European Penny Stocks Spotlight: Lindex Group Oyj Among 3 To Consider

Reviewed by Simply Wall St

Amidst the backdrop of economic uncertainty and fluctuating market conditions, European stocks have been navigating a landscape marked by trade tensions and monetary policy shifts. Despite these challenges, certain investment opportunities continue to emerge, particularly in the realm of penny stocks—a term that may seem outdated but still holds significance for investors seeking growth potential at lower price points. Typically representing smaller or newer companies, penny stocks can offer unique opportunities when backed by strong financials and solid fundamentals.

Top 10 Penny Stocks In Europe

| Name | Share Price | Market Cap | Rewards & Risks |

| Bredband2 i Skandinavien (OM:BRE2) | SEK2.115 | SEK2.02B | ✅ 4 ⚠️ 0 View Analysis > |

| Transferator (NGM:TRAN A) | SEK2.29 | SEK220.31M | ✅ 2 ⚠️ 3 View Analysis > |

| Angler Gaming (NGM:ANGL) | SEK3.89 | SEK291.69M | ✅ 3 ⚠️ 3 View Analysis > |

| Hifab Group (OM:HIFA B) | SEK4.02 | SEK244.57M | ✅ 2 ⚠️ 2 View Analysis > |

| IMS (WSE:IMS) | PLN3.75 | PLN127.1M | ✅ 3 ⚠️ 2 View Analysis > |

| Cellularline (BIT:CELL) | €2.59 | €54.54M | ✅ 4 ⚠️ 2 View Analysis > |

| I.M.D. International Medical Devices (BIT:IMD) | €1.40 | €24.25M | ✅ 4 ⚠️ 1 View Analysis > |

| Netgem (ENXTPA:ALNTG) | €0.99 | €33.15M | ✅ 4 ⚠️ 3 View Analysis > |

| High (ENXTPA:HCO) | €2.71 | €53.23M | ✅ 2 ⚠️ 3 View Analysis > |

| Deceuninck (ENXTBR:DECB) | €2.265 | €313.47M | ✅ 3 ⚠️ 1 View Analysis > |

Click here to see the full list of 428 stocks from our European Penny Stocks screener.

Let's take a closer look at a couple of our picks from the screened companies.

Lindex Group Oyj (HLSE:LINDEX)

Simply Wall St Financial Health Rating: ★★★★☆☆

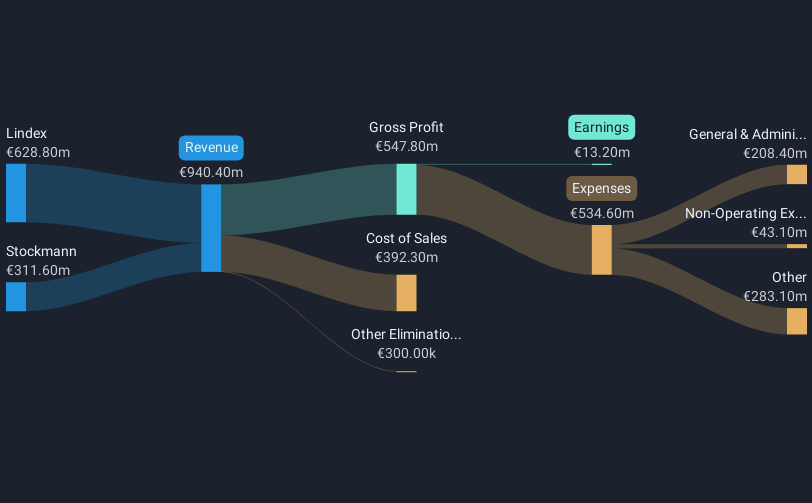

Overview: Lindex Group Oyj operates in the retail sector both within Finland and internationally, with a market capitalization of €518 million.

Operations: The company generates revenue from its Lindex segment, which accounts for €628.8 million, and its Stockmann segment, contributing €311.6 million.

Market Cap: €518M

Lindex Group Oyj, with a market cap of €518 million, operates in the retail sector and has shown mixed financial signals. Its recent earnings report indicates stable sales at €273.7 million for Q4 2024, while net income rose significantly to €19.8 million from the previous year. Despite this improvement, profit margins have declined to 1.4% from 5.4%. The company is financially sound with more cash than debt and short-term assets exceeding short-term liabilities; however, interest coverage remains weak at 1.7x EBIT. Earnings are expected to grow by approximately 18% annually despite past negative growth trends.

- Click here and access our complete financial health analysis report to understand the dynamics of Lindex Group Oyj.

- Understand Lindex Group Oyj's earnings outlook by examining our growth report.

Verkkokauppa.com Oyj (HLSE:VERK)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Verkkokauppa.com Oyj is an online retailer based in Finland with a market cap of €92.12 million.

Operations: The company generates revenue of €467.83 million from its online retail operations.

Market Cap: €92.12M

Verkkokauppa.com Oyj, with a market cap of €92.12 million, faces challenges as it navigates financial instability and regulatory hurdles. Despite generating €467.83 million in revenue for 2024, the company reported a net loss of €0.803 million due to increased expenses and an administrative fine upheld by the Helsinki Administrative Court. While its short-term assets exceed liabilities, providing some financial cushion, its debt-to-equity ratio has risen significantly over five years to 68.2%. The company's earnings are projected to grow by nearly 47% annually; however, high share price volatility persists amidst these uncertainties.

- Get an in-depth perspective on Verkkokauppa.com Oyj's performance by reading our balance sheet health report here.

- Evaluate Verkkokauppa.com Oyj's prospects by accessing our earnings growth report.

Exasol (XTRA:EXL)

Simply Wall St Financial Health Rating: ★★★★★★

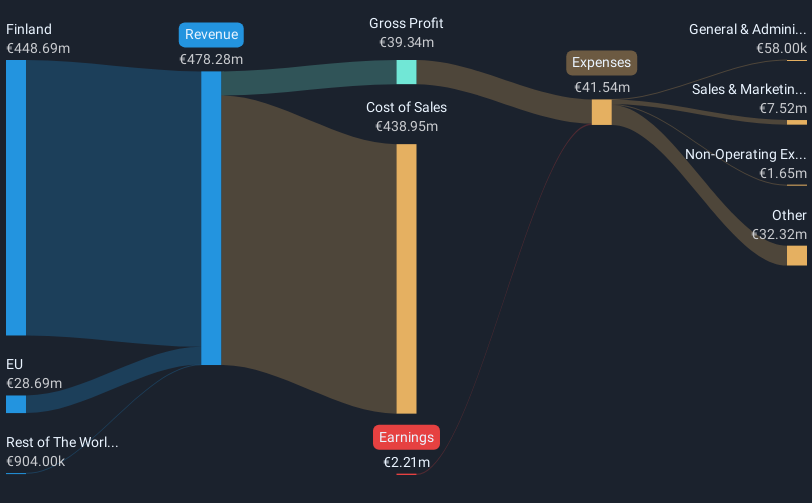

Overview: Exasol AG develops databases for analytics and data warehousing across Germany, Austria, Switzerland, Great Britain, North America, and internationally with a market cap of €88.26 million.

Operations: Exasol does not report distinct revenue segments.

Market Cap: €88.26M

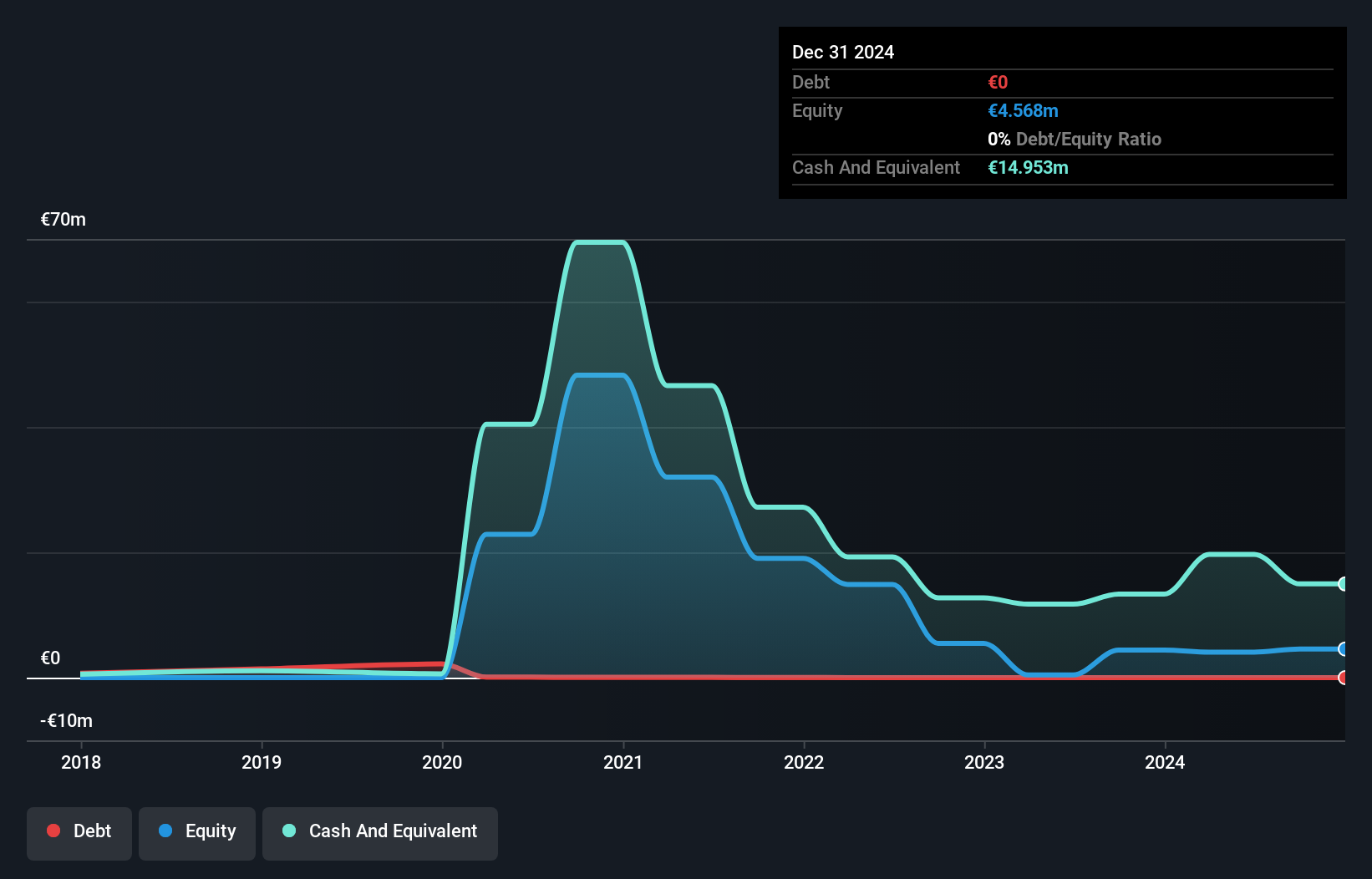

Exasol AG, with a market cap of €88.26 million, has transitioned to profitability, reporting €39.63 million in sales for 2024 and a net income of €0.23 million compared to a loss the previous year. The company benefits from strong short-term asset coverage over liabilities and remains debt-free, reducing financial risk. However, share price volatility is high compared to most German stocks. Recent management enhancements aim to drive growth in the competitive data analytics market, with guidance indicating mid-single-digit revenue growth for 2025 amidst ongoing strategic portfolio shifts and contract terminations outside core focus areas.

- Click to explore a detailed breakdown of our findings in Exasol's financial health report.

- Assess Exasol's future earnings estimates with our detailed growth reports.

Seize The Opportunity

- Take a closer look at our European Penny Stocks list of 428 companies by clicking here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Exasol might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About XTRA:EXL

Exasol

Develops database for analytics and data warehousing in Germany, Austria, Switzerland, Great Britain, North America, and internationally.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Community Narratives