French Political Turmoil and Rising Bond Yields Might Change the Case For Investing In BNP Paribas (ENXTPA:BNP)

Reviewed by Sasha Jovanovic

- Earlier this week, French stocks, including major lenders like BNP Paribas, experienced volatility as the resignation of French Prime Minister Sébastien Lecornu intensified political uncertainty and drove up bond yields amid concerns about France's budget position.

- This sudden leadership change heightened scrutiny on large French financial institutions and their exposure to both domestic policy shifts and international legal issues.

- We will now examine how France’s deepening political crisis and regulatory scrutiny could influence the future direction of BNP Paribas’s investment outlook.

Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

BNP Paribas Investment Narrative Recap

Shareholders in BNP Paribas must have confidence in the group's ability to manage through both evolving European banking sector challenges and short-term turbulence driven by French political uncertainty. While the recent resignation of the French Prime Minister brought market volatility and scrutiny, the immediate impact on BNP Paribas’s revenue growth potential and its most significant risk, ongoing earnings headwinds in traditional Eurozone banking, appears limited for now.

Among recent developments, the US court’s decision allowing a high-profile lawsuit linked to past dealings with sanctioned Iranian entities is most relevant to today's heightened regulatory and reputational risks. As BNP Paribas focuses on expanding digital platforms and new markets, these legal issues have added complexity to its risk environment and could influence management’s near-term priorities.

By contrast, investors should pay close attention to BNP Paribas’s exposure to changing regulatory requirements and what this could mean for shareholder returns...

Read the full narrative on BNP Paribas (it's free!)

BNP Paribas' outlook anticipates €57.9 billion in revenue and €13.8 billion in earnings by 2028. This is based on a projected annual revenue growth rate of 7.7% and an earnings increase of €3.2 billion from current earnings of €10.6 billion.

Uncover how BNP Paribas' forecasts yield a €92.08 fair value, a 22% upside to its current price.

Exploring Other Perspectives

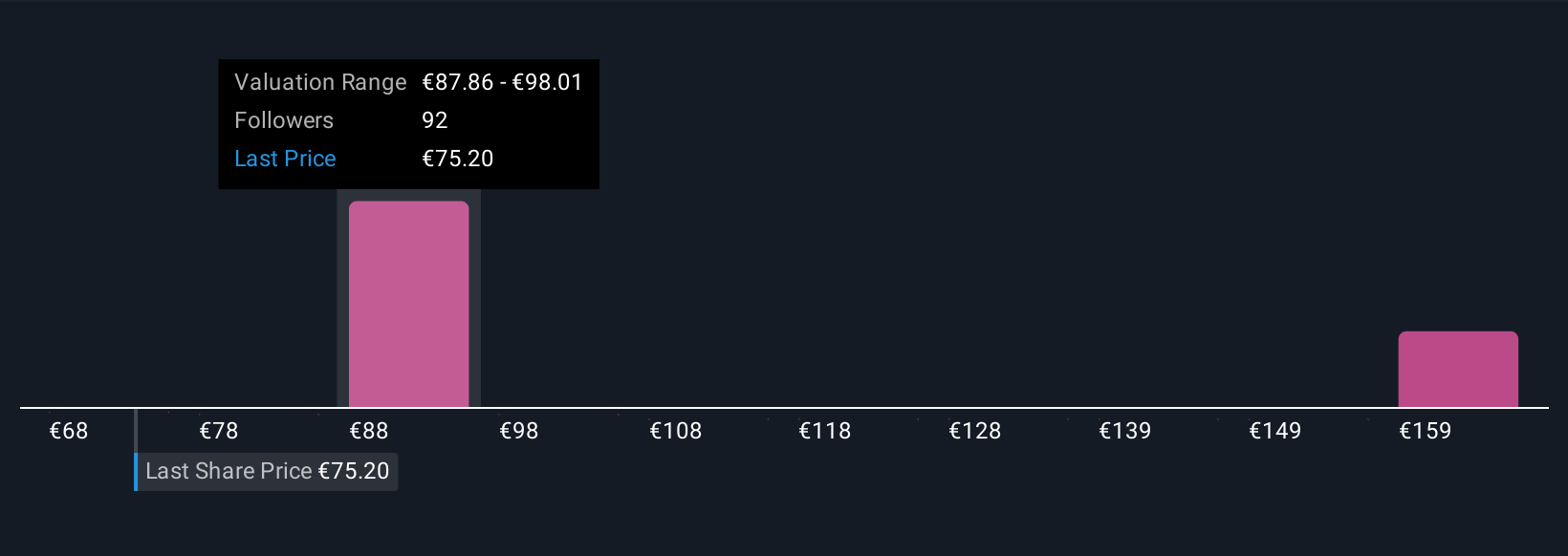

Twelve members of the Simply Wall St Community see BNP Paribas’s fair value ranging from €67.56 to €168.46 per share. Your view on the risks in highly regulated, low-growth Eurozone banking could make the difference in how you interpret these valuations.

Explore 12 other fair value estimates on BNP Paribas - why the stock might be worth over 2x more than the current price!

Build Your Own BNP Paribas Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your BNP Paribas research is our analysis highlighting 5 key rewards and 4 important warning signs that could impact your investment decision.

- Our free BNP Paribas research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate BNP Paribas' overall financial health at a glance.

Searching For A Fresh Perspective?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if BNP Paribas might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:BNP

BNP Paribas

Provides various banking and financial products and services in Europe, the Middle East, Africa, the Americas, and the Asia Pacific.

Very undervalued established dividend payer.

Similar Companies

Market Insights

Community Narratives