- Finland

- /

- Trade Distributors

- /

- HLSE:RELAIS

Here's Why I Think Relais Group Oyj (HEL:RELAIS) Might Deserve Your Attention Today

Some have more dollars than sense, they say, so even companies that have no revenue, no profit, and a record of falling short, can easily find investors. But as Peter Lynch said in One Up On Wall Street, 'Long shots almost never pay off.'

If, on the other hand, you like companies that have revenue, and even earn profits, then you may well be interested in Relais Group Oyj (HEL:RELAIS). Even if the shares are fully valued today, most capitalists would recognize its profits as the demonstration of steady value generation. Loss-making companies are always racing against time to reach financial sustainability, but time is often a friend of the profitable company, especially if it is growing.

Check out our latest analysis for Relais Group Oyj

Relais Group Oyj's Improving Profits

Even with very modest growth rates, a company will usually do well if it improves earnings per share (EPS) year after year. So it's no surprise that some investors are more inclined to invest in profitable businesses. Like a firecracker arcing through the night sky, Relais Group Oyj's EPS shot from €0.18 to €0.50, over the last year. You don't see 180% year-on-year growth like that, very often. The best case scenario? That the business has hit a true inflection point.

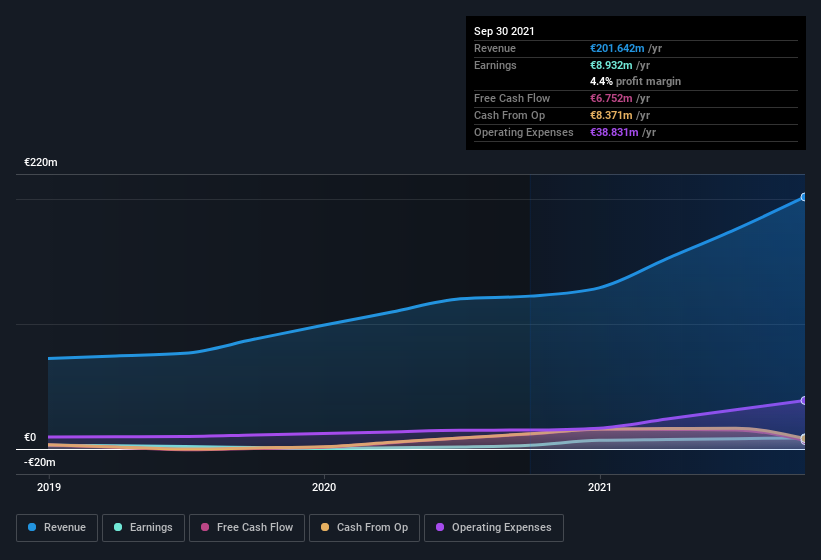

I like to take a look at earnings before interest and (EBIT) tax margins, as well as revenue growth, to get another take on the quality of the company's growth. While we note Relais Group Oyj's EBIT margins were flat over the last year, revenue grew by a solid 65% to €202m. That's progress.

You can take a look at the company's revenue and earnings growth trend, in the chart below. To see the actual numbers, click on the chart.

In investing, as in life, the future matters more than the past. So why not check out this free interactive visualization of Relais Group Oyj's forecast profits?

Are Relais Group Oyj Insiders Aligned With All Shareholders?

Personally, I like to see high insider ownership of a company, since it suggests that it will be managed in the interests of shareholders. So we're pleased to report that Relais Group Oyj insiders own a meaningful share of the business. Actually, with 35% of the company to their names, insiders are profoundly invested in the business. I'm reassured by this kind of alignment, as it suggests the business will be run for the benefit of shareholders. In terms of absolute value, insiders have €146m invested in the business, using the current share price. That should be more than enough to keep them focussed on creating shareholder value!

Is Relais Group Oyj Worth Keeping An Eye On?

Relais Group Oyj's earnings per share have taken off like a rocket aimed right at the moon. That sort of growth is nothing short of eye-catching, and the large investment held by insiders certainly brightens my view of the company. The hope is, of course, that the strong growth marks a fundamental improvement in the business economics. So yes, on this short analysis I do think it's worth considering Relais Group Oyj for a spot on your watchlist. It's still necessary to consider the ever-present spectre of investment risk. We've identified 2 warning signs with Relais Group Oyj (at least 1 which is concerning) , and understanding these should be part of your investment process.

Although Relais Group Oyj certainly looks good to me, I would like it more if insiders were buying up shares. If you like to see insider buying, too, then this free list of growing companies that insiders are buying, could be exactly what you're looking for.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About HLSE:RELAIS

Relais Group Oyj

Operates as a consolidator and acquisition platform for vehicle aftermarket in the Nordic and Baltic countries.

Very undervalued with solid track record.