- Finland

- /

- Communications

- /

- HLSE:NOKIA

Three Leading Dividend Stocks To Consider

Reviewed by Simply Wall St

In a week marked by mixed performances across major indices, the S&P 500, Dow Jones Industrial Average, and Nasdaq Composite reached record highs while growth stocks outpaced value stocks significantly. This dynamic market environment underscores the importance of considering dividend stocks as part of a diversified investment strategy; these stocks can offer stability and income potential amid fluctuating economic conditions.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Guaranty Trust Holding (NGSE:GTCO) | 6.95% | ★★★★★★ |

| Peoples Bancorp (NasdaqGS:PEBO) | 4.58% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.50% | ★★★★★★ |

| Financial Institutions (NasdaqGS:FISI) | 4.49% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 3.92% | ★★★★★★ |

| FALCO HOLDINGS (TSE:4671) | 6.78% | ★★★★★★ |

| E J Holdings (TSE:2153) | 3.88% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 5.47% | ★★★★★★ |

| Premier Financial (NasdaqGS:PFC) | 4.33% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 4.85% | ★★★★★★ |

Click here to see the full list of 1938 stocks from our Top Dividend Stocks screener.

Let's review some notable picks from our screened stocks.

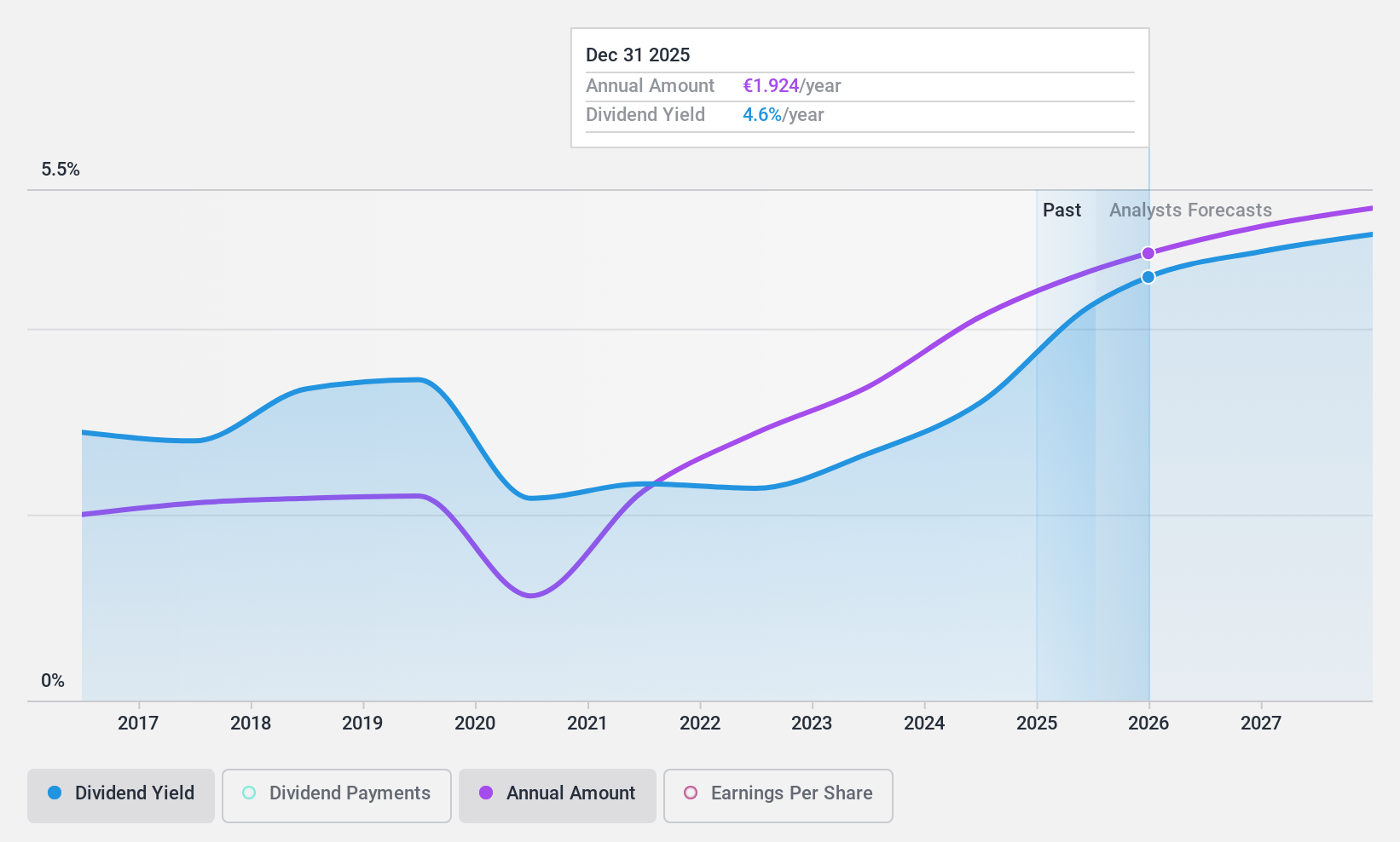

Ipsos (ENXTPA:IPS)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Ipsos SA operates as a global market research company offering survey-based research services across various regions including Europe, the Middle East, Africa, the Americas, and the Asia-Pacific, with a market cap of €1.96 billion.

Operations: Ipsos SA generates revenue of €2.44 billion from its survey-based research services provided to companies and institutions worldwide.

Dividend Yield: 3.6%

Ipsos offers a mixed dividend profile, with dividends well-covered by earnings and cash flows due to low payout ratios of 39.3% and 25.3%, respectively. However, its dividend yield of 3.63% is below the top tier in France, and past payments have been volatile with significant drops over the last decade. Despite trading at good value relative to peers, recent guidance revisions indicate limited organic growth prospects for the year ahead.

- Click to explore a detailed breakdown of our findings in Ipsos' dividend report.

- Insights from our recent valuation report point to the potential undervaluation of Ipsos shares in the market.

