Does Sampo Offer Opportunity After Strong 95% Five Year Rally Into 2025?

Reviewed by Bailey Pemberton

If you are weighing what to do with your Sampo Oyj shares right now, you are definitely not alone. This Finnish financial giant has had quite the journey, up nearly 21.0% so far this year, with a staggering 95.5% climb over the past five years. In the last week, it dipped by 1.1%, basically flat over the month, but the longer-term picture tells a story of steady, impressive growth.

These movements have captured the attention of investors who are watching how shifting interest rate landscapes and insurance sector trends play into Sampo’s risk perception and opportunity set. While daily headlines will sometimes jostle the price here or there, it is the bigger strategic tailwinds boosting the financial sector that helped fuel most of Sampo’s upward momentum, beyond any single news story.

If you are the kind of investor who looks for value, here is a quick snapshot: Sampo currently scores a 3 out of 6 on our valuation score, meaning it appears undervalued on half of our major checks. That could catch the eye of bargain hunters, depending on what is driving the numbers underneath.

Let us break down the main valuation approaches investors use to analyze Sampo, and see how the numbers stack up. Spoiler alert: there is one perspective on value that often gets overlooked but can make all the difference. More on that at the end of our discussion.

Why Sampo Oyj is lagging behind its peers

Approach 1: Sampo Oyj Excess Returns Analysis

The Excess Returns valuation model measures how much profit a company generates above the cost of its own capital. In other words, it looks at how effectively Sampo Oyj is deploying shareholders' funds to earn more than what investors could get elsewhere at the same risk level.

- Book Value: €2.54 per share

- Stable EPS: €0.55 per share

(Source: Weighted future Return on Equity estimates from 10 analysts.) - Cost of Equity: €0.16 per share

- Excess Return: €0.39 per share

- Average Return on Equity: 19.24%

- Stable Book Value: €2.85 per share

(Source: Weighted future Book Value estimates from 5 analysts.)

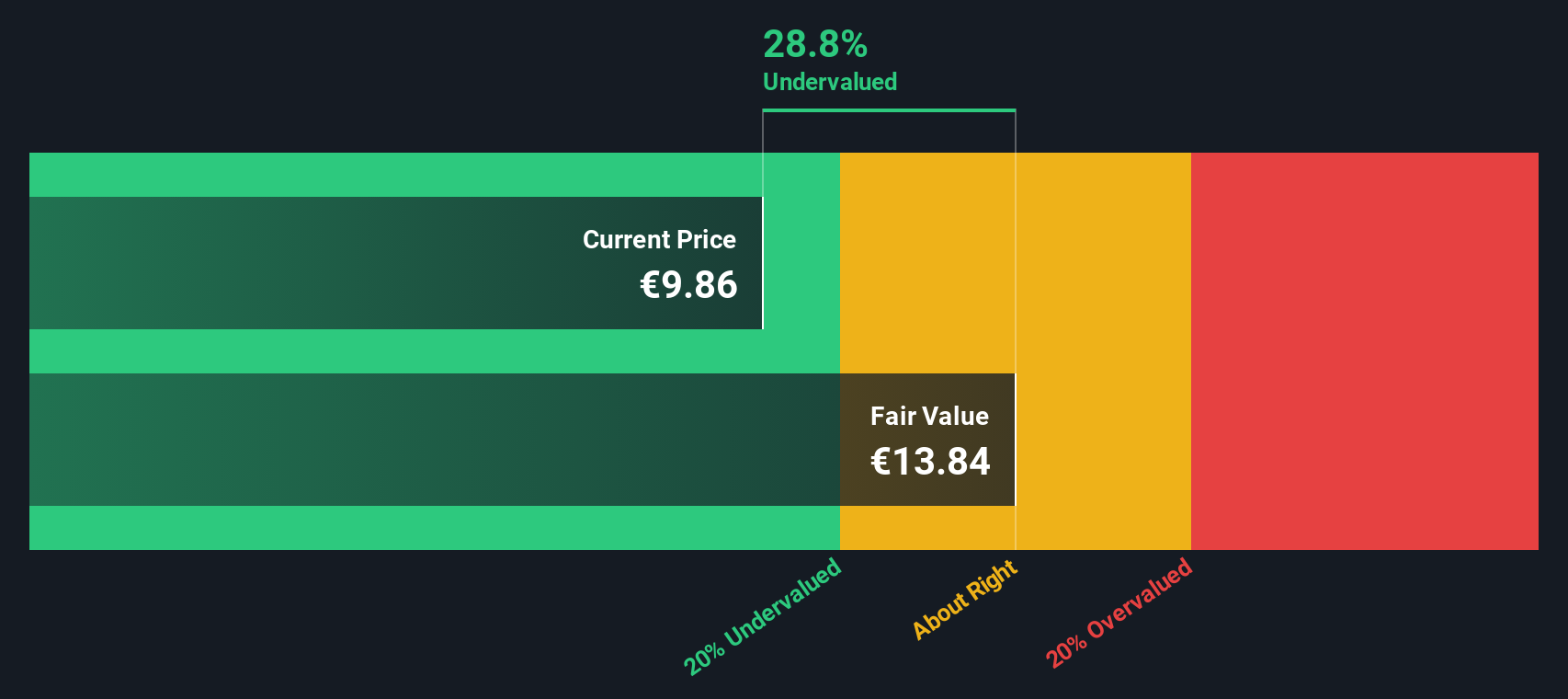

Based on these metrics, Sampo's average returns on shareholder equity are strong and comfortably outpace its cost of equity. The model estimates an intrinsic value of €13.48 per share, which is 28.7% higher than the current market price. This suggests Sampo is notably undervalued when analyzed using its return-generating power compared to its cost of capital.

Result: UNDERVALUED

Our Excess Returns analysis suggests Sampo Oyj is undervalued by 28.7%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: Sampo Oyj Price vs Earnings

The Price-to-Earnings (PE) ratio is a popular and effective valuation metric, especially for profitable companies like Sampo Oyj. It allows investors to gauge how much the market is willing to pay for each euro of the company’s earnings. This makes it a useful way to compare businesses in the same sector.

Growth expectations and perceived risks play a big role in what qualifies as a “normal” or “fair” PE ratio for any business. Companies with robust earnings growth and strong profitability typically command higher PE multiples, while riskier or slower-growing firms tend to trade at lower ones.

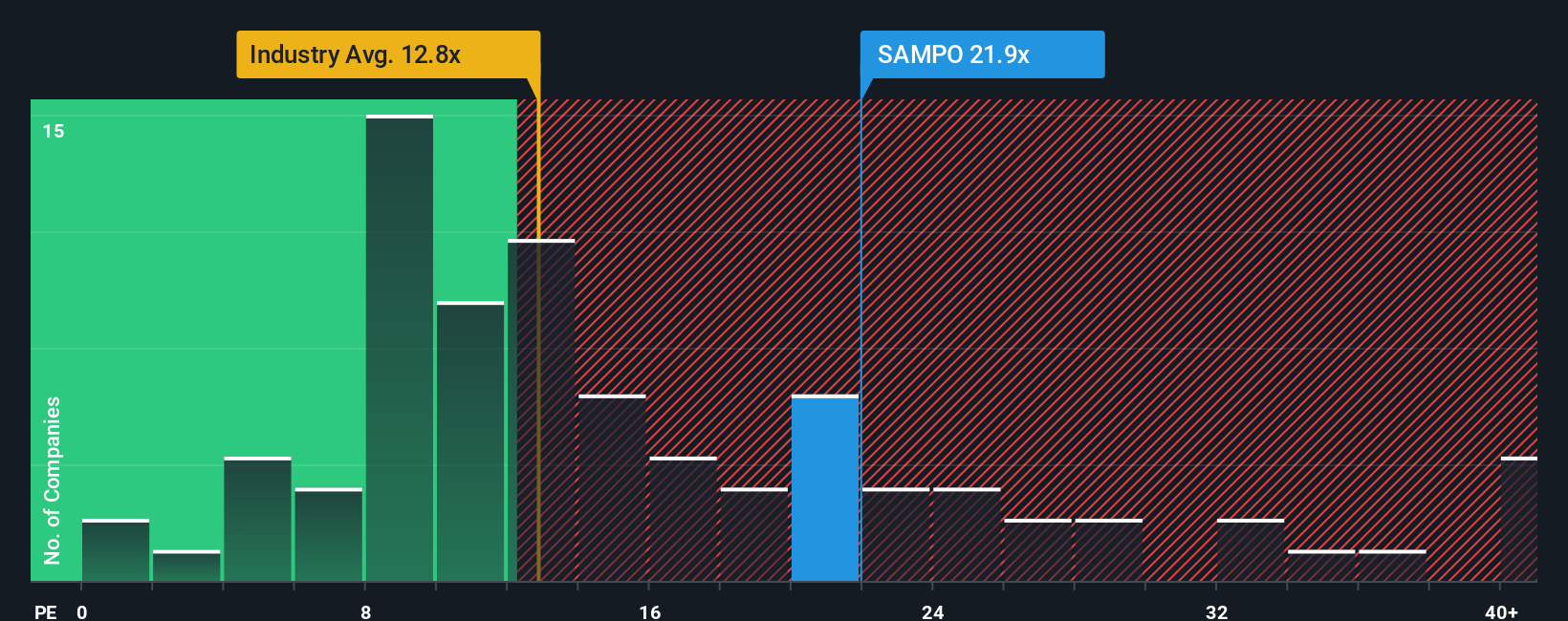

Sampo currently trades at a PE ratio of 21.4x. For context, this is well above the Insurance industry average of 12.3x and also above the peer group average of 13.6x. However, multiples can be misleading in isolation, especially if a company’s growth prospects, margins, or risk profile differ from the broad market.

This is where Simply Wall St’s “Fair Ratio” comes in. The Fair Ratio (24.2x for Sampo) is a proprietary measure that incorporates factors like Sampo’s earnings growth, industry trends, profit margins, company size, and its unique risk profile. Because it captures these dynamics, it often gives a more complete picture than simple peer or industry comparisons.

When comparing Sampo’s actual PE ratio of 21.4x to its Fair Ratio of 24.2x, the stock appears undervalued from this perspective. The current price does not fully reflect what would be expected given the company’s fundamentals and outlook.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Sampo Oyj Narrative

Earlier we mentioned there is an even better way to understand valuation. Let us introduce you to Narratives. Narratives are stories that connect your view of a company's future to a financial forecast and resulting fair value, all based on your expectations for revenue, margins, and earnings.

Instead of relying on a single number or ratio, you create a personal, evidence-based "story" behind the numbers. Narratives link what you believe about a company, such as new digital strategies or climate risk management, with your estimated forecasts and what you think the stock is truly worth.

On Simply Wall St's Community page, Narratives are an easy and dynamic tool used by millions of investors. They empower you to see, build, and compare different outlooks. With Narratives, you can spot opportunities by comparing any fair value derived from your story with today’s actual share price, helping you decide if it is time to buy or sell.

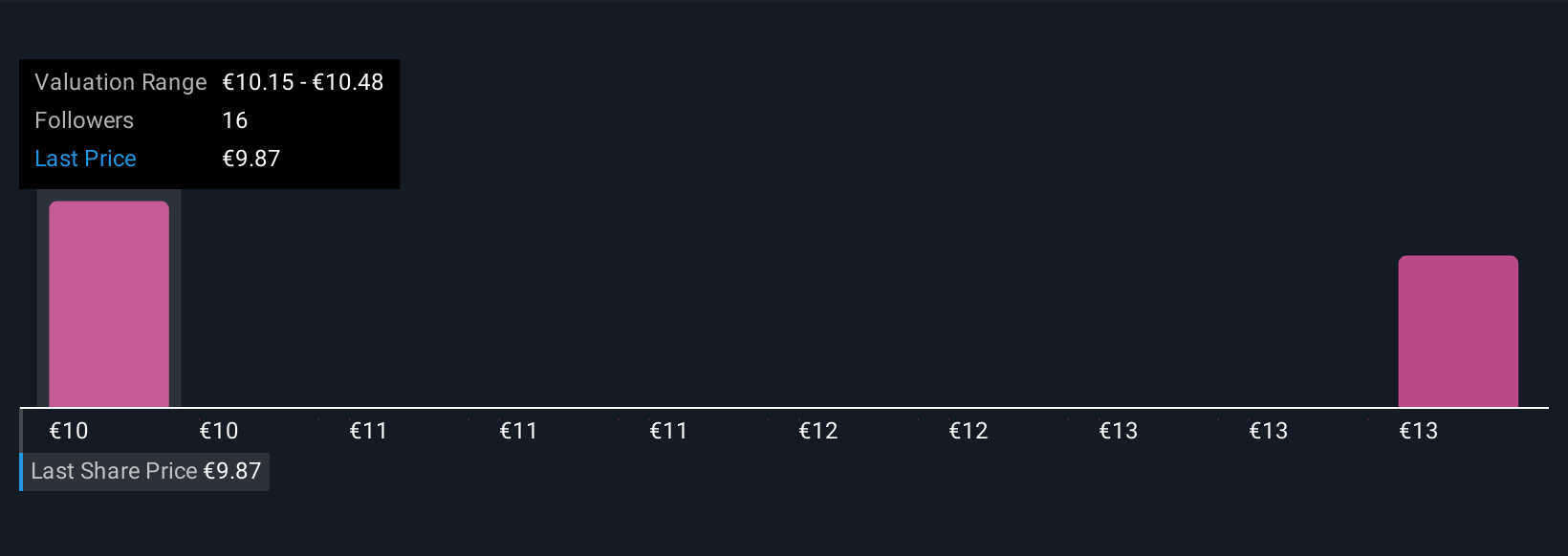

Best of all, Narratives automatically update whenever new information, like news or earnings, emerges, so your perspective remains current. For example, with Sampo Oyj, some investors are bullish and see fair value near €11.50 based on aggressive growth and margin expansion. Others take a more cautious approach with a lower estimate close to €8.00, reflecting different risk assumptions and earnings forecasts.

Do you think there's more to the story for Sampo Oyj? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About HLSE:SAMPO

Sampo Oyj

Provides non-life insurance products and services in Finland, Sweden, Norway, Denmark, Estonia, Lithuania, Latvia, Spain, Gibraltar, Germany, the Netherlands, France, and the United Kingdom.

Excellent balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives