3 European Dividend Stocks To Consider With At Least 3.2% Yield

Reviewed by Simply Wall St

The European market has shown resilience with the pan-European STOXX Europe 600 Index rising 2.11%, buoyed by strong corporate earnings and optimism regarding geopolitical tensions. As the Bank of England's recent rate cut signals concerns over a weakening labor market, investors are increasingly looking towards dividend stocks as a potential source of steady income amidst economic uncertainties. A good dividend stock often combines a reliable yield with solid financial health, making it an attractive option for those seeking stability in fluctuating markets.

Top 10 Dividend Stocks In Europe

| Name | Dividend Yield | Dividend Rating |

| Zurich Insurance Group (SWX:ZURN) | 4.29% | ★★★★★★ |

| Telekom Austria (WBAG:TKA) | 4.26% | ★★★★★☆ |

| Rubis (ENXTPA:RUI) | 7.06% | ★★★★★★ |

| Holcim (SWX:HOLN) | 4.57% | ★★★★★★ |

| HEXPOL (OM:HPOL B) | 5.02% | ★★★★★★ |

| DKSH Holding (SWX:DKSH) | 4.08% | ★★★★★★ |

| Cembra Money Bank (SWX:CMBN) | 4.62% | ★★★★★★ |

| CaixaBank (BME:CABK) | 6.53% | ★★★★★☆ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 4.61% | ★★★★★☆ |

| Banca Popolare di Sondrio (BIT:BPSO) | 6.30% | ★★★★★☆ |

Click here to see the full list of 217 stocks from our Top European Dividend Stocks screener.

Let's review some notable picks from our screened stocks.

