- Finland

- /

- Electrical

- /

- HLSE:KEMPOWR

3 Stocks Estimated To Be Trading Below Their Intrinsic Value

Reviewed by Simply Wall St

In the current global market landscape, uncertainty surrounding the incoming Trump administration's policies has led to volatility across various sectors, with financials and energy benefiting from deregulation hopes while healthcare faces challenges due to potential policy shifts. Amidst these fluctuations, identifying stocks trading below their intrinsic value can offer investors opportunities for growth by focusing on companies with strong fundamentals that may be temporarily undervalued by the market.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Shandong Bailong Chuangyuan Bio-Tech (SHSE:605016) | CN¥16.71 | CN¥33.16 | 49.6% |

| Tibet Rhodiola Pharmaceutical Holding (SHSE:600211) | CN¥38.49 | CN¥76.93 | 50% |

| Taiwan Union Technology (TPEX:6274) | NT$156.50 | NT$311.70 | 49.8% |

| Wuhan Keqian BiologyLtd (SHSE:688526) | CN¥14.57 | CN¥29.09 | 49.9% |

| ConvaTec Group (LSE:CTEC) | £2.43 | £4.85 | 49.9% |

| TF Bank (OM:TFBANK) | SEK312.00 | SEK621.04 | 49.8% |

| AirBoss of America (TSX:BOS) | CA$4.23 | CA$8.44 | 49.9% |

| Saipem (BIT:SPM) | €2.342 | €4.65 | 49.6% |

| Intellian Technologies (KOSDAQ:A189300) | ₩44450.00 | ₩88893.31 | 50% |

| Nokian Renkaat Oyj (HLSE:TYRES) | €7.408 | €14.72 | 49.7% |

We're going to check out a few of the best picks from our screener tool.

Kempower Oyj (HLSE:KEMPOWR)

Overview: Kempower Oyj manufactures and sells electric vehicle charging equipment and solutions under the Kempower brand in the Nordics, Europe, North America, and internationally, with a market cap of €547.49 million.

Operations: Kempower Oyj's revenue is primarily derived from its electric equipment segment, totaling €234.81 million.

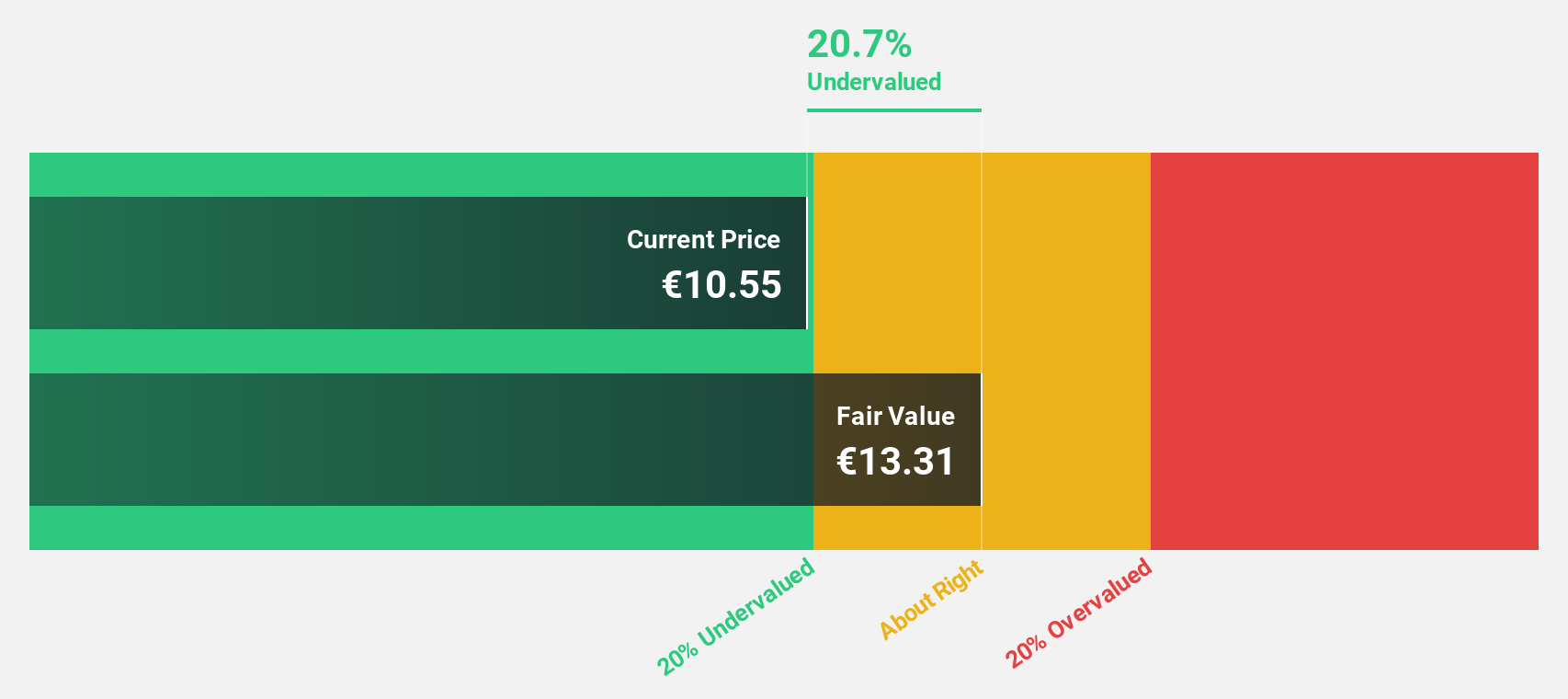

Estimated Discount To Fair Value: 30.7%

Kempower Oyj is trading at €9.91, significantly below its estimated fair value of €14.29, indicating potential undervaluation based on discounted cash flow analysis. Despite recent volatility and lowered revenue guidance for 2024, Kempower's earnings are projected to grow by 72.04% annually, with profitability expected within three years—surpassing average market growth rates. The appointment of Mathias Wiklund as CSO may bolster sales efforts amid these financial challenges and opportunities for growth.

- The analysis detailed in our Kempower Oyj growth report hints at robust future financial performance.

- Dive into the specifics of Kempower Oyj here with our thorough financial health report.

Ningbo Sanxing Medical ElectricLtd (SHSE:601567)

Overview: Ningbo Sanxing Medical Electric Co., Ltd. manufactures and sells power distribution and utilization systems both in China and internationally, with a market capitalization of CN¥46.02 billion.

Operations: Ningbo Sanxing Medical Electric Co., Ltd. generates revenue through the production and sale of power distribution and utilization systems across domestic and international markets.

Estimated Discount To Fair Value: 20%

Ningbo Sanxing Medical Electric Ltd. is trading at CN¥32.61, which is below its estimated fair value of CN¥40.74, suggesting it might be undervalued based on cash flow analysis. The company's earnings grew by 28.5% over the past year and are forecasted to grow annually by 21.34%, although slower than the broader Chinese market's growth rate of 25.9%. Despite an unstable dividend track record, revenue growth remains robust at an expected annual rate of 21.1%.

- Our growth report here indicates Ningbo Sanxing Medical ElectricLtd may be poised for an improving outlook.

- Get an in-depth perspective on Ningbo Sanxing Medical ElectricLtd's balance sheet by reading our health report here.

Nayax (TASE:NYAX)

Overview: Nayax Ltd. is a fintech company that provides system and payment platforms for various retailers across the United States, Europe, the United Kingdom, Australia, Israel, and other regions worldwide, with a market cap of ₪3.87 billion.

Operations: Revenue Segments (in millions of $):

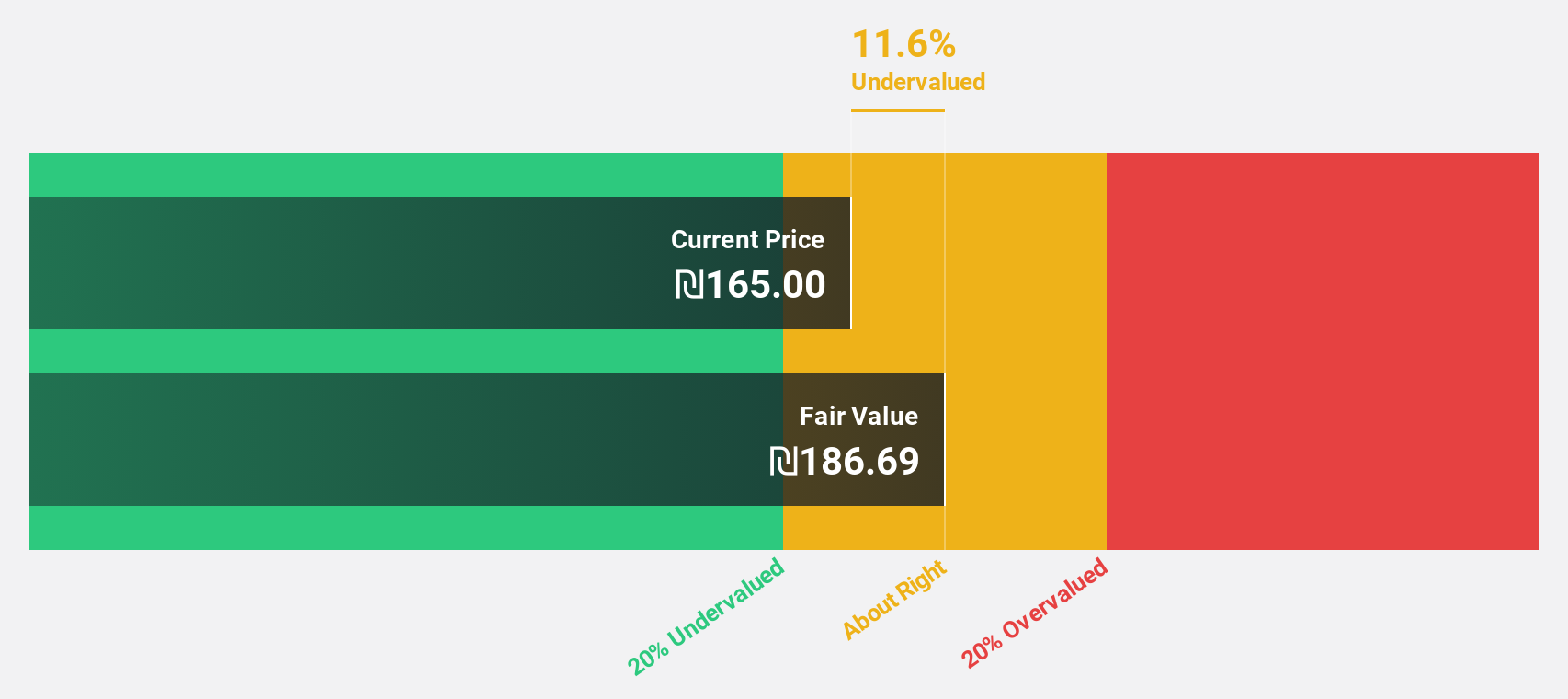

Estimated Discount To Fair Value: 44.1%

Nayax Ltd., trading at ₪106.7, is valued below its estimated fair value of ₪190.97, indicating potential undervaluation based on cash flows. The company anticipates profitability within three years and forecasts revenue growth of 23% annually, surpassing the Israeli market's rate. Recent earnings showed improved net income and sales growth despite shareholder dilution last year. However, revised revenue guidance for 2024 reflects a slight decrease due to product certification delays impacting short-term expectations.

- The growth report we've compiled suggests that Nayax's future prospects could be on the up.

- Delve into the full analysis health report here for a deeper understanding of Nayax.

Seize The Opportunity

- Discover the full array of 935 Undervalued Stocks Based On Cash Flows right here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Kempower Oyj might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About HLSE:KEMPOWR

Kempower Oyj

Manufactures and sells electric vehicle (EV) charging equipment and solutions for cars, buses, trucks, boats, aviation, and machinery in Nordics, rest of Europe, North America, and internationally.

High growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives