- Taiwan

- /

- Semiconductors

- /

- TWSE:4919

Nokian Renkaat Oyj And 2 Additional Stocks That May Be Priced Below Their Estimated Worth

Reviewed by Simply Wall St

In the wake of a "red sweep" in the U.S. elections, global markets have seen significant movements, with major benchmarks like the S&P 500 and Nasdaq Composite reaching record highs amid expectations of policy shifts that could influence economic growth and inflation. Amidst these developments, investors are increasingly seeking stocks that may be undervalued by market standards, presenting potential opportunities for those looking to capitalize on discrepancies between current prices and intrinsic value estimates.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| UMB Financial (NasdaqGS:UMBF) | US$123.80 | US$245.87 | 49.6% |

| NBT Bancorp (NasdaqGS:NBTB) | US$50.32 | US$99.93 | 49.6% |

| IMAGICA GROUP (TSE:6879) | ¥473.00 | ¥944.72 | 49.9% |

| Ramssol Group Berhad (KLSE:RAMSSOL) | MYR0.695 | MYR1.39 | 49.8% |

| SISB (SET:SISB) | THB31.75 | THB63.07 | 49.7% |

| Appier Group (TSE:4180) | ¥1697.00 | ¥3377.51 | 49.8% |

| S-Pool (TSE:2471) | ¥344.00 | ¥686.71 | 49.9% |

| XPEL (NasdaqCM:XPEL) | US$45.62 | US$91.03 | 49.9% |

| BuySell TechnologiesLtd (TSE:7685) | ¥3890.00 | ¥7757.36 | 49.9% |

| Medios (XTRA:ILM1) | €14.88 | €29.67 | 49.8% |

Below we spotlight a couple of our favorites from our exclusive screener.

