- France

- /

- Auto Components

- /

- ENXTPA:ML

Top Dividend Stocks On Euronext Paris For October 2024

Reviewed by Simply Wall St

As the CAC 40 Index in France experiences modest gains amid broader European hopes for quicker interest rate cuts by the ECB, investors are increasingly looking to dividend stocks as a stable income source amidst economic uncertainties. In this environment, selecting stocks with strong dividend yields and reliable payout histories can provide a cushion against market volatility and offer consistent returns.

Top 10 Dividend Stocks In France

| Name | Dividend Yield | Dividend Rating |

| Vicat (ENXTPA:VCT) | 5.63% | ★★★★★★ |

| Rubis (ENXTPA:RUI) | 7.97% | ★★★★★★ |

| Électricite de Strasbourg Société Anonyme (ENXTPA:ELEC) | 8.04% | ★★★★★☆ |

| Arkema (ENXTPA:AKE) | 4.18% | ★★★★★☆ |

| VIEL & Cie société anonyme (ENXTPA:VIL) | 3.69% | ★★★★★☆ |

| Samse (ENXTPA:SAMS) | 6.62% | ★★★★★☆ |

| Exacompta Clairefontaine (ENXTPA:ALEXA) | 4.82% | ★★★★★☆ |

| Caisse Régionale de Crédit Agricole Mutuel du Languedoc Société coopérative (ENXTPA:CRLA) | 5.83% | ★★★★★☆ |

| Piscines Desjoyaux (ENXTPA:ALPDX) | 7.84% | ★★★★★☆ |

| Eiffage (ENXTPA:FGR) | 4.57% | ★★★★☆☆ |

Click here to see the full list of 32 stocks from our Top Euronext Paris Dividend Stocks screener.

Let's review some notable picks from our screened stocks.

