- France

- /

- Auto Components

- /

- ENXTPA:ML

Is Michelin's (ENXTPA:ML) R&D Progress in Recyclable Composites a Sign of Evolving Innovation Strategy?

Reviewed by Sasha Jovanovic

- ALUULA Composites Inc. recently announced the successful completion of its R&D phase in collaboration with Michelin Inflatable Solutions, with the first commercial product using ultra-light, high-performance recyclable materials expected from Michelin in late 2025.

- This partnership marks a meaningful advancement in sustainable shelter technology, highlighting Michelin's commitment to circular materials and innovation beyond traditional tire manufacturing.

- We'll now assess how Michelin's new focus on recyclable composite innovations may shape the company's investment narrative moving forward.

Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

Compagnie Générale des Établissements Michelin Société en commandite par actions Investment Narrative Recap

To invest in Michelin today, you need to believe in its ability to expand beyond traditional tire manufacturing, leverage sustainability leadership, and execute restructuring efforts to drive margin and efficiency improvements. While the ALUULA partnership confirms Michelin's push into recyclable composites and innovation, this development is unlikely to materially shift the near-term focus or risks, which remain centered on managing weak OE volumes and ongoing regulatory pressure.

Among recent announcements, Michelin's share buyback program stands out as a timely move, reflecting efforts to boost shareholder value following softer first-half earnings and margin pressures. This action sits alongside longer-term catalysts like plant optimization and new product launches, while the new material technology partnership adds another layer to its growth and sustainability ambitions.

By contrast, investors should be aware that recurring tariff and regulatory headwinds could continue to affect net margins if...

Compagnie Générale des Établissements Michelin Société en commandite par actions' outlook anticipates €29.1 billion in revenue and €2.9 billion in earnings by 2028. This is based on a forecast annual revenue growth rate of 2.9% and an earnings increase of €1.3 billion from the current earnings of €1.6 billion.

Uncover how Compagnie Générale des Établissements Michelin Société en commandite par actions' forecasts yield a €35.56 fair value, a 20% upside to its current price.

Exploring Other Perspectives

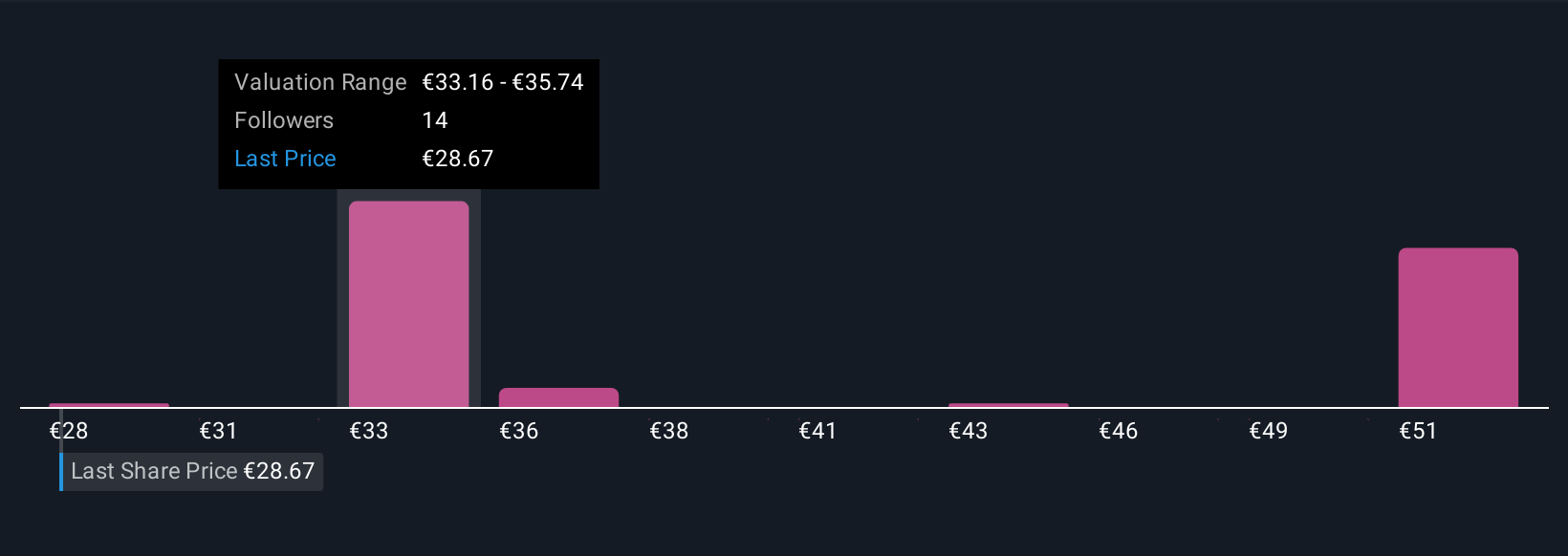

Six fair value estimates from the Simply Wall St Community range widely from €28 to €79.27 per share. While community expectations diverge, ongoing exposure to tightening trade regulations could weigh on Michelin’s operating performance and outlook, explore these differing viewpoints to inform your stance.

Explore 6 other fair value estimates on Compagnie Générale des Établissements Michelin Société en commandite par actions - why the stock might be worth 6% less than the current price!

Build Your Own Compagnie Générale des Établissements Michelin Société en commandite par actions Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Compagnie Générale des Établissements Michelin Société en commandite par actions research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Compagnie Générale des Établissements Michelin Société en commandite par actions research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Compagnie Générale des Établissements Michelin Société en commandite par actions' overall financial health at a glance.

Searching For A Fresh Perspective?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- Rare earth metals are the new gold rush. Find out which 35 stocks are leading the charge.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 25 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:ML

Compagnie Générale des Établissements Michelin Société en commandite par actions

Engages in the manufacture and sale of tires worldwide.

Flawless balance sheet, good value and pays a dividend.

Similar Companies

Market Insights

Community Narratives