- France

- /

- Auto Components

- /

- ENXTPA:FR

Does the Recent FCF Surge Signal a Turning Point for Valeo in 2025?

Reviewed by Bailey Pemberton

If you have been watching Valeo, you are probably wondering whether its current stock price of €10.66 represents a smart opportunity or just another stop in a long road of volatility. The stock’s journey has been far from dull. Just look at the numbers: while Valeo gained 3.3% over the past month and is up a solid 13.2% year-to-date, its three- and five-year returns tell a different story, with declines of -25.7% and -56.3% respectively. Over the last week, Valeo slipped by -0.7%, hinting at market uncertainty despite broader gains in automotive and tech stocks.

Recent shifts in the market have put a fresh spotlight on companies like Valeo. The company is benefiting from renewed interest in the automotive innovation space and evolving perceptions of risk. Investors are clearly weighing the company’s potential for a rebound against a backdrop of long-term underperformance. When looking through a valuation lens, Valeo scores 3 out of 6 on our value checklist, meaning it is undervalued in half of the categories we consider.

So, how should you interpret Valeo’s value in the current climate? Let’s dig into the different approaches analysts use to assess valuation and explore why some methods offer clearer guidance than others. By the end, you might learn a better, more holistic way to understand what Valeo is really worth.

Approach 1: Valeo Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow (DCF) model estimates what a company is worth based on its future cash flows, which are projected and then discounted back to today’s value. This approach is widely used because it focuses on tangible money the business is expected to produce, helping to cut through short-term market noise.

For Valeo, the most recent twelve months have seen Free Cash Flow of approximately €570 million. Analysts project this figure will continue climbing, with estimates reaching €709 million by 2027. Looking further ahead over a ten-year period, extrapolated growth suggests Free Cash Flow could potentially exceed €1 billion, but it’s important to note that these longer-term numbers lean on assumptions and not direct analyst forecasts.

