- Finland

- /

- Communications

- /

- HLSE:NOKIA

How Investors Are Reacting To Nokia Oyj (HLSE:NOKIA) Launching Quantum-Safe 50G Broadband and AI Automation

Reviewed by Sasha Jovanovic

- On October 7, 2025, Nokia announced the launch of the world’s first 50G PON solution featuring post-quantum broadband and advanced AI-powered automation, alongside new partnerships and technology deployments in fiber, smart buildings, and data center networks.

- This wave of innovation highlights Nokia's efforts to position its network offerings as future-proof with quantum-safe encryption, seamless upgrade paths, and operational enhancements driven by AI, addressing key enterprise and cloud operator concerns about security and scalability.

- We'll examine how Nokia's introduction of quantum-safe, ultra-fast broadband solutions could influence expectations for growth in high-margin infrastructure segments.

Outshine the giants: these 25 early-stage AI stocks could fund your retirement.

Nokia Oyj Investment Narrative Recap

To be a Nokia shareholder today, you need to believe the company’s strategy of leading in next-gen networking, through fiber, cloud, and AI, will outweigh persistent risks like macroeconomic headwinds, margin pressure in Mobile Networks, and stiff competition. The recent launch of Nokia's 50G PON solution strengthens the innovation story, but its near-term impact on critical catalysts, such as meaningful market share gains in high-margin infrastructure, may take time to materialize, while exposure to cyclical carrier spending and earnings seasonality remains a key watchpoint.

Among recent announcements, Nokia’s partnership with Nscale to accelerate the build-out of AI-ready data centers closely aligns with the same infrastructure growth drivers underpinning the new 50G PON launch. This collaboration underscores Nokia’s ambitions to expand beyond traditional telecom into adjacent high-growth areas, which could become increasingly important for improving margins and offsetting the volatility in its core Mobile Networks division.

On the other hand, investors should also consider how ongoing global trends in network commoditization and Open RAN adoption may impact Nokia’s ability to maintain...

Read the full narrative on Nokia Oyj (it's free!)

Nokia Oyj's outlook anticipates €21.0 billion in revenue and €1.7 billion in earnings by 2028. This is based on a 3.0% annual revenue growth rate and an increase in earnings of €791 million from current earnings of €909.0 million.

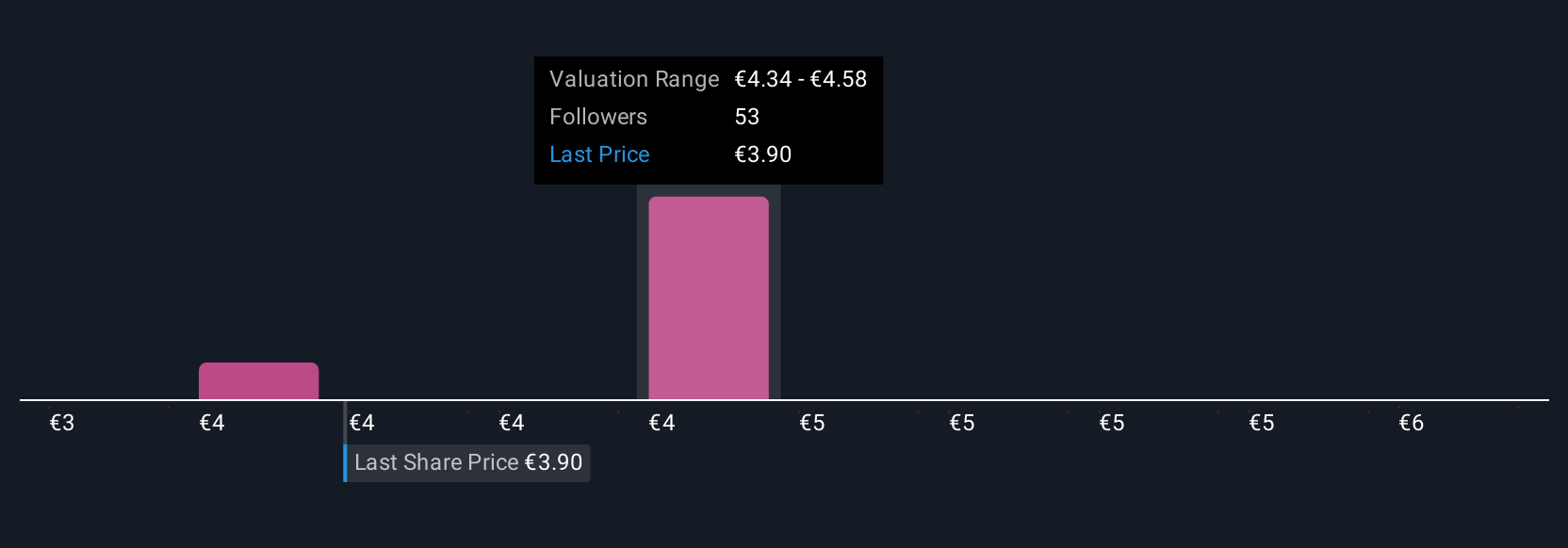

Uncover how Nokia Oyj's forecasts yield a €4.49 fair value, a 6% upside to its current price.

Exploring Other Perspectives

Five Simply Wall St Community members set Nokia’s fair value estimates in a wide €1.93 to €5.75 range. With ongoing risks in Mobile Networks and competitive headwinds, you might see the company’s potential very differently, explore alternative viewpoints to challenge your own assessment.

Explore 5 other fair value estimates on Nokia Oyj - why the stock might be worth as much as 35% more than the current price!

Build Your Own Nokia Oyj Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Nokia Oyj research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Nokia Oyj research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Nokia Oyj's overall financial health at a glance.

Curious About Other Options?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

- AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Nokia Oyj might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About HLSE:NOKIA

Nokia Oyj

Provides mobile, fixed, and cloud network solutions in North and Latin America, Greater China, India, rest of the Asia Pacific, Europe, the Middle East, and Africa.

Flawless balance sheet with proven track record.

Similar Companies

Market Insights

Community Narratives