As global markets navigate geopolitical tensions and economic uncertainties, such as the recent contraction in U.S. services PMI and tariff concerns, investors are increasingly focused on identifying stocks that demonstrate resilience and potential for growth. In this context, companies with high insider ownership often stand out, as they suggest strong internal confidence in the business's future prospects despite broader market challenges.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| Lavvi Empreendimentos Imobiliários (BOVESPA:LAVV3) | 17.3% | 22.8% |

| Archean Chemical Industries (NSEI:ACI) | 22.9% | 50.1% |

| Propel Holdings (TSX:PRL) | 36.5% | 38.1% |

| Pricol (NSEI:PRICOLLTD) | 25.4% | 25.2% |

| CD Projekt (WSE:CDR) | 29.7% | 39.4% |

| On Holding (NYSE:ONON) | 19.1% | 29.8% |

| Kingstone Companies (NasdaqCM:KINS) | 20.8% | 24.9% |

| Pharma Mar (BME:PHM) | 11.9% | 45.4% |

| Elliptic Laboratories (OB:ELABS) | 26.8% | 121.1% |

| Plenti Group (ASX:PLT) | 12.7% | 120.1% |

Here we highlight a subset of our preferred stocks from the screener.

Etteplan Oyj (HLSE:ETTE)

Simply Wall St Growth Rating: ★★★★☆☆

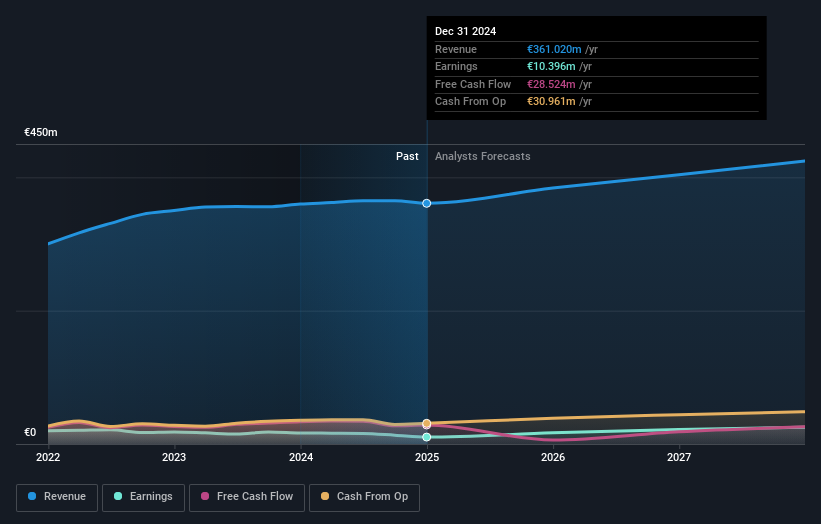

Overview: Etteplan Oyj offers software and embedded solutions, industrial equipment and plant engineering, and technical communication services across Finland, Scandinavia, China, and Central Europe with a market cap of €280.27 million.

Operations: The company's revenue segments are comprised of €192.80 million from Engineering Solutions, €97.36 million from Software and Embedded Solutions, and €70.49 million from Technical Communication Solutions.

Insider Ownership: 13.8%

Etteplan Oyj, with substantial insider ownership, is positioned for significant earnings growth at 23.3% annually over the next three years, outpacing the Finnish market. Despite trading below its estimated fair value and having a high debt level, its revenue growth forecast of 4.6% surpasses the local market average. Recent financials show a decrease in net income and profit margins compared to last year, alongside a proposed dividend reduction for 2024.

- Take a closer look at Etteplan Oyj's potential here in our earnings growth report.

- Our valuation report unveils the possibility Etteplan Oyj's shares may be trading at a discount.

Asia Cuanon Technology (Shanghai)Ltd (SHSE:603378)

Simply Wall St Growth Rating: ★★★★☆☆

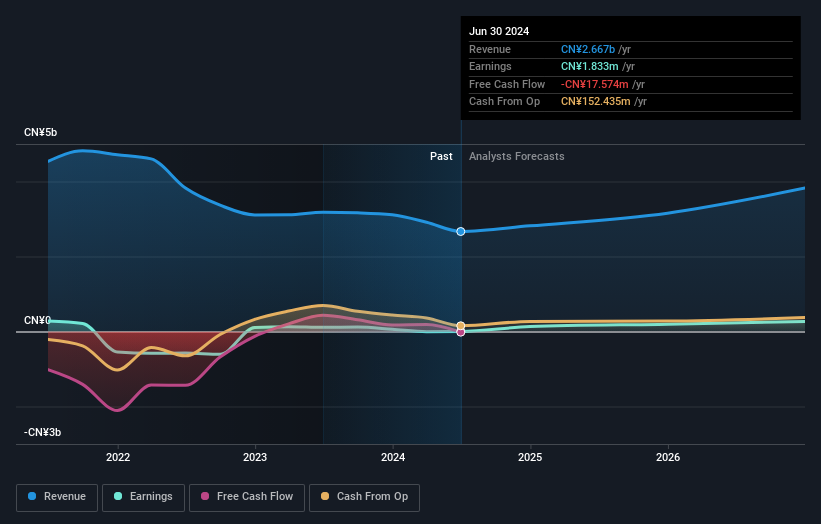

Overview: Asia Cuanon Technology (Shanghai) Ltd, with a market cap of CN¥2.75 billion, is engaged in the development and production of environmentally friendly building insulation materials.

Operations: Revenue Segments (in millions of CN¥):

Insider Ownership: 14.0%

Asia Cuanon Technology (Shanghai) Ltd. is set for substantial growth, with revenue expected to increase by 16.5% annually, surpassing the broader Chinese market's growth rate. Despite its good value relative to peers, the company faces challenges with low forecasted return on equity and insufficient operating cash flow coverage for debt. A recent acquisition of a 5.14% stake highlights continued interest in the firm despite its modest dividend yield of 0.66%, which is not well covered by earnings or free cash flows.

- Click here and access our complete growth analysis report to understand the dynamics of Asia Cuanon Technology (Shanghai)Ltd.

- Insights from our recent valuation report point to the potential undervaluation of Asia Cuanon Technology (Shanghai)Ltd shares in the market.

Japan Eyewear Holdings (TSE:5889)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Japan Eyewear Holdings Co., Ltd. operates in Japan through its subsidiaries, focusing on the planning, designing, manufacturing, wholesaling, and retailing of eyewear products with a market cap of ¥53.36 billion.

Operations: The company's revenue segments include Four Nines, generating ¥5.60 billion, and Kaneko Glasses, contributing ¥10.34 billion.

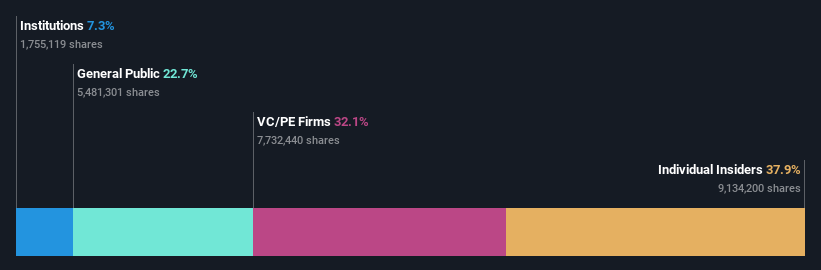

Insider Ownership: 37.9%

Japan Eyewear Holdings demonstrates potential for growth with earnings projected to rise 14.6% annually, outpacing the Japanese market. Despite trading 20.4% below its estimated fair value, the company faces challenges including high debt levels and recent share price volatility. Insider ownership remains stable without significant recent transactions. The company's decision to cancel a secondary offering may indicate strategic shifts, while increased dividends and revised earnings guidance reflect strong performance driven by robust store sales and tourism demand.

- Unlock comprehensive insights into our analysis of Japan Eyewear Holdings stock in this growth report.

- The valuation report we've compiled suggests that Japan Eyewear Holdings' current price could be quite moderate.

Where To Now?

- Click this link to deep-dive into the 1452 companies within our Fast Growing Companies With High Insider Ownership screener.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:603378

Asia Cuanon Technology (Shanghai)Ltd

Asia Cuanon Technology (Shanghai) Co.,Ltd.

Reasonable growth potential and fair value.

Similar Companies

Market Insights

Community Narratives