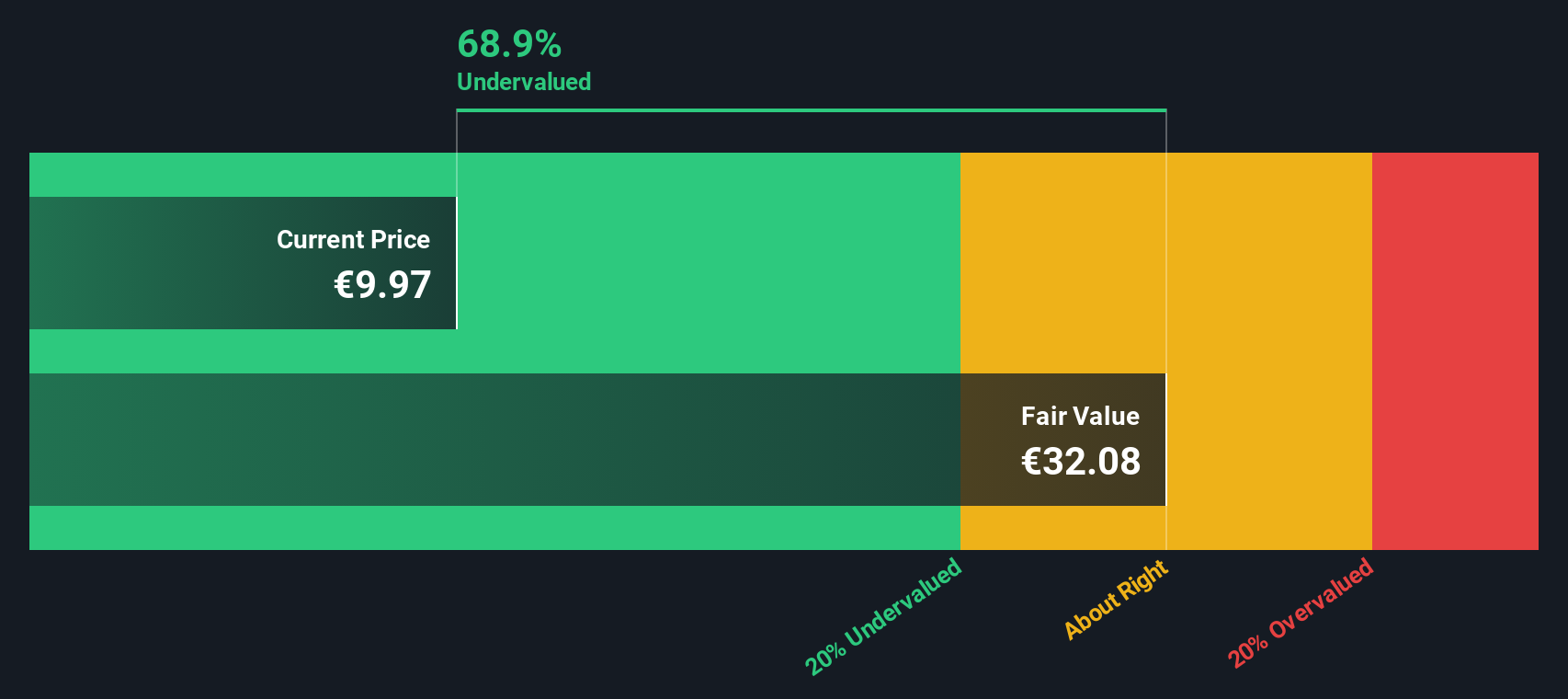

Bringing all these future cash flows into present terms, the DCF model calculates an intrinsic value of €32.07 per share. With Valeo’s stock currently trading at €10.66, this implies a considerable discount. In fact, the DCF suggests Valeo is trading at a 66.8% discount to its intrinsic value. This sizable gap signals that, based on cash flow fundamentals, Valeo shares are significantly undervalued at the moment.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Valeo is undervalued by 66.8%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: Valeo Price vs Earnings

The Price-to-Earnings (PE) ratio is a widely used valuation metric for profitable companies like Valeo because it directly connects a company’s share price to its actual earnings performance. It helps investors see what the market is willing to pay today for a euro of Valeo’s earnings, which is particularly relevant when the business is consistently profitable.

Growth prospects and perceived risks play a major role in shaping what a "normal" or "fair" PE ratio should be. Fast-growing companies or those with a more stable profit outlook usually command higher ratios, since investors are willing to pay a premium for future potential and lower risk. By contrast, companies with uncertain earnings or higher perceived risks typically trade at lower multiples.

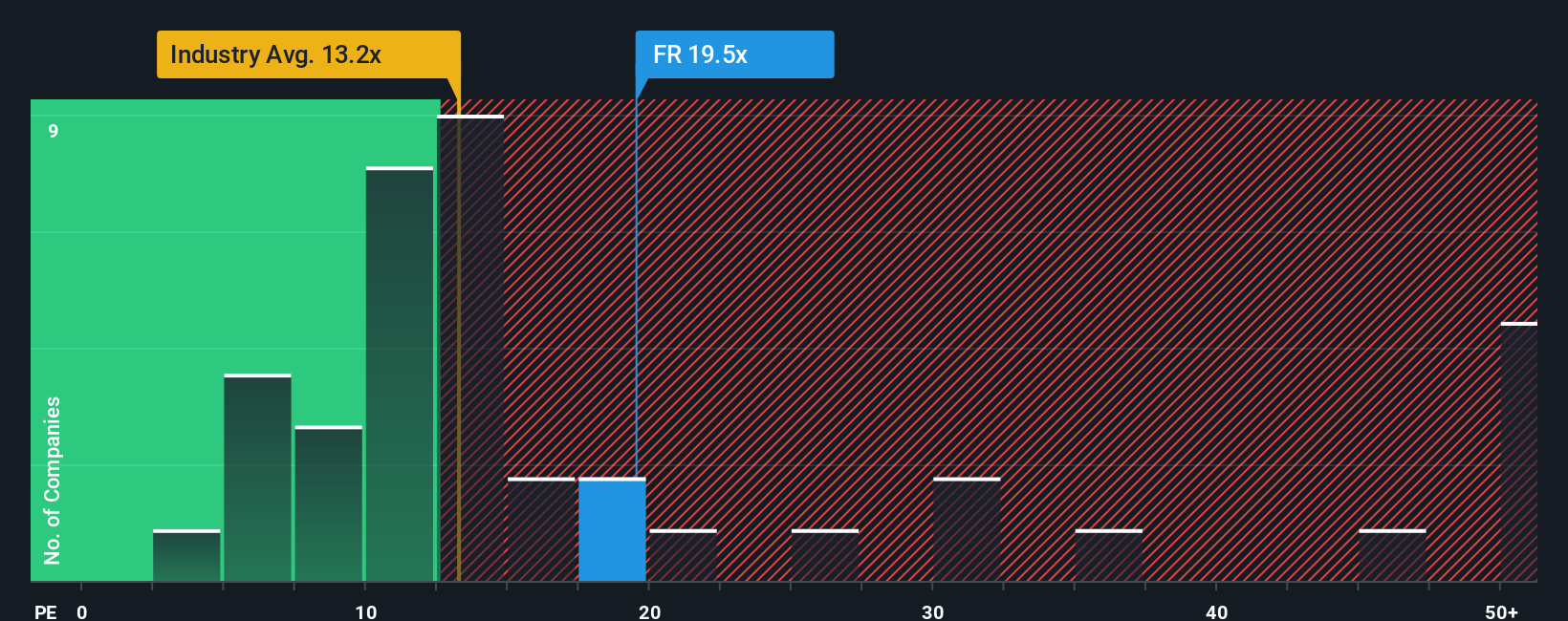

For Valeo, the current PE ratio stands at 20.8x. That is very close to the auto components industry average of 21.7x and noticeably higher than the peer group average of 10.2x. However, instead of just stopping at these benchmarks, Simply Wall St’s proprietary “Fair Ratio” takes into account Valeo’s unique mix of earnings growth, profit margins, industry context, market cap and risk profile. For Valeo, the Fair Ratio is calculated at 34.2x, suggesting the stock could support a higher valuation based on its fundamentals.

The advantage of the Fair Ratio is that, unlike a simple industry or peer comparison, it provides a tailored benchmark that is sensitive to what really drives value for Valeo specifically.

Comparing the Fair Ratio (34.2x) to the actual PE ratio (20.8x), Valeo currently trades well below where its fundamentals suggest it could be valued. This positions the stock as undervalued on a PE basis.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Valeo Narrative

Earlier we mentioned that there is an even better way to understand valuation. Let's introduce you to Narratives. A Narrative is simply a story or perspective you create about a company, linking your assumptions about Valeo's future revenue, earnings, and margins to an estimated fair value supported by your own rationale. Narratives allow you to combine the numbers with real-world events and your investment thesis, tying the company's business context directly to a financial forecast and ultimately to a target price.

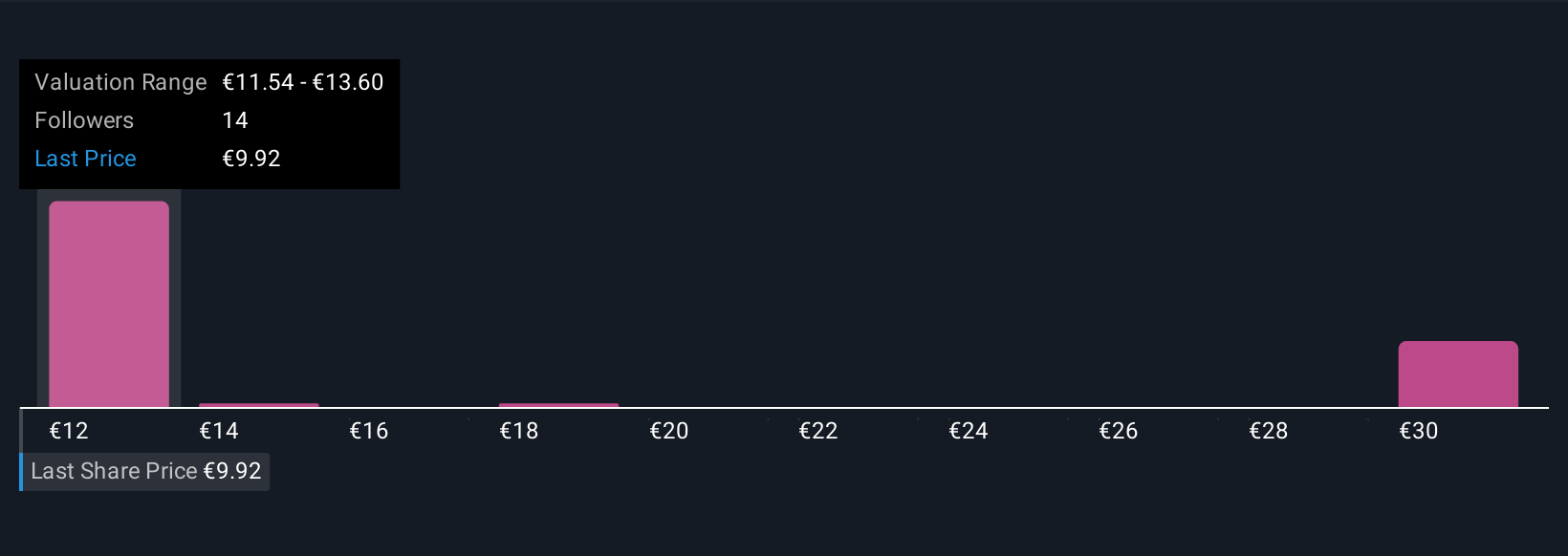

On Simply Wall St's Community page, millions of investors use Narratives as an easy and accessible tool to clarify their thinking, compare perspectives, and track how news and earnings reports affect those viewpoints in real time. Narratives empower you to make smarter buy or sell decisions by clearly showing the gap between Fair Value and the current Price as your story or the facts evolve. For example, one investor may build a bullish Narrative around Valeo by forecasting revenue and earnings growth driven by electrification and ADAS technologies and arrive at a fair value of €22.0. Another investor might be more cautious on profitability, estimating a value closer to €8.8.

Do you think there's more to the story for Valeo? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:FR

Valeo

A technology company, designs, produces, and sells products and systems for the automotive markets in France, other European countries, Africa, North America, South America, and Asia.

Adequate balance sheet with slight risk.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Butler National (Buks) outperforms.

A tech powerhouse quietly powering the world’s AI infrastructure.

Keppel DC REIT (SGX: AJBU) is a resilient gem in the data center space.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)