- Hong Kong

- /

- Communications

- /

- SEHK:2342

Raisio And 2 Other Promising Penny Stocks To Consider

Reviewed by Simply Wall St

Global markets have shown mixed performances recently, with major indexes like the S&P 500 and Nasdaq Composite reaching record highs, while others such as the Russell 2000 experienced declines. Amid these fluctuating conditions, investors often look beyond large-cap stocks to explore opportunities in smaller companies that may offer both value and growth potential. Though the term "penny stocks" might seem outdated, it remains relevant for identifying smaller or newer companies that could provide significant upside when backed by strong financials and a clear growth trajectory.

Top 10 Penny Stocks

| Name | Share Price | Market Cap | Financial Health Rating |

| DXN Holdings Bhd (KLSE:DXN) | MYR0.51 | MYR2.54B | ★★★★★★ |

| Embark Early Education (ASX:EVO) | A$0.78 | A$143.12M | ★★★★☆☆ |

| Datasonic Group Berhad (KLSE:DSONIC) | MYR0.425 | MYR1.18B | ★★★★★★ |

| Hil Industries Berhad (KLSE:HIL) | MYR0.90 | MYR298.75M | ★★★★★★ |

| ME Group International (LSE:MEGP) | £2.16 | £806.27M | ★★★★★★ |

| Bosideng International Holdings (SEHK:3998) | HK$4.02 | HK$44.27B | ★★★★★★ |

| LaserBond (ASX:LBL) | A$0.575 | A$67.4M | ★★★★★★ |

| Lever Style (SEHK:1346) | HK$0.87 | HK$545.92M | ★★★★★★ |

| Secure Trust Bank (LSE:STB) | £3.53 | £67.32M | ★★★★☆☆ |

| Tristel (AIM:TSTL) | £3.65 | £183.61M | ★★★★★★ |

Click here to see the full list of 5,700 stocks from our Penny Stocks screener.

We're going to check out a few of the best picks from our screener tool.

Raisio (HLSE:RAIVV)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Raisio plc, with a market cap of €350.57 million, operates in the production and sale of food and food ingredients across Finland, the Netherlands, Belgium, and other parts of Europe.

Operations: The company's revenue is primarily derived from its Healthy Food segment, which contributed €149.7 million, and the Healthy Ingredients segment, with €112 million in revenue.

Market Cap: €350.57M

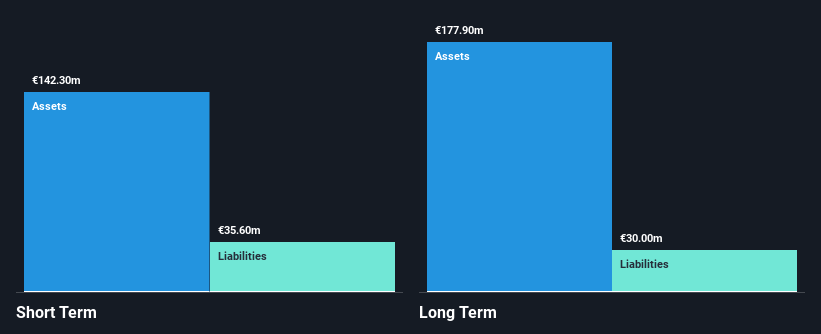

Raisio plc, operating in the food sector with a market cap of €350.57 million, has shown stable financial health with short-term assets exceeding both its long and short-term liabilities. Despite being debt-free and trading below estimated fair value, the company faces challenges such as low return on equity (7%) and negative earnings growth over the past year. Recent earnings reports indicate slight sales growth but declining quarterly net income (€4.9 million from €5.9 million). The dividend yield of 6.36% is not well covered by earnings, reflecting potential sustainability concerns amidst management changes and an inexperienced team average tenure of 1.7 years.

- Jump into the full analysis health report here for a deeper understanding of Raisio.

- Review our growth performance report to gain insights into Raisio's future.

Comba Telecom Systems Holdings (SEHK:2342)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Comba Telecom Systems Holdings Limited is an investment holding company that researches, develops, manufactures, and sells wireless telecommunications network system equipment and related engineering services globally, with a market cap of HK$2.58 billion.