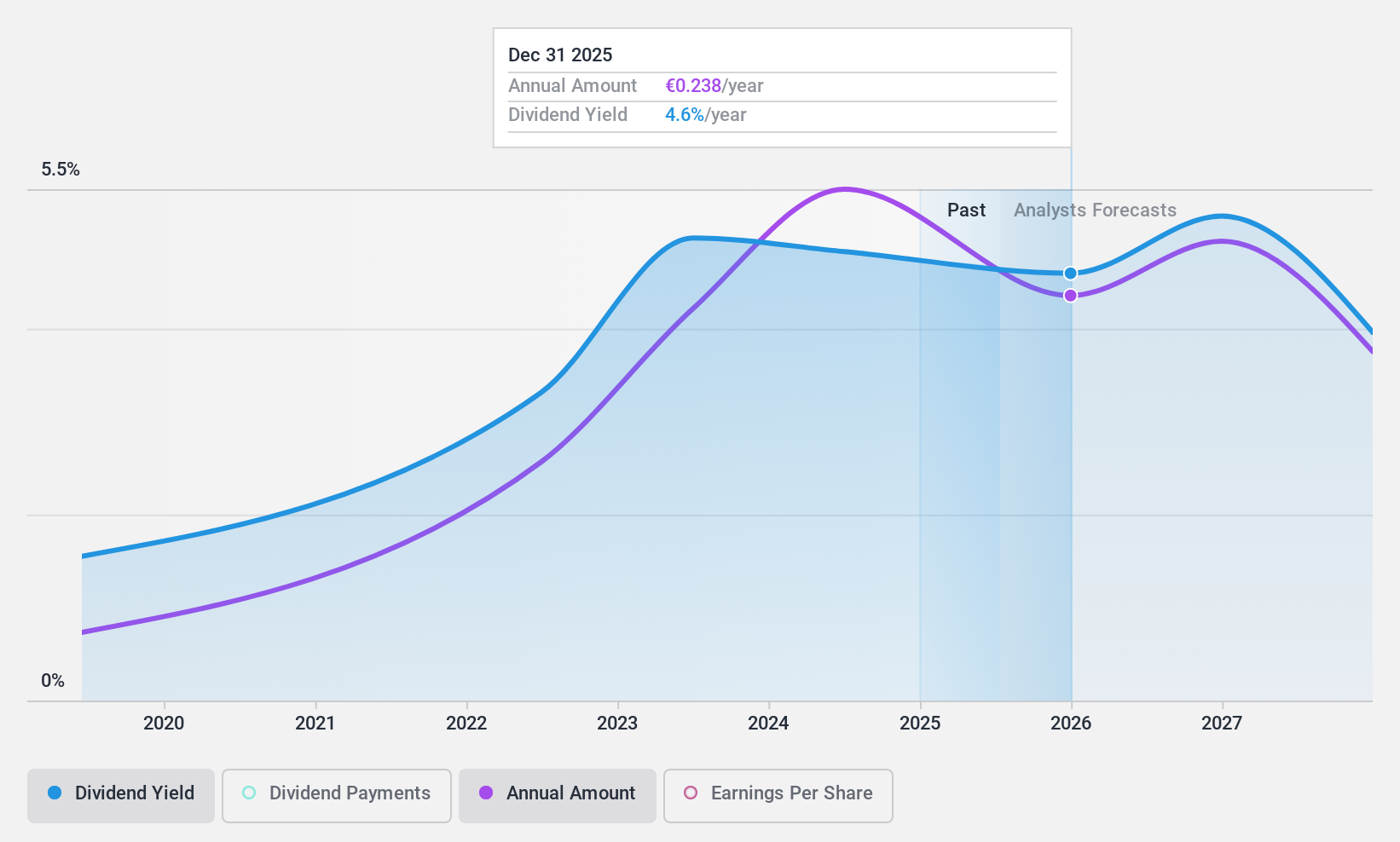

Etablissements Maurel & Prom (ENXTPA:MAU)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Etablissements Maurel & Prom S.A. is involved in the exploration and production of oil, gas, and hydrocarbons across Gabon, Tanzania, Angola, Colombia, and France with a market capitalization of approximately €1 billion.

Operations: Etablissements Maurel & Prom S.A. generates its revenue primarily from Production, contributing $658.76 million, followed by Drilling at $30.57 million.

Dividend Yield: 5.8%

Etablissements Maurel & Prom's dividend yield of 5.84% ranks in the top 25% of French market payers, supported by low payout ratios of 25.5% from earnings and 35.6% from cash flows, ensuring coverage. However, its dividend history is volatile with only five years of payments and significant annual drops over 20%. Despite trading at a discount to estimated fair value, future earnings are forecasted to decline by an average of 13.5% annually over three years.

- Dive into the specifics of Etablissements Maurel & Prom here with our thorough dividend report.

- Our comprehensive valuation report raises the possibility that Etablissements Maurel & Prom is priced lower than what may be justified by its financials.

