- Italy

- /

- Tech Hardware

- /

- BIT:CELL

European Penny Stocks Under €60M Market Cap: 3 Promising Picks

Reviewed by Simply Wall St

European markets have faced a challenging week, with the pan-European STOXX Europe 600 Index falling by about 1.4% amid fresh U.S. trade tariffs that dampened investor sentiment despite earlier optimism from encouraging economic updates. In this context, penny stocks—typically representing smaller or newer companies—continue to offer potential growth opportunities for investors willing to explore beyond the mainstream indices. While often considered speculative, these stocks can still present value when backed by strong financials and clear growth trajectories, making them intriguing options for those seeking unique investment opportunities in Europe's diverse market landscape.

Top 10 Penny Stocks In Europe

| Name | Share Price | Market Cap | Rewards & Risks |

| Bredband2 i Skandinavien (OM:BRE2) | SEK1.974 | SEK1.89B | ✅ 4 ⚠️ 0 View Analysis > |

| Transferator (NGM:TRAN A) | SEK2.41 | SEK222.05M | ✅ 2 ⚠️ 3 View Analysis > |

| Angler Gaming (NGM:ANGL) | SEK3.65 | SEK273.7M | ✅ 4 ⚠️ 3 View Analysis > |

| Hifab Group (OM:HIFA B) | SEK3.86 | SEK234.84M | ✅ 2 ⚠️ 2 View Analysis > |

| IMS (WSE:IMS) | PLN3.62 | PLN122.7M | ✅ 3 ⚠️ 2 View Analysis > |

| Cellularline (BIT:CELL) | €2.54 | €53.57M | ✅ 4 ⚠️ 2 View Analysis > |

| Netgem (ENXTPA:ALNTG) | €0.984 | €32.95M | ✅ 4 ⚠️ 3 View Analysis > |

| High (ENXTPA:HCO) | €3.14 | €61.68M | ✅ 2 ⚠️ 3 View Analysis > |

| Fondia Oyj (HLSE:FONDIA) | €4.99 | €18.65M | ✅ 2 ⚠️ 3 View Analysis > |

| Deceuninck (ENXTBR:DECB) | €2.175 | €300.29M | ✅ 3 ⚠️ 1 View Analysis > |

Click here to see the full list of 417 stocks from our European Penny Stocks screener.

Let's review some notable picks from our screened stocks.

Cellularline (BIT:CELL)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Cellularline S.p.A. is a company that manufactures and sells accessories for smartphones and tablets across various regions including Europe, the Middle East, North America, and internationally, with a market cap of €53.57 million.

Operations: The company generates revenue of €164.26 million from its Electronic Components & Parts segment.

Market Cap: €53.57M

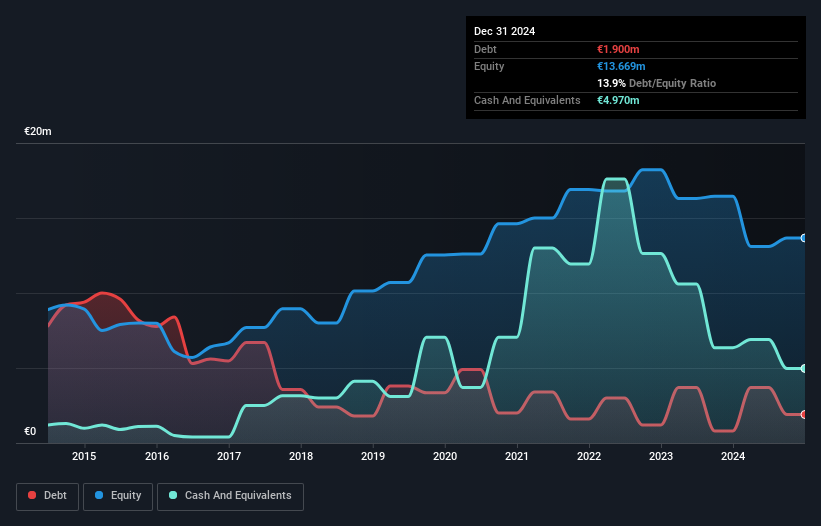

Cellularline S.p.A., with a market cap of €53.57 million, has shown strong earnings growth over the past year at 57.1%, surpassing the tech industry average. Despite a decline in profits over the past five years, recent improvements in net profit margins and stable weekly volatility suggest resilience. The company's debt is well-covered by operating cash flow, though interest coverage remains low at 1.1x EBIT. Recent events include participation in the Euronext Milan STAR Conference and an increased annual dividend of €0.093 per share, reflecting a commitment to shareholder returns amidst ongoing financial recovery efforts.

