As the pan-European STOXX Europe 600 Index reaches record levels, buoyed by a rally in technology stocks and expectations for lower U.S. borrowing costs, investors are increasingly focused on growth opportunities within the continent. In this environment, companies with high insider ownership can be particularly appealing as they often signal strong alignment between management and shareholder interests, potentially enhancing long-term growth potential.

Top 10 Growth Companies With High Insider Ownership In Europe

| Name | Insider Ownership | Earnings Growth |

| XTPL (WSE:XTP) | 23.3% | 107.3% |

| Xbrane Biopharma (OM:XBRANE) | 13% | 112.0% |

| Pharma Mar (BME:PHM) | 11.9% | 44.2% |

| MedinCell (ENXTPA:MEDCL) | 12.5% | 90.7% |

| KebNi (OM:KEBNI B) | 36.3% | 63.7% |

| Elliptic Laboratories (OB:ELABS) | 24.4% | 97.5% |

| CTT Systems (OM:CTT) | 17.5% | 37.9% |

| Circus (XTRA:CA1) | 24.5% | 67.1% |

| CD Projekt (WSE:CDR) | 29.7% | 43.1% |

| Bonesupport Holding (OM:BONEX) | 10.4% | 59.4% |

Let's take a closer look at a couple of our picks from the screened companies.

Lectra (ENXTPA:LSS)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Lectra SA offers industrial intelligence solutions for the fashion, automotive, and furniture markets globally, with a market cap of €915.93 million.

Operations: The company's revenue segments are distributed as follows: €170.21 million from the Americas, €134.93 million from the Asia-Pacific region, and €220.52 million from EMEA (Europe, Middle East, and Africa).

Insider Ownership: 12.7%

Earnings Growth Forecast: 21% p.a.

Lectra's earnings are forecast to grow significantly at 21% annually over the next three years, outpacing the French market. Despite trading 43.6% below its estimated fair value, revenue growth is slower at 5.4% per year but still exceeds the French market average. Recent successful implementation of Lectra's digital solutions by Walters demonstrates operational efficiency and customer satisfaction improvements, potentially supporting future growth. Analyst consensus suggests a potential stock price increase of 26.1%.

- Get an in-depth perspective on Lectra's performance by reading our analyst estimates report here.

- Our valuation report here indicates Lectra may be undervalued.

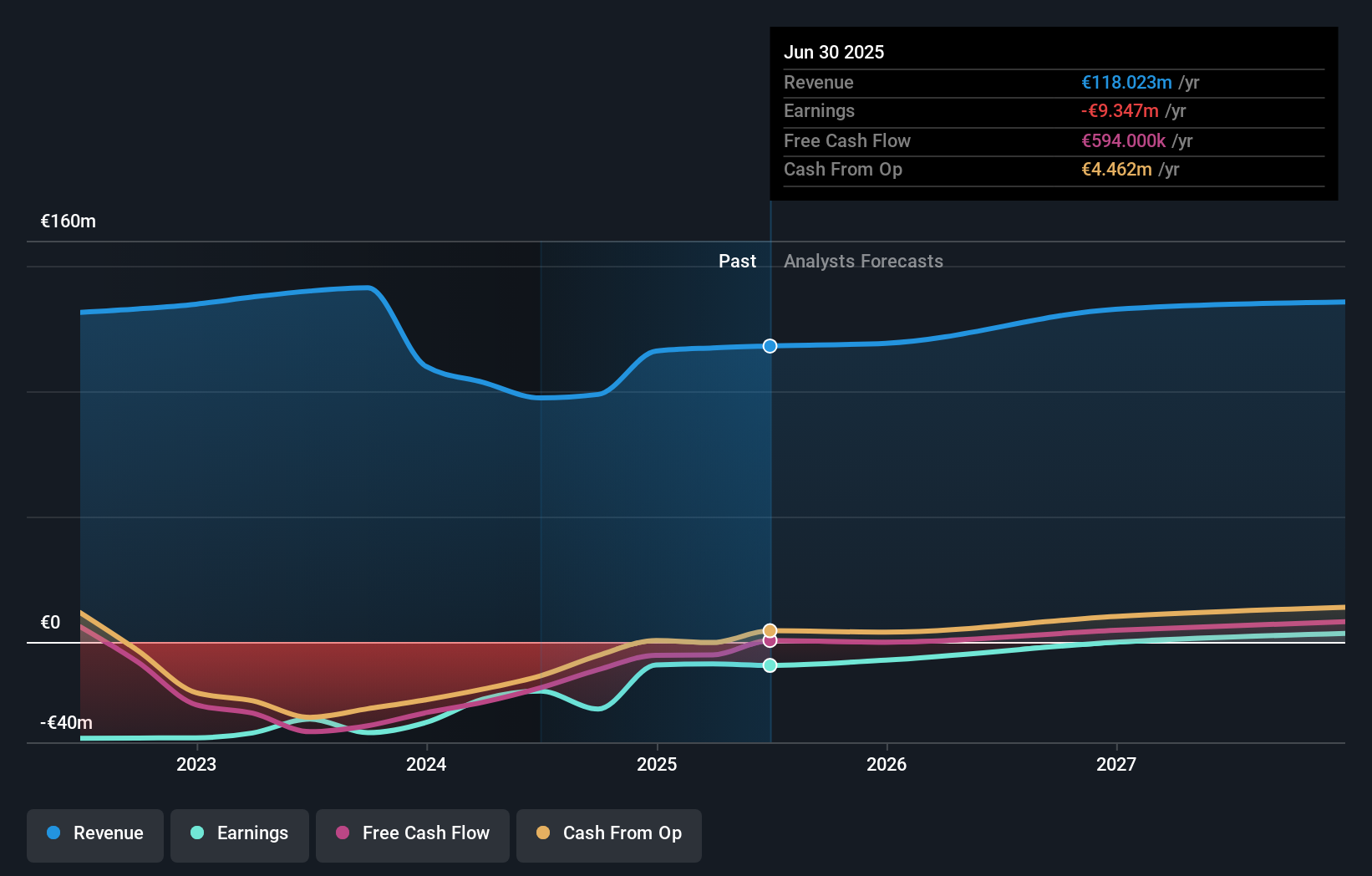

WithSecure Oyj (HLSE:WITH)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: WithSecure Oyj operates in the corporate security business globally and has a market cap of €298.59 million.

