Does a Wave of Hybrid Automation Contracts Reinforce Kalmar’s Sustainable Growth Story (HLSE:KALMAR)?

Reviewed by Sasha Jovanovic

- Recently, Kalmar announced it secured major equipment and service contracts, including supplying 14 hybrid AutoStrad machines to Patrick Terminals in Australia, five hybrid straddle carriers to Rotterdam Shortsea Terminals in Europe, and a three-year maintenance agreement with Noatum Ports Malaga in Spain.

- These contracts highlight both ongoing demand for Kalmar’s hybrid automation equipment and growth in recurring service revenue through multi-year client partnerships.

- We’ll examine how the addition of high-value automation contracts might impact Kalmar’s investment narrative and outlook on sustainable growth.

This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

Kalmar Oyj Investment Narrative Recap

For Kalmar Oyj, believing in the company means seeing demand for port automation, hybrid equipment, and recurring service contracts as key to sustained growth, even amid global trade uncertainties. The recent contracts underline continued customer appetite for Kalmar’s solutions, yet short-term order intake from the Americas, sensitive to tariffs and trade policy, remains the most influential catalyst. Current news has limited impact on this particular risk, which continues to define near-term results.

The new maintenance agreement with Noatum Ports Malaga stands out among recent announcements, as it advances Kalmar’s push into higher-margin, recurring service revenue and supports efficient, lower-emission terminal operations. This development aligns with ongoing industry trends toward service-driven margins, offering some insulation if equipment demand wavers.

On the other hand, sharp swings in order placements from U.S. clients could still...

Read the full narrative on Kalmar Oyj (it's free!)

Kalmar Oyj's outlook forecasts €2.0 billion in revenue and €211.3 million in earnings by 2028. This is based on analysts expecting 5.4% annual revenue growth and a €74.8 million increase in earnings from the current level of €136.5 million.

Uncover how Kalmar Oyj's forecasts yield a €41.40 fair value, a 16% upside to its current price.

Exploring Other Perspectives

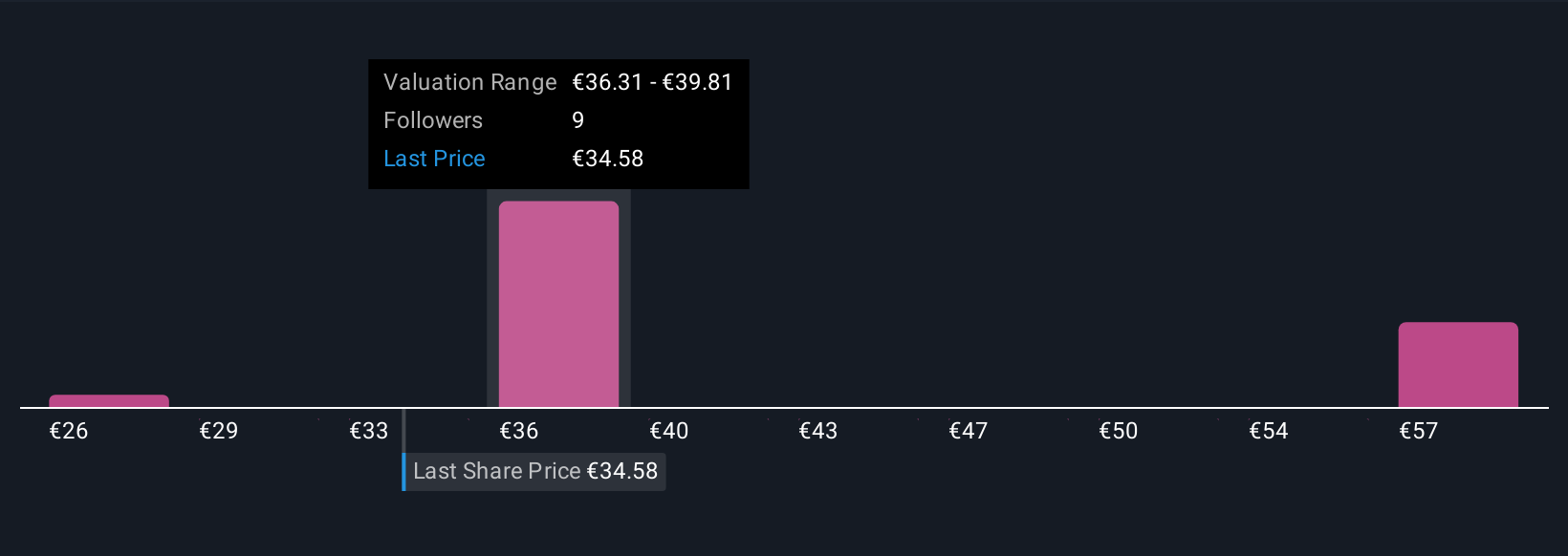

Community fair value estimates for Kalmar span from €25.81 to €60.82, with three different perspectives shared by Simply Wall St Community members. Despite this wide dispersion, many are watching the company’s recurring service growth as a possible stabilizer in periods of equipment order volatility; you can view these sharply contrasting views for yourself and decide how they fit your assessment.

Explore 3 other fair value estimates on Kalmar Oyj - why the stock might be worth 28% less than the current price!

Build Your Own Kalmar Oyj Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Kalmar Oyj research is our analysis highlighting 3 key rewards that could impact your investment decision.

- Our free Kalmar Oyj research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Kalmar Oyj's overall financial health at a glance.

Contemplating Other Strategies?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- These 10 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Kalmar Oyj might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About HLSE:KALMAR

Kalmar Oyj

Provides heavy material handling equipment and services for ports, terminals, distribution centres, manufacturing, and heavy logistics industries in the Americas, Europe, Asia, the Middle East, and Africa.

Undervalued with excellent balance sheet.

Market Insights

Community Narratives