- Sweden

- /

- Real Estate

- /

- OM:FPAR A

Undervalued Small Caps With Insider Action In January 2025

Reviewed by Simply Wall St

As global markets navigate a tumultuous start to 2025, small-cap stocks have notably underperformed their large-cap counterparts, with the Russell 2000 Index slipping into correction territory amid inflation concerns and political uncertainties. Despite these challenges, value-oriented small-cap stocks may present opportunities for investors seeking resilience in a choppy market environment. Identifying promising small caps often involves looking for companies with strong fundamentals and potential insider activity that may suggest confidence in their future performance.

Top 10 Undervalued Small Caps With Insider Buying

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| 4imprint Group | 15.7x | 1.3x | 39.66% | ★★★★★☆ |

| Paradeep Phosphates | 24.8x | 0.8x | 27.11% | ★★★★★☆ |

| Maharashtra Seamless | 9.9x | 1.7x | 36.95% | ★★★★★☆ |

| Speedy Hire | NA | 0.3x | 35.29% | ★★★★★☆ |

| ABG Sundal Collier Holding | 12.7x | 2.1x | 39.90% | ★★★★☆☆ |

| Avia Avian | 14.9x | 3.4x | 19.16% | ★★★★☆☆ |

| Logistri Fastighets | 12.4x | 8.8x | 42.80% | ★★★★☆☆ |

| Mark Dynamics Indonesia | 13.6x | 4.4x | 2.68% | ★★★☆☆☆ |

| Digital Mediatama Maxima | NA | 1.2x | 17.61% | ★★★☆☆☆ |

| THG | NA | 0.3x | -517.31% | ★★★☆☆☆ |

Here we highlight a subset of our preferred stocks from the screener.

Kempower Oyj (HLSE:KEMPOWR)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Kempower Oyj specializes in the production of electric equipment, with a focus on charging solutions for electric vehicles, and has a market capitalization of approximately €1.36 billion.

Operations: Kempower Oyj generates revenue primarily from its electric equipment segment, with recent figures reaching €234.81 million. The company's gross profit margin has shown an upward trend, reaching 54.39% in late 2023 before slightly decreasing to 53.17% by September 2024. Operating expenses have consistently impacted net income, leading to a negative net income margin of -7.87% as of late 2024.

PE: -33.5x

Kempower, a company in the electric vehicle charging sector, recently underwent significant leadership changes with Mathias Wiklund stepping in as Chief Sales Officer. This shift aims to enhance customer focus by integrating sales and service operations. Despite a forecasted negative EBIT margin for 2024, profitability is expected to improve by year-end. The company's reliance on external borrowing presents funding risks but insider confidence is evident with recent share purchases over the past year.

- Navigate through the intricacies of Kempower Oyj with our comprehensive valuation report here.

Evaluate Kempower Oyj's historical performance by accessing our past performance report.

FastPartner (OM:FPAR A)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: FastPartner is a real estate company primarily engaged in property management across three regions, with operations generating significant revenue from its diverse portfolio.

Operations: FastPartner generates revenue primarily through property management across three regions, with Region 1 contributing the largest share. The company's gross profit margin has shown a notable upward trend, reaching 71.45% by September 2023. Operating expenses have remained relatively stable over recent periods, while non-operating expenses have significantly impacted net income margins, resulting in negative figures in recent quarters.

