Tecnotree Oyj And 2 Other European Penny Stocks With Growth Potential

Reviewed by Simply Wall St

Recent developments in Europe, such as proposed tariffs from the U.S., have stirred market volatility, with major indices like Germany’s DAX and France's CAC 40 experiencing declines. Despite these challenges, certain investment opportunities remain attractive, particularly in the realm of penny stocks. Though often considered a niche market segment, penny stocks can offer significant growth potential when backed by solid financial foundations. In this article, we highlight Tecnotree Oyj and two other European penny stocks that exhibit promising financial strength and growth potential for investors seeking under-the-radar opportunities.

Top 10 Penny Stocks In Europe

| Name | Share Price | Market Cap | Rewards & Risks |

| Bredband2 i Skandinavien (OM:BRE2) | SEK2.31 | SEK2.21B | ✅ 4 ⚠️ 1 View Analysis > |

| Transferator (NGM:TRAN A) | SEK2.14 | SEK205.88M | ✅ 2 ⚠️ 3 View Analysis > |

| Angler Gaming (NGM:ANGL) | SEK3.70 | SEK277.44M | ✅ 4 ⚠️ 2 View Analysis > |

| Hifab Group (OM:HIFA B) | SEK3.38 | SEK205.64M | ✅ 2 ⚠️ 2 View Analysis > |

| IMS (WSE:IMS) | PLN4.10 | PLN138.97M | ✅ 3 ⚠️ 2 View Analysis > |

| Cellularline (BIT:CELL) | €2.83 | €59.69M | ✅ 3 ⚠️ 2 View Analysis > |

| Netgem (ENXTPA:ALNTG) | €0.934 | €31.28M | ✅ 3 ⚠️ 2 View Analysis > |

| Euroland Société anonyme (ENXTPA:MLERO) | €3.26 | €9.49M | ✅ 2 ⚠️ 5 View Analysis > |

| Fondia Oyj (HLSE:FONDIA) | €4.80 | €17.95M | ✅ 2 ⚠️ 3 View Analysis > |

| Deceuninck (ENXTBR:DECB) | €2.145 | €296.15M | ✅ 3 ⚠️ 1 View Analysis > |

Click here to see the full list of 448 stocks from our European Penny Stocks screener.

Let's take a closer look at a couple of our picks from the screened companies.

Tecnotree Oyj (HLSE:TEM1V)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Tecnotree Oyj offers telecommunication IT solutions, including charging, billing, customer care, and messaging services across Europe, the Americas, the Middle East, Africa, and the Asia Pacific with a market cap of €56.15 million.

Operations: The company's revenue is primarily derived from the MEA and APAC regions, contributing €57.43 million, while Europe and the Americas account for €14.73 million.

Market Cap: €56.15M

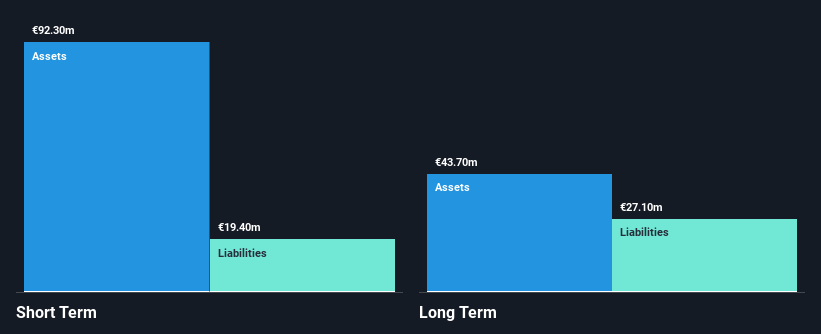

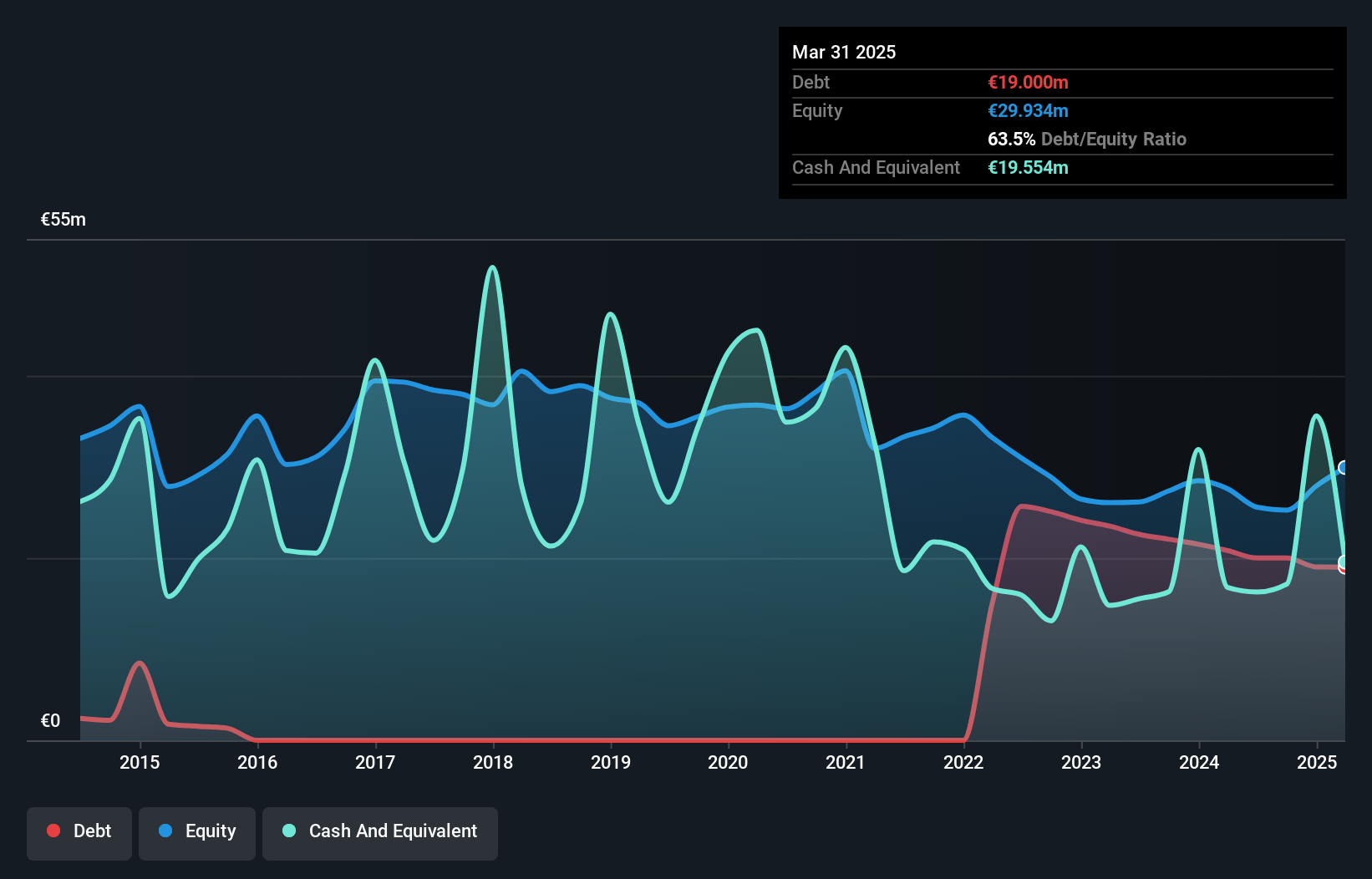

Tecnotree Oyj, with a market cap of €56.15 million, has been navigating challenges in earnings growth and volatility. Despite a decline in earnings over five years and lower profit margins compared to last year, the company maintains high-quality earnings and has reduced its debt significantly from 217.2% to 29.5%. Recent strategic agreements, including a €39.6 million contract with a South African telecom operator for digital BSS transformation, highlight its efforts to strengthen revenue streams beyond frontier markets. Tecnotree's short-term assets exceed liabilities comfortably, indicating solid financial management amidst fluctuating share prices and modest dividend payouts.

