- Finland

- /

- Communications

- /

- HLSE:NOKIA

Top Dividend Stocks To Consider In February 2025

Reviewed by Simply Wall St

As global markets navigate a turbulent start to 2025, marked by fluctuating corporate earnings and geopolitical tensions, investors are keeping a close eye on the Federal Reserve's steady interest rates and the European Central Bank's recent rate cuts. Amidst this backdrop of economic uncertainty and competitive pressures in sectors like technology, dividend stocks offer a potential avenue for stability through regular income streams.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Guaranty Trust Holding (NGSE:GTCO) | 5.97% | ★★★★★★ |

| Peoples Bancorp (NasdaqGS:PEBO) | 4.85% | ★★★★★★ |

| Daito Trust ConstructionLtd (TSE:1878) | 4.01% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 5.29% | ★★★★★★ |

| Southside Bancshares (NYSE:SBSI) | 4.53% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.46% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 3.41% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.46% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 3.95% | ★★★★★★ |

| Premier Financial (NasdaqGS:PFC) | 4.45% | ★★★★★☆ |

Click here to see the full list of 1972 stocks from our Top Dividend Stocks screener.

Let's uncover some gems from our specialized screener.

Nokia Oyj (HLSE:NOKIA)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Nokia Oyj offers mobile, fixed, and cloud network solutions globally and has a market cap of €24.41 billion.

Operations: Nokia Oyj's revenue is primarily derived from its Mobile Networks segment at €7.73 billion, Network Infrastructure at €6.52 billion, Cloud and Network Services at €3.02 billion, and Nokia Technologies contributing €1.93 billion.

