- Spain

- /

- Renewable Energy

- /

- BME:COXG

3 European Stocks Estimated To Be Trading Below Intrinsic Value By Up To 48.4%

Reviewed by Simply Wall St

Amidst a challenging economic landscape marked by new U.S. trade tariffs and fluctuating consumer sentiment, European markets have experienced a turbulent period, with indices like the STOXX Europe 600 Index ending lower recently. In such an environment, identifying stocks that are trading below their intrinsic value can offer potential opportunities for investors seeking to capitalize on market inefficiencies and future growth prospects.

Top 10 Undervalued Stocks Based On Cash Flows In Europe

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Micro Systemation (OM:MSAB B) | SEK49.30 | SEK96.82 | 49.1% |

| LPP (WSE:LPP) | PLN16295.00 | PLN31758.31 | 48.7% |

| Cenergy Holdings (ENXTBR:CENER) | €9.07 | €18.00 | 49.6% |

| BAWAG Group (WBAG:BG) | €93.90 | €182.92 | 48.7% |

| Net Insight (OM:NETI B) | SEK4.51 | SEK9.00 | 49.9% |

| Vimi Fasteners (BIT:VIM) | €0.985 | €1.95 | 49.5% |

| Cavotec (OM:CCC) | SEK17.40 | SEK33.94 | 48.7% |

| Wall to Wall Group (OM:WTW A) | SEK56.00 | SEK110.76 | 49.4% |

| BlueNord (OB:BNOR) | NOK605.00 | NOK1196.63 | 49.4% |

| HBX Group International (BME:HBX) | €9.76 | €18.96 | 48.5% |

We'll examine a selection from our screener results.

Cox ABG Group (BME:COXG)

Overview: Cox ABG Group, S.A. is an integrated utility company specializing in water and energy services with a market cap of €690.21 million.

Operations: The company generates revenue from three main segments: €101.72 million from water, €501.13 million from energy, and €99.61 million from services.

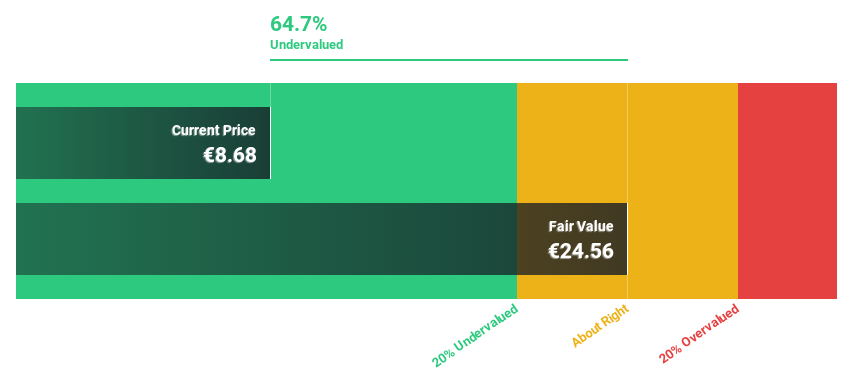

Estimated Discount To Fair Value: 48.4%

Cox ABG Group is trading at €8.86, significantly below its estimated fair value of €17.17, indicating it may be undervalued based on cash flows. With earnings forecast to grow 16.5% annually, outpacing the Spanish market's 5.9%, and revenue expected to increase by 8.9% per year, Cox shows strong growth potential despite its debt coverage concerns. Recent results show sales increased to €702.46 million with net income rising to €42.22 million from the previous year.

- The analysis detailed in our Cox ABG Group growth report hints at robust future financial performance.

- Get an in-depth perspective on Cox ABG Group's balance sheet by reading our health report here.

Lime Technologies (OM:LIME)

Overview: Lime Technologies AB (publ) offers SaaS-based CRM solutions in the Nordic region and has a market cap of SEK4.51 billion.

Operations: The company generates revenue from selling and implementing CRM software systems, totaling SEK687.14 million.

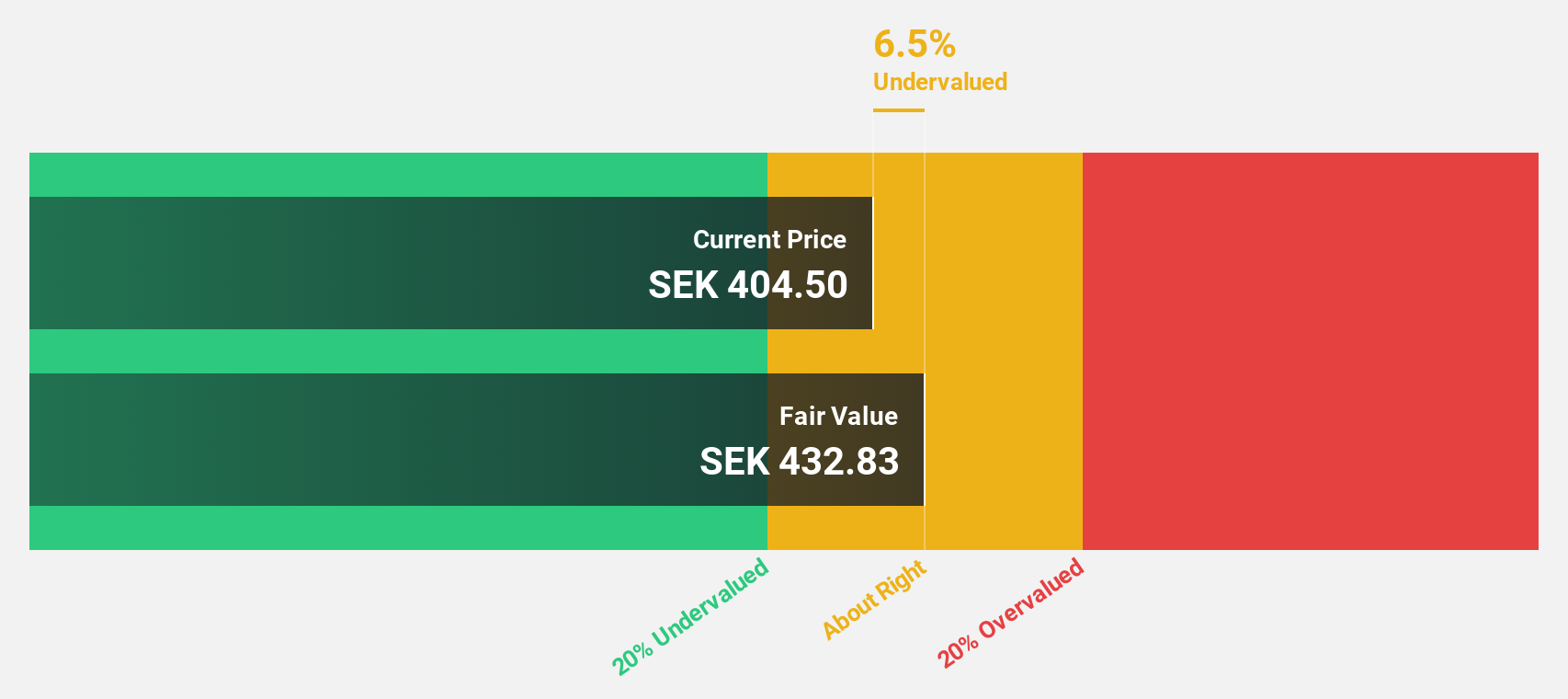

Estimated Discount To Fair Value: 11.6%

Lime Technologies is trading at SEK339.5, slightly under its fair value of SEK383.91, based on cash flow assessments. Despite high debt levels, the company's earnings are projected to grow significantly at 21.7% annually over the next three years, surpassing Swedish market averages. Recent financials show a revenue increase to SEK184.32 million and stable net income growth with a proposed dividend hike to SEK4 per share, reflecting robust profitability and strategic alignment with financial targets.

- Upon reviewing our latest growth report, Lime Technologies' projected financial performance appears quite optimistic.

- Unlock comprehensive insights into our analysis of Lime Technologies stock in this financial health report.

MilDef Group (OM:MILDEF)

Overview: MilDef Group AB (publ) develops, manufactures, and sells rugged IT solutions across various international markets, with a market cap of SEK9.93 billion.

Operations: MilDef Group generates revenue primarily from its Computer Hardware segment, amounting to SEK1.20 billion.

