As European markets navigate the challenges posed by new U.S. tariff threats and a contraction in business activity, investors are keenly observing how these dynamics impact small-cap stocks across the region. In this environment, identifying promising companies involves looking for those that demonstrate resilience through strong fundamentals and the ability to adapt to shifting economic landscapes.

Top 10 Undiscovered Gems With Strong Fundamentals In Europe

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| AB Traction | NA | 5.39% | 5.24% | ★★★★★★ |

| Linc | NA | 101.28% | 29.81% | ★★★★★★ |

| Intellego Technologies | 11.59% | 68.05% | 72.76% | ★★★★★★ |

| Caisse Regionale de Credit Agricole Mutuel Toulouse 31 | 19.46% | 0.47% | 7.14% | ★★★★★☆ |

| Decora | 18.47% | 11.59% | 10.86% | ★★★★★☆ |

| Dekpol | 63.20% | 11.99% | 14.08% | ★★★★★☆ |

| Viohalco | 91.31% | 12.25% | 17.37% | ★★★★☆☆ |

| Evergent Investments | 5.39% | 8.97% | 21.29% | ★★★★☆☆ |

| Castellana Properties Socimi | 53.49% | 6.64% | 21.96% | ★★★★☆☆ |

| Eurofins-Cerep | 0.46% | 6.80% | 6.93% | ★★★★☆☆ |

We'll examine a selection from our screener results.

Castellana Properties Socimi (BME:YCPS)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Castellana Properties Socimi, S.A. is a real estate investment company focused on acquiring and managing retail and office properties, with a market capitalization of €912.57 million as of December 20, 2016.

Operations: Castellana Properties generates revenue primarily from its retail and office segments, with retail contributing €64.73 million and offices €22.88 million.

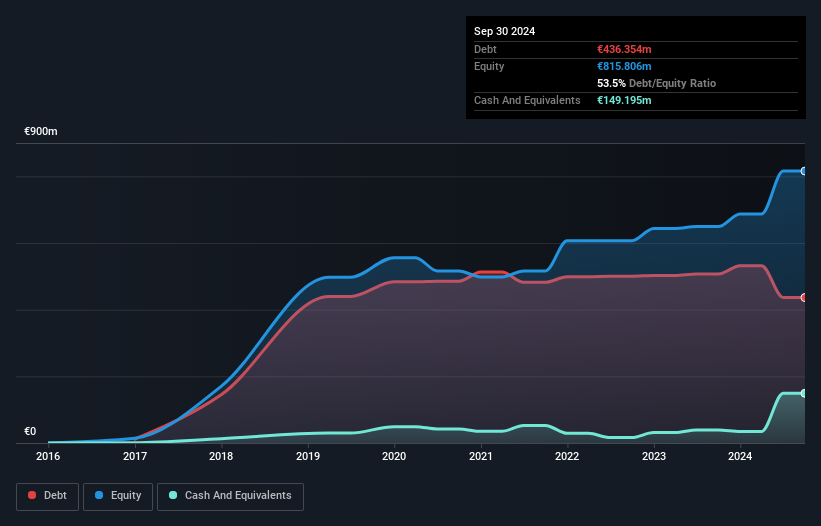

Castellana Properties, a nimble player in the European real estate market, has shown robust financial health with debt to equity ratio dropping from 87.6% to 53.5% over five years and net debt to equity at a satisfactory 35.2%. Despite earnings growth of 7.7% trailing industry peers at 14.9%, Castellana remains free cash flow positive and boasts high-quality earnings with interest payments well-covered by EBIT at 6.5 times coverage. The recent acquisition of Bonaire Shopping Centre for €305 million enhances its portfolio, promising an attractive cash-on-cash yield around 8.5%, supported by strategic funding and seller-provided NOI guarantees worth €32.85 million over eighteen months post-acquisition.

- Unlock comprehensive insights into our analysis of Castellana Properties Socimi stock in this health report.

Gain insights into Castellana Properties Socimi's past trends and performance with our Past report.

Incap Oyj (HLSE:ICP1V)

Simply Wall St Value Rating: ★★★★★★

Overview: Incap Oyj, along with its subsidiaries, offers electronics manufacturing services across Europe, North America, and Asia with a market capitalization of €318.51 million.