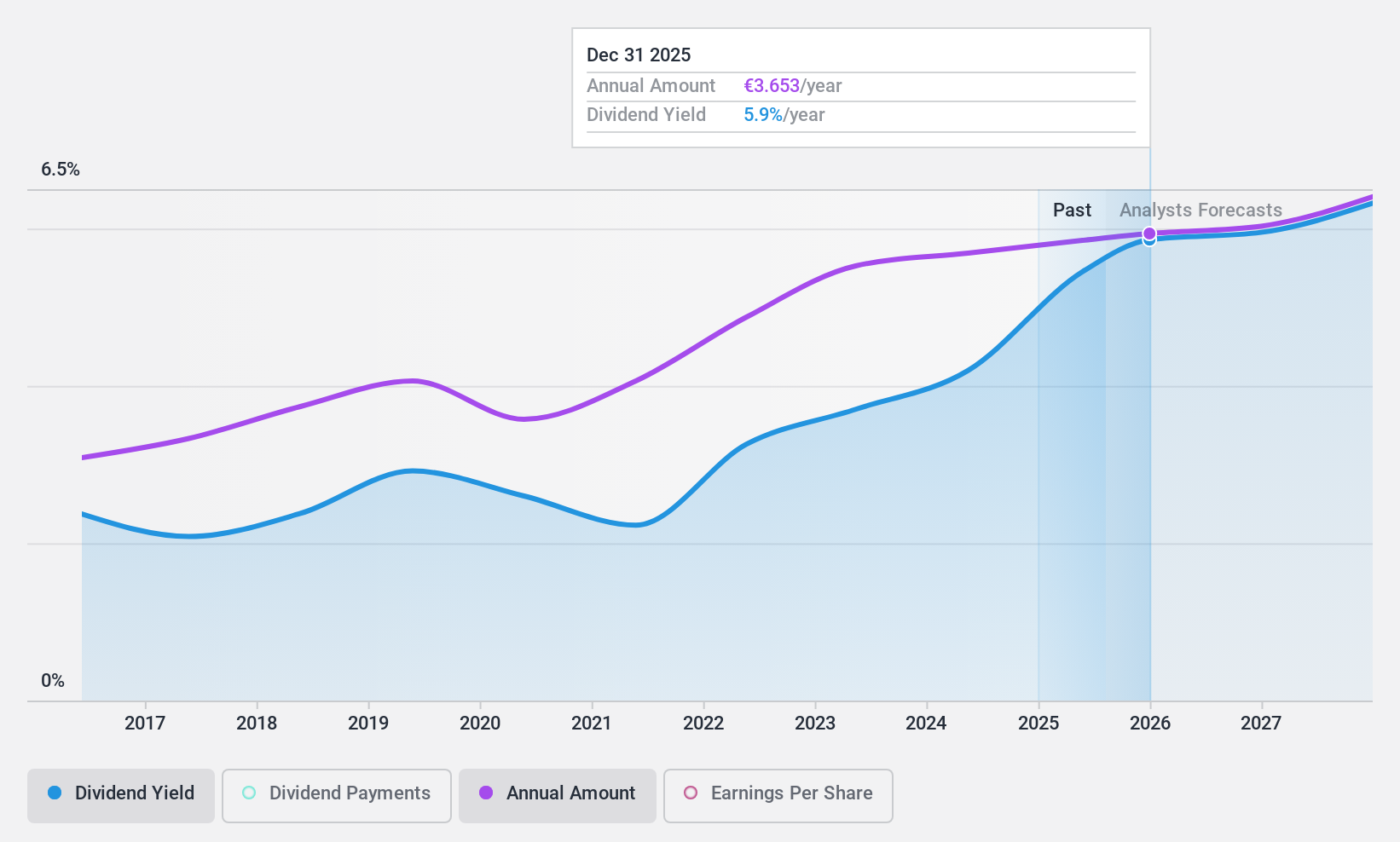

Arkema (ENXTPA:AKE)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Arkema S.A. is a global manufacturer and seller of specialty chemicals and advanced materials, with a market cap of approximately €6.25 billion.

Operations: Arkema S.A.'s revenue is primarily derived from its Advanced Materials segment at €3.51 billion, followed by Adhesive Solutions at €2.71 billion, Coating Solutions at €2.39 billion, and Intermediates at €779 million.

Dividend Yield: 4.2%

Arkema's dividend is well-covered by earnings and cash flows, with a payout ratio of 76.4% and a cash payout ratio of 47%. The dividend has been stable and growing over the past decade, though its yield of 4.18% is below the top tier in France. Recent strategic moves, such as bio-based production initiatives and executive changes, aim to enhance long-term value creation. Despite lower earnings in H1 2024 compared to last year, Arkema remains focused on growth through acquisitions.

- Click here to discover the nuances of Arkema with our detailed analytical dividend report.

- According our valuation report, there's an indication that Arkema's share price might be on the cheaper side.

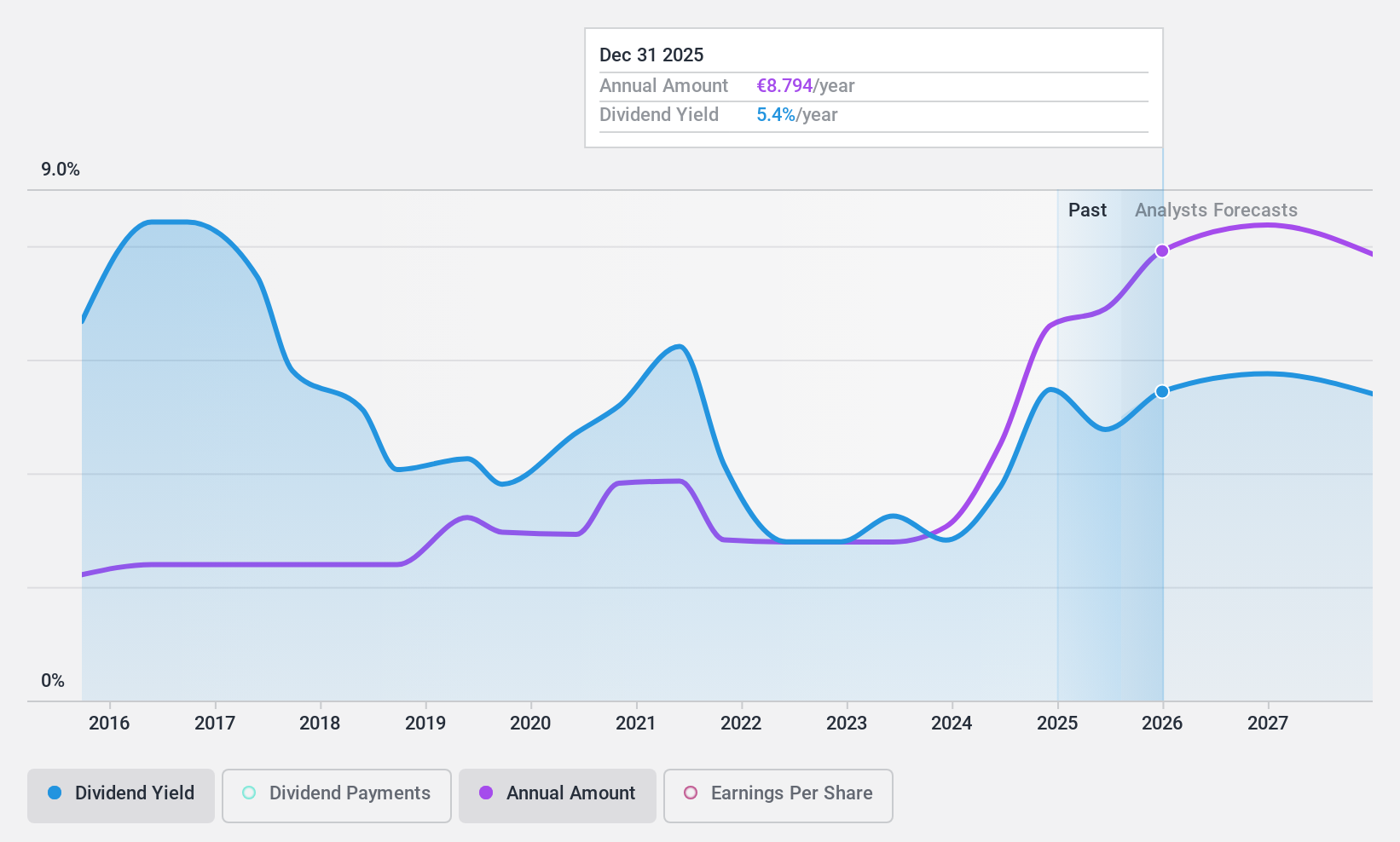

Gaztransport & Technigaz (ENXTPA:GTT)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Gaztransport & Technigaz SA is a technology and engineering company specializing in cryogenic membrane containment systems for maritime transportation and storage of liquefied gas and LNG globally, with a market cap of €4.76 billion.

Operations: Gaztransport & Technigaz generates revenue primarily from its Core Business Including Services, amounting to €530.73 million, and from Hydrogen, contributing €13.96 million.

Dividend Yield: 5.7%

Gaztransport & Technigaz's dividend yield of 5.71% is among the top 25% in France, yet its payments have been volatile and not consistently covered by cash flows, with a high cash payout ratio of 139.7%. Despite this, dividends have increased over the past decade. Recent earnings showed significant growth, with net income rising to €170.31 million for H1 2024 from €84.03 million a year ago, supporting an interim dividend of €3.67 per share announced in July 2024.

- Navigate through the intricacies of Gaztransport & Technigaz with our comprehensive dividend report here.

- In light of our recent valuation report, it seems possible that Gaztransport & Technigaz is trading behind its estimated value.

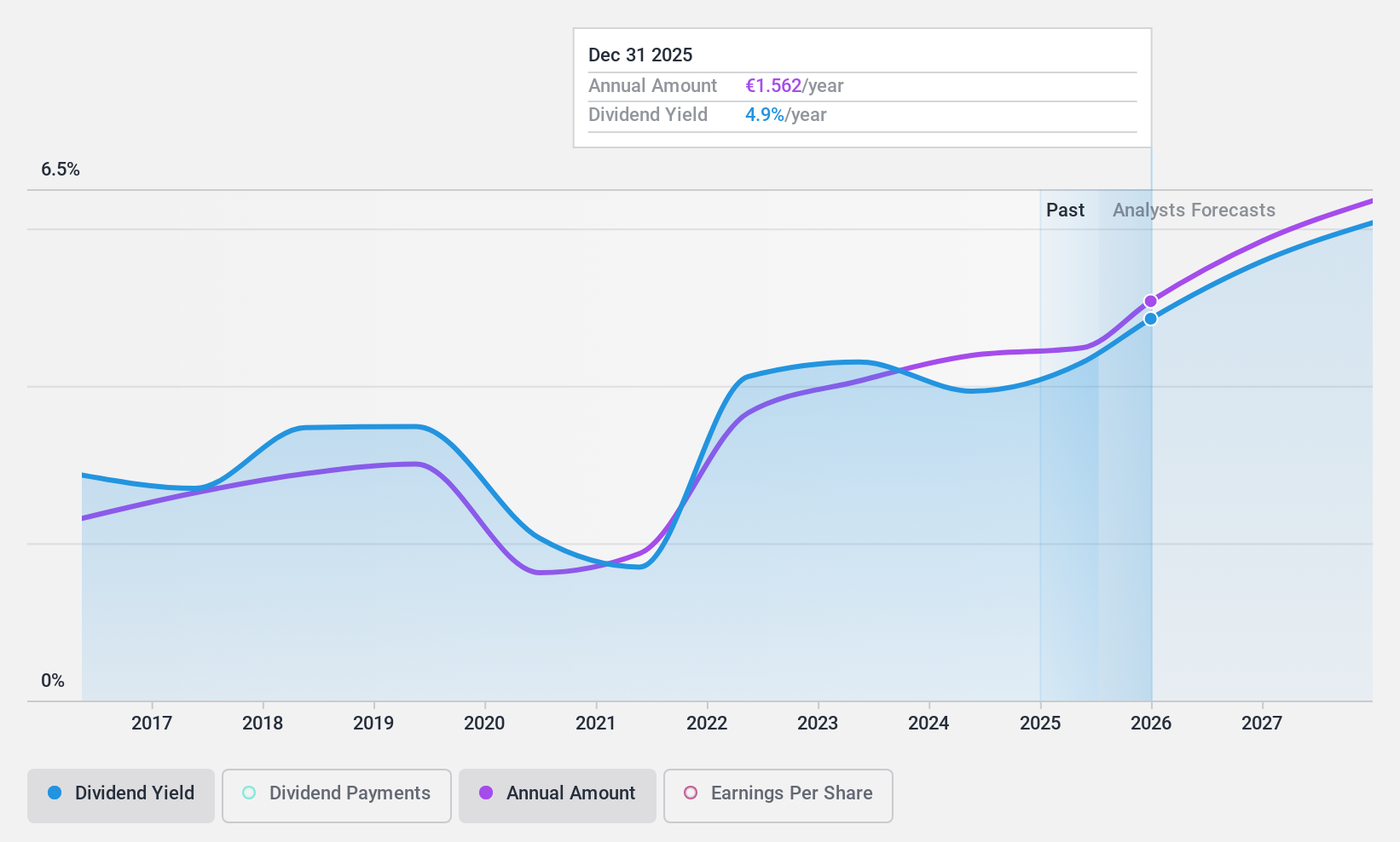

Compagnie Générale des Établissements Michelin Société en commandite par actions (ENXTPA:ML)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Compagnie Générale des Établissements Michelin Société en commandite par actions manufactures and sells tires globally, with a market cap of €23.83 billion.

Operations: Compagnie Générale des Établissements Michelin Société en commandite par actions generates revenue through three main segments: Automotive and Related Distribution (€14.16 billion), Road Transportation and Related Distribution (€6.84 billion), and Specialty Businesses and Related Distribution (€6.74 billion).

Dividend Yield: 4%

Compagnie Générale des Établissements Michelin's dividend yield of 3.98% is below the top 25% in France, with a history of volatility and unreliability over the past decade. Despite this, dividends have increased during that time and are well covered by earnings (payout ratio: 50.2%) and cash flows (cash payout ratio: 32.3%). Recent half-year results showed a decline in sales to €13.48 billion from €14.08 billion, with net income slightly down to €1.16 billion from €1.22 billion year-on-year.

- Delve into the full analysis dividend report here for a deeper understanding of Compagnie Générale des Établissements Michelin Société en commandite par actions.

- In light of our recent valuation report, it seems possible that Compagnie Générale des Établissements Michelin Société en commandite par actions is trading beyond its estimated value.

Key Takeaways

- Dive into all 32 of the Top Euronext Paris Dividend Stocks we have identified here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:ML

Compagnie Générale des Établissements Michelin Société en commandite par actions

Manufactures and sells tires worldwide.

Flawless balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives