- Finland

- /

- Capital Markets

- /

- HLSE:EQV1V

eQ Oyj's (HEL:EQV1V) Shareholders Will Receive A Bigger Dividend Than Last Year

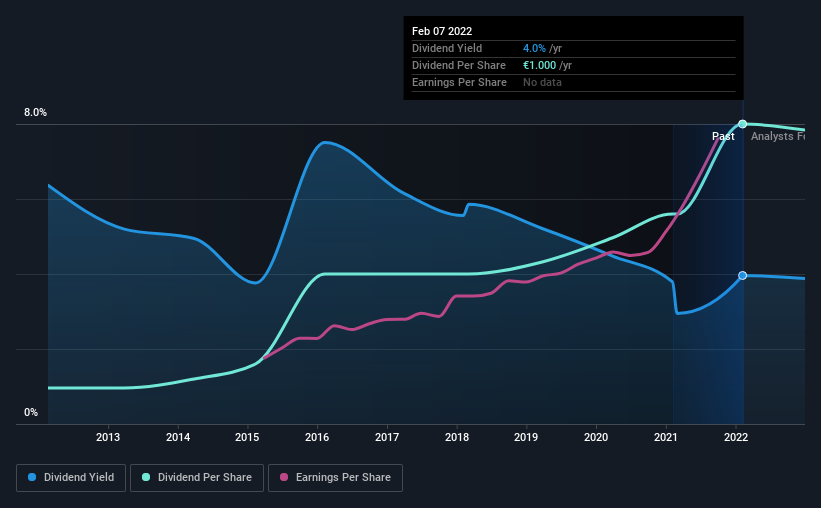

eQ Oyj's (HEL:EQV1V) dividend will be increasing to €1.00 on 1st of April. This takes the annual payment to 4.0% of the current stock price, which is about average for the industry.

View our latest analysis for eQ Oyj

eQ Oyj Doesn't Earn Enough To Cover Its Payments

While it is always good to see a solid dividend yield, we should also consider whether the payment is feasible. The last dividend was quite comfortably covered by eQ Oyj's earnings, but it was a bit tighter on the cash flow front. By paying out so much of its cash flows, this could indicate that the company has limited opportunities for investment and growth.

Earnings per share could rise by 22.9% over the next year if things go the same way as they have for the last few years. If the dividend continues on its recent course, the payout ratio in 12 months could be 101%, which is a bit high and could start applying pressure to the balance sheet.

eQ Oyj Has A Solid Track Record

Even over a long history of paying dividends, the company's distributions have been remarkably stable. The dividend has gone from €0.12 in 2012 to the most recent annual payment of €1.00. This works out to be a compound annual growth rate (CAGR) of approximately 24% a year over that time. So, dividends have been growing pretty quickly, and even more impressively, they haven't experienced any notable falls during this period.

The Dividend Looks Likely To Grow

Investors could be attracted to the stock based on the quality of its payment history. It's encouraging to see eQ Oyj has been growing its earnings per share at 23% a year over the past five years. The company doesn't have any problems growing, despite returning a lot of capital to shareholders, which is a very nice combination for a dividend stock to have.

Our Thoughts On eQ Oyj's Dividend

Overall, it's great to see the dividend being raised and that it is still in a sustainable range. The payments look okay by most measures, the lack of cash flow could definitely cause problems for them in the future. This looks like it could be a good dividend stock going forward, but we would note that the payout ratio has been at higher levels in the past so it could happen again.

Market movements attest to how highly valued a consistent dividend policy is compared to one which is more unpredictable. Still, investors need to consider a host of other factors, apart from dividend payments, when analysing a company. You can also discover whether shareholders are aligned with insider interests by checking our visualisation of insider shareholdings and trades in eQ Oyj stock. We have also put together a list of global stocks with a solid dividend.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About HLSE:EQV1V

Excellent balance sheet second-rate dividend payer.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

A case for USD $14.81 per share based on book value. Be warned, this is a micro-cap dependent on a single mine.

Occidental Petroleum to Become Fairly Priced at $68.29 According to Future Projections

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)