- Take a closer look at Cellularline's potential here in our financial health report.

- Understand Cellularline's earnings outlook by examining our growth report.

Honkarakenne Oyj (HLSE:HONBS)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Honkarakenne Oyj designs, manufactures, and sells log and solid-wood house packages in Finland, with a market cap of €15.55 million.

Operations: The company's revenue is primarily derived from its Home Builders segment, encompassing both residential and commercial projects, totaling €36.71 million.

Market Cap: €15.55M

Honkarakenne Oyj, with a market cap of €15.55 million, has recently demonstrated improved financial performance by reporting a net income of €2.3 million for Q4 2024 compared to a net loss the previous year. Despite being unprofitable over the past five years, its debt levels have decreased significantly, and short-term assets exceed both short- and long-term liabilities. The company trades at good value relative to peers and industry standards but faces challenges with negative operating cash flow and return on equity (-15.8%). No dividend was proposed for 2024 as it focuses on stabilizing profitability amidst volatile earnings forecasts.

- Click here and access our complete financial health analysis report to understand the dynamics of Honkarakenne Oyj.

- Examine Honkarakenne Oyj's earnings growth report to understand how analysts expect it to perform.

VOOLT Spólka Akcyjna (WSE:VLT)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: VOOLT Spólka Akcyjna produces and sells electricity through renewable energy sources in Poland, with a market capitalization of PLN27.37 million.

Operations: VOOLT Spólka Akcyjna has not reported any specific revenue segments.

Market Cap: PLN27.37M

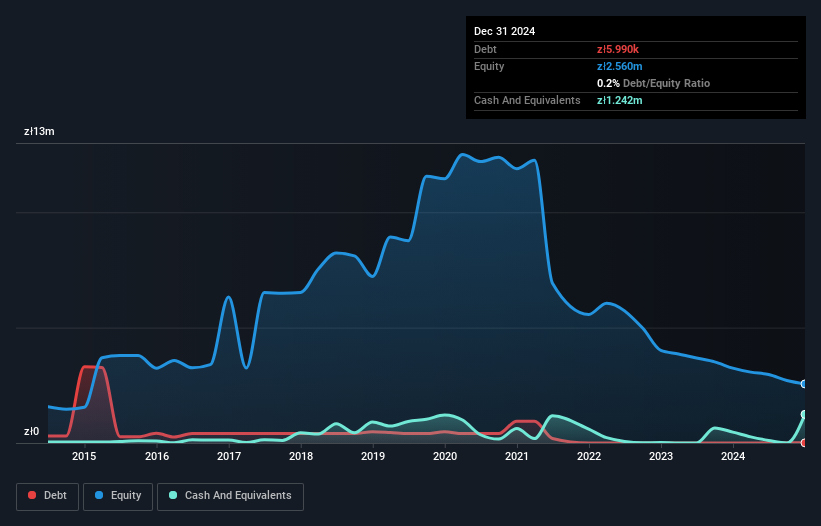

VOOLT Spólka Akcyjna, with a market cap of PLN27.37 million, is pre-revenue, generating less than US$1 million annually. It remains unprofitable with increasing losses over the past five years at 65.5% per year. Despite this, VOOLT's short-term assets of PLN2.6 million comfortably cover both its short- and long-term liabilities. The company's debt to equity ratio has improved significantly from 4.3% to 0.2% over five years, and shareholders have not faced dilution recently. However, high weekly volatility persists compared to most Polish stocks, and operating cash flow remains negative despite having more cash than total debt.

- Jump into the full analysis health report here for a deeper understanding of VOOLT Spólka Akcyjna.

- Learn about VOOLT Spólka Akcyjna's historical performance here.

Key Takeaways

- Navigate through the entire inventory of 417 European Penny Stocks here.

- Contemplating Other Strategies? Outshine the giants: these 22 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BIT:CELL

Cellularline

Manufactures and sells accessories for smartphones and tablets in Italy, Spain/Portugal, Germany, Eastern Europe, Switzerland, Benelux, Northern Europe, France, Great Britain, the Middle East, North America, and internationally.

Undervalued with proven track record.

Market Insights

Community Narratives