Operations: The company generates revenue from two main segments: Operator Telecommunication Services, contributing HK$156.22 million, and Wireless Telecommunications Network System Equipment and Services, which brings in HK$4.94 billion.

Market Cap: HK$2.58B

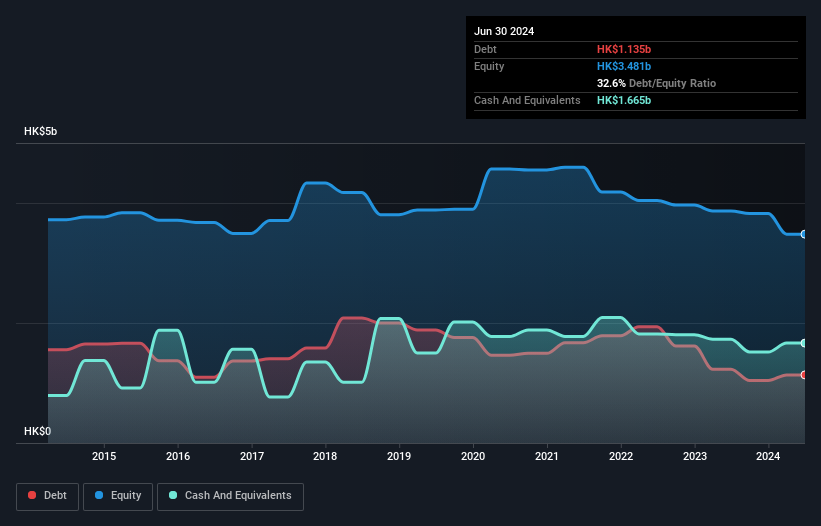

Comba Telecom Systems Holdings, with a market cap of HK$2.58 billion, has demonstrated financial resilience by reducing its debt-to-equity ratio from 48.5% to 32.6% over five years and maintaining more cash than total debt. Despite unprofitability and increased losses at a rate of 1.7% annually over the past five years, it holds significant short-term assets (HK$6.5 billion) exceeding both long-term (HK$515.4 million) and short-term liabilities (HK$4.7 billion). Recent leadership changes include Ms. Huo Xinru's appointment as president, potentially impacting strategic direction given her extensive industry experience since joining in 2010.

- Dive into the specifics of Comba Telecom Systems Holdings here with our thorough balance sheet health report.

- Examine Comba Telecom Systems Holdings' past performance report to understand how it has performed in prior years.

China Vered Financial Holding (SEHK:245)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: China Vered Financial Holding Corporation Limited is an investment holding company offering asset management, consultancy, financing, and securities advisory and brokerage services across Hong Kong, Mainland China, Japan, and Canada with a market cap of approximately HK$1.82 billion.

Operations: The company's revenue is primarily derived from Investment Holding (HK$58.71 million), Asset Management (HK$16.56 million), and Securities Brokerage including Investment Banking (HK$9.04 million).

Market Cap: HK$1.82B

China Vered Financial Holding, with a market cap of HK$1.82 billion, operates in investment holding and related services across several regions. Despite being unprofitable with losses increasing over the past five years, it maintains a strong financial position by being debt-free and having sufficient cash runway for more than three years. The company has experienced shareholder dilution with shares outstanding growing by 7.1%, but its short-term assets of HK$1.4 billion comfortably cover short-term liabilities of HK$285 million. Recently, it was added to the S&P Global BMI Index, potentially enhancing its visibility among investors.

- Click here to discover the nuances of China Vered Financial Holding with our detailed analytical financial health report.

- Learn about China Vered Financial Holding's historical performance here.

Key Takeaways

- Embark on your investment journey to our 5,700 Penny Stocks selection here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:2342

Comba Telecom Systems Holdings

An investment holding company, research, develops, manufactures, and sells wireless telecommunications network system equipment and related engineering services in Mainland China, rest of Asia Pacific, the Americas, the European Union, the Middle East, and internationally.

Adequate balance sheet and slightly overvalued.

Similar Companies

Market Insights

Community Narratives