Operations: The company's revenue segments include Elements Company at €105.12 million and Cloud Protection for Salesforce at €12.01 million.

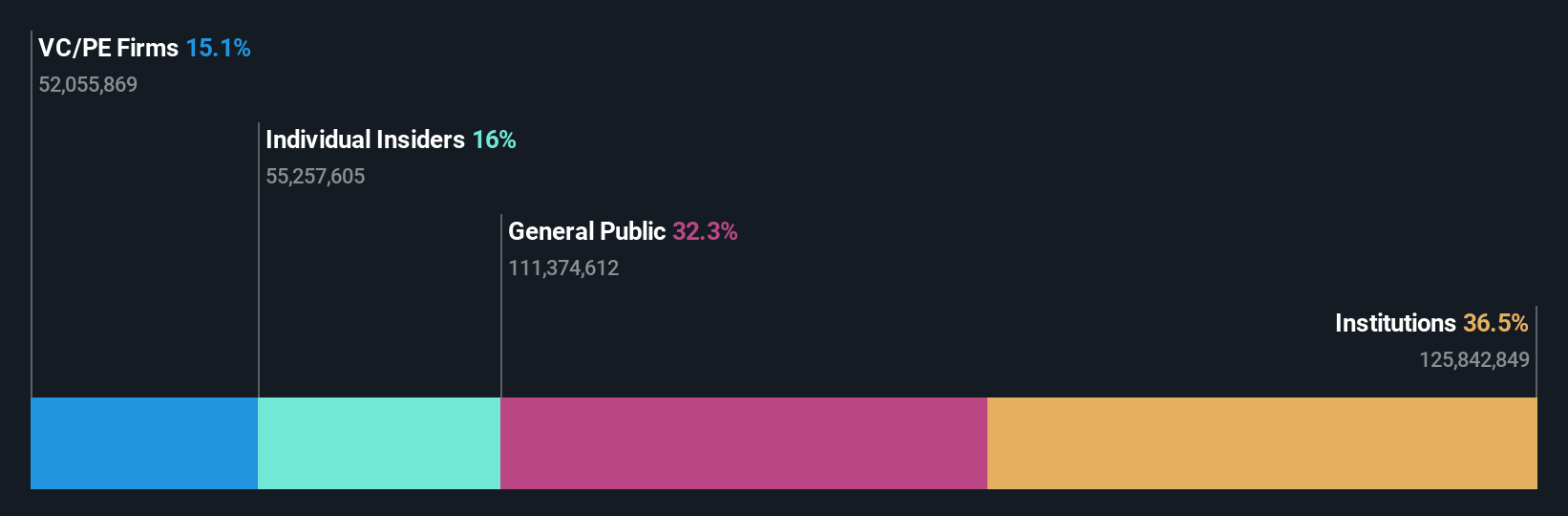

Insider Ownership: 35%

Earnings Growth Forecast: 93.9% p.a.

WithSecure Oyj is undergoing significant changes, including a €300 million acquisition by CVC Capital Partners, with insider Risto Siilasmaa reinvesting through equity. The company anticipates becoming profitable within three years with revenue growth forecasted at 5.7% annually, outpacing the Finnish market. Recent restructuring aims for €6.5 million in annual cost savings despite incurring one-off expenses of €2.8 million this year. Insiders have been net buyers recently, although not in substantial amounts.

- Click here and access our complete growth analysis report to understand the dynamics of WithSecure Oyj.

- Our expertly prepared valuation report WithSecure Oyj implies its share price may be too high.

Truecaller (OM:TRUE B)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Truecaller AB (publ) develops and publishes mobile caller ID applications for individuals and businesses across India, the Middle East, Africa, and internationally, with a market cap of approximately SEK13.48 billion.

Operations: The company generates revenue primarily from its communications software segment, amounting to SEK1.99 billion.

Insider Ownership: 16.1%

Earnings Growth Forecast: 23.1% p.a.

Truecaller is experiencing robust growth, with earnings expected to rise significantly at 23.1% annually over the next three years, outpacing the Swedish market. Recent product innovation, such as the adVantage AI-powered recommendation engine, enhances business engagement and revenue opportunities. Despite trading below its estimated fair value by a substantial margin, Truecaller maintains strong insider ownership with minimal recent selling activity. The company's strategic hires further bolster its advertising ecosystem's capabilities and expansion efforts.

- Navigate through the intricacies of Truecaller with our comprehensive analyst estimates report here.

- According our valuation report, there's an indication that Truecaller's share price might be on the cheaper side.

Turning Ideas Into Actions

- Delve into our full catalog of 182 Fast Growing European Companies With High Insider Ownership here.

- Curious About Other Options? The latest GPUs need a type of rare earth metal called Neodymium and there are only 35 companies in the world exploring or producing it. Find the list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:LSS

Lectra

Provides industrial intelligence solutions for fashion, automotive, furniture markets, and other industries in Europe, the Americas, the Asia Pacific, and internationally.

Reasonable growth potential with adequate balance sheet.

Market Insights

Community Narratives