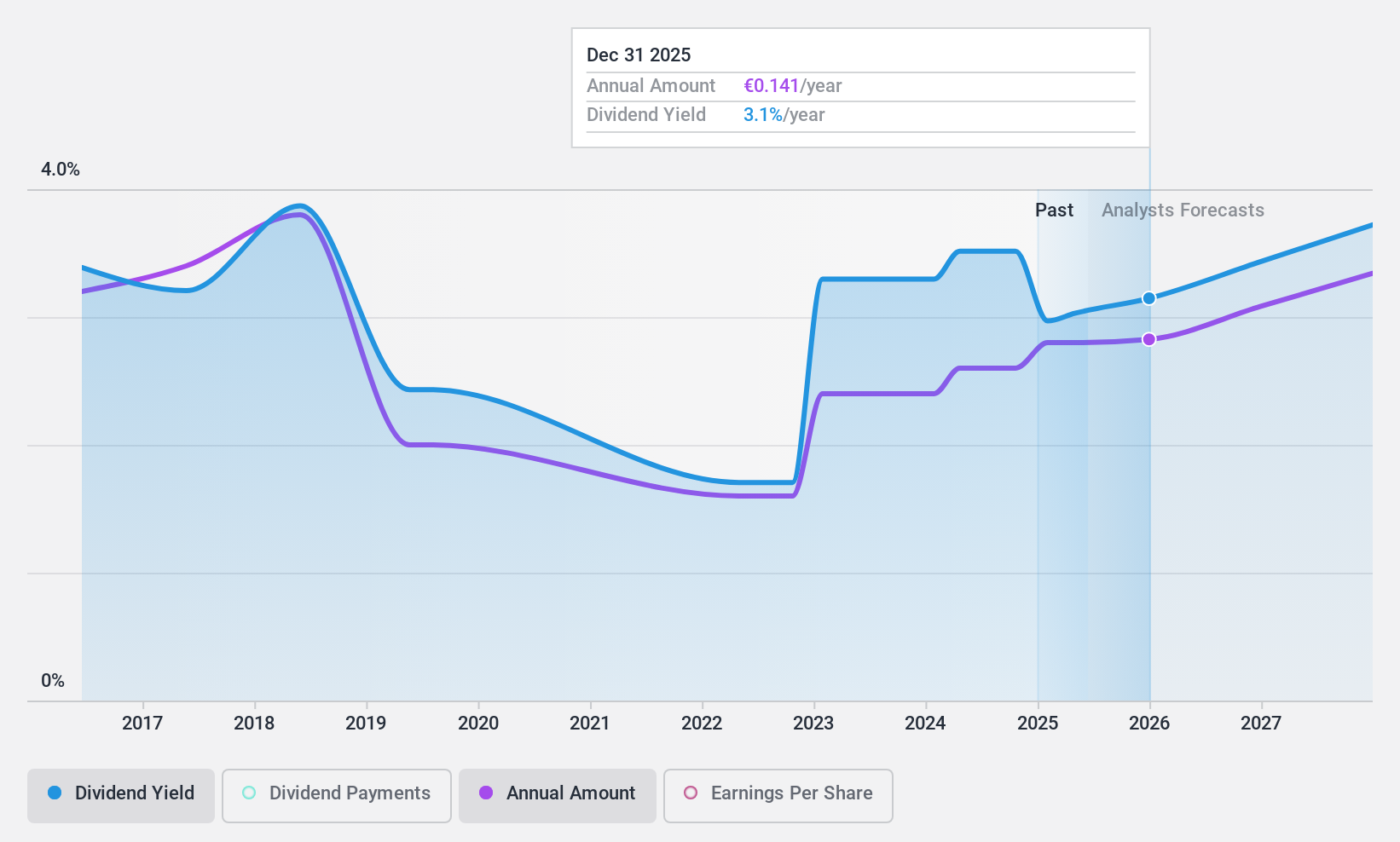

Dividend Yield: 3.1%

Nokia's dividend payments have been volatile over the past decade, lacking consistent growth. However, recent proposals suggest a maximum aggregate distribution of €0.14 per share for 2024, reflecting a cautious approach to dividends. The company's payout ratios indicate dividends are well-covered by both earnings (45%) and cash flows (37.2%), suggesting sustainability despite past volatility. Nokia's strategic partnerships and technological advancements may support future financial stability but do not directly assure dividend reliability or growth.

- Click here and access our complete dividend analysis report to understand the dynamics of Nokia Oyj.

- Our comprehensive valuation report raises the possibility that Nokia Oyj is priced lower than what may be justified by its financials.

Samsung SecuritiesLtd (KOSE:A016360)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Samsung Securities Co., Ltd. is a financial investment company operating in South Korea and internationally, with a market cap of ₩4.15 trillion.

Operations: Samsung Securities Co., Ltd. generates revenue from several segments, including Selling and buying on consignment (₩1.42 trillion), S&T (₩217.87 billion), Futures brokerage business (₩160.16 billion), Floor trading (₩49.58 billion), Corporate Finance (₩45.54 billion), and International Sales (₩19.04 billion).

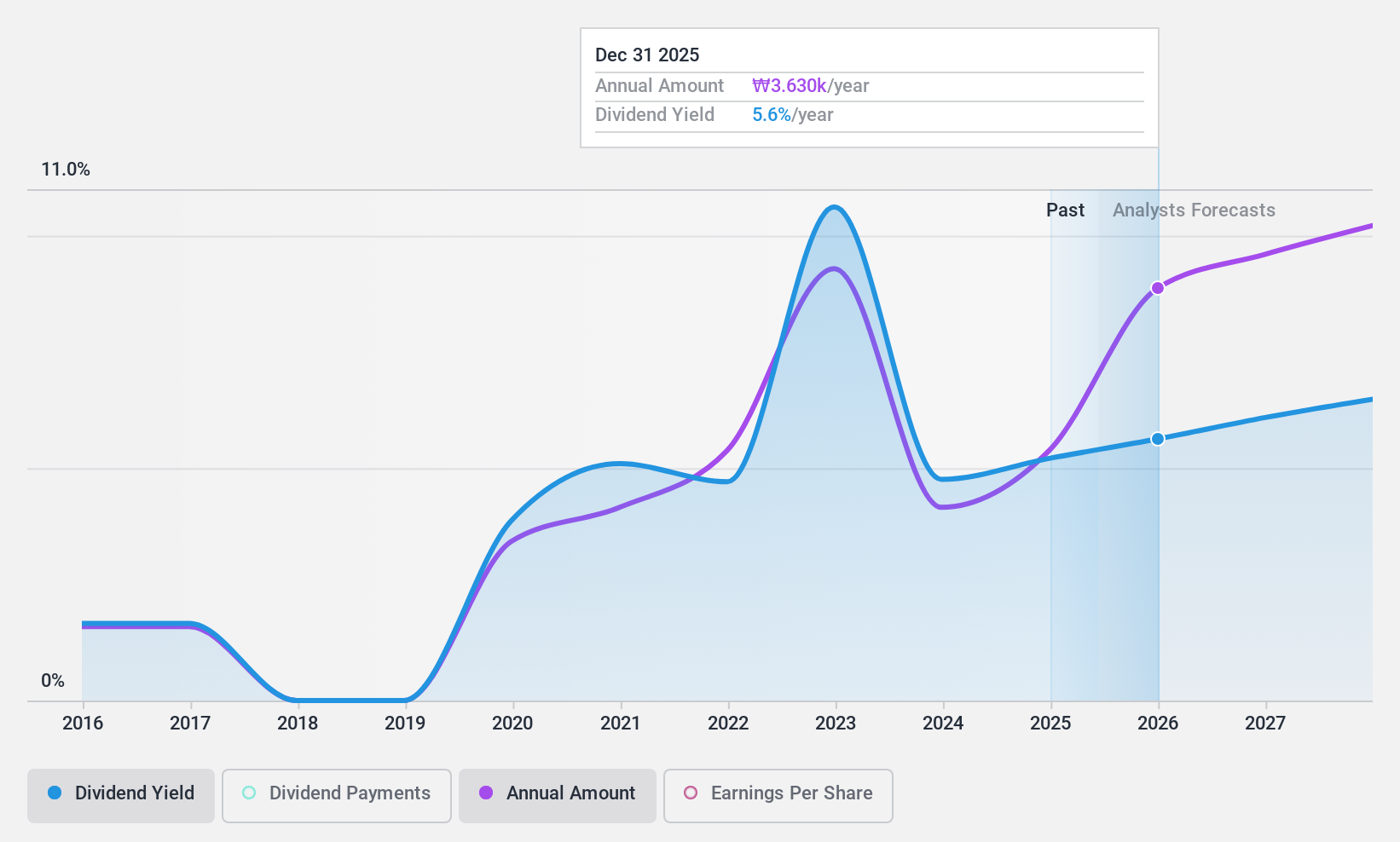

Dividend Yield: 7.5%

Samsung Securities has a high dividend yield of 7.53%, ranking in the top 25% of KR market payers, yet its payments are not covered by free cash flows, raising sustainability concerns. Despite a low payout ratio of 26.4%, dividends have been volatile and unreliable over the past decade. Recent earnings growth is strong, with net income rising significantly year-over-year, but non-cash earnings quality may affect future dividend stability.

- Get an in-depth perspective on Samsung SecuritiesLtd's performance by reading our dividend report here.

- Our valuation report unveils the possibility Samsung SecuritiesLtd's shares may be trading at a discount.

Arcadyan Technology (TWSE:3596)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Arcadyan Technology Corporation, along with its subsidiaries, focuses on the research, development, manufacture, and sale of broadband access, multimedia, and wireless infrastructure solutions with a market cap of NT$41.87 billion.

Operations: Arcadyan Technology's revenue primarily comes from its Communication Network segment, totaling NT$51.01 billion.

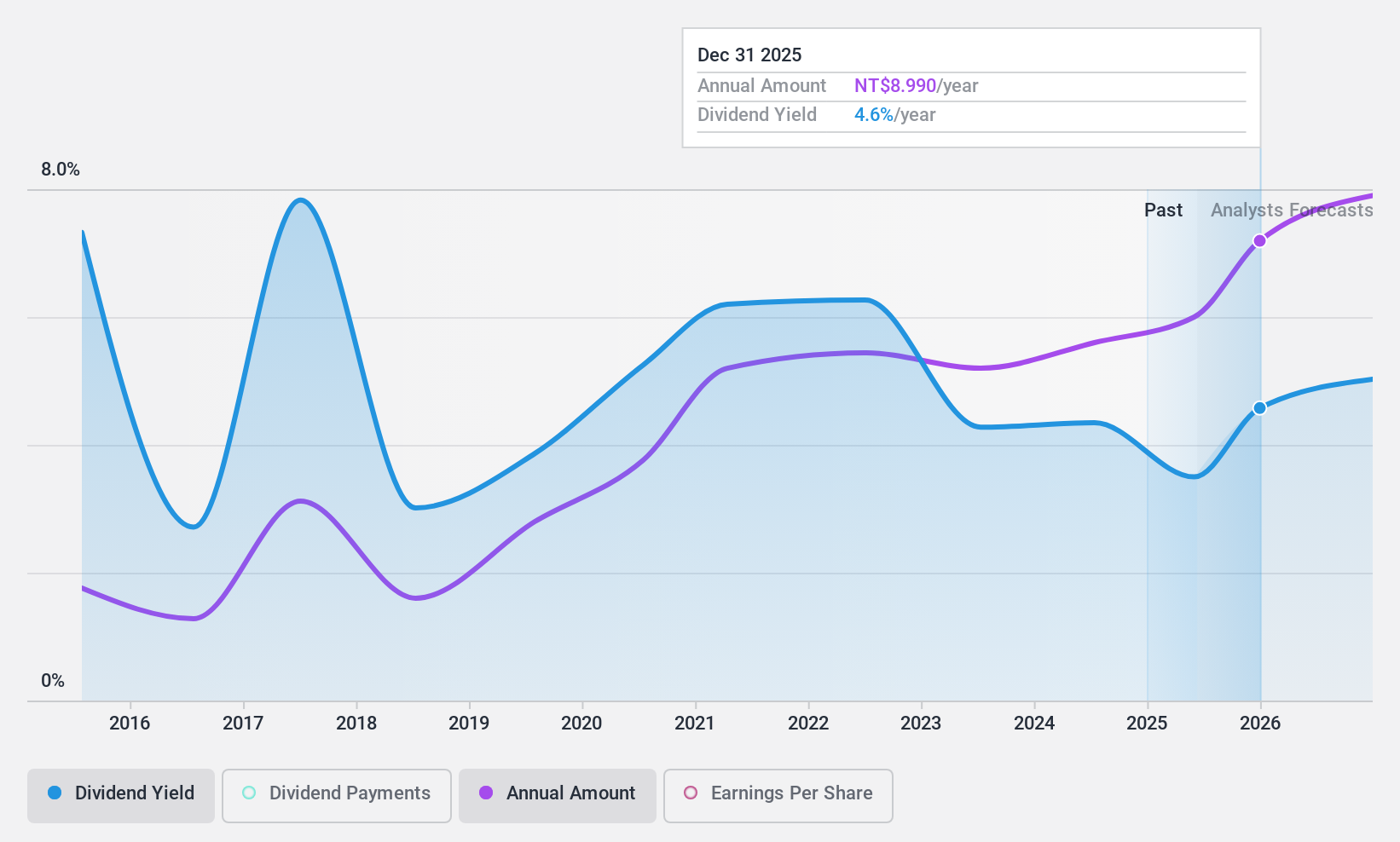

Dividend Yield: 3.7%

Arcadyan Technology's dividend profile shows mixed elements for investors. While the company's dividends are well covered by both earnings (61% payout ratio) and cash flows (27.5% cash payout ratio), its dividend history is unstable, with volatility over the past decade. Despite recent earnings growth of 6%, its dividend yield of 3.68% lags behind top-tier TW market payers. Additionally, a favorable price-to-earnings ratio of 16.6x suggests potential value relative to the market average.

- Navigate through the intricacies of Arcadyan Technology with our comprehensive dividend report here.

- Insights from our recent valuation report point to the potential overvaluation of Arcadyan Technology shares in the market.

Seize The Opportunity

- Unlock our comprehensive list of 1972 Top Dividend Stocks by clicking here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Nokia Oyj might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About HLSE:NOKIA

Nokia Oyj

Provides mobile, fixed, and cloud network solutions in North and Latin America, Greater China, India, rest of the Asia Pacific, Europe, the Middle East, and Africa.

Flawless balance sheet with moderate growth potential.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

A case for USD $14.81 per share based on book value. Be warned, this is a micro-cap dependent on a single mine.

Occidental Petroleum to Become Fairly Priced at $68.29 According to Future Projections

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)