yet done any work to value the stock. So if you like to buy cheap, you may want to check if Caisse Régionale de Crédit Agricole Mutuel de Paris et d'Ile-de-France is trading on a high P/E or a low P/E, relative to its industry.

The beauty of investing is that you can invest in almost any company you want. But if you prefer to focus on stocks that have demonstrated insider buying, here is a list of companies with insider buying in the last three months.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ENXTPA:CAF

Caisse Régionale de Crédit Agricole Mutuel de Paris et d'Ile-de-France

Provides banking services to its members in France, Other European Union countries, North America, Central America, South Africa, the Middle East, Asia and Oceania, and Japan.

Excellent balance sheet and slightly overvalued.

Market Insights

Community Narratives