- Spain

- /

- Telecom Services and Carriers

- /

- BME:TEF

Investors Don't See Light At End Of Telefónica, S.A.'s (BME:TEF) Tunnel

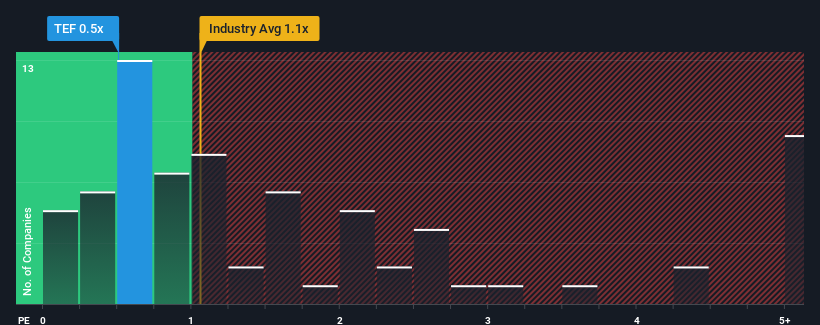

When close to half the companies operating in the Telecom industry in Spain have price-to-sales ratios (or "P/S") above 1.1x, you may consider Telefónica, S.A. (BME:TEF) as an attractive investment with its 0.5x P/S ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/S.

Check out our latest analysis for Telefónica

How Has Telefónica Performed Recently?

Telefónica could be doing better as its revenue has been going backwards lately while most other companies have been seeing positive revenue growth. Perhaps the P/S remains low as investors think the prospects of strong revenue growth aren't on the horizon. So while you could say the stock is cheap, investors will be looking for improvement before they see it as good value.

Keen to find out how analysts think Telefónica's future stacks up against the industry? In that case, our free report is a great place to start.Is There Any Revenue Growth Forecasted For Telefónica?

There's an inherent assumption that a company should underperform the industry for P/S ratios like Telefónica's to be considered reasonable.

Taking a look back first, we see that there was hardly any revenue growth to speak of for the company over the past year. The lack of growth did nothing to help the company's aggregate three-year performance, which is an unsavory 12% drop in revenue. So unfortunately, we have to acknowledge that the company has not done a great job of growing revenue over that time.

Looking ahead now, revenue is anticipated to slump, contracting by 0.2% per annum during the coming three years according to the analysts following the company. Meanwhile, the broader industry is forecast to expand by 2.2% per annum, which paints a poor picture.

With this in consideration, we find it intriguing that Telefónica's P/S is closely matching its industry peers. However, shrinking revenues are unlikely to lead to a stable P/S over the longer term. There's potential for the P/S to fall to even lower levels if the company doesn't improve its top-line growth.

The Bottom Line On Telefónica's P/S

We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

With revenue forecasts that are inferior to the rest of the industry, it's no surprise that Telefónica's P/S is on the lower end of the spectrum. Right now shareholders are accepting the low P/S as they concede future revenue probably won't provide any pleasant surprises. It's hard to see the share price rising strongly in the near future under these circumstances.

Before you take the next step, you should know about the 3 warning signs for Telefónica (1 is a bit concerning!) that we have uncovered.

If these risks are making you reconsider your opinion on Telefónica, explore our interactive list of high quality stocks to get an idea of what else is out there.

Valuation is complex, but we're here to simplify it.

Discover if Telefónica might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About BME:TEF

Telefónica

Provides telecommunications services in Europe and Latin America.

Undervalued with moderate growth potential.