- Hong Kong

- /

- Capital Markets

- /

- SEHK:227

3 Promising Penny Stocks With Market Caps Under US$80M

Reviewed by Simply Wall St

Global markets have shown mixed performances recently, with major U.S. indices like the S&P 500 and Nasdaq Composite reaching record highs, while smaller-cap indexes such as the Russell 2000 experienced declines. This divergence highlights the varying opportunities across different segments of the market, including penny stocks—a term that may seem outdated but still captures a niche for investors interested in smaller or newer companies. Despite their reputation for volatility, penny stocks can offer substantial growth potential when backed by strong financial health and solid fundamentals.

Top 10 Penny Stocks

| Name | Share Price | Market Cap | Financial Health Rating |

| DXN Holdings Bhd (KLSE:DXN) | MYR0.505 | MYR2.51B | ★★★★★★ |

| Teo Seng Capital Berhad (KLSE:TEOSENG) | MYR2.33 | MYR346.54M | ★★★★★★ |

| Embark Early Education (ASX:EVO) | A$0.79 | A$144.95M | ★★★★☆☆ |

| ME Group International (LSE:MEGP) | £2.105 | £793.09M | ★★★★★★ |

| Hil Industries Berhad (KLSE:HIL) | MYR0.885 | MYR293.77M | ★★★★★★ |

| LaserBond (ASX:LBL) | A$0.56 | A$65.64M | ★★★★★★ |

| Datasonic Group Berhad (KLSE:DSONIC) | MYR0.435 | MYR1.21B | ★★★★★★ |

| Bosideng International Holdings (SEHK:3998) | HK$4.05 | HK$44.6B | ★★★★★★ |

| Lever Style (SEHK:1346) | HK$0.87 | HK$539.57M | ★★★★★★ |

| Secure Trust Bank (LSE:STB) | £3.48 | £66.37M | ★★★★☆☆ |

Click here to see the full list of 5,707 stocks from our Penny Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

Herantis Pharma Oyj (HLSE:HRTIS)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Herantis Pharma Oyj is a biotech company focused on developing disease-modifying cerebral dopamine neurotrophic factor (CDNF) based therapies for Parkinson’s disease, with a market cap of €32.56 million.

Operations: Herantis Pharma Oyj does not have any reported revenue segments.

Market Cap: €32.56M

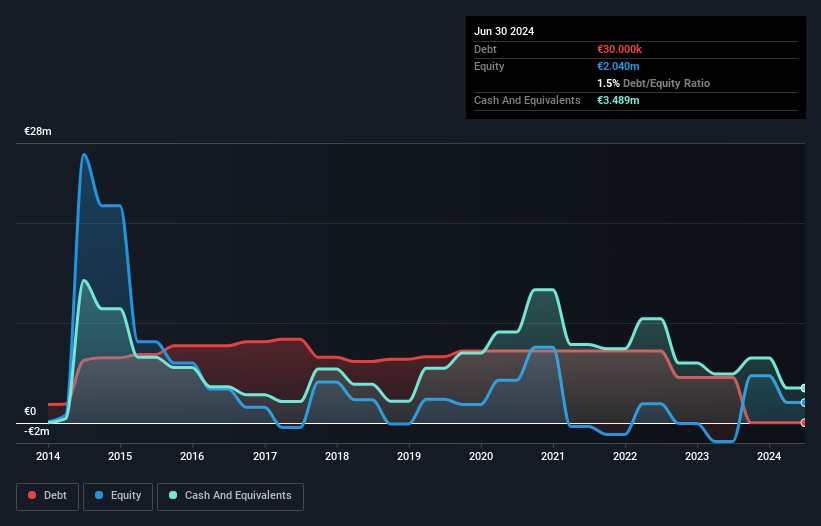

Herantis Pharma Oyj, a biotech firm focused on Parkinson's disease therapies, is pre-revenue with a market cap of €32.56 million. The company recently completed Part 1 of its Phase 1b clinical trial for HER-096, advancing to Part 2 involving Parkinson’s patients. Despite being unprofitable and having a volatile share price, Herantis has reduced its debt significantly over the past five years and holds more cash than debt. However, shareholders have faced dilution recently. The company's experienced management team is navigating these challenges while aiming to leverage HER-096's potential in the therapeutic landscape.

- Click to explore a detailed breakdown of our findings in Herantis Pharma Oyj's financial health report.

- Explore historical data to track Herantis Pharma Oyj's performance over time in our past results report.

Trigiant Group (SEHK:1300)

Simply Wall St Financial Health Rating: ★★★★☆☆

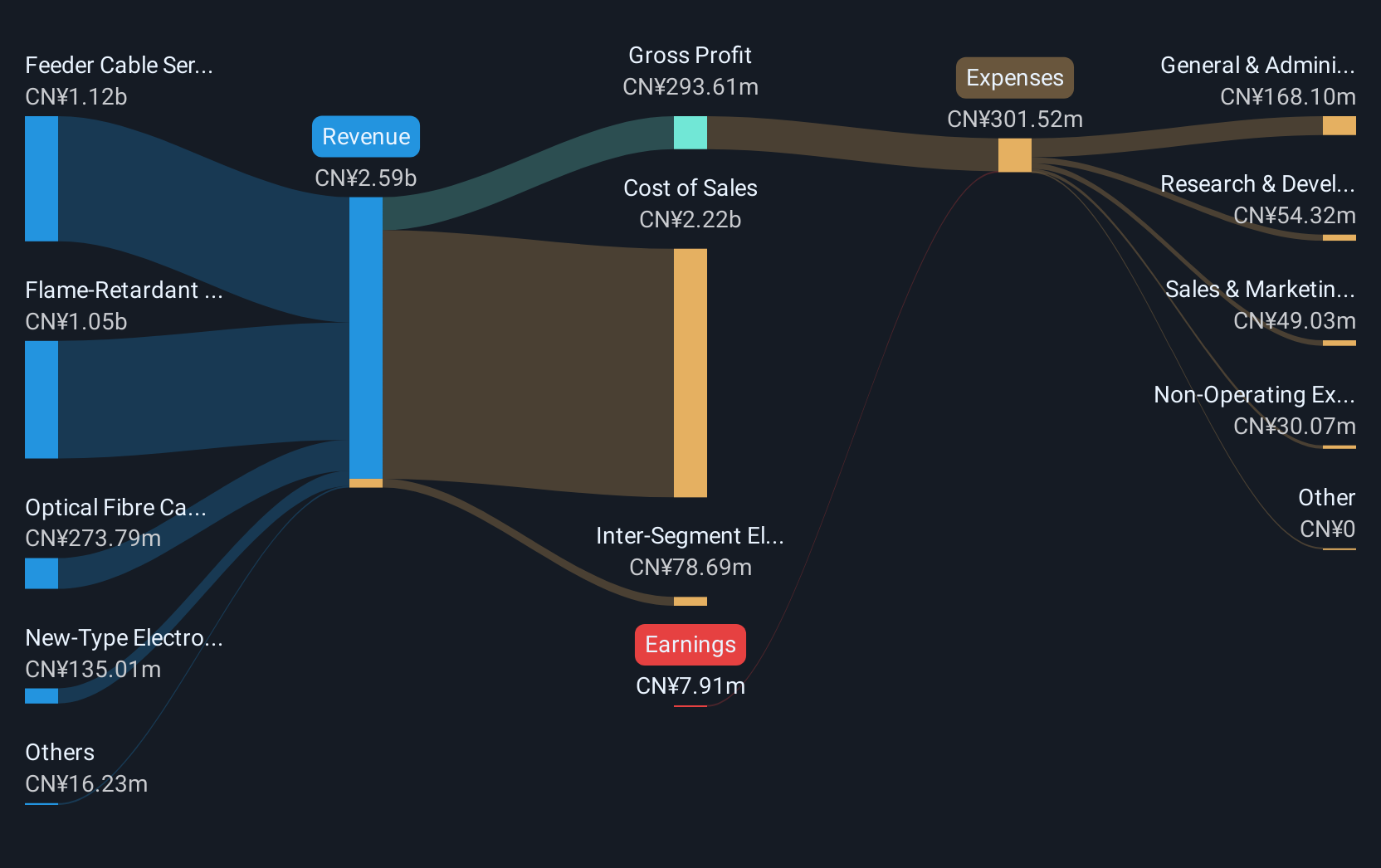

Overview: Trigiant Group Limited is an investment holding company that manufactures and sells feeder cables, optical fiber cables, flame-retardant flexible cables, and related products for mobile communications and telecommunication equipment in the People's Republic of China, with a market cap of HK$537.45 million.

Operations: The company's revenue is primarily derived from its Feeder Cable Series at CN¥1.10 billion, followed by Flame-Retardant Flexible Cable Series at CN¥961.90 million, Optical Fibre Cable Series and Related Products at CN¥256.16 million, and New-Type Electronic Components at CN¥146.36 million.

Market Cap: HK$537.45M

Trigiant Group Limited, with a market cap of HK$537.45 million, is undertaking a share buyback program authorized to repurchase up to 10% of its shares, aiming to enhance net asset value and earnings per share. Despite being unprofitable with negative return on equity and increasing losses over the past five years, the company has strong short-term asset coverage exceeding both long-term and short-term liabilities. Its debt level is satisfactory with operating cash flow covering 50.1% of its debt obligations. The management team is seasoned; however, the board lacks experience with an average tenure of 1.9 years.

- Click here to discover the nuances of Trigiant Group with our detailed analytical financial health report.

- Review our historical performance report to gain insights into Trigiant Group's track record.

First Shanghai Investments (SEHK:227)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: First Shanghai Investments Limited is an investment holding company involved in financial services, direct investments, and property and hotel development across Hong Kong, the People’s Republic of China, and France with a market cap of HK$569.58 million.

Operations: The company's revenue is primarily derived from Financial Services (HK$151.04 million), Property Investment and Hotel (HK$150.92 million), and Property Development (HK$56.18 million).

Market Cap: HK$569.58M

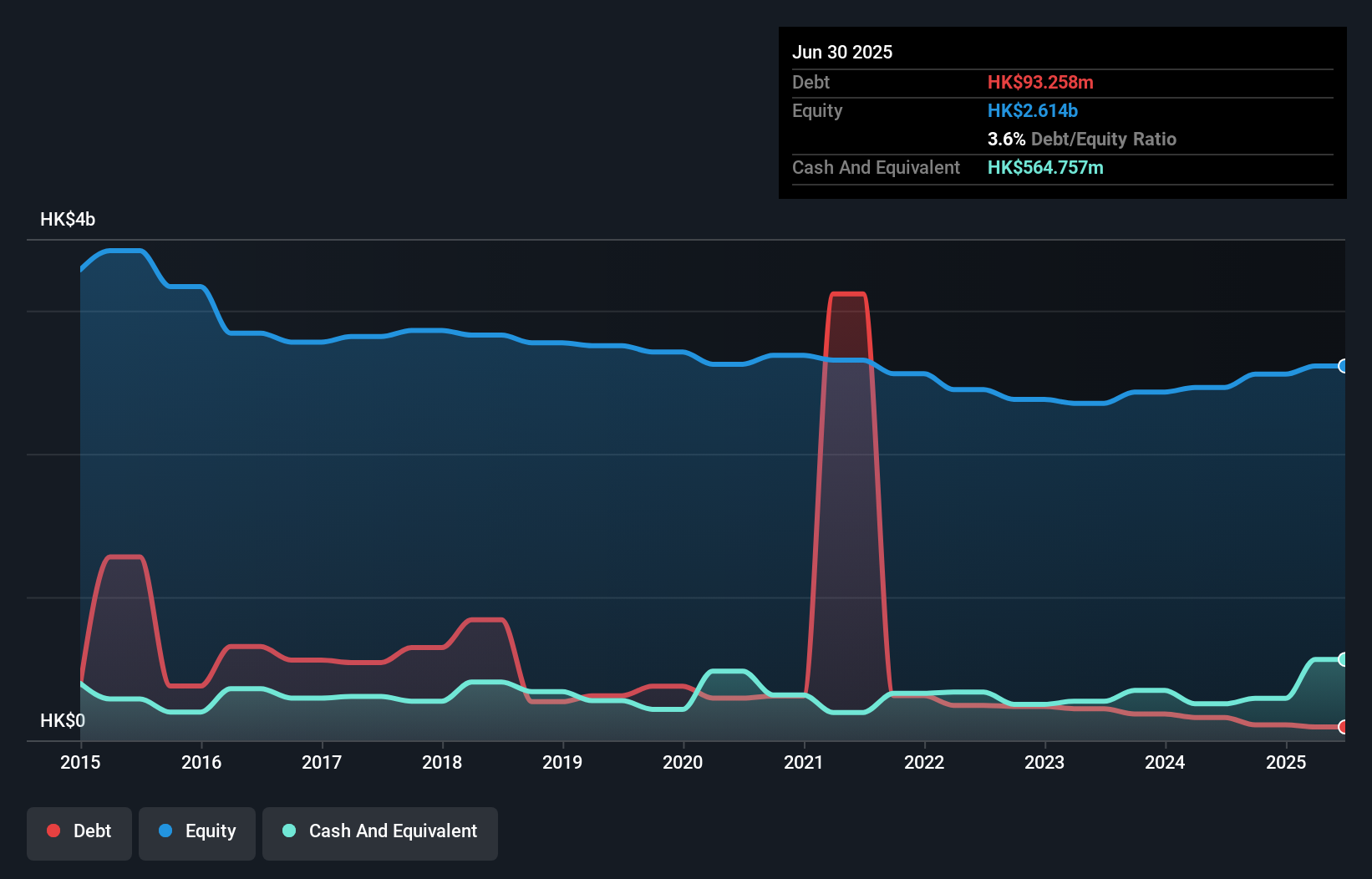

First Shanghai Investments Limited, with a market cap of HK$569.58 million, has recently turned profitable, making it challenging to compare its earnings growth to the industry average. The company benefits from strong short-term asset coverage (HK$4.1 billion), exceeding both short-term and long-term liabilities. Despite a low return on equity of 2.4%, it holds more cash than total debt and has reduced its debt-to-equity ratio over five years. However, negative operating cash flow indicates potential challenges in covering debt obligations through operations alone. The management team is notably experienced with an average tenure of 30.9 years.

- Click here and access our complete financial health analysis report to understand the dynamics of First Shanghai Investments.

- Gain insights into First Shanghai Investments' past trends and performance with our report on the company's historical track record.

Where To Now?

- Navigate through the entire inventory of 5,707 Penny Stocks here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:227

First Shanghai Investments

An investment holding company, engages in financial services, direct investments, and property and hotel development businesses in Hong Kong, the People’s Republic of China, and France.

Adequate balance sheet low.