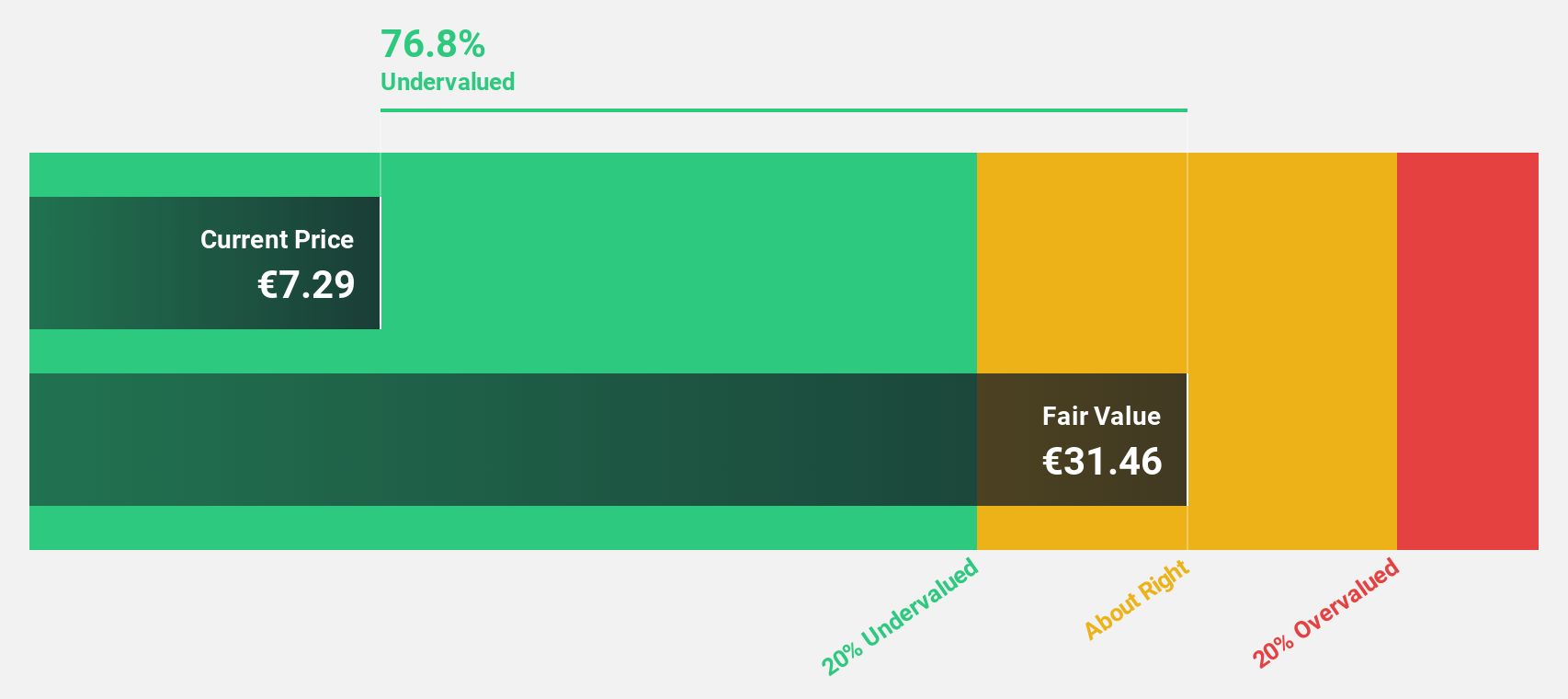

Nokian Renkaat Oyj (HLSE:TYRES)

Overview: Nokian Renkaat Oyj is a tire manufacturer operating in Finland, the Nordics, Europe, the Americas, and internationally with a market cap of €1.04 billion.

Operations: The company's revenue segments include €346.80 million from Vianor, €235 million from Heavy Tyres, and €739.70 million from Passenger Car Tyres.

Estimated Discount To Fair Value: 48.8%

Nokian Renkaat Oyj is trading significantly below its estimated fair value, presenting a potential opportunity for investors focused on undervalued stocks based on cash flows. Despite the company's current challenges, including a net loss of €4.2 million in Q3 2024 and an unsustainable dividend yield of 7.27%, revenue growth is forecasted to outpace the Finnish market at 12.7% annually, and profitability is expected within three years.

- According our earnings growth report, there's an indication that Nokian Renkaat Oyj might be ready to expand.

- Unlock comprehensive insights into our analysis of Nokian Renkaat Oyj stock in this financial health report.

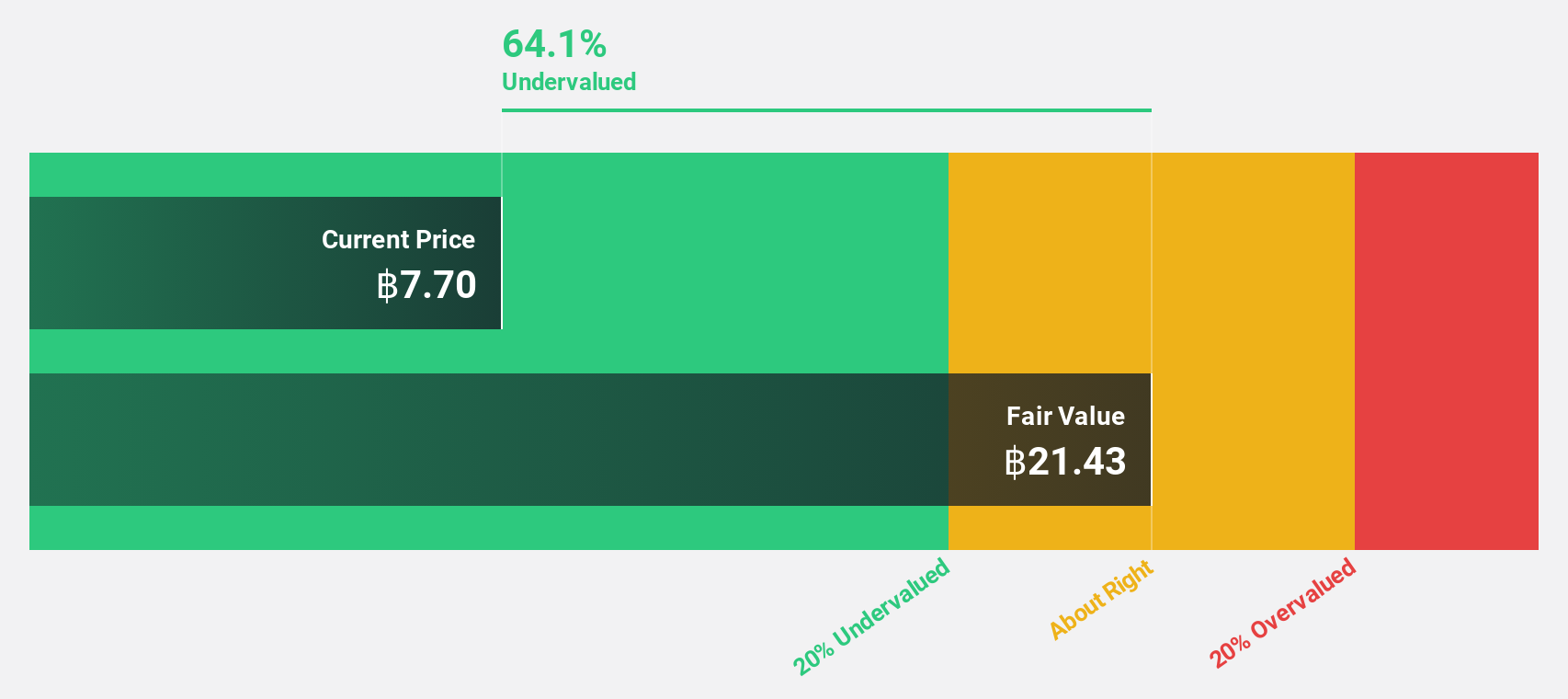

Thai Coconut (SET:COCOCO)

Overview: Thai Coconut Public Company Limited produces and distributes coconut products in Thailand with a market capitalization of THB16.02 billion.

Operations: Revenue segments for Thai Coconut Public Company Limited include coconut milk at THB3.50 billion, coconut water at THB2.10 billion, and desiccated coconut at THB1.75 billion.

Estimated Discount To Fair Value: 42.8%

Thai Coconut is trading 42.8% below its estimated fair value of THB19.59, highlighting its potential as an undervalued stock based on cash flows. Recent earnings show robust growth with Q3 revenue at THB1.93 billion, up from THB1.30 billion year-on-year, and net income rising to THB172.15 million from THB152.81 million. Despite high non-cash earnings and a dividend not well-covered by free cash flows, projected earnings growth remains strong at 21.6% annually over the next three years.

- Our comprehensive growth report raises the possibility that Thai Coconut is poised for substantial financial growth.

- Click here and access our complete balance sheet health report to understand the dynamics of Thai Coconut.

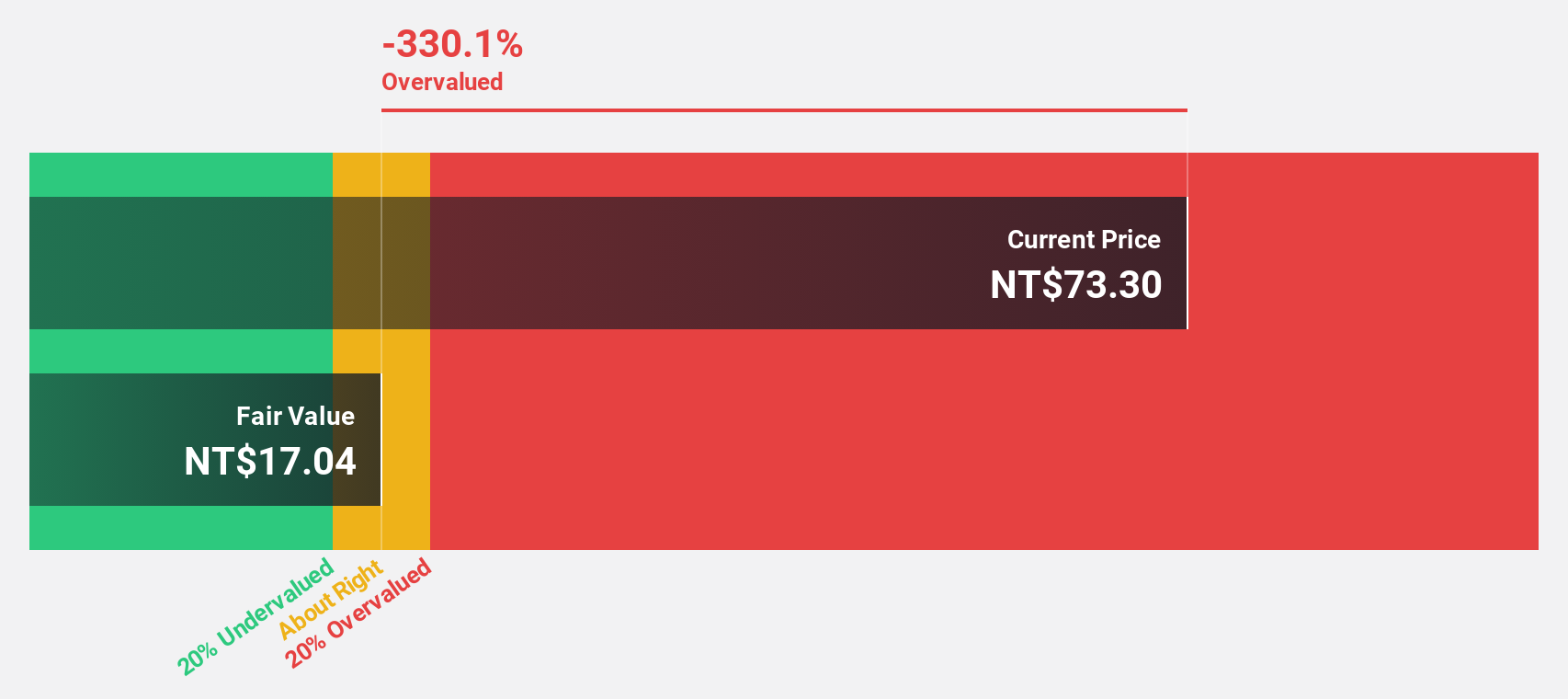

Nuvoton Technology (TWSE:4919)

Overview: Nuvoton Technology Corporation, along with its subsidiaries, operates as a semiconductor company and has a market capitalization of NT$40.26 billion.

Operations: Nuvoton Technology Corporation generates revenue through its semiconductor operations, with a market capitalization of NT$40.26 billion.

Estimated Discount To Fair Value: 49.6%

Nuvoton Technology is trading at NT$98.5, significantly below its estimated fair value of NT$195.44, suggesting potential undervaluation based on cash flows. Despite a recent net loss of TWD 105.46 million in Q3 and declining profit margins from 6.7% to 3%, earnings are forecast to grow significantly at 82.4% annually over the next three years, outpacing the market average, though volatility and dividend coverage remain concerns.

- Our expertly prepared growth report on Nuvoton Technology implies its future financial outlook may be stronger than recent results.

- Click to explore a detailed breakdown of our findings in Nuvoton Technology's balance sheet health report.

Next Steps

- Access the full spectrum of 896 Undervalued Stocks Based On Cash Flows by clicking on this link.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Nuvoton Technology might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TWSE:4919

Fair value with mediocre balance sheet.

Market Insights

Community Narratives