Last Update01 Aug 25Fair value Increased 16%

Analysts have raised their price target for Kalmar Oyj, driven by stronger consensus forecasts for revenue growth and higher expected future P/E multiples, resulting in a new fair value estimate of €40.50.

Valuation Changes

Summary of Valuation Changes for Kalmar Oyj

- The Consensus Analyst Price Target has significantly risen from €35.00 to €40.50.

- The Consensus Revenue Growth forecasts for Kalmar Oyj has significantly risen from 4.1% per annum to 5.4% per annum.

- The Future P/E for Kalmar Oyj has risen from 13.60x to 14.83x.

Key Takeaways

- Rising demand for automation and sustainability is driving order growth, expanding eco portfolio sales, and supporting both revenue growth and stronger gross margins.

- Investment in digital platforms, services, and operational efficiency is increasing recurring revenues, boosting profitability, and strengthening Kalmar's industry leadership in decarbonization.

- Slow U.S. demand, tariff confusion, competitive pricing pressures, and electrification risks threaten Kalmar's revenue, margins, and ability to drive sustained growth.

Catalysts

About Kalmar Oyj- Provides heavy material handling equipment and services for ports, terminals, distribution centres, manufacturing, and heavy logistics industries in the Americas, Europe, Asia, the Middle East, and Africa.

- Strong growth in orders received (up 20% YoY, with large equipment contracts and a solid backlog) highlights rising demand for Kalmar's automation and electrified solutions, driven by global container trade and needs for port optimization; this should support future revenue growth as these orders convert into sales over the coming 12 months.

- The increasing share of eco portfolio sales (44% of total sales and orders) demonstrates Kalmar's ability to capture customer demand for sustainable, electric, and hybrid equipment; this supports both top-line growth and higher gross margins as ports and logistics shift to decarbonized operations.

- Ongoing investments in automation, digital platforms (e.g., MyKalmar INSIGHT, Automation as a Service), and modular fleet management solutions are expanding Kalmar's recurring service revenues and increasing aftermarket attach rates, positioning the company to improve net margins through higher-margin software/services income.

- Strategic relocations and outsourcing of key distribution centers are expected to enhance operational efficiency and improve long-term service growth, boosting resilience and profitability despite recent temporary impacts on margin.

- Kalmar's leadership and early move in emissions reduction (science-based targets, commitment to net zero by 2045, and release of new electric terminal tractors) position the company as a preferred partner for customers seeking sustainable transition, supporting premium pricing and potentially expanding both revenue and gross margins as regulatory and customer pressures for decarbonization accelerate.

Kalmar Oyj Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Kalmar Oyj's revenue will grow by 5.4% annually over the next 3 years.

- Analysts assume that profit margins will increase from 8.1% today to 10.7% in 3 years time.

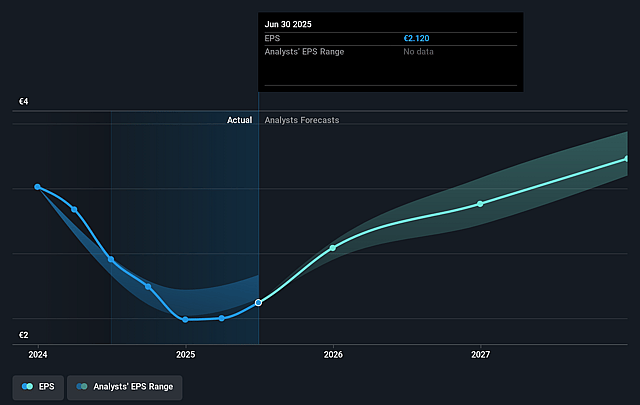

- Analysts expect earnings to reach €211.3 million (and earnings per share of €3.29) by about August 2028, up from €136.5 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 14.8x on those 2028 earnings, down from 19.0x today. This future PE is lower than the current PE for the FI Machinery industry at 20.7x.

- Analysts expect the number of shares outstanding to decline by 0.28% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.96%, as per the Simply Wall St company report.

Kalmar Oyj Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Prolonged uncertainty and softness in the U.S. and broader Americas markets-driven by ongoing tariff ambiguity, geopolitical tensions, and economic slowdown-could dampen equipment and services demand, reducing revenue growth and causing increased earnings volatility in a key region.

- Indecisiveness and hesitancy among customers to place orders in the face of unclear tariff and trade policy, especially in the U.S. distribution sector, may result in delayed investments, lower order intake, and weaker backlog conversion, putting future revenue and order book growth at risk.

- Strong price competition in AMEA regions and the rise of cost-competitive offerings (including from Asian manufacturers) could pressure Kalmar to lower prices or invest more in differentiation, leading to gross margin compression and challenging long-term profitability.

- The flat development in fully electric machine sales (still only 10% of equipment orders) and reliance on a high eco-portfolio share to support growth exposes the company to risk if electrification does not accelerate as expected, potentially limiting market share expansion and delaying gross margin improvements.

- Execution risks tied to large-scale operational changes (such as distribution center relocations and outsourcing in both the U.S. and Europe) may cause operational disruptions, higher costs, or impact service quality, temporarily suppressing net margins and cash conversion if not managed effectively.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of €40.5 for Kalmar Oyj based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of €47.0, and the most bearish reporting a price target of just €27.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be €2.0 billion, earnings will come to €211.3 million, and it would be trading on a PE ratio of 14.8x, assuming you use a discount rate of 7.0%.

- Given the current share price of €40.38, the analyst price target of €40.5 is 0.3% higher. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.