As we enter January 2025, global markets are navigating a mixed landscape with U.S. consumer confidence dipping and major stock indexes experiencing moderate gains during the holiday-shortened week. In this environment, dividend stocks can offer investors a reliable income stream and potential stability amid fluctuating economic indicators.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Guaranty Trust Holding (NGSE:GTCO) | 6.49% | ★★★★★★ |

| Tsubakimoto Chain (TSE:6371) | 4.09% | ★★★★★★ |

| Wuliangye YibinLtd (SZSE:000858) | 3.33% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.84% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 3.36% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 7.42% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 3.83% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.26% | ★★★★★★ |

| FALCO HOLDINGS (TSE:4671) | 6.38% | ★★★★★★ |

| E J Holdings (TSE:2153) | 3.82% | ★★★★★★ |

Click here to see the full list of 1940 stocks from our Top Dividend Stocks screener.

We're going to check out a few of the best picks from our screener tool.

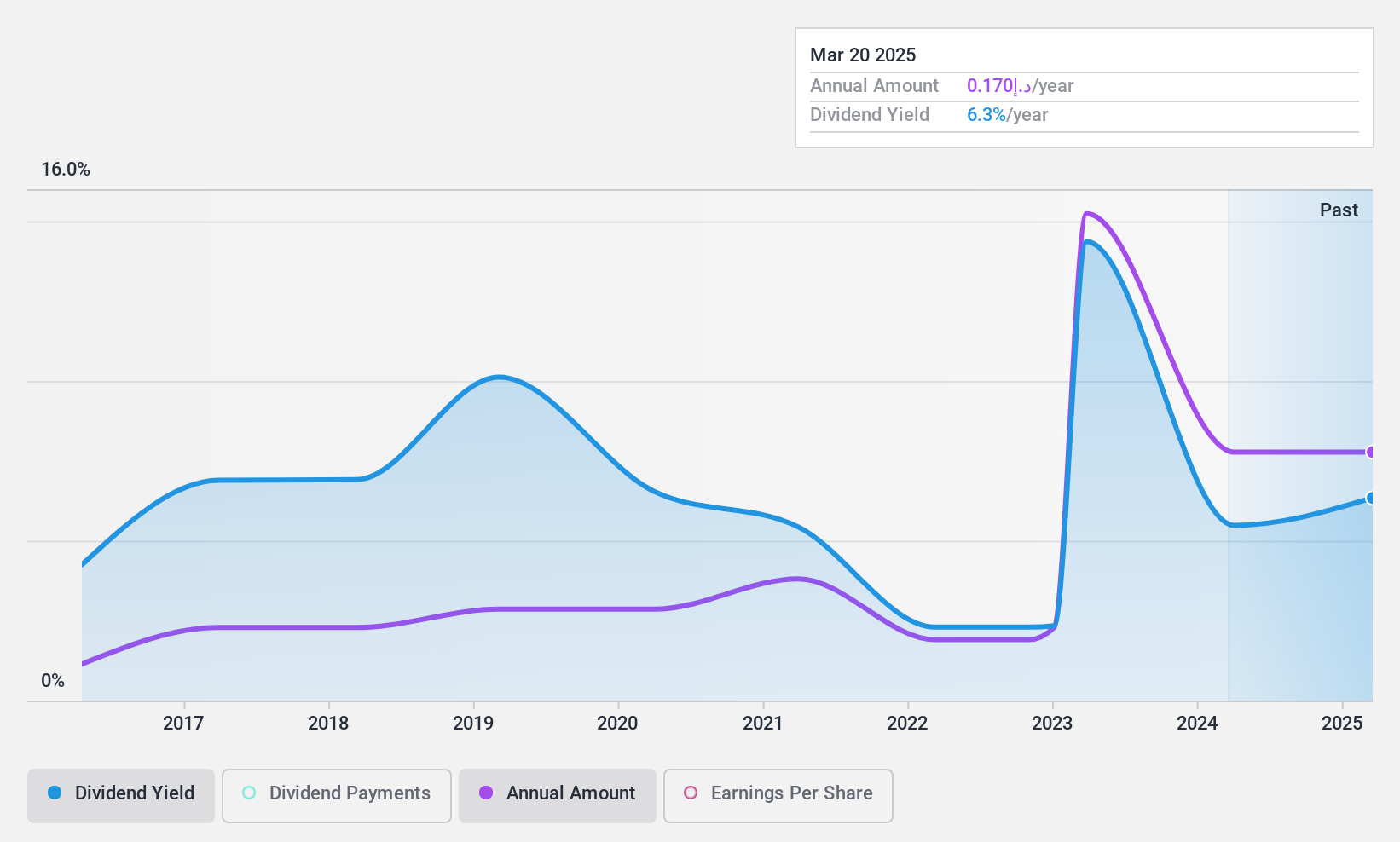

Emirates Driving Company P.J.S.C (ADX:DRIVE)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Emirates Driving Company P.J.S.C., along with its subsidiaries, specializes in managing and developing motor vehicle driving training, with a market cap of AED3.02 billion.

Operations: Emirates Driving Company P.J.S.C. generates revenue primarily from its Car and Other Related Services segment, amounting to AED429.02 million.

Dividend Yield: 6.1%

Emirates Driving Company P.J.S.C. offers a reasonable dividend payout ratio of 65.7%, ensuring coverage by earnings, and a cash payout ratio of 72%, indicating dividends are supported by cash flows. Despite being volatile over the past decade, dividends have grown, though they remain less competitive in yield compared to top AE market payers. Recent financial results show robust growth in sales and net income, supporting its ability to maintain dividend payments.

- Click here and access our complete dividend analysis report to understand the dynamics of Emirates Driving Company P.J.S.C.

- Upon reviewing our latest valuation report, Emirates Driving Company P.J.S.C's share price might be too pessimistic.

