Amid cautious optimism in Europe, the pan-European STOXX Europe 600 Index has seen a modest rise as investors weigh developments in U.S. trade policy and geopolitical efforts concerning the Russia-Ukraine conflict. In this context, penny stocks—often representing smaller or newer companies—remain an intriguing area of investment due to their potential for growth at lower price points. Despite being considered a niche market, these stocks can offer significant opportunities when supported by strong financial health and solid fundamentals.

Top 10 Penny Stocks In Europe

| Name | Share Price | Market Cap | Financial Health Rating |

| Angler Gaming (NGM:ANGL) | SEK3.95 | SEK296.19M | ★★★★★★ |

| Netgem (ENXTPA:ALNTG) | €0.952 | €31.88M | ★★★★★★ |

| Transferator (NGM:TRAN A) | SEK2.86 | SEK255.53M | ★★★★★★ |

| High (ENXTPA:HCO) | €2.70 | €53.03M | ★★★★★★ |

| Hifab Group (OM:HIFA B) | SEK3.68 | SEK223.89M | ★★★★★★ |

| Bredband2 i Skandinavien (OM:BRE2) | SEK2.07 | SEK1.98B | ★★★★☆☆ |

| I.M.D. International Medical Devices (BIT:IMD) | €1.47 | €25.46M | ★★★★★☆ |

| Nurminen Logistics Oyj (HLSE:NLG1V) | €1.16 | €93.44M | ★★★★★☆ |

| Deceuninck (ENXTBR:DECB) | €2.485 | €343.91M | ★★★★★☆ |

| IMS (WSE:IMS) | PLN3.79 | PLN128.46M | ★★★★☆☆ |

Click here to see the full list of 420 stocks from our European Penny Stocks screener.

Let's review some notable picks from our screened stocks.

Ilkka Oyj (HLSE:ILKKA2)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Ilkka Oyj, with a market cap of €90.65 million, operates in the publishing and printing sectors both in Finland and internationally through its subsidiaries.

Operations: The company's revenue is primarily derived from Marketing and Technology Services, generating €30.95 million, and Media and Market Soothing Services, contributing €23.32 million.

Market Cap: €90.65M

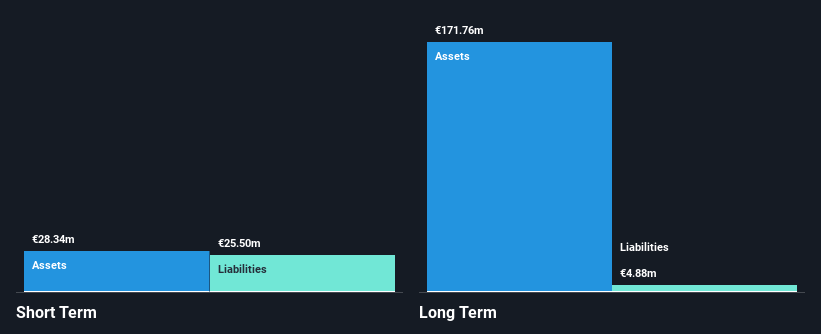

Ilkka Oyj, with a market cap of €90.65 million, has demonstrated strong earnings growth over the past year at 23.8%, surpassing its five-year average decline of 13.4% per year and outpacing the Media industry growth. The company maintains a stable financial position with short-term assets exceeding both short and long-term liabilities and cash reserves surpassing total debt. However, its dividend yield of 6.3% is not well covered by earnings or free cash flow, raising sustainability concerns. Recent results show improved net profit margins from 8.6% to 11%, although future earnings are expected to decline by an average of 8.8% annually over the next three years.

- Dive into the specifics of Ilkka Oyj here with our thorough balance sheet health report.

- Gain insights into Ilkka Oyj's future direction by reviewing our growth report.

Raisio (HLSE:RAIVV)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Raisio plc, with a market cap of €374.47 million, operates in the production and sale of food and food ingredients across Finland, the Netherlands, Belgium, and other parts of Europe.

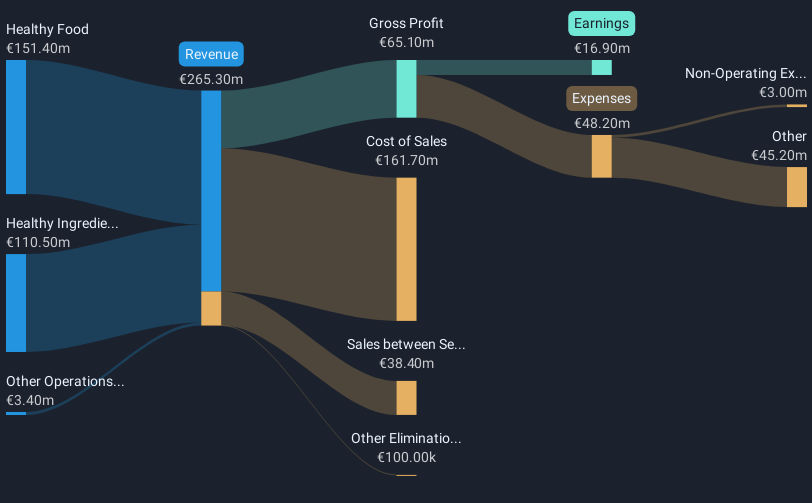

Operations: The company's revenue is primarily derived from its Healthy Food segment at €151.4 million and Healthy Ingredients segment at €110.5 million, with additional contributions from Other Operations totaling €3.4 million.

Market Cap: €374.47M

Raisio plc, with a market cap of €374.47 million, faces challenges in earnings growth, having reported a decline over the past year and five years. Despite this, Raisio's financial health appears solid with short-term assets comfortably covering liabilities and cash reserves exceeding debt. The company's dividend yield of 5.89% may raise concerns due to insufficient earnings coverage; however, it has proposed both basic and supplementary dividends for 2024. Recent board changes could influence strategic direction as two members will not seek re-election in April 2025. Earnings guidance suggests potential EBIT improvement for the current year compared to 2024.

- Take a closer look at Raisio's potential here in our financial health report.

- Gain insights into Raisio's outlook and expected performance with our report on the company's earnings estimates.

Bredband2 i Skandinavien (OM:BRE2)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Bredband2 i Skandinavien AB (publ) offers data communication and security solutions to individuals and companies in Sweden, with a market cap of SEK1.98 billion.

Operations: The company's revenue is primarily generated from its National Broadband Service, amounting to SEK1.73 billion.

Market Cap: SEK1.98B

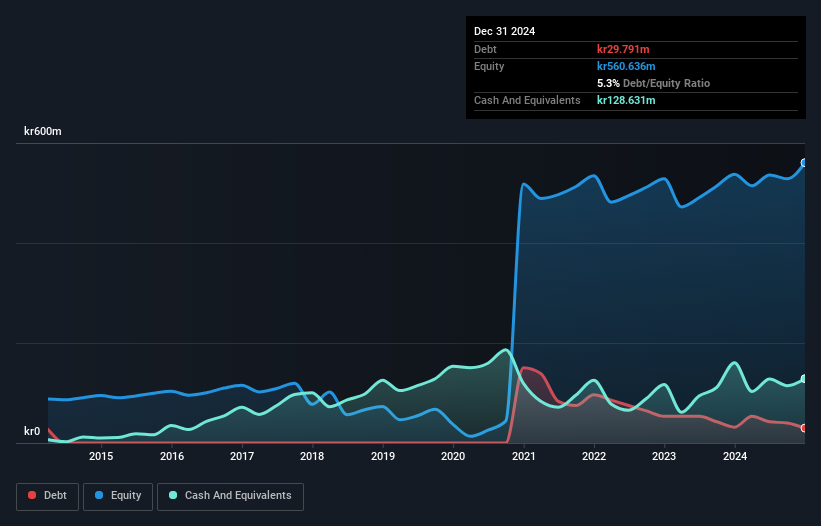

Bredband2 i Skandinavien AB, with a market cap of SEK1.98 billion, demonstrates solid financial health and growth potential. The company's earnings have grown by 28.1% over the past year, outpacing the Telecom industry average, while maintaining high-quality earnings. Its debt is well covered by operating cash flow and interest payments are comfortably managed by EBIT. However, short-term assets fall short of covering short-term liabilities. Despite trading significantly below its estimated fair value, Bredband2 offers an attractive dividend yield of 4.83%. Recent earnings reports show improved sales and net income compared to last year’s figures.

- Jump into the full analysis health report here for a deeper understanding of Bredband2 i Skandinavien.

- Explore Bredband2 i Skandinavien's analyst forecasts in our growth report.

Taking Advantage

- Click through to start exploring the rest of the 417 European Penny Stocks now.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Raisio, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About HLSE:RAIVV

Raisio

Engages in the production and sale of food and food ingredients in Finland, the Netherlands, Belgium, and rest of Europe.

Excellent balance sheet average dividend payer.