PE: -45.0x

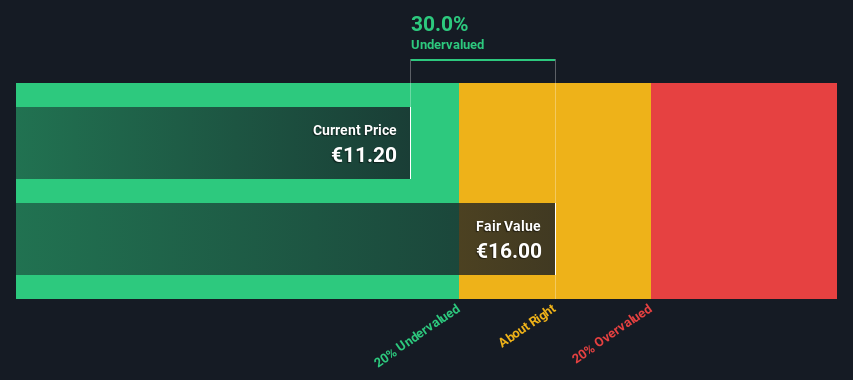

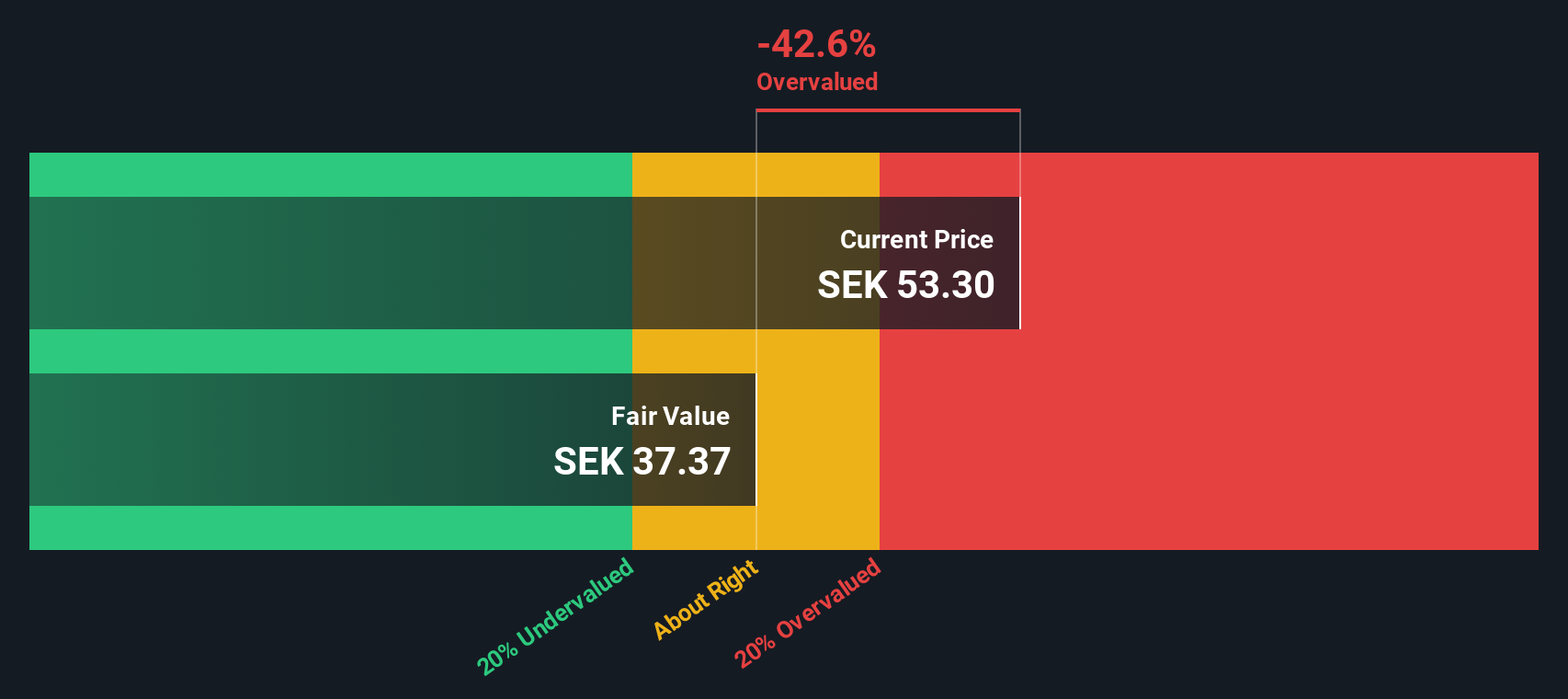

FastPartner, a small company with potential value, has seen insider confidence through Sven-Olof Johansson's purchase of 50,000 shares worth approximately SEK 3.55 million in October 2024. Despite facing challenges with interest payments and reliance on higher-risk external borrowing, the company reported increased sales of SEK 574 million for Q3 and a turnaround to a net income of SEK 488.8 million over nine months in 2024. Earnings are forecasted to grow significantly at an annual rate of over 63%.

- Get an in-depth perspective on FastPartner's performance by reading our valuation report here.

Gain insights into FastPartner's past trends and performance with our Past report.

East West Banking (PSE:EW)

Simply Wall St Value Rating: ★★★★★☆

Overview: East West Banking is a financial institution engaged in retail, consumer, and corporate banking services, along with treasury and trust operations, with a market capitalization of ₱25.68 billion.

Operations: The company generates revenue primarily from Consumer Banking (₱13.92 billion) and Retail Banking (₱12.40 billion), with additional contributions from Corporate Banking and Treasury and Trust services. Operating expenses are a significant part of its cost structure, with General & Administrative Expenses reaching ₱10.79 billion in the latest period. Notably, the net income margin has shown variability over time, recently recorded at 21.88%.

PE: 3.2x

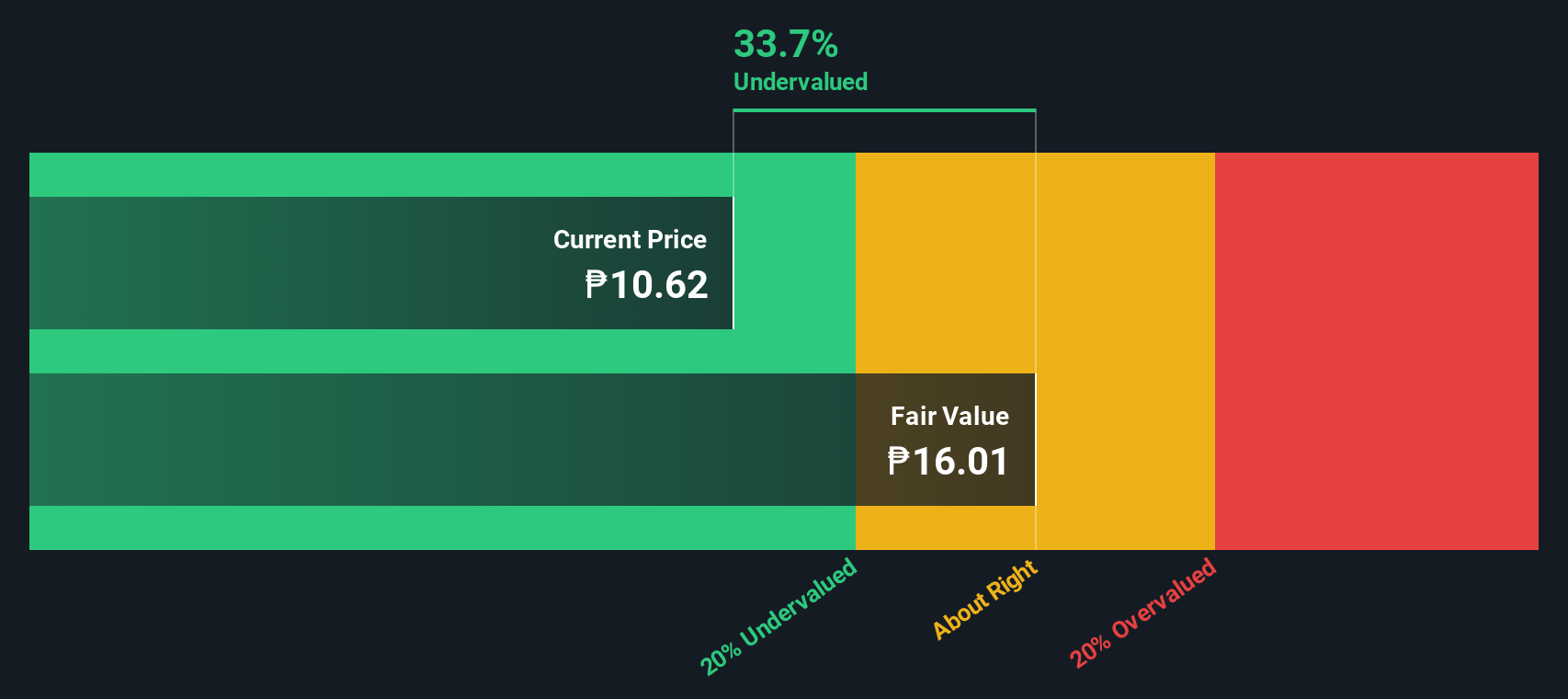

East West Banking presents a compelling case among smaller companies, with recent insider confidence highlighted by CEO Jerry Ngo's purchase of 903,900 shares worth PHP 8.73 million in December 2024. This move suggests belief in the bank's future potential despite a high bad loans ratio of 5.4%. The bank reported strong earnings growth for the third quarter of 2024, with net income rising to PHP 2.32 billion from PHP 1.56 billion year-over-year, indicating resilience amidst challenges and strategic leadership changes effective January 2025.

- Click here to discover the nuances of East West Banking with our detailed analytical valuation report.

Understand East West Banking's track record by examining our Past report.

Summing It All Up

- Click here to access our complete index of 177 Undervalued Small Caps With Insider Buying.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:FPAR A

FastPartner

A real estate company, develops, owns, and manages residential and commercial properties in Sweden.

Reasonable growth potential and fair value.