Patrick Koller has been the CEO of Faurecia S.E. (EPA:EO) since 2016, and this article will examine the executive's compensation with respect to the overall performance of the company. This analysis will also look to assess whether the CEO is appropriately paid, considering recent earnings growth and investor returns for Faurecia.

See our latest analysis for Faurecia

How Does Total Compensation For Patrick Koller Compare With Other Companies In The Industry?

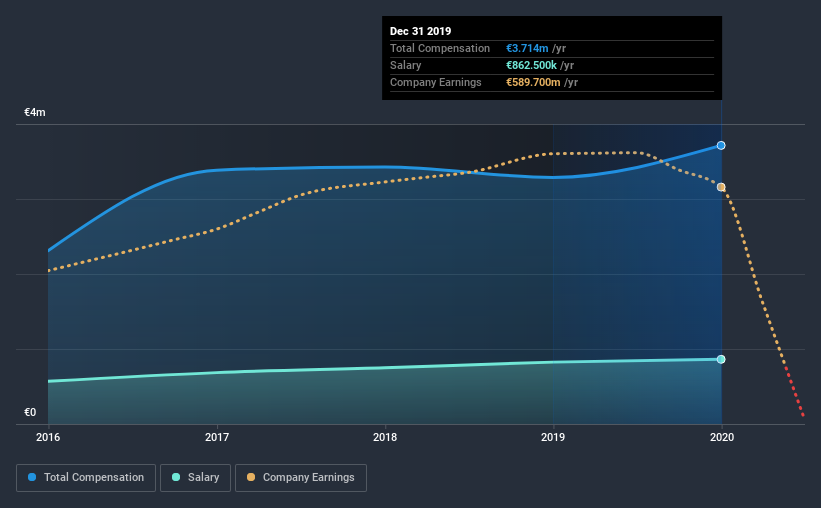

According to our data, Faurecia S.E. has a market capitalization of €5.4b, and paid its CEO total annual compensation worth €3.7m over the year to December 2019. That's a notable increase of 13% on last year. While we always look at total compensation first, our analysis shows that the salary component is less, at €863k.

On comparing similar companies from the same industry with market caps ranging from €3.4b to €10b, we found that the median CEO total compensation was €4.3m. From this we gather that Patrick Koller is paid around the median for CEOs in the industry. Furthermore, Patrick Koller directly owns €1.7m worth of shares in the company.

| Component | 2019 | 2018 | Proportion (2019) |

| Salary | €863k | €825k | 23% |

| Other | €2.9m | €2.5m | 77% |

| Total Compensation | €3.7m | €3.3m | 100% |

On an industry level, around 54% of total compensation represents salary and 46% is other remuneration. It's interesting to note that Faurecia allocates a smaller portion of compensation to salary in comparison to the broader industry. It's important to note that a slant towards non-salary compensation suggests that total pay is tied to the company's performance.

Faurecia S.E.'s Growth

Over the last three years, Faurecia S.E. has shrunk its earnings per share by 27% per year. It saw its revenue drop 15% over the last year.

Few shareholders would be pleased to read that EPS have declined. And the fact that revenue is down year on year arguably paints an ugly picture. It's hard to argue the company is firing on all cylinders, so shareholders might be averse to high CEO remuneration. Historical performance can sometimes be a good indicator on what's coming up next but if you want to peer into the company's future you might be interested in this free visualization of analyst forecasts.

Has Faurecia S.E. Been A Good Investment?

With a three year total loss of 34% for the shareholders, Faurecia S.E. would certainly have some dissatisfied shareholders. Therefore, it might be upsetting for shareholders if the CEO were paid generously.

To Conclude...

As we noted earlier, Faurecia pays its CEO in line with similar-sized companies belonging to the same industry. In the meantime, the company has reported declining EPS growth and shareholder returns over the last three years. It's tough to call out the compensation as inappropriate, but shareholders might not favor a raise before company performance improves.

We can learn a lot about a company by studying its CEO compensation trends, along with looking at other aspects of the business. We did our research and identified 2 warning signs (and 1 which is a bit unpleasant) in Faurecia we think you should know about.

Arguably, business quality is much more important than CEO compensation levels. So check out this free list of interesting companies that have HIGH return on equity and low debt.

If you decide to trade Faurecia, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About ENXTPA:FRVIA

Forvia

Manufactures and sells automotive technology solutions in France, Germany, other European countries, the Americas, Asia, and internationally.

Undervalued with moderate growth potential.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

China Starch Holdings eyes a revenue growth of 4.66% with a 5-year strategic plan

PSIX The timing of insider sales is a serious question mark

The Great Strategy Swap – Selling "Old Auto" to Buy "Future Light"

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026