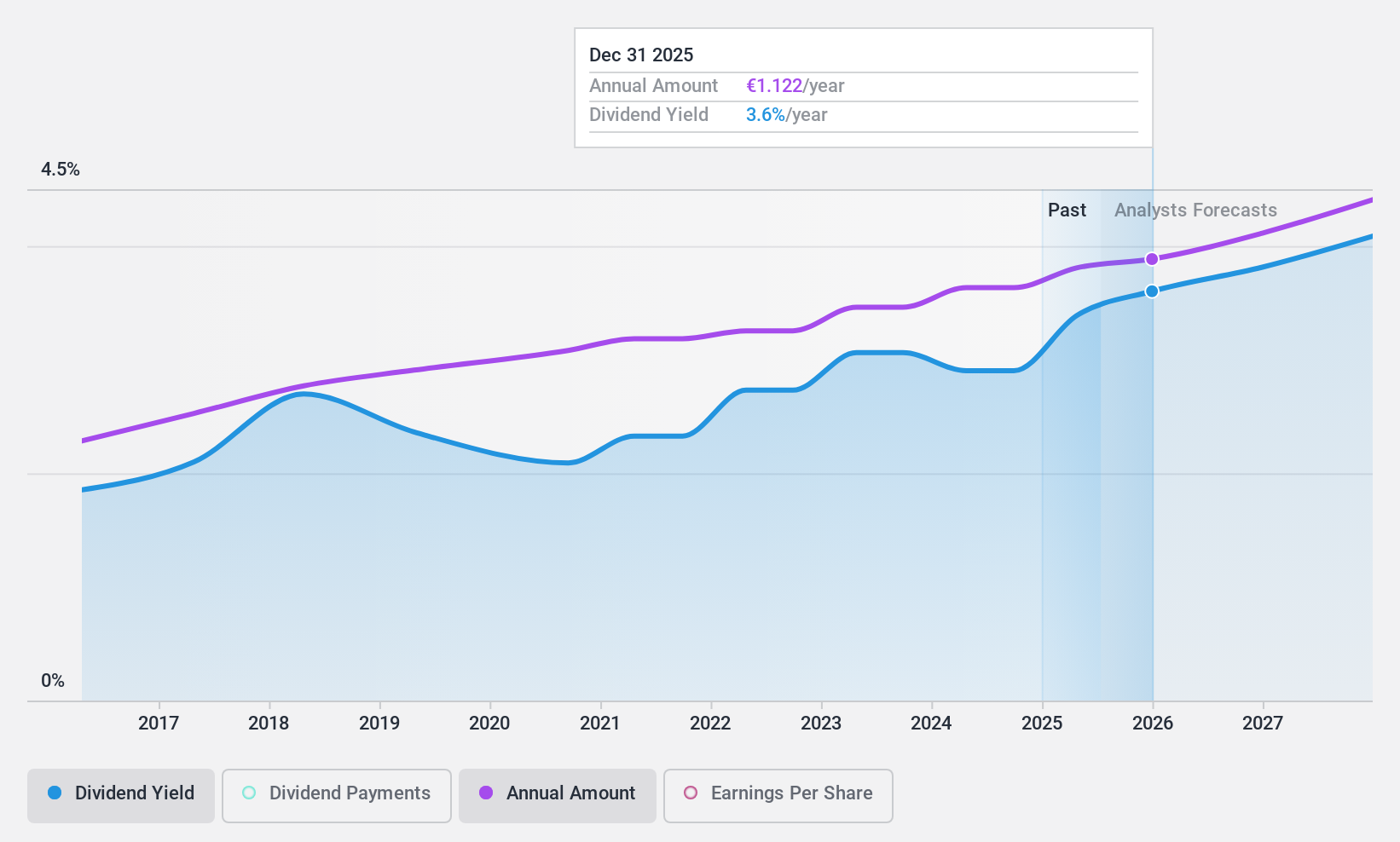

Huhtamäki Oyj (HLSE:HUH1V)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Huhtamäki Oyj offers packaging solutions across various countries including the United States, Germany, and India, with a market cap of €3.58 billion.

Operations: Huhtamäki Oyj's revenue is primarily derived from its North America segment (€1.45 billion), Flexible Packaging (€1.31 billion), Fiber Packaging (€353.50 million), and Foodservice Europe-Asia-Oceania (€990.60 million).

Dividend Yield: 3.1%

Huhtamäki Oyj offers a stable dividend supported by a payout ratio of 44.4% and cash flow coverage at 55.7%. Its dividends have been reliable and growing over the past decade, though its yield of 3.07% is below the Finnish market's top tier. Recent earnings growth of 41.1% enhances its financial position despite high debt levels, while strategic expansions in sustainable packaging bolster long-term prospects amidst executive leadership changes.

- Dive into the specifics of Huhtamäki Oyj here with our thorough dividend report.

- Our expertly prepared valuation report Huhtamäki Oyj implies its share price may be lower than expected.

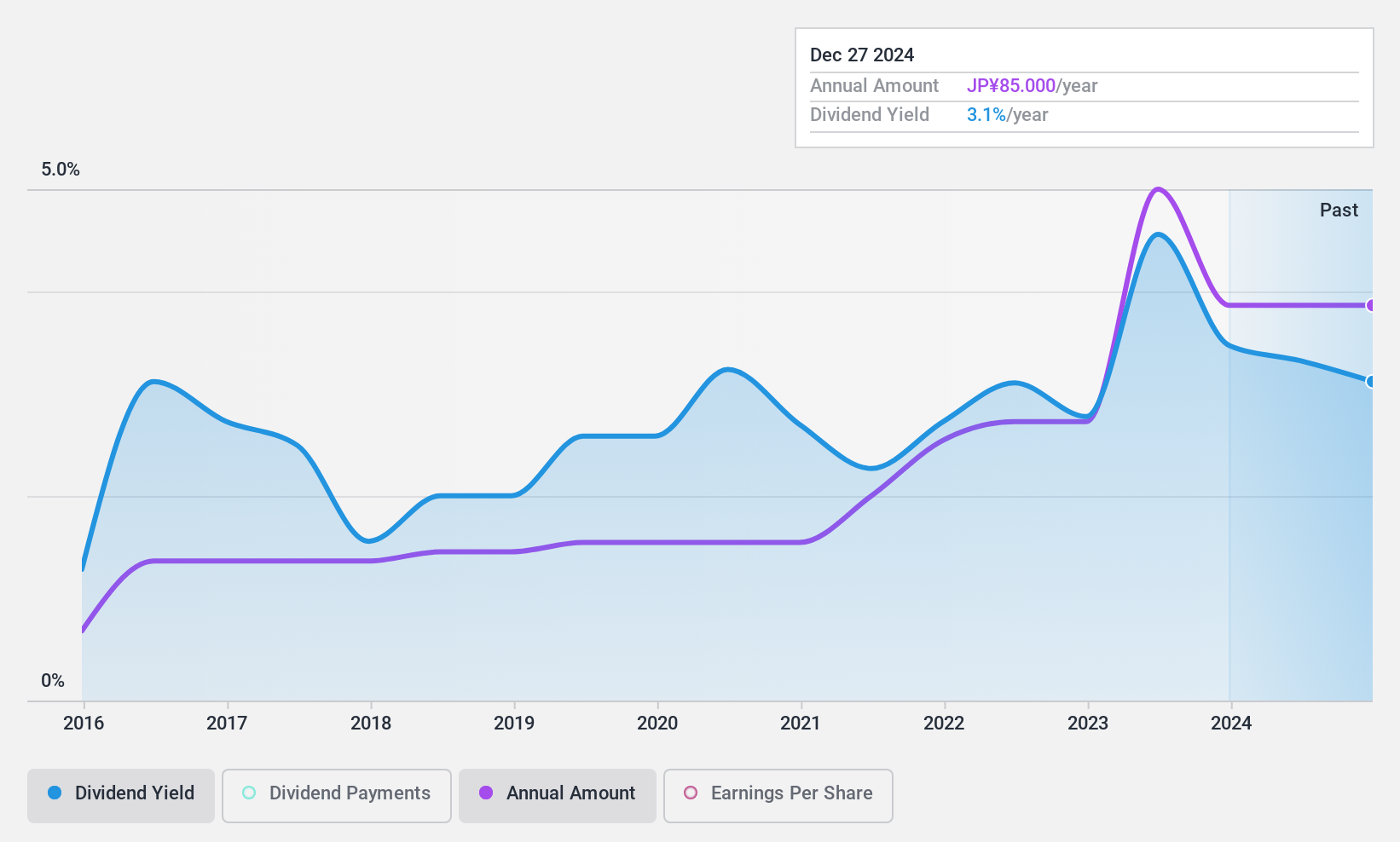

Naigai Trans Line (TSE:9384)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Naigai Trans Line Ltd. offers integrated logistics services both in Japan and internationally, with a market cap of ¥26.26 billion.

Operations: Naigai Trans Line Ltd.'s revenue is comprised of ¥24.36 billion from Japan and ¥14.17 billion from overseas operations.

Dividend Yield: 3.2%

Naigai Trans Line's dividend payments have grown over the past decade, supported by a low payout ratio of 29.7% and cash payout ratio of 39.9%, indicating strong coverage by earnings and cash flows. However, its dividend yield of 3.16% falls short compared to top-tier Japanese payers at 3.75%. Despite trading at ¥45 per share ex-dividend in late 2024, its dividends have been unstable and unreliable due to volatility exceeding annual drops of over 20%.

- Unlock comprehensive insights into our analysis of Naigai Trans Line stock in this dividend report.

- The analysis detailed in our Naigai Trans Line valuation report hints at an deflated share price compared to its estimated value.

Taking Advantage

- Dive into all 1940 of the Top Dividend Stocks we have identified here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Huhtamäki Oyj might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About HLSE:HUH1V

Huhtamäki Oyj

Provides packaging solutions in the United States, Germany, the United Kingdom, India, Turkey, Australia, Thailand, Poland, South Africa, Spain, Finland, and internationally.

Very undervalued with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives