Metso Oyj's (HEL:METSO) Business And Shares Still Trailing The Market

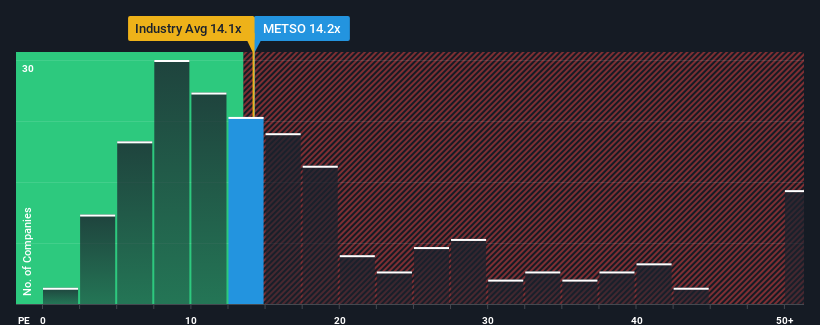

Metso Oyj's (HEL:METSO) price-to-earnings (or "P/E") ratio of 14.2x might make it look like a buy right now compared to the market in Finland, where around half of the companies have P/E ratios above 19x and even P/E's above 31x are quite common. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's limited.

With its earnings growth in positive territory compared to the declining earnings of most other companies, Metso Oyj has been doing quite well of late. One possibility is that the P/E is low because investors think the company's earnings are going to fall away like everyone else's soon. If not, then existing shareholders have reason to be quite optimistic about the future direction of the share price.

View our latest analysis for Metso Oyj

What Are Growth Metrics Telling Us About The Low P/E?

There's an inherent assumption that a company should underperform the market for P/E ratios like Metso Oyj's to be considered reasonable.

Taking a look back first, we see that the company grew earnings per share by an impressive 90% last year. The strong recent performance means it was also able to grow EPS by 170% in total over the last three years. Therefore, it's fair to say the earnings growth recently has been superb for the company.

Shifting to the future, estimates from the analysts covering the company suggest earnings should grow by 6.2% each year over the next three years. With the market predicted to deliver 17% growth per annum, the company is positioned for a weaker earnings result.

In light of this, it's understandable that Metso Oyj's P/E sits below the majority of other companies. Apparently many shareholders weren't comfortable holding on while the company is potentially eyeing a less prosperous future.

The Bottom Line On Metso Oyj's P/E

While the price-to-earnings ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of earnings expectations.

We've established that Metso Oyj maintains its low P/E on the weakness of its forecast growth being lower than the wider market, as expected. Right now shareholders are accepting the low P/E as they concede future earnings probably won't provide any pleasant surprises. Unless these conditions improve, they will continue to form a barrier for the share price around these levels.

We don't want to rain on the parade too much, but we did also find 1 warning sign for Metso Oyj that you need to be mindful of.

If these risks are making you reconsider your opinion on Metso Oyj, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About HLSE:METSO

Metso Oyj

Provides technologies, end-to-end solutions, and services for aggregates, minerals processing, and metals refining industries in Europe, North and Central America, South America, the Asia Pacific, Greater China, Africa, the Middle East, and India.

Very undervalued with proven track record.