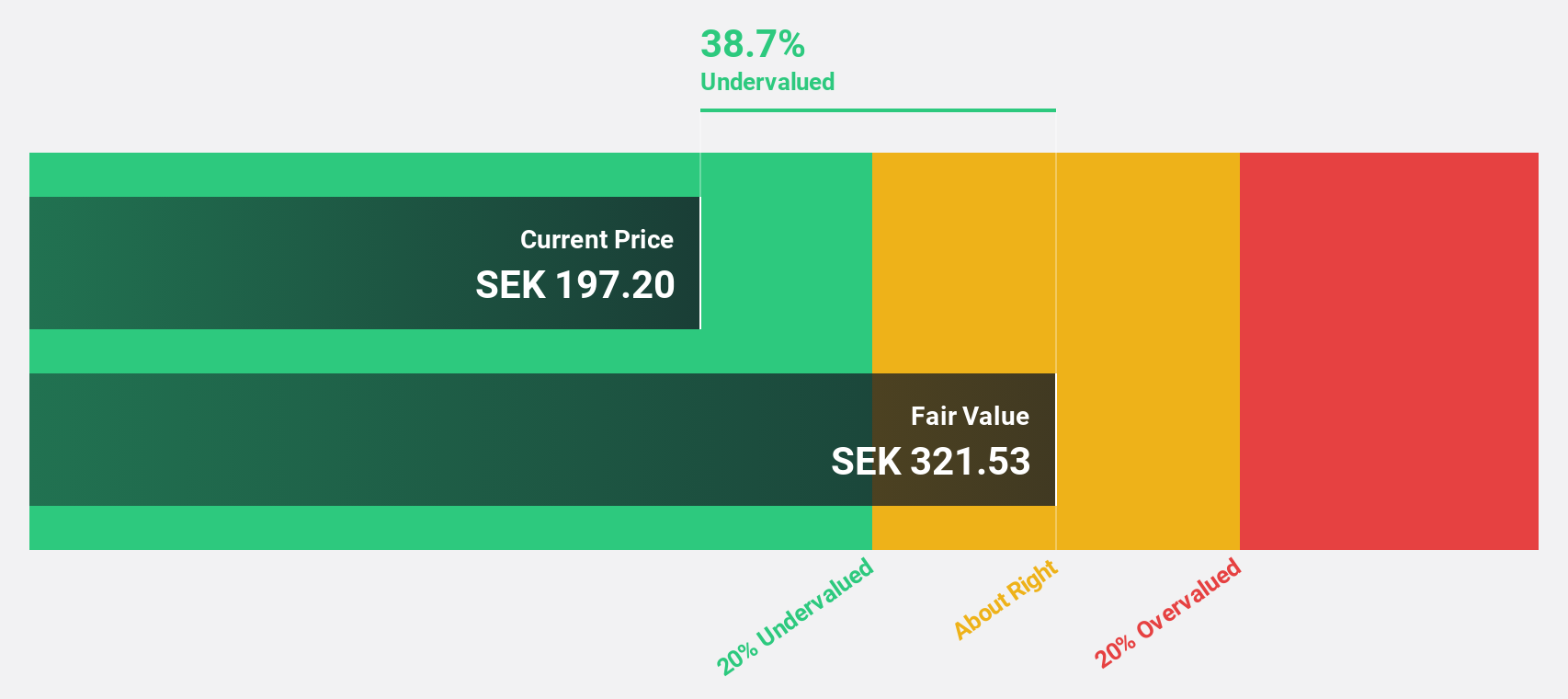

Estimated Discount To Fair Value: 48.2%

MilDef Group is trading at SEK218, significantly below its estimated fair value of SEK421.12, highlighting its undervaluation based on cash flows. Despite recent net losses, the company is poised for substantial revenue growth at 31.8% annually, outpacing the Swedish market and expected to become profitable in three years. Recent cybersecurity contracts with Clavister bolster future prospects but share price volatility and insider selling present risks.

- Insights from our recent growth report point to a promising forecast for MilDef Group's business outlook.

- Navigate through the intricacies of MilDef Group with our comprehensive financial health report here.

Taking Advantage

- Click this link to deep-dive into the 192 companies within our Undervalued European Stocks Based On Cash Flows screener.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BME:COXG

Cox ABG Group

Operates as an integrated utility of water and energy company.

Exceptional growth potential with mediocre balance sheet.

Market Insights

Community Narratives