- Finland

- /

- Trade Distributors

- /

- HLSE:RELAIS

Why We're Not Concerned Yet About Relais Group Oyj's (HEL:RELAIS) 27% Share Price Plunge

To the annoyance of some shareholders, Relais Group Oyj (HEL:RELAIS) shares are down a considerable 27% in the last month, which continues a horrid run for the company. The recent drop completes a disastrous twelve months for shareholders, who are sitting on a 58% loss during that time.

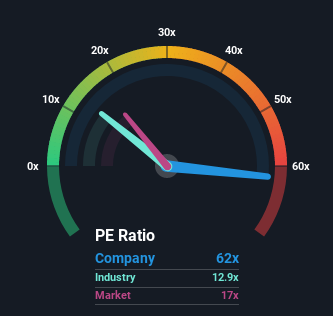

In spite of the heavy fall in price, given close to half the companies in Finland have price-to-earnings ratios (or "P/E's") below 16x, you may still consider Relais Group Oyj as a stock to avoid entirely with its 62x P/E ratio. However, the P/E might be quite high for a reason and it requires further investigation to determine if it's justified.

Relais Group Oyj hasn't been tracking well recently as its declining earnings compare poorly to other companies, which have seen some growth on average. One possibility is that the P/E is high because investors think this poor earnings performance will turn the corner. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

View our latest analysis for Relais Group Oyj

Does Growth Match The High P/E?

There's an inherent assumption that a company should far outperform the market for P/E ratios like Relais Group Oyj's to be considered reasonable.

Retrospectively, the last year delivered a frustrating 63% decrease to the company's bottom line. The last three years don't look nice either as the company has shrunk EPS by 22% in aggregate. Accordingly, shareholders would have felt downbeat about the medium-term rates of earnings growth.

Shifting to the future, estimates from the three analysts covering the company suggest earnings should grow by 38% per year over the next three years. Meanwhile, the rest of the market is forecast to only expand by 13% each year, which is noticeably less attractive.

In light of this, it's understandable that Relais Group Oyj's P/E sits above the majority of other companies. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

The Key Takeaway

A significant share price dive has done very little to deflate Relais Group Oyj's very lofty P/E. It's argued the price-to-earnings ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

We've established that Relais Group Oyj maintains its high P/E on the strength of its forecast growth being higher than the wider market, as expected. Right now shareholders are comfortable with the P/E as they are quite confident future earnings aren't under threat. It's hard to see the share price falling strongly in the near future under these circumstances.

Before you settle on your opinion, we've discovered 4 warning signs for Relais Group Oyj (2 make us uncomfortable!) that you should be aware of.

If these risks are making you reconsider your opinion on Relais Group Oyj, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About HLSE:RELAIS

Relais Group Oyj

Operates as a consolidator and acquisition platform for vehicle aftermarket in the Nordic and Baltic countries.

Good value with acceptable track record.

Market Insights

Community Narratives