- France

- /

- Auto Components

- /

- ENXTPA:FRVIA

Forvia (EPA:FRVIA) sheds €73m, company earnings and investor returns have been trending downwards for past five years

Long term investing works well, but it doesn't always work for each individual stock. We don't wish catastrophic capital loss on anyone. Spare a thought for those who held Forvia SE (EPA:FRVIA) for five whole years - as the share price tanked 83%. And we doubt long term believers are the only worried holders, since the stock price has declined 57% over the last twelve months. Furthermore, it's down 16% in about a quarter. That's not much fun for holders. While a drop like that is definitely a body blow, money isn't as important as health and happiness.

Since Forvia has shed €73m from its value in the past 7 days, let's see if the longer term decline has been driven by the business' economics.

Check out our latest analysis for Forvia

To quote Buffett, 'Ships will sail around the world but the Flat Earth Society will flourish. There will continue to be wide discrepancies between price and value in the marketplace...' One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

During five years of share price growth, Forvia moved from a loss to profitability. Most would consider that to be a good thing, so it's counter-intuitive to see the share price declining. Other metrics may better explain the share price move.

The most recent dividend was actually lower than it was in the past, so that may have sent the share price lower.

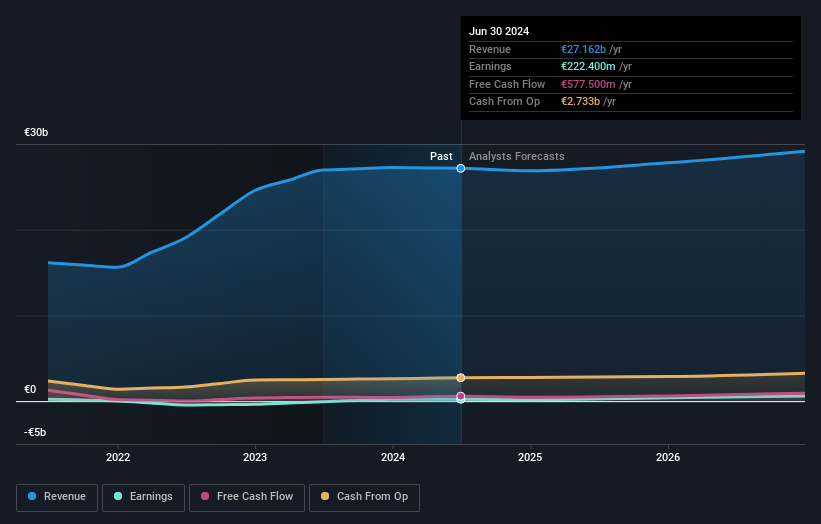

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

Forvia is a well known stock, with plenty of analyst coverage, suggesting some visibility into future growth. Given we have quite a good number of analyst forecasts, it might be well worth checking out this free chart depicting consensus estimates.

What About Dividends?

As well as measuring the share price return, investors should also consider the total shareholder return (TSR). The TSR is a return calculation that accounts for the value of cash dividends (assuming that any dividend received was reinvested) and the calculated value of any discounted capital raisings and spin-offs. Arguably, the TSR gives a more comprehensive picture of the return generated by a stock. As it happens, Forvia's TSR for the last 5 years was -80%, which exceeds the share price return mentioned earlier. And there's no prize for guessing that the dividend payments largely explain the divergence!

A Different Perspective

While the broader market lost about 0.6% in the twelve months, Forvia shareholders did even worse, losing 55% (even including dividends). Having said that, it's inevitable that some stocks will be oversold in a falling market. The key is to keep your eyes on the fundamental developments. Regrettably, last year's performance caps off a bad run, with the shareholders facing a total loss of 13% per year over five years. Generally speaking long term share price weakness can be a bad sign, though contrarian investors might want to research the stock in hope of a turnaround. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. For instance, we've identified 4 warning signs for Forvia (1 makes us a bit uncomfortable) that you should be aware of.

Of course Forvia may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on French exchanges.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ENXTPA:FRVIA

Forvia

Manufactures and sells automotive technology solutions in France, Germany, other European countries, the Americas, Asia, and internationally.

Undervalued with moderate growth potential.

Similar Companies

Market Insights

Community Narratives