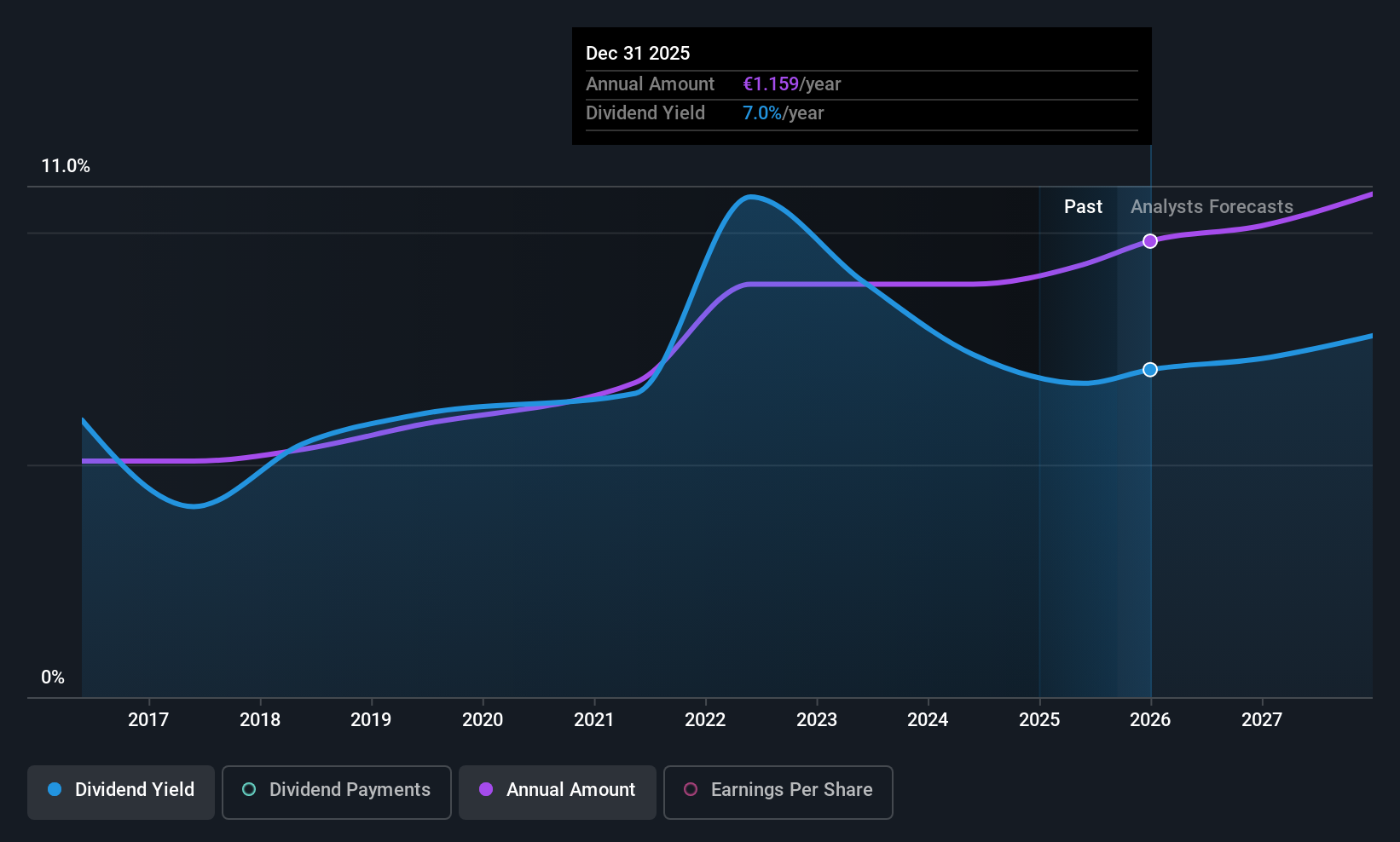

Crédit Agricole (ENXTPA:ACA)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Crédit Agricole S.A. offers a range of retail, corporate, insurance, and investment banking products and services both in France and internationally, with a market cap of €51.51 billion.

Operations: Crédit Agricole S.A.'s revenue segments include Asset Gathering (€8.32 billion), Large Customers (€8.69 billion), French Retail Banking - LCL (€3.54 billion), International Retail Banking (€3.82 billion), and Specialised Financial Services (€2.51 billion).

Dividend Yield: 6.5%

Crédit Agricole's dividend yield is among the top 25% in the French market, with a current payout ratio of 34.2%, indicating dividends are well covered by earnings. However, its dividend history has been volatile over the past decade. Despite being undervalued compared to peers and industry standards, future earnings are forecasted to decline by an average of 5.1% annually over three years. Recent financials show net income growth from €3.73 billion to €4.21 billion year-over-year for H1 2025.

- Get an in-depth perspective on Crédit Agricole's performance by reading our dividend report here.

- Upon reviewing our latest valuation report, Crédit Agricole's share price might be too pessimistic.