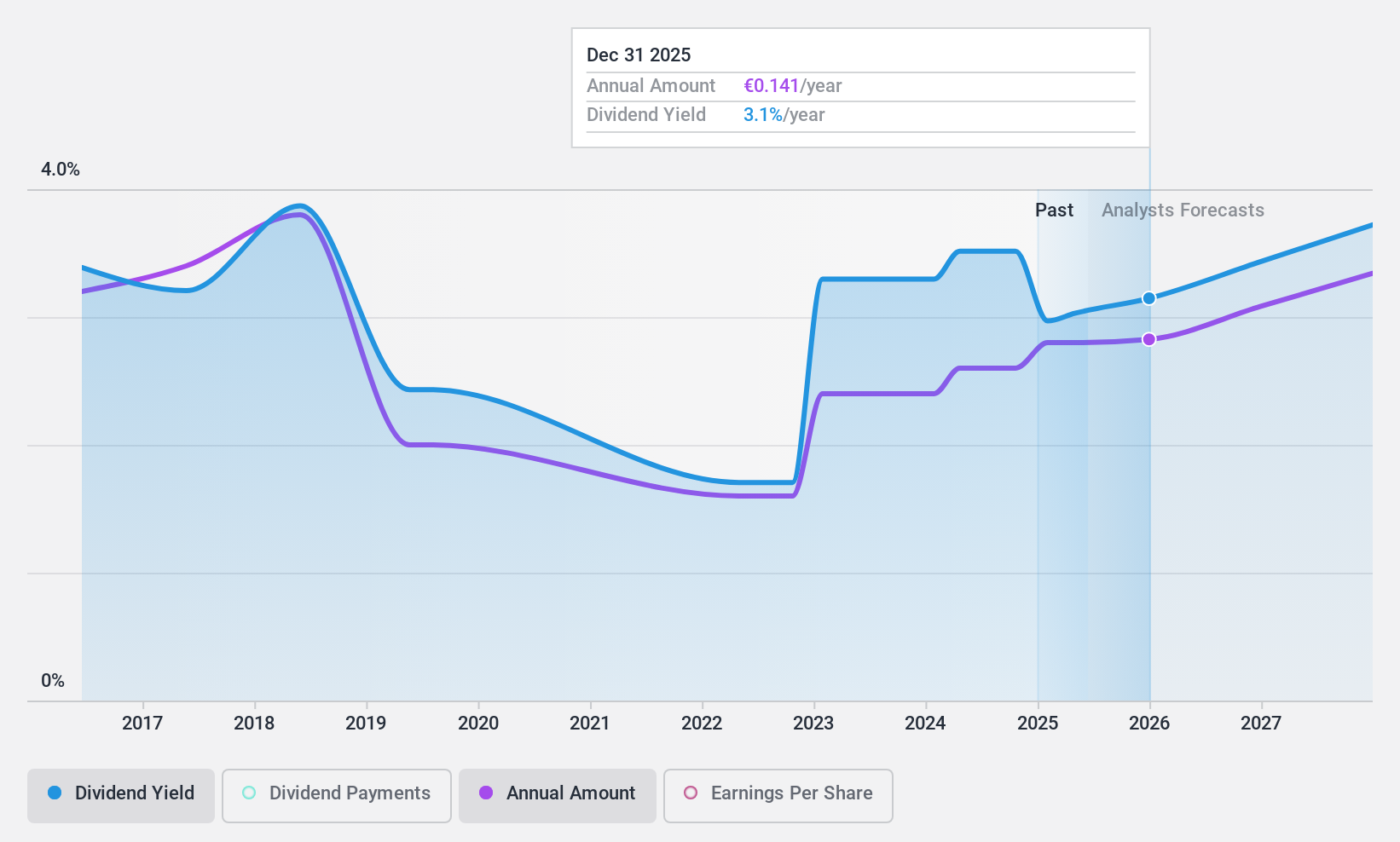

Nokia Oyj (HLSE:NOKIA)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Nokia Oyj is a global provider of mobile, fixed, and cloud network solutions with a market cap of €22.73 billion.

Operations: Nokia Oyj's revenue segments include Mobile Networks (€7.74 billion), Nokia Technologies (€1.72 billion), Network Infrastructure (€7.32 billion), and Cloud and Network Services (€2.95 billion).

Dividend Yield: 3.1%

Nokia's dividend yield of 3.09% is below the Finnish market's top payers, but its low cash payout ratio of 19% suggests strong coverage by cash flows. Despite a volatile dividend history over the past decade, recent increases indicate some growth. The current payout ratio of 78.3% shows dividends are covered by earnings, though not without risk given fluctuating profit margins. Recent strategic partnerships and technological advancements may bolster future financial stability and support dividend sustainability.

- Take a closer look at Nokia Oyj's potential here in our dividend report.

- In light of our recent valuation report, it seems possible that Nokia Oyj is trading behind its estimated value.

Turning Ideas Into Actions

- Unlock more gems! Our Top Dividend Stocks screener has unearthed 1935 more companies for you to explore.Click here to unveil our expertly curated list of 1938 Top Dividend Stocks.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Nokia Oyj might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About HLSE:NOKIA

Flawless balance sheet average dividend payer.