- Finland

- /

- Metals and Mining

- /

- HLSE:PAMPALO

3 European Stocks Estimated To Be Trading Up To 49.2% Below Intrinsic Value

Reviewed by Simply Wall St

Amid recent declines in major European stock indexes, such as the STOXX Europe 600 and Germany's DAX, investors are keenly observing the market for potential opportunities. In this environment of economic stagnation and trade uncertainties, identifying undervalued stocks becomes crucial for those looking to capitalize on discrepancies between current market prices and intrinsic value.

Top 10 Undervalued Stocks Based On Cash Flows In Europe

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Upsales Technology (OM:UPSALE) | SEK39.10 | SEK76.83 | 49.1% |

| Tecnotree Oyj (HLSE:TEM1V) | €4.855 | €9.57 | 49.3% |

| Sparebank 68° Nord (OB:SB68) | NOK177.00 | NOK349.92 | 49.4% |

| Rheinmetall (XTRA:RHM) | €1769.00 | €3480.81 | 49.2% |

| Libertas 7 (BME:LIB) | €2.96 | €5.87 | 49.6% |

| Exel Composites Oyj (HLSE:EXL1V) | €0.381 | €0.75 | 49.5% |

| doValue (BIT:DOV) | €2.48 | €4.85 | 48.9% |

| ams-OSRAM (SWX:AMS) | CHF10.35 | CHF20.67 | 49.9% |

| Alfio Bardolla Training Group (BIT:ABTG) | €1.85 | €3.63 | 49.1% |

| Absolent Air Care Group (OM:ABSO) | SEK260.00 | SEK508.35 | 48.9% |

Let's take a closer look at a couple of our picks from the screened companies.

Neste Oyj (HLSE:NESTE)

Overview: Neste Oyj, with a market cap of €10.92 billion, operates in the production and supply of renewable diesel and sustainable aviation fuel across Finland, other Nordic countries, the Baltic Rim, various European nations, the United States, and internationally.

Operations: Neste Oyj's revenue is primarily derived from three segments: Oil Products (€11.86 billion), Renewable Products (€7.36 billion), and Marketing & Services (€4.38 billion).

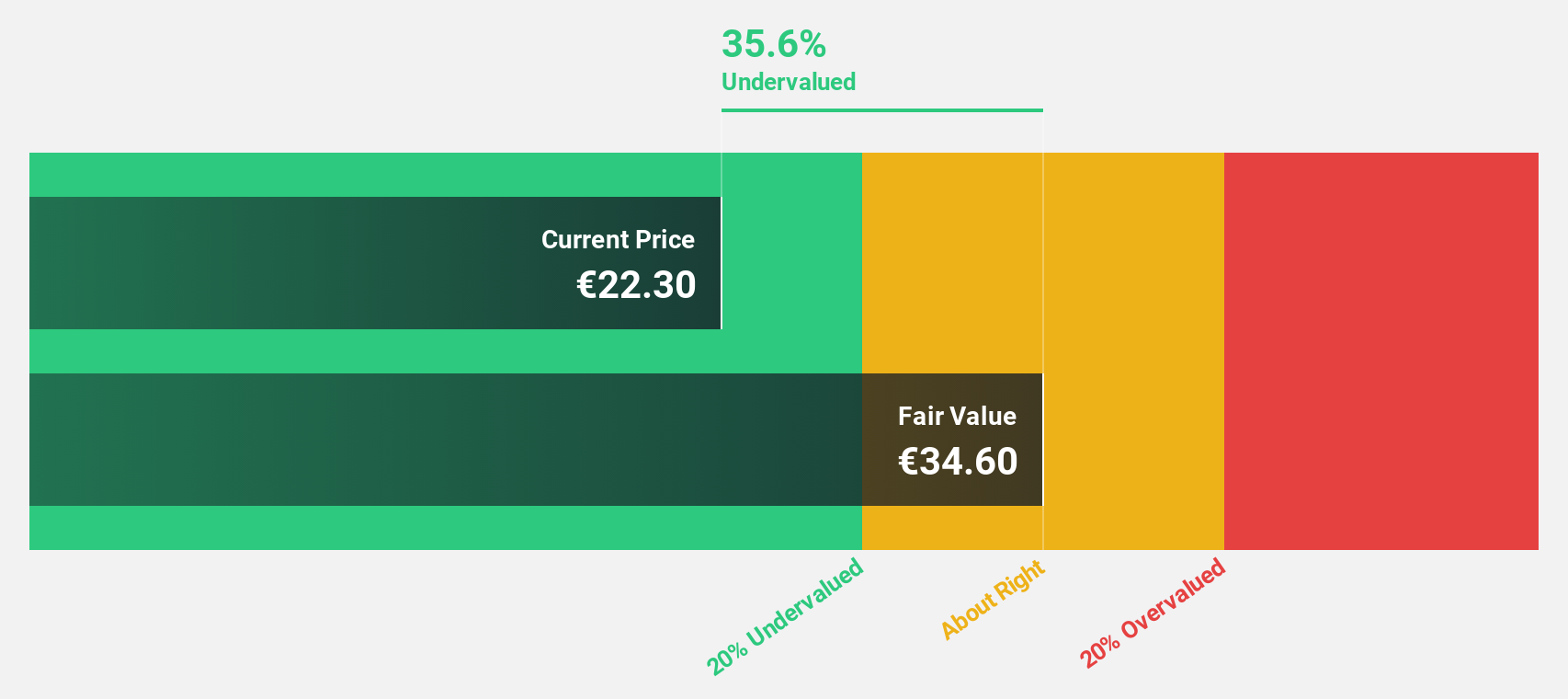

Estimated Discount To Fair Value: 29.3%

Neste Oyj is trading significantly below its estimated fair value, indicating potential undervaluation based on cash flows. Despite a high debt level and recent removal from the OMX Nordic 40 Index, Neste's revenue growth is expected to outpace the Finnish market. Recent earnings show reduced losses compared to last year, and the company is forecasted to become profitable within three years. Additionally, Neste's collaboration with Chevron Lummus Global on renewable fuels technology could enhance future prospects.

- The growth report we've compiled suggests that Neste Oyj's future prospects could be on the up.

- Delve into the full analysis health report here for a deeper understanding of Neste Oyj.

Endomines Finland Oyj (HLSE:PAMPALO)

Overview: Endomines Finland Oyj focuses on the mining and exploration of gold deposits in Finland and the United States, with a market capitalization of €323.90 million.

Operations: The company's revenue primarily comes from its Pampalo Production segment, which generated €28.70 million.

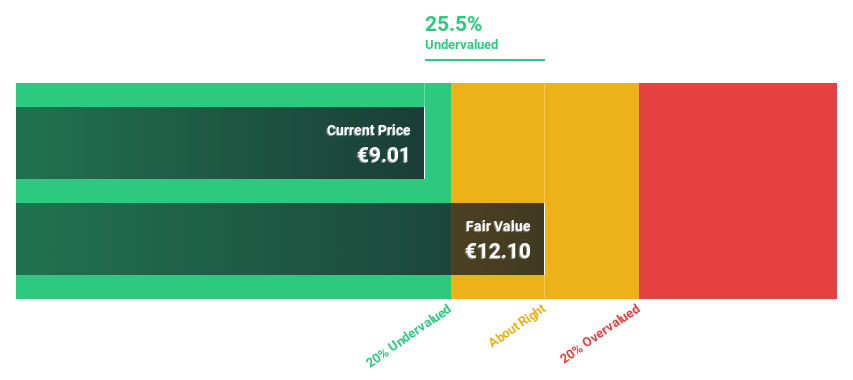

Estimated Discount To Fair Value: 23.3%

Endomines Finland Oyj is trading over 20% below its estimated fair value, highlighting potential undervaluation based on cash flows. The company recently became profitable and forecasts show earnings growth of 32.5% annually, outpacing the Finnish market. Recent drilling results from the Ukko deposit revealed high-grade gold zones, supporting production guidance of up to 22,000 oz for 2025. However, share price volatility remains a concern despite promising financial forecasts and exploration outcomes.

- In light of our recent growth report, it seems possible that Endomines Finland Oyj's financial performance will exceed current levels.

- Navigate through the intricacies of Endomines Finland Oyj with our comprehensive financial health report here.

Rheinmetall (XTRA:RHM)

Overview: Rheinmetall AG is a company that offers mobility and security technologies across various regions globally, with a market cap of €81.05 billion.

Operations: The company's revenue is derived from several segments, including Power Systems (€2.00 billion), Vehicle Systems (€4.25 billion), Electronic Solutions (€1.87 billion), and Weapon and Ammunition (€3.02 billion).

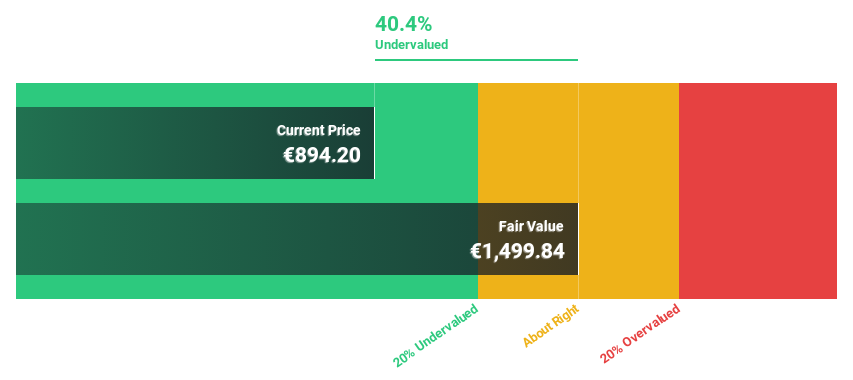

Estimated Discount To Fair Value: 49.2%

Rheinmetall is trading significantly below its estimated fair value of €3.48 billion, presenting an undervaluation opportunity based on cash flows. The company's earnings grew 45.7% last year and are forecast to rise 31.4% annually, outpacing the German market's growth rate. Recent strategic partnerships, such as with Reliance Defence for ammunition supply and a joint venture with Leonardo for Iveco's defense unit, enhance its growth prospects and supply chain security in the defense sector.

- Our growth report here indicates Rheinmetall may be poised for an improving outlook.

- Take a closer look at Rheinmetall's balance sheet health here in our report.

Next Steps

- Explore the 187 names from our Undervalued European Stocks Based On Cash Flows screener here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Endomines Finland Oyj might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About HLSE:PAMPALO

Endomines Finland Oyj

Engages in the mining and exploration of gold deposits in Finland and the United States.

High growth potential with acceptable track record.

Market Insights

Community Narratives