- Click here to discover the nuances of Tecnotree Oyj with our detailed analytical financial health report.

- Understand Tecnotree Oyj's earnings outlook by examining our growth report.

Verkkokauppa.com Oyj (HLSE:VERK)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Verkkokauppa.com Oyj is an online retailer based in Finland with a market cap of €120.87 million.

Operations: The company generates €470.39 million in revenue from its online retail operations.

Market Cap: €120.87M

Verkkokauppa.com Oyj, with a market cap of €120.87 million, has shown resilience in the online retail sector. The company reported first-quarter sales of €110.54 million and a net income turnaround from a loss to €2.03 million year-over-year, reflecting improved profit margins and earnings growth exceeding industry averages. Despite high share price volatility and an inexperienced board, Verkkokauppa.com maintains strong financial footing with short-term assets surpassing liabilities and debt covered by cash flow. However, interest coverage remains weak at 2.3 times EBIT, highlighting potential challenges in managing financial obligations amidst executive changes and strategic transitions.

- Get an in-depth perspective on Verkkokauppa.com Oyj's performance by reading our balance sheet health report here.

- Gain insights into Verkkokauppa.com Oyj's outlook and expected performance with our report on the company's earnings estimates.

VRG (WSE:VRG)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: VRG S.A. is a company that designs, manufactures, and distributes jewelry and clothing for both women and men across Poland, Hungary, the Eurozone, and the United States with a market cap of PLN900.31 million.

Operations: VRG S.A. does not report specific revenue segments, but it operates in the design, manufacturing, and distribution of jewelry and clothing for both women and men across Poland, Hungary, the Eurozone, and the United States.

Market Cap: PLN900.31M

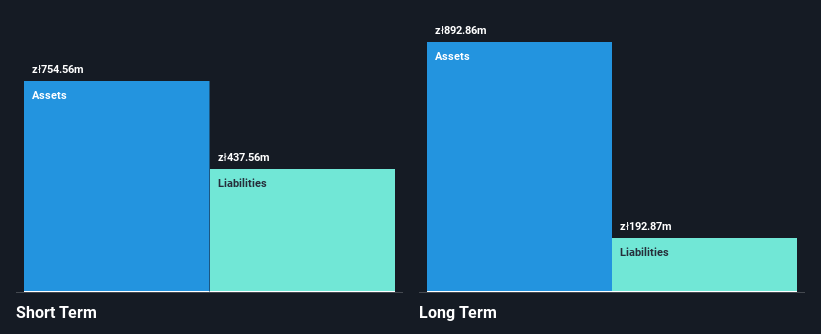

VRG S.A., with a market cap of PLN 900.31 million, has demonstrated financial stability despite recent challenges. The company's short-term assets comfortably cover both its short and long-term liabilities, while its net debt to equity ratio remains satisfactory at 12.2%. Recent earnings reports indicate a positive trajectory, with first-quarter sales increasing to PLN 293.64 million and net income rising significantly year-over-year. Although VRG's earnings growth was negative last year compared to the luxury industry average, it has achieved high-quality past earnings and improved interest coverage at 6.9 times EBIT, suggesting robust operational management amidst volatile market conditions.

- Jump into the full analysis health report here for a deeper understanding of VRG.

- Assess VRG's future earnings estimates with our detailed growth reports.

Turning Ideas Into Actions

- Navigate through the entire inventory of 448 European Penny Stocks here.

- Looking For Alternative Opportunities? We've found 19 US stocks that are forecast to pay a dividend yeild of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About WSE:VRG

VRG

Designs, manufactures, and distributes jewelry and clothing for women and men in Poland, Hungary, the Eurozone, and the United States.

Flawless balance sheet with questionable track record.

Market Insights

Community Narratives