- Sweden

- /

- Tech Hardware

- /

- OM:DYVOX

Three Stocks That May Be Priced Below Their Intrinsic Value In January 2025

Reviewed by Simply Wall St

As global markets grapple with inflation fears and political uncertainties, investors are witnessing a period of volatility marked by fluctuating indices and cautious optimism. Amidst this choppy landscape, the search for stocks that may be priced below their intrinsic value becomes particularly appealing as these opportunities can offer potential resilience against broader market turbulence.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Türkiye Sise Ve Cam Fabrikalari (IBSE:SISE) | TRY39.18 | TRY78.31 | 50% |

| Sudarshan Chemical Industries (BSE:506655) | ₹1115.85 | ₹2228.29 | 49.9% |

| Aguas Andinas (SNSE:AGUAS-A) | CLP290.00 | CLP578.96 | 49.9% |

| MLG Oz (ASX:MLG) | A$0.57 | A$1.14 | 50% |

| LifeMD (NasdaqGM:LFMD) | US$4.90 | US$9.77 | 49.8% |

| Dino Polska (WSE:DNP) | PLN433.60 | PLN863.86 | 49.8% |

| Cicor Technologies (SWX:CICN) | CHF59.60 | CHF118.58 | 49.7% |

| Greenworks (Jiangsu) (SZSE:301260) | CN¥13.95 | CN¥27.87 | 49.9% |

| Shinko Electric Industries (TSE:6967) | ¥5869.00 | ¥11708.96 | 49.9% |

| Prodways Group (ENXTPA:PWG) | €0.608 | €1.21 | 49.9% |

Let's uncover some gems from our specialized screener.

Dynavox Group (OM:DYVOX)

Overview: Dynavox Group AB (publ) develops and sells assistive technology products for communication in Sweden and internationally, with a market cap of SEK6.32 billion.

Operations: The company's revenue is primarily derived from its Computer Hardware segment, which generated SEK1.86 billion.

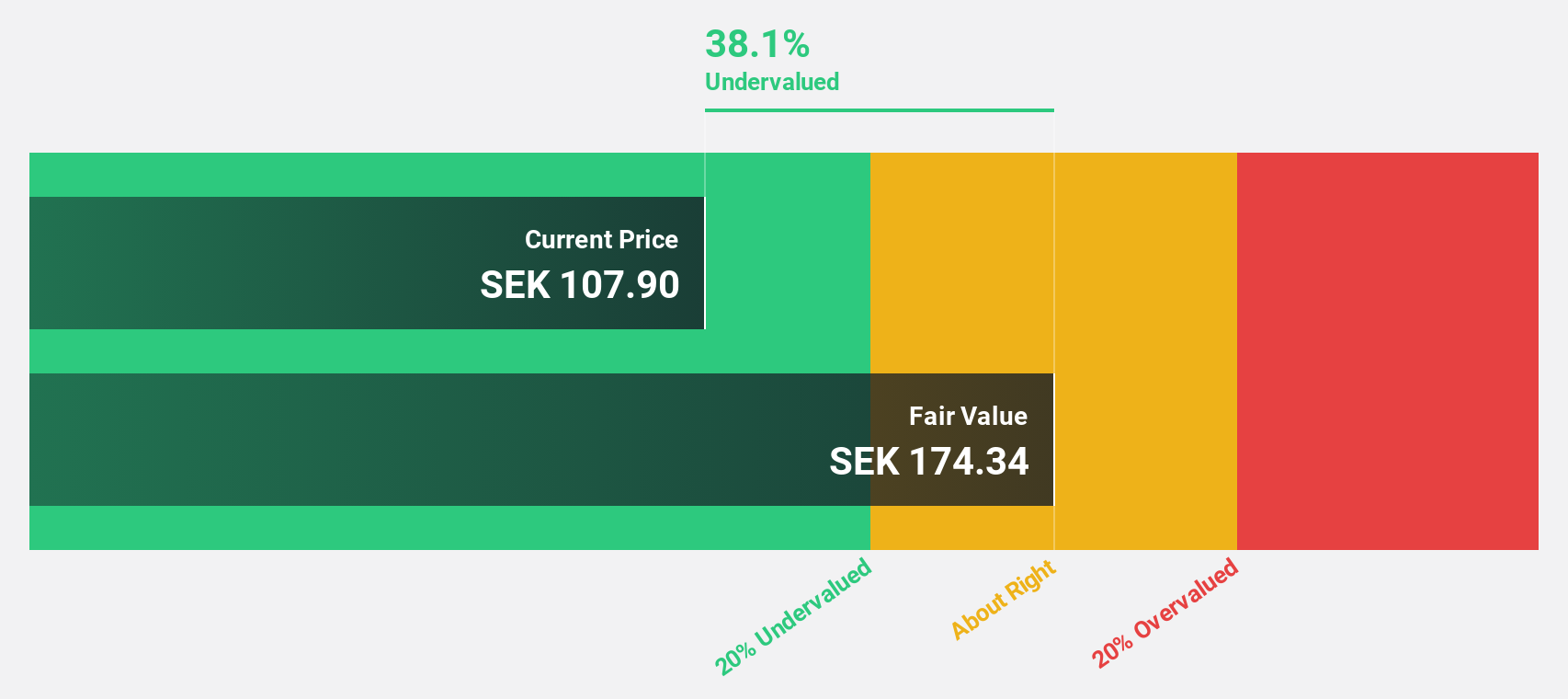

Estimated Discount To Fair Value: 49.1%

Dynavox Group is trading at SEK68.6, significantly below its estimated fair value of SEK134.83, highlighting its undervaluation based on cash flows. Despite high debt levels and significant insider selling recently, earnings are expected to grow 34.4% annually over the next three years, outpacing the Swedish market's growth rate. Recent financial results show strong performance with third-quarter sales increasing to SEK483 million and net income rising to SEK45 million compared to last year.

- Our expertly prepared growth report on Dynavox Group implies its future financial outlook may be stronger than recent results.

- Dive into the specifics of Dynavox Group here with our thorough financial health report.

Kraken Robotics (TSXV:PNG)

Overview: Kraken Robotics Inc. is a marine technology company that designs, manufactures, and sells sonar and optical sensors, batteries, and underwater robotic equipment for unmanned underwater vehicles used in military and commercial applications globally, with a market cap of CA$714.14 million.

Operations: The company's revenue segments consist of CA$67.40 million from products and CA$23.79 million from services.

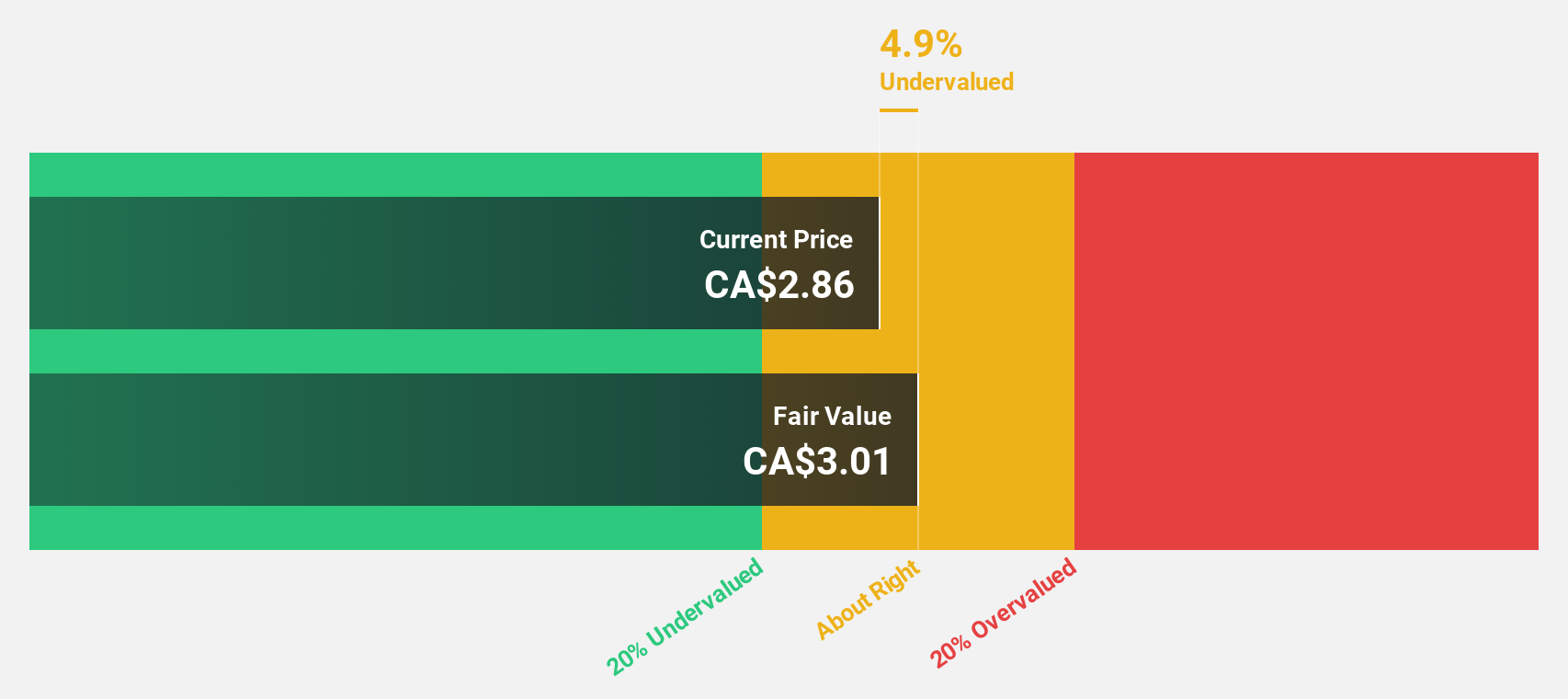

Estimated Discount To Fair Value: 18.2%

Kraken Robotics, trading at CA$2.75, is undervalued relative to its estimated fair value of CA$3.36 based on discounted cash flows. Recent earnings showed a net income increase to CAD 6.42 million for the first nine months of 2024 from CAD 2.96 million last year, indicating robust profit growth despite shareholder dilution over the past year. Kraken's revenue and earnings are forecasted to grow faster than the Canadian market, driven by strong product demand and strategic advancements like its ALARS system demonstrations.

- Insights from our recent growth report point to a promising forecast for Kraken Robotics' business outlook.

- Click here to discover the nuances of Kraken Robotics with our detailed financial health report.

Nanya Technology (TWSE:2408)

Overview: Nanya Technology Corporation researches, develops, manufactures, and sells semiconductor products across various countries including Taiwan, Japan, Malaysia, China, the United States, Thailand, Germany, Singapore, and Poland with a market cap of NT$86.76 billion.

Operations: Nanya Technology Corporation generates its revenue through the research, development, manufacturing, and sale of semiconductor products across multiple international markets.

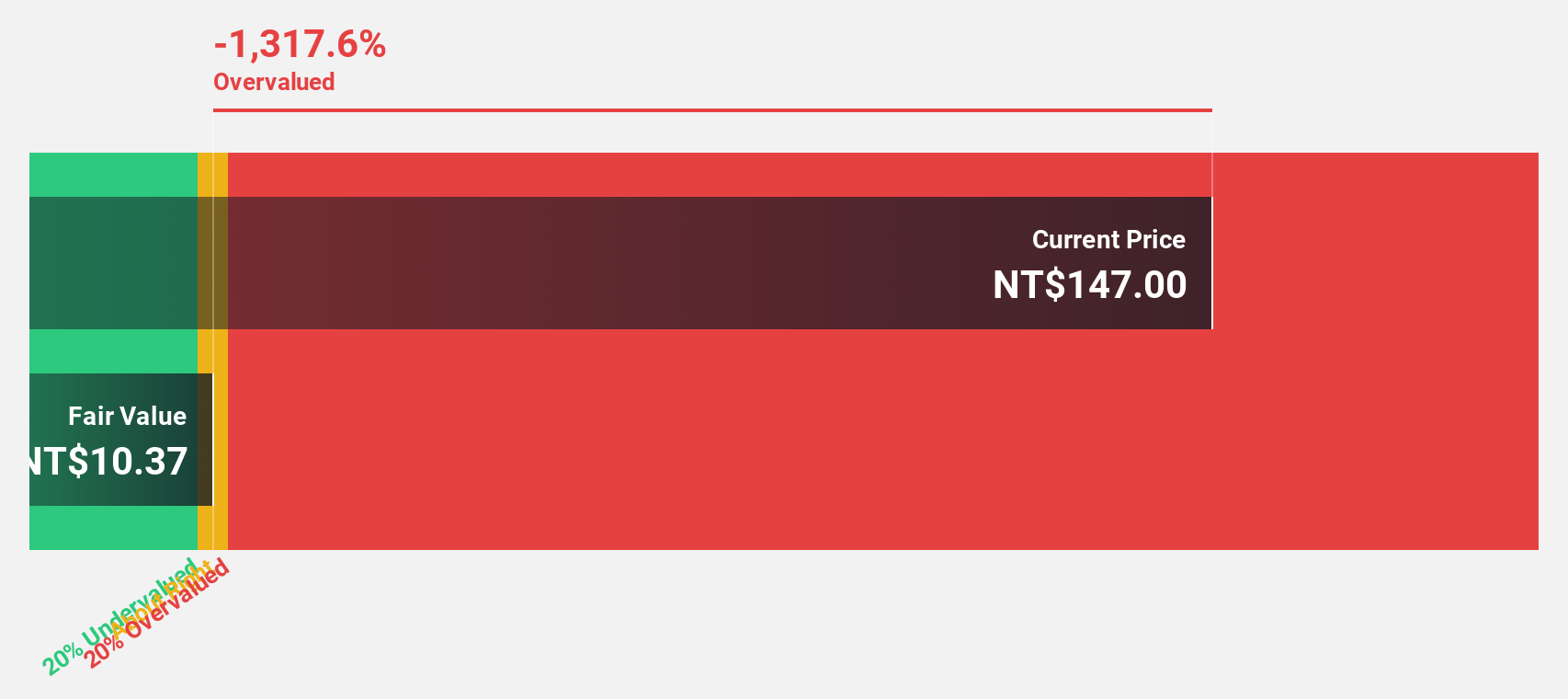

Estimated Discount To Fair Value: 35.5%

Nanya Technology is trading at NT$28, significantly undervalued compared to its estimated fair value of NT$43.44, based on discounted cash flows. Despite a net loss of TWD 5.08 billion in 2024, the company has shown improved financial performance from the previous year and is expected to achieve profitability within three years with revenue growth forecasted at 19.1% annually, outpacing the Taiwan market's growth rate. However, its return on equity remains low at a forecasted 4.9%.

- According our earnings growth report, there's an indication that Nanya Technology might be ready to expand.

- Click to explore a detailed breakdown of our findings in Nanya Technology's balance sheet health report.

Key Takeaways

- Access the full spectrum of 880 Undervalued Stocks Based On Cash Flows by clicking on this link.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:DYVOX

Dynavox Group

Through its subsidiaries, engages in the development and sale of assistive technology products for communication in Sweden and internationally.

High growth potential with solid track record.

Market Insights

Community Narratives