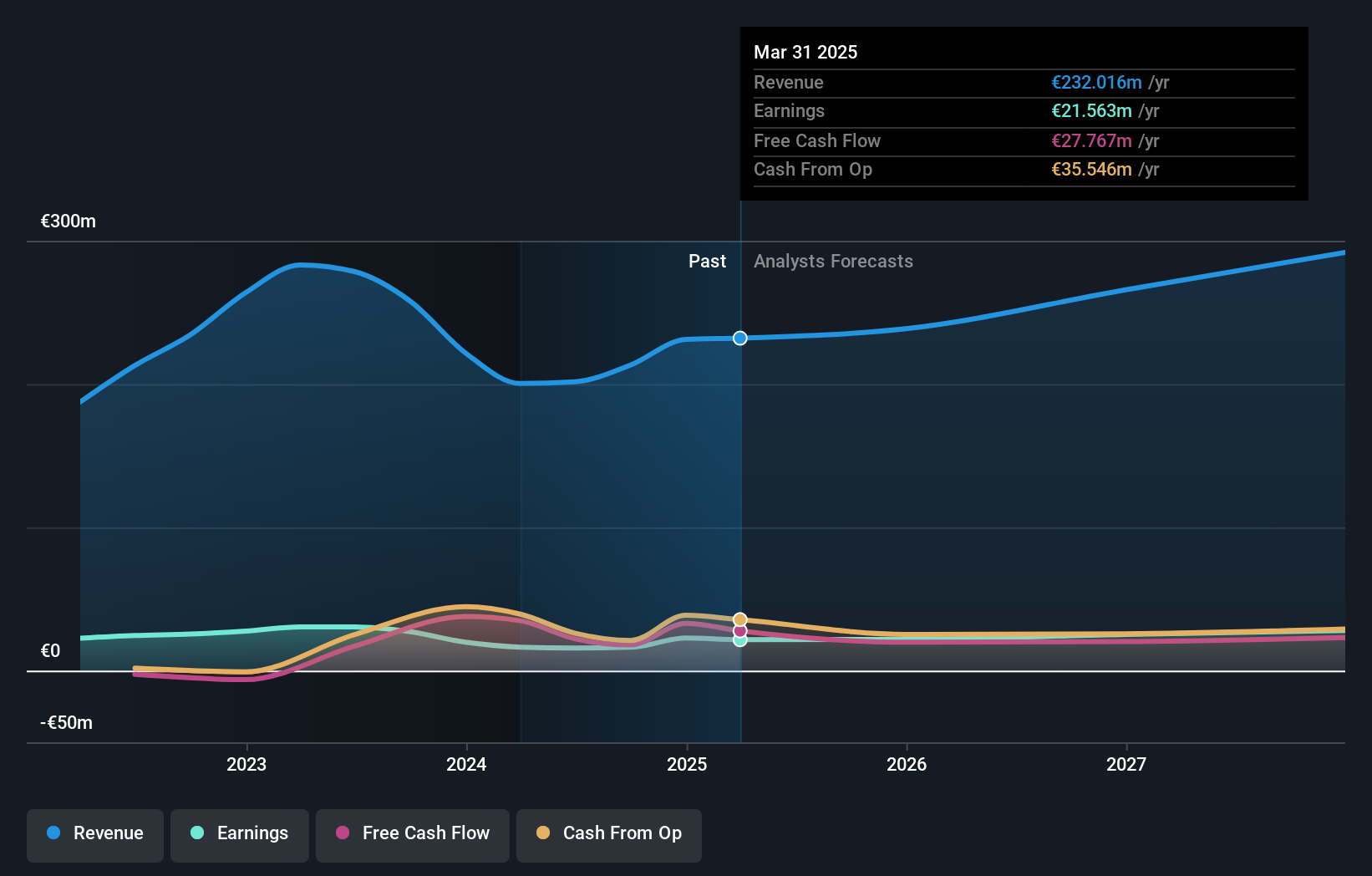

Operations: Incap Oyj generates revenue primarily from its electronics manufacturing services, amounting to €232.02 million. The company's financial performance can be analyzed through its net profit margin, which provides insight into profitability relative to total revenue.

Incap Oyj, a small-cap player in the electronics manufacturing sector, is making strategic moves to bolster its global footprint. Recent investments in advanced surface-mount technology (SMT) lines across its UK and US facilities have significantly boosted production capacity by over 55% and 110% respectively. The company's net income for Q1 2025 was €3.78 million, down from €4.95 million the previous year, yet it continues to trade at a compelling value with shares priced at €9.66 against a target of €12.73. Despite geopolitical challenges, Incap's ongoing upgrades position it well for future growth opportunities.

Raisio (HLSE:RAIVV)

Simply Wall St Value Rating: ★★★★★☆

Overview: Raisio plc is a company that, along with its subsidiaries, focuses on the production and sale of food and food ingredients across Finland, the United Kingdom, Ireland, Belgium, and the Netherlands; it has a market capitalization of approximately €404.83 million.

Operations: Raisio's revenue streams are primarily derived from its Healthy Food segment (€155.80 million) and Healthy Ingredients segment (€110.80 million). The company experiences a net profit margin trend that warrants attention, as it reflects the efficiency of its operations in converting revenues into actual profit.

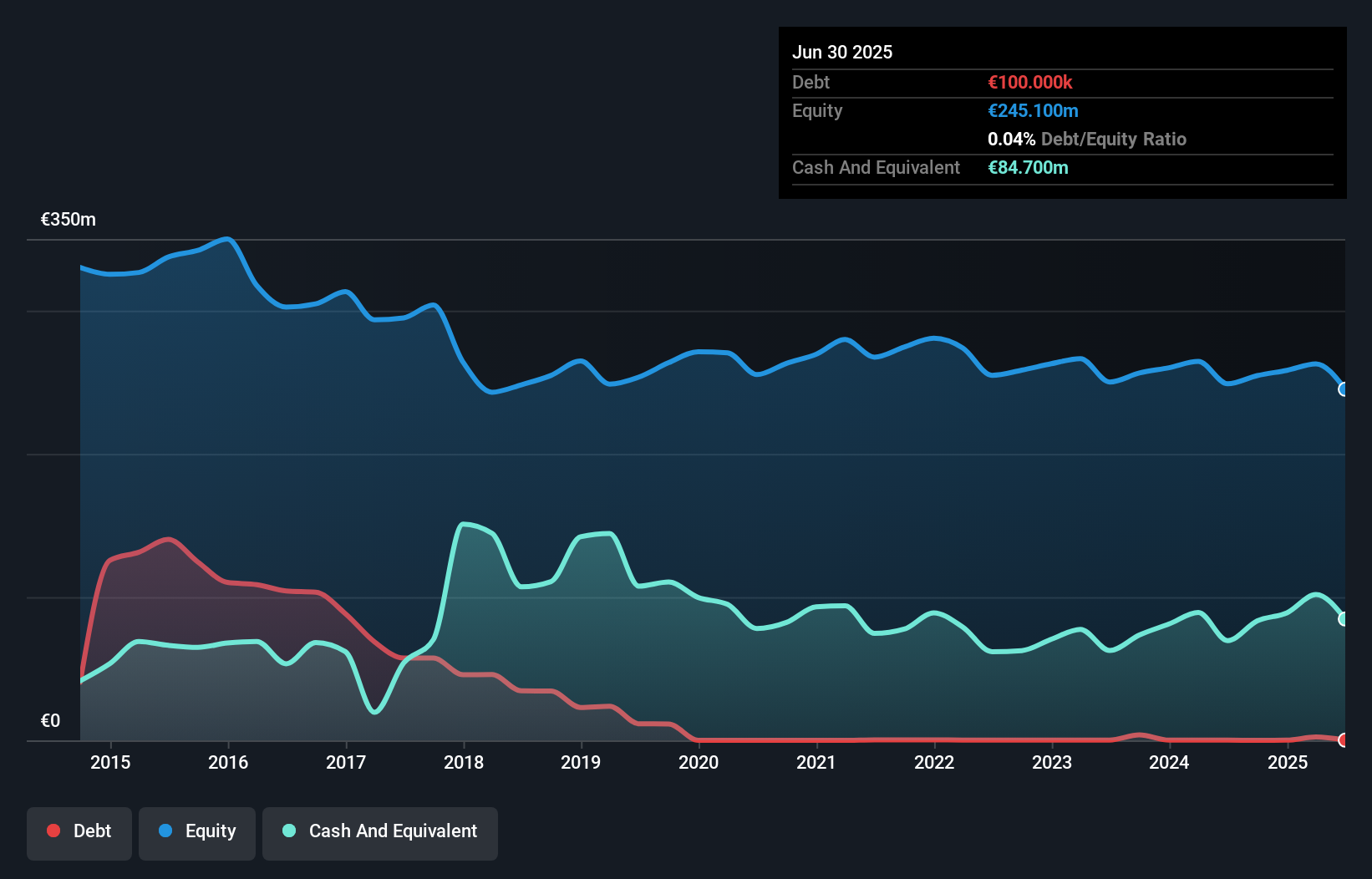

Raisio, a nimble player in the food sector, seems to be on solid financial footing with cash exceeding its total debt. The company reported a net income of €5.1 million for Q1 2025, up from €3.5 million the previous year, and earnings per share rose to €0.03 from €0.02. Despite this progress, Raisio's 5-year debt-to-equity ratio climbed slightly to 0.9%, indicating some leverage increase over time. Trading at about 21% below estimated fair value suggests potential upside for investors keeping an eye on valuation metrics while benefiting from high-quality past earnings and positive free cash flow trends.

Next Steps

- Dive into all 328 of the European Undiscovered Gems With Strong Fundamentals we have identified here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About HLSE:RAIVV

Raisio

Produces and sells food and food ingredients in Finland, the United Kingdom, Ireland, Belgium, and the Netherlands.

Excellent balance sheet with acceptable track record.

Similar Companies

Market Insights

Community Narratives