Assessing Alma Media Shares After Solid Run and Latest 12% Digital Revenue Growth

Reviewed by Bailey Pemberton

Thinking about what to do with Alma Media Oyj shares? You are not alone. With a solid track record of growth and a reputation for adapting quickly to changing market dynamics, Alma Media Oyj draws the attention of both long-term investors and those looking to catch the next upward move. The company’s share price closed recently at 14.1. While there has been a brief dip of -5.7% over the last week, the stock is flat for the past month, hinting at a possible pause after a strong run. Year-to-date, shares have climbed 25.3% and have delivered a remarkable 28.4% return over the past year. Stretch out to three and five years and the results are even more striking: up 98.9% and 128.7% respectively. These numbers reflect not just business performance, but also broader confidence in Alma Media’s adaptability, especially as digital media continues to reshape the landscape.

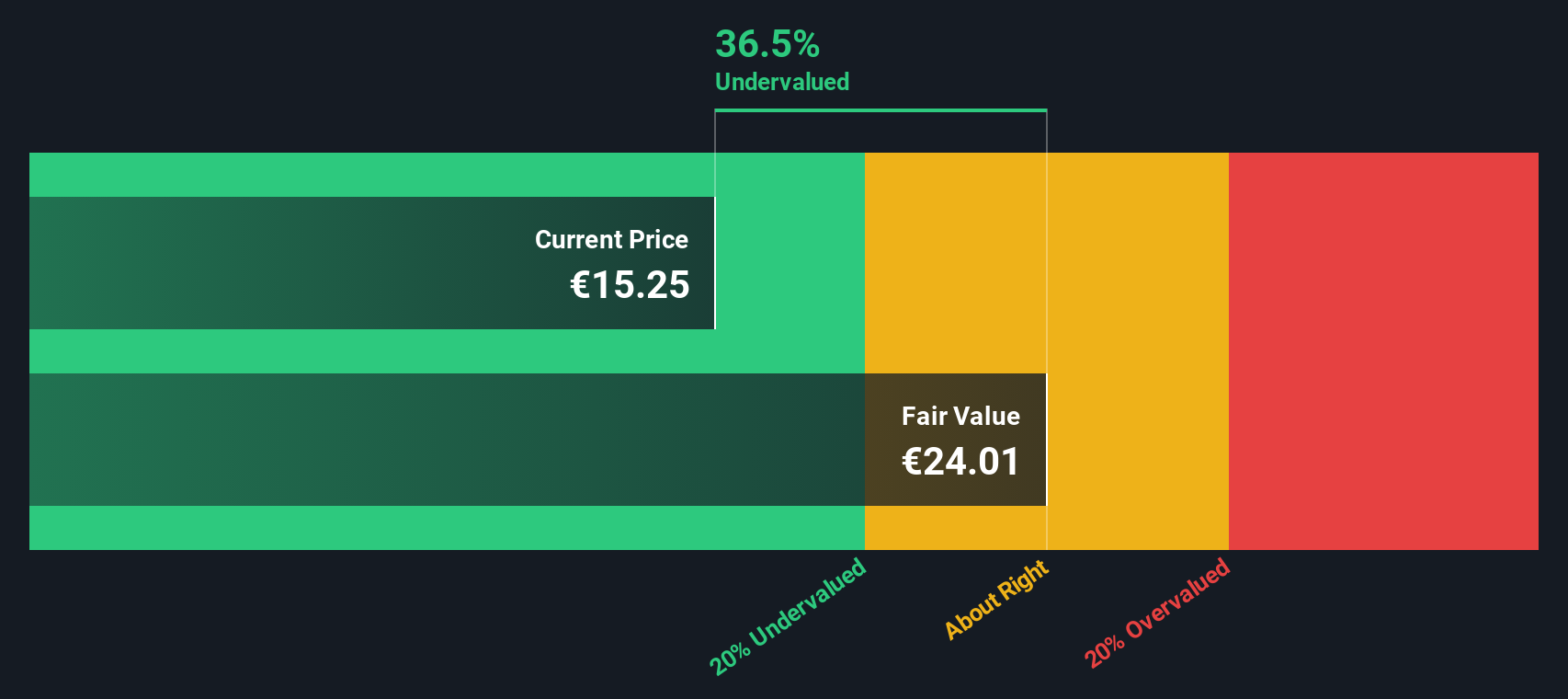

Of course, recent price action always gets people wondering whether the stock is still a bargain or if most of the value has been realized. Our valuation score comes in at 4 out of 6, meaning Alma Media is considered undervalued on four of the six checks most investors care about.

Next, we will dig into the specific valuation approaches underpinning these numbers. Further on, I will share a perspective that offers an even deeper understanding of what the numbers really mean for Alma Media Oyj’s future potential.

Why Alma Media Oyj is lagging behind its peers

Approach 1: Alma Media Oyj Discounted Cash Flow (DCF) Analysis

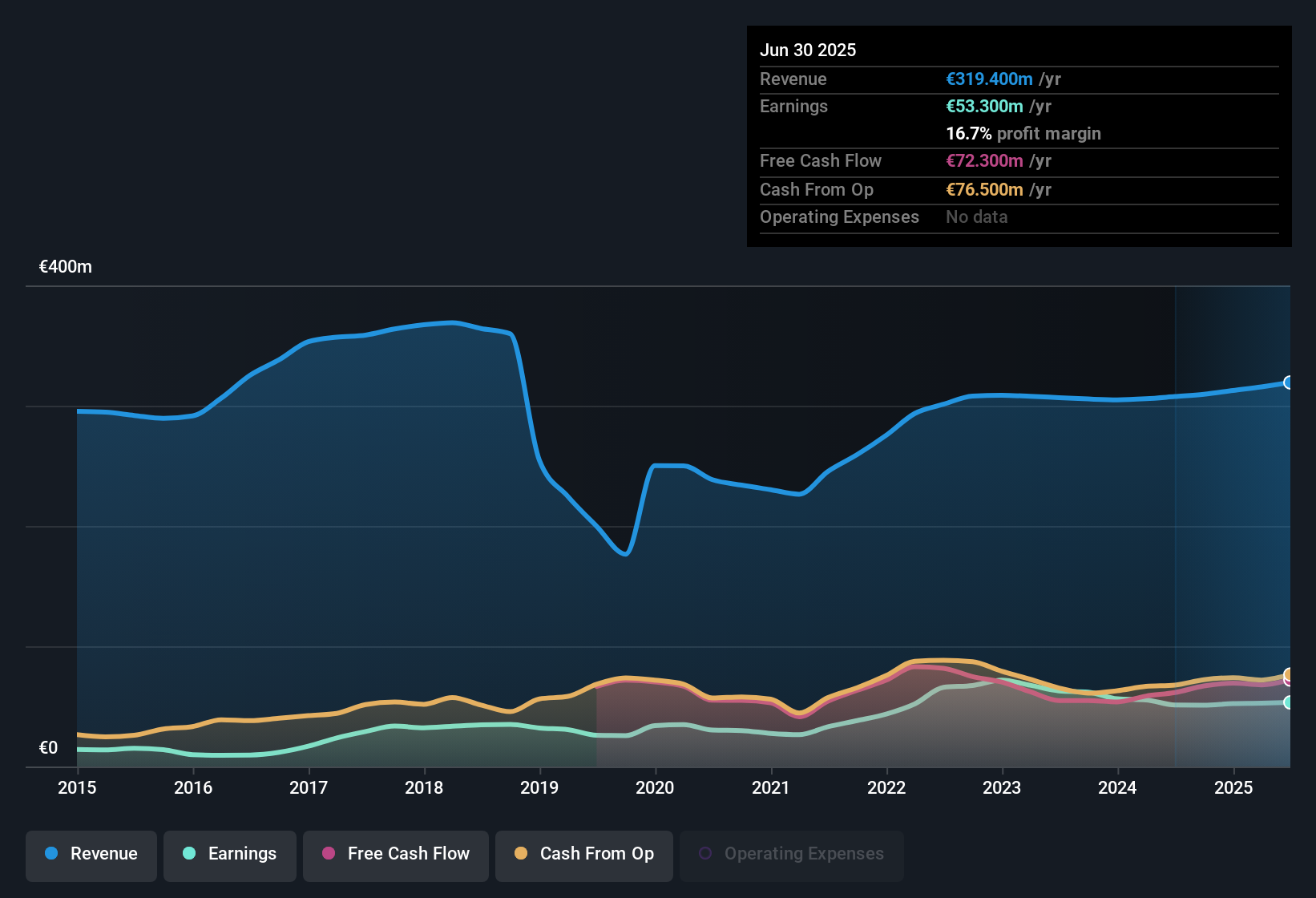

The Discounted Cash Flow (DCF) model is a cornerstone of company valuation, projecting a business’s future cash flows and discounting them back to today’s value. For Alma Media Oyj, the analysis begins with its latest trailing twelve-month Free Cash Flow of €69.4 million. Analyst estimates project Free Cash Flow to rise over the coming years, reaching €75.1 million by 2029. While analysts cover the next five years, Simply Wall St extrapolates further and offers a fuller picture through to 2035.

These cash flow projections are systematically discounted to reflect both the time value of money and underlying business risk. The resulting calculation yields an estimated intrinsic value of €20.31 per share. In comparison to Alma Media Oyj’s recent share price of €14.10, this suggests that the stock is about 30.6% below its fair value and may indicate a meaningful undervaluation.

According to the DCF model, Alma Media Oyj currently trades at a significant discount relative to its projected cash-generating power. For investors who trust the assumptions within these models, this may represent an attractive entry point.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Alma Media Oyj is undervalued by 30.6%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: Alma Media Oyj Price vs Earnings

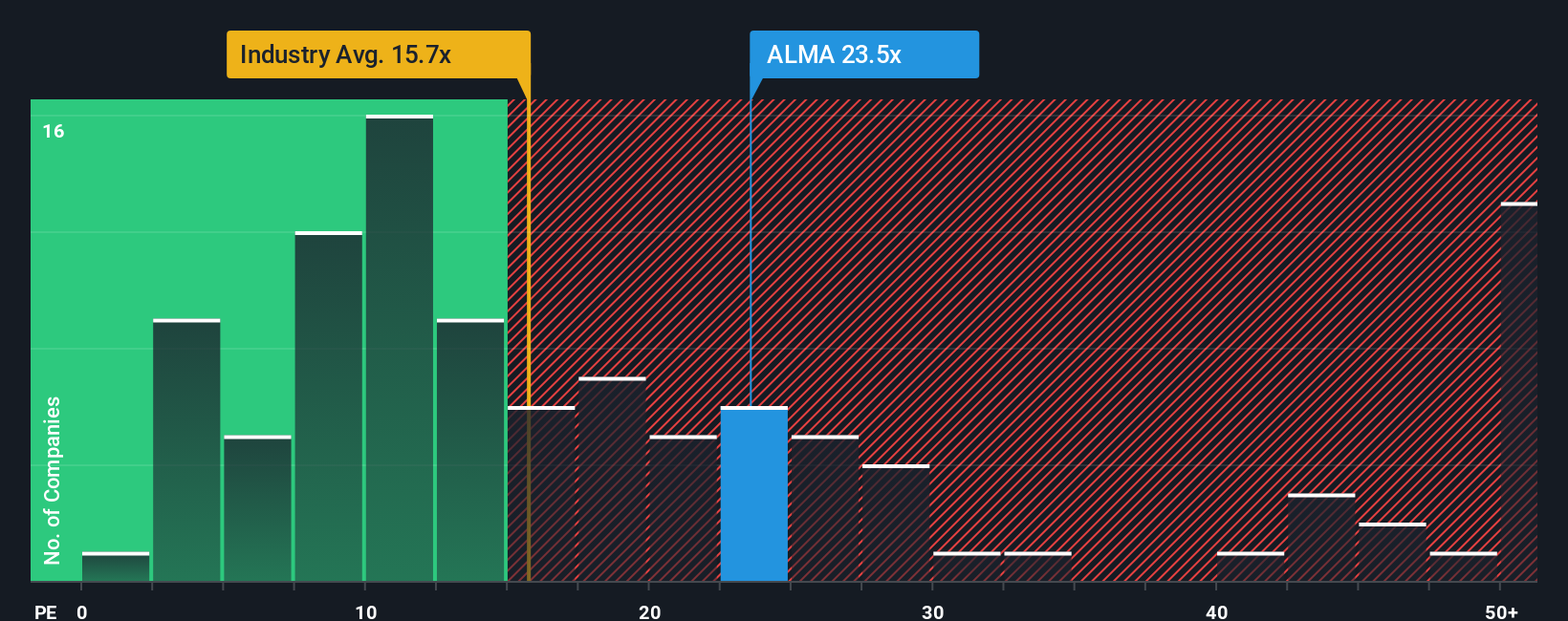

For profitable companies like Alma Media Oyj, the Price-to-Earnings (PE) ratio is a widely respected tool for determining value. This metric gives investors a quick way to gauge how much the market is willing to pay for each euro of earnings, making it directly relevant when a business generates consistent profits.

Growth expectations and risk play a crucial role in shaping what counts as a fair PE ratio. Higher growth prospects or lower risks often justify a higher PE, while slower growth or more risk typically lowers the bar for what is considered reasonable.

Currently, Alma Media Oyj trades at a PE ratio of 21.76x. This is close to its peer group average of 22.00x and notably higher than the broader Media industry average of 17.50x. These comparisons suggest the market expects Alma Media to outperform the typical media company, perhaps due to its growth potential or operational efficiency.

However, Simply Wall St’s proprietary "Fair Ratio" offers a more nuanced perspective, factoring in variables like earnings growth, profit margin, market cap, and industry context. For Alma Media Oyj, the Fair Ratio stands at 23.55x. Because this calculation weighs company-specific growth and risk factors rather than just broad industry trends, it better reflects what would be reasonable for this particular business.

Comparing Alma Media’s current PE ratio (21.76x) with its Fair Ratio (23.55x), the difference is less than 2x. This means the market price is closely aligned with expectations for Alma Media in today’s climate, neither undervaluing nor significantly overvaluing the company based on earnings.

Result: ABOUT RIGHT

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Alma Media Oyj Narrative

Earlier, we mentioned that there is an even better way to understand valuation. Let us introduce you to Narratives. At its core, a Narrative is a story you create about Alma Media Oyj that ties together what you believe about its future with numbers like expected revenue, margins, or fair value. This allows you to articulate why you think the company is worth more or less than its current price.

Rather than just crunching numbers, Narratives help you link Alma Media’s business evolution, such as its shift to digital media or investment in AI, directly to your financial outlook, and then to a fair value that reflects your expectations. It is more than theory. The Narratives feature on Simply Wall St's Community page, used by millions of investors, makes it easy for anyone to build, compare, and update their view as conditions change.

Narratives shine when you use them to compare your calculated fair value to Alma Media's current share price, helping you decide when to buy, hold, or sell if the market price and your expectations diverge. Additionally, they update automatically when important news or earnings are released, so your view stays current with every market move.

For example, if you are very optimistic about Alma Media Oyj’s digital transformation and believe net margins will expand dramatically as analysts expect, your Narrative may point to a fair value above €14.57 per share. A more cautious Narrative that emphasizes advertising market risks and persistent costs could produce a fair value closer to €13.80.

Do you think there's more to the story for Alma Media Oyj? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About HLSE:ALMA

Alma Media Oyj

A media company, engages in digital services and journalistic media content in Finland and the rest of Europe.

Undervalued with solid track record and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Hitit Bilgisayar Hizmetleri will achieve a 19.7% revenue boost in the next five years

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)