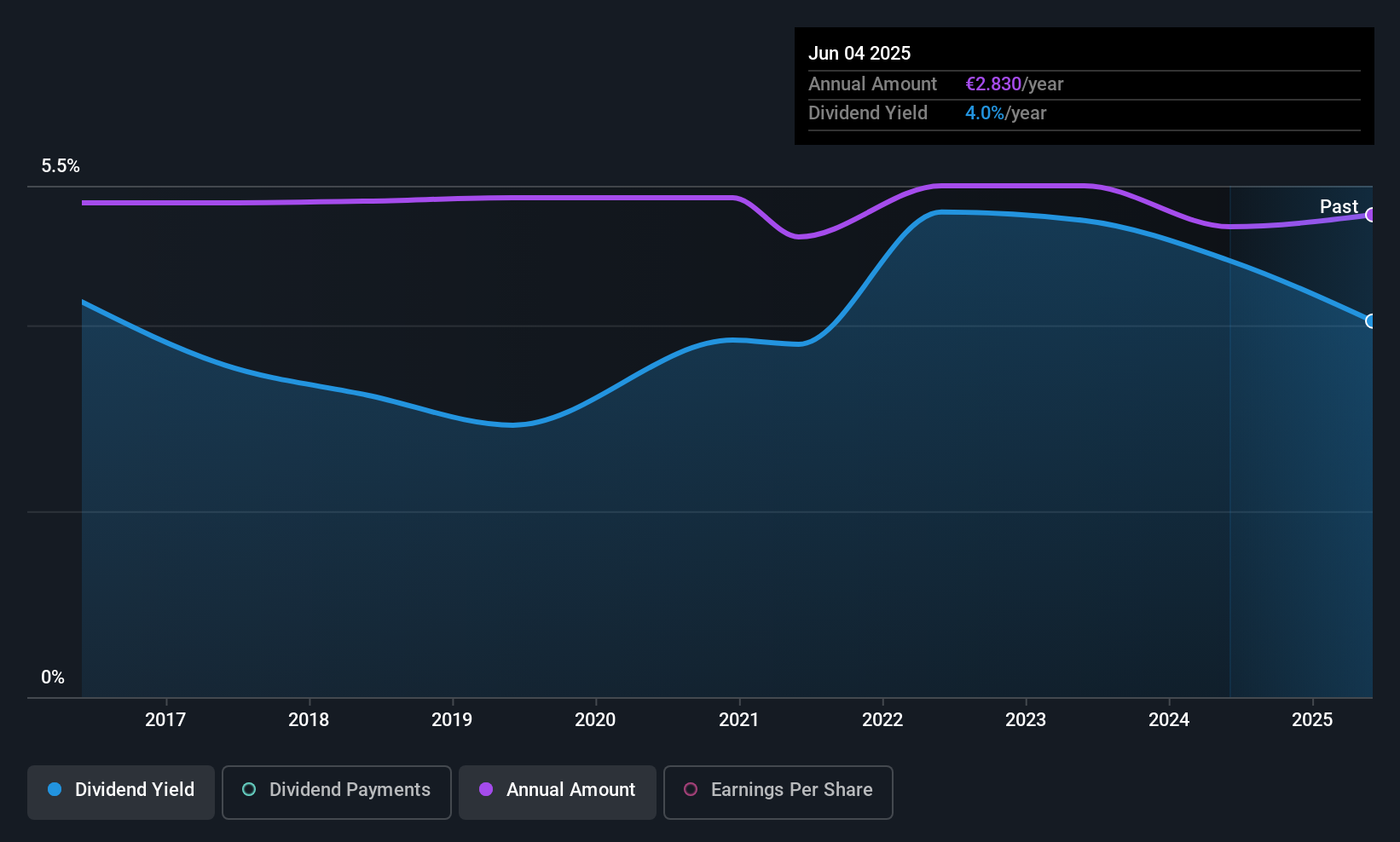

Caisse Régionale de Crédit Agricole Mutuel Loire Haute-Loire Société coopérative (ENXTPA:CRLO)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Caisse Régionale de Crédit Agricole Mutuel Loire Haute-Loire Société coopérative offers a range of banking products and services to diverse clients including individuals, professionals, farmers, businesses, public communities, social housing entities, and associations in France with a market cap of approximately €713.88 million.

Operations: Caisse Régionale de Crédit Agricole Mutuel Loire Haute-Loire Société coopérative's revenue is primarily derived from Land (€1.13 billion), Local Banking in France (€234.80 million), and Leasing activity (€151.14 million).

Dividend Yield: 3.2%

Caisse Régionale de Crédit Agricole Mutuel Loire Haute-Loire Société coopérative offers a stable and reliable dividend, with payments consistently increasing over the past decade. The current payout ratio of 29.5% suggests dividends are well covered by earnings, though the yield of 3.21% is below top-tier French dividend payers. Despite solid earnings growth of 14.9% last year, concerns arise from a high bad loans ratio at 3.2%, potentially impacting future payouts if not addressed.

- Navigate through the intricacies of Caisse Régionale de Crédit Agricole Mutuel Loire Haute-Loire Société coopérative with our comprehensive dividend report here.

- According our valuation report, there's an indication that Caisse Régionale de Crédit Agricole Mutuel Loire Haute-Loire Société coopérative's share price might be on the expensive side.

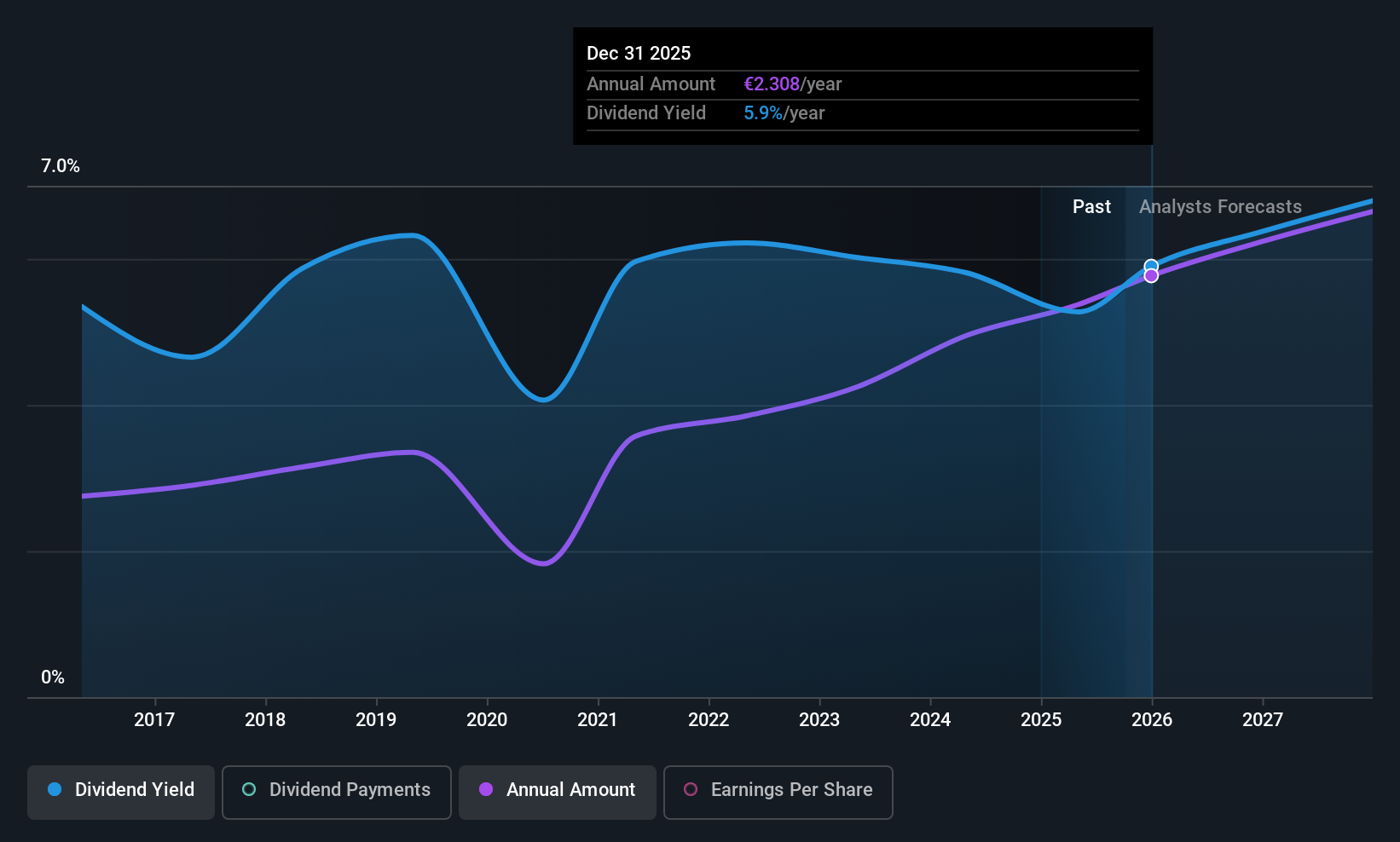

AXA (ENXTPA:CS)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: AXA SA operates globally through its subsidiaries, offering insurance, asset management, and banking services with a market cap of €92.86 billion.

Operations: AXA SA generates revenue from several key segments: AXA XL (€19.92 billion), Europe (€34.84 billion), France (€23.76 billion), and Asia, Africa & EME-LATAM (€13.54 billion).

Dividend Yield: 5%

AXA's dividend sustainability is supported by a reasonable payout ratio of 65.3% and a low cash payout ratio of 22.8%, indicating strong coverage by earnings and cash flows. Despite trading at an attractive value, AXA's dividends have been unreliable over the past decade due to volatility. Recent earnings showed slight declines, with net income at €3.92 billion for H1 2025, while M&A discussions regarding Prima Assicurazioni could impact future financials and dividend stability.

- Click here and access our complete dividend analysis report to understand the dynamics of AXA.

- The valuation report we've compiled suggests that AXA's current price could be quite moderate.

Seize The Opportunity

- Investigate our full lineup of 217 Top European Dividend Stocks right here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:CS

AXA

Through its subsidiaries, insurance, asset management, and banking services worldwide.